Introduction

Are you considering selling your accounting firm? Getting your business ready for sale requires a focus on specifics and current market conditions. It's more, than just enhancing the workspace! It involves reviewing your documents meticulously and upgrading technology while also determining the worth of your business.

In this piece we'll delve into the procedures required to ready your accounting company for a sale and offer tips and tactics to draw in interested parties. Whether you're ponder ing an external transaction overseeing debts and financial flow or showcasing your staff and business image we've got it all covered. Moreover we'll touch on the significance of technology timing the transaction determining the value of your accounting company collaborating with experts discussing terms of the deal and promoting your firm efficiently.

By adhering to these steps outlined above and implementing them accordingly to sell your accounting practice while maximizing its value in the process.

Preparing Your Accounting Firm for Sale

Preparing your accounting or bookkeeping enterprise for sale involves more than just improving the office decor with a fresh coat of paint; it is a deliberate procedure that requires meticulous focus on details and an understanding of market trends.

Consider the optimal moment to sell your enterprise by considering industry trends and economic conditions, as well as the competitive landscape, which can affect the most suitable timing for such action. Apply the analytical mindset you use when advising clients on financial decisions to evaluate the current market conditions and future opportunities effectively.

Firstly examination your documents carefully as precision is crucial here. Possessing outdated records can demotivate buyers and diminish the worth of your enterprise. If necessary, consult an accountant or bookkeeper to ensure that each figure accurately represents the financial well-being of your organization.

In a time when technology is advancing quickly upgrading equipment or software can greatly enhance the appeal of your enterprise to potential customers who appreciate companies that are adapting and excelling with contemporary tools and methods.

Furthermore, it is essential to carry out an accurate evaluation of your company's worth. Don't make the error of relying on instinct or conjecture to establish prices for your company. Seek guidance from appraisers or valuation specialists who can provide an unbiased evaluation of your company's value by considering factors such, as financial records, assets, customer base and industry developments. Stephanie Wells of Formidable Forms stresses the significance of understanding your company's worth before entering into any negotiations.

Just take your time when deciding to sell your company; don't rush it! Think about your career goals and how the sale fits into your long term plans. Ensure that the decision to sell reflects not the current state of your company but also where you envision yourself heading in the future.

When you start on this adventure remember to think about the scheme of things. An equipped organization not only fetches a higher price but also serves as a representation of your lasting impact, in the field.

Evaluating Your Firm's Performance and Identifying Selling Points

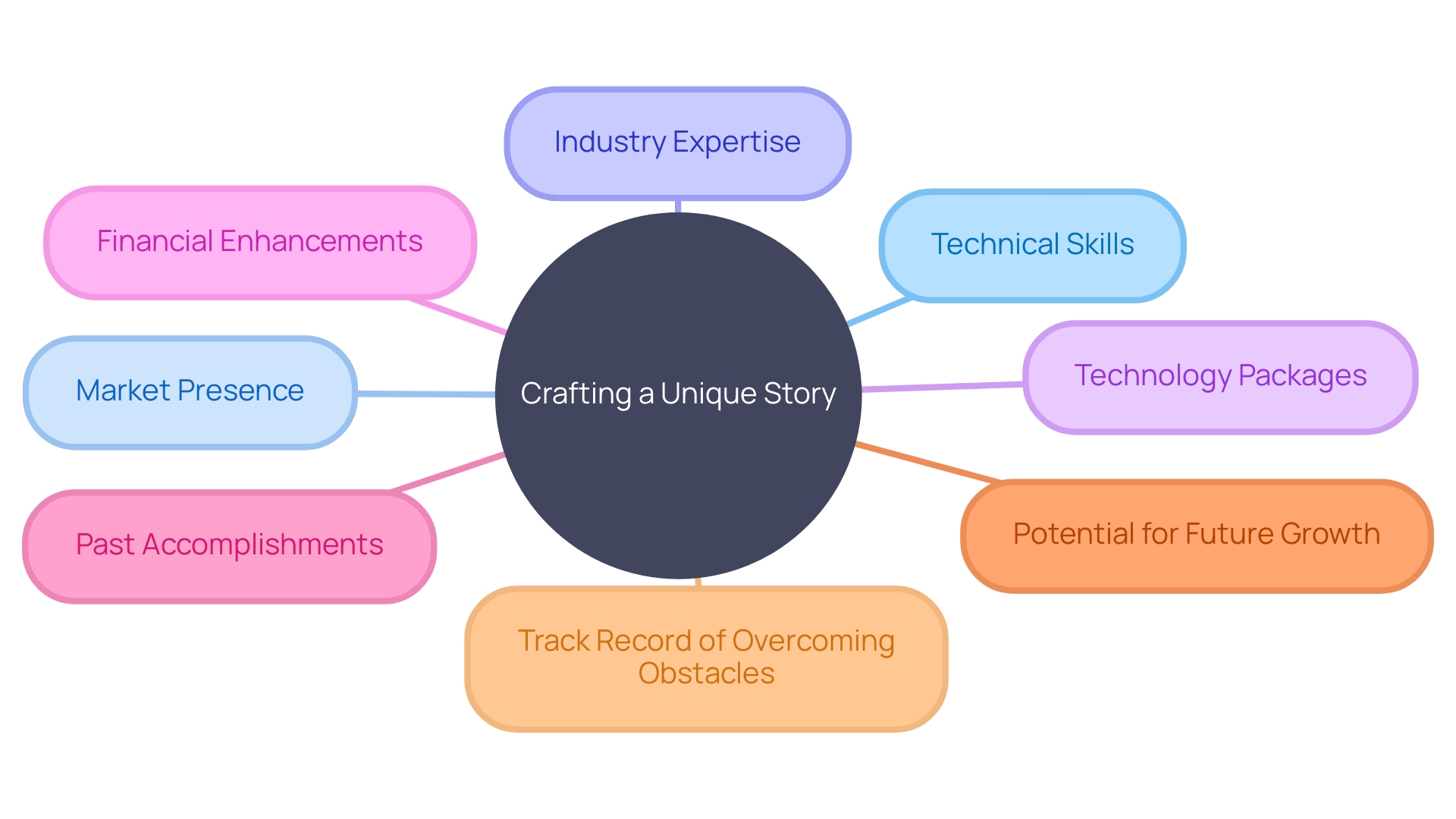

When preparing to sell your accounting firm it's more than the figures. It's about crafting a story highlighting what makes your business special and distinctive. Take inspiration from professionals in the field who have combined their technical skills, like Django and Tailwind with a deep knowledge of their market presence by studying rival traffic patterns to establish their own unique position. Your organization could emphasize its expertise in an industry such as restaurants where hands on experience is valued as highly, as knowledge; alternatively it may be recognized for its all inclusive technology packages that streamline client processes at a set cost.

Reports such as those from KLAS stress the significance of financial enhancement consulting by highlighting the importance clients place on increased efficiency and performance improvements. The overall financial well being of your organization. Spanning from income, to expense cuts. Serves as evidence of your capability to achieve these results. However it’s not about past accomplishments but also about showcasing your potential going forward. Utilize your past experience in optimizing labor forces or engaging in strategic contract talks to portray an organization that excels in efficiency.

Your organization may have served as a guiding light during times as evidenced by the 56% rise in financial performance enhancement projects recognized by KLAS. This track record of overcoming obstacles establishes you as a reliable consultant in the industry. Showcasing these aspects can draw in customers seeking more, than a profitable entity but one that assures ongoing development and creativity.

Planning for Succession: Internal vs. External Sale

Choosing how to sell your accounting firm is a decision that needs careful consideration and thoughtfulness involved in depth analysis of options and strategies available to you, as the owner. Participating in marketing offers the opportunity to bring in new perspectives and reach a broader spectrum of potential purchasers; however, this method usually entails a more intricate and extended process.

When contemplating a decision to sell or acquire a business entity or corporate acquisition deal, it is crucial to understand the distinctions between a stock transaction and an asset transaction. In a stock sale you're selling the shares of the company which's more common for C corporations and S corporations while an asset sale involves selling the physical assets of the company such as buildings and machinery. Both approaches come with their unique tax consequences and considerations, for capital gains. When you sell your enterprise and earn a profit referred to as capital gain is calculated based on the difference between the buying price of the corporation and any funds invested in improvements or advancements along, with the ultimate selling price.

The tax implications of the transaction also depend on whether it's classified as a short term or long term gain; different tax rates are applicable, to each case of capital gains tax rates being used in different scenarios as well the property value of your assets should consider all associated expenses not only the buying price but also costs related to installation training and other additional expenses.

In the changing world of professional services like KPMGs expansion and advancements in the United States market involves making a decision to sell that is both strategic and personal in nature. Effectively navigating this complex process requires understanding of the company's value proposition, tax considerations, and identifying prospective purchasers in the market. Whether you opt for a transition within your organization or go for an external sale, being well informed with the right insights and guidance is crucial for a smooth transition that upholds your organization's heritage and future prospects.

Financial Preparation: Managing Debts and Cash Flow

When getting ready to sell your accounting or bookkeeping business business it's important to present a financial picture to potential . Take a dive into your financial documents. Like the balance sheet sheet income statement statement and cash flow statement statement. To make sure everything is, in good . Address any areas of inefficiency that could turn off buyersbuyers by streamlining upgrading your IT system systems or improving financial management . Pay off debts. Show a healthy cash flow to build trust and perhaps increase the value of your companycompany.

Companies such as Anchin have flourished for than a hundred years by tailoring their methods and cultivating solid client connections. Likewise Baker Tilly commitment to their Family Office division emphasizes the significance of providing solutions centered around clients. Learn from their example; Review all expenses without hasty budget cuts as this deliberate financial adjustment aligns, with your future goals.

'Moreover' understanding the worth of your organization is essential A Quality of Earnings (QOE) assessment can play a role by providing a detailed and adjusted perspective on your company finances that goes beyond what standard audits uncover.' This comprehensive approach to assessing your enterprise will reveal its position, in the market for potential purchasers, assisting you in presenting a highly appealing and financially secure corporate entity

Staffing and Business Presentation: Key to Attracting Buyers

To attract the ideal buyer for your accounting firm entails highlighting the top notch qualities your business brings to the table from the get go. It all kicks off with the team that drives your day to day operations forward. A diverse and well informed workforce serves as the cornerstone for a firm. Take a look, at your existing teams makeup and skills to identify areas where further training or fresh talent could fill in any gaps or elevate customer service standards. Stephanie Wells astutely emphasizes that the true value of your organization resides not in its current financial status but also in its future expansion opportunities, over the next ten years; furthermore, a competent team plays a vital role in realizing this potential.

Additionally the initial impression of your organization plays a role in shaping perceptions. The branding elements of your organization such as the website, marketing materials and the office ambiance should reflect professionalism and a consistent brand image. It's crucial to listen to the guidance of Abhijeet Kaldate from Astra WordPress Theme, who stresses the significance of evaluating your enterprise before a possible transaction. An integrated visual identity that connects with the values and strengths of your organization will communicate a message to prospective purchasers, regarding the quality and dependability of the enterprise being evaluated.

As per experts at Strategic Solution Partners, it is essential to address shortcomings and enhance revenue strategies proactively for your organization to operate more efficiently and seem more attractive and valuable to prospective buyers. With a team and an impressive presentation in hand, your company has the ability to leave a lasting impact in the market.

Timing the Sale: Considering Busy and Slow Cycles

Determining the appropriate timing to divest your accounting and bookkeeping enterprise can have a substantial impact on the outcome, given the fluctuations of the industry during different seasons. With busier seasons like tax time attracting more interested buyers looking to leverage the demand, for accounting services that occur during peak times of workload. On the side when things slow down you might notice a smaller group of potential buyers which could impact the terms of the transaction and even the price.

Keeping up with market trends is important too as being aware of market predictions and real estate trends can give you valuable information about the optimal time to sell your business successfully. It's helpful to seek advice from industry professionals and rely upon recommendations from trusted real estate service providers who have a grasp of the market intricacies to assist you in timing your transaction, for maximum advantage.

Understanding the kind of transaction you're conducting. Whether it's a stock transaction or an asset transaction. Can greatly impact your tax consequences and ultimately your bottom line profit margin.It's important to think about how each method fits in with the current capital gains tax rules to make sure that the sale is, as tax effective as it can be. Remember that the aim isn't to make a sale but also to smartly boost the worth you've accumulated over time.

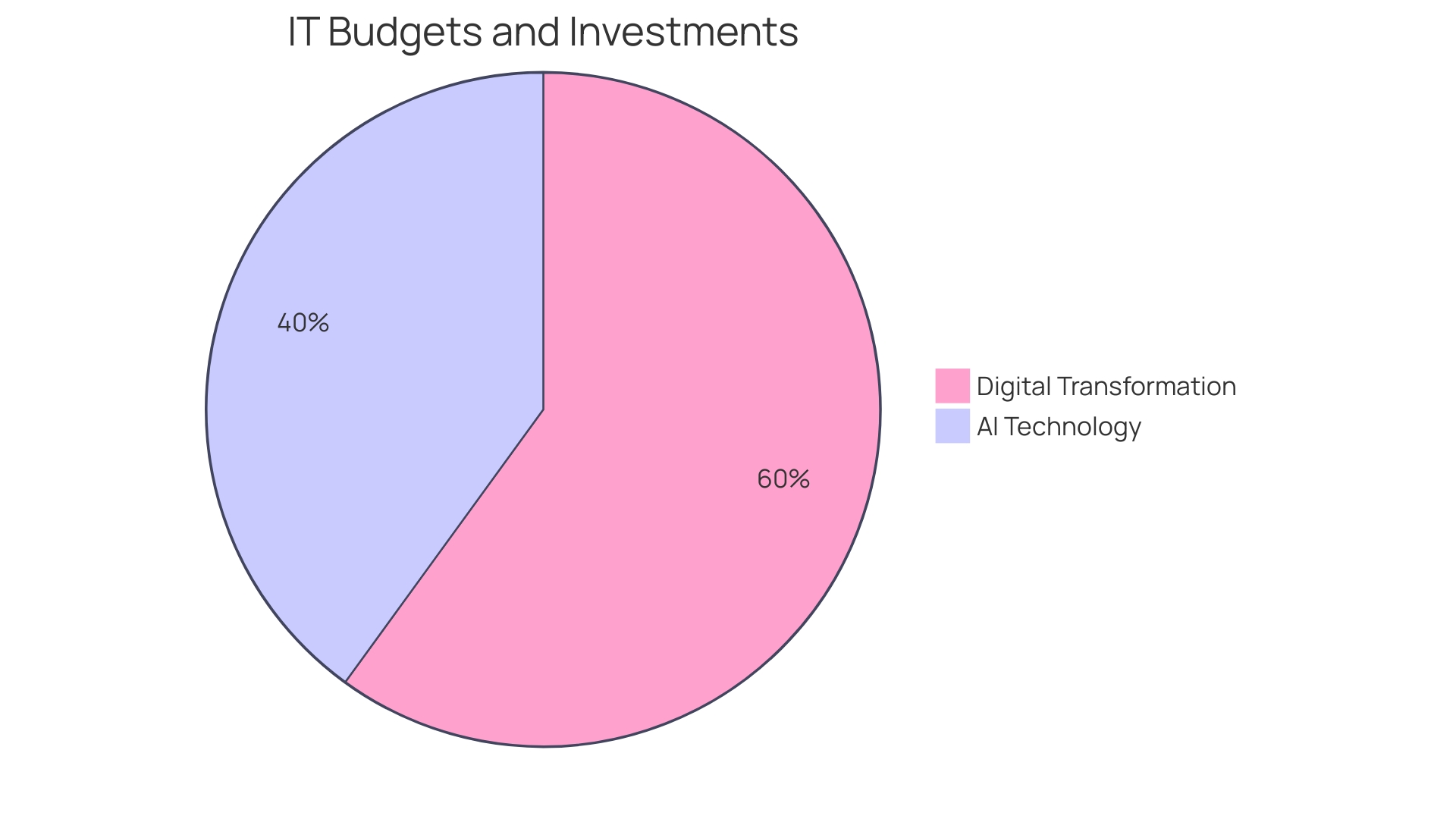

The Importance of Technology in Selling an Accounting Practice

In todays business landscape where technology plays a role in operations across various sectors including accounting firms are required to demonstrate their proficiency in digital tools to appeal to prospective clients effectively highlighting the incorporation of advanced technologies such as artificial intelligence for consolidating data a practice that has significantly transformed processes like tax filing and financial assessment can be a persuasive selling factor organizations that leverage these innovations are viewed as forward thinking and are, in a strong position to deliver top notch services. Highlight the investments made in systems and software to enhance productivity. For example project management tools and advanced analytics that can analyze financial data more effectively due to the growing complexity of financial transactions nowadays. One way to demonstrate dedication to innovation and client safety is by collaborating with organizations like Chainalysis. A move to Challenge De Grandpre Chait partnership. Especially when working in new sectors such, as cryptocurrency. By highlighting the expertise of your organization through offerings, like cost effective technology bundles that enhance client productivity and efficiency levels; you convey a progressive mindset and preparedness to address the diverse requirements of contemporary finance industry trends. Which can make your organization attractive to investors who value a forward looking approach and adaptability in times of market changes.

Valuing Your Accounting Firm: Understanding Key Factors

When considering selling your accounting business firm ensuring its worth is an aspect to focus on first and foremost. The value of your firm is influenced by aspects including revenue streams, potential profits, the range and loyalty of your clientele the reputation of your firm and its future growth opportunities. Consulting with a business appraiser or accountant who specializes in the accounting industry can help determine a valuation that matches industry standards and current market conditions.

The significance of staff members in evaluating the value of your organization cannot be overstated.. It's crucial to recognize that influential individuals may be present at levels within your organization and their impact, on value can differ.. An effective leadership team or competent experts can significantly contribute to the value of the organization providing assurance to buyers regarding the continuous success of the business..

In addition to that the changing trends in the industry highlight how crucial it is to have a grasp of the accounting industry. Having experienced professionals in your organization could become highly valuable as there are new certified public accountants joining the profession partly due to baby boomers retiring and a decline in CPA exam participants. The shortage of trained accountants especially, in audit roles might increase the importance and value of your accounting firm.

It's wise to take into account how the accounting field is changing over time too.As the traditional tasks of accountants face challenges in assessing intangible assets and requiring more forward looking approaches, your organization's flexibility in adjusting to these shifts could prove beneficial, in valuation situations.

In the end understanding the worth of your organization surpasses a number. It involves grasping the complex network of factors that add to its importance. This perception is crucial not for establishing a practical pricing strategy but also for guiding discussions, with prospective purchasers to guarantee that you are prepared to make well informed choices regarding the future of your enterprise.

Working with Consultants to Secure Assignable Non-Solicitation Agreements

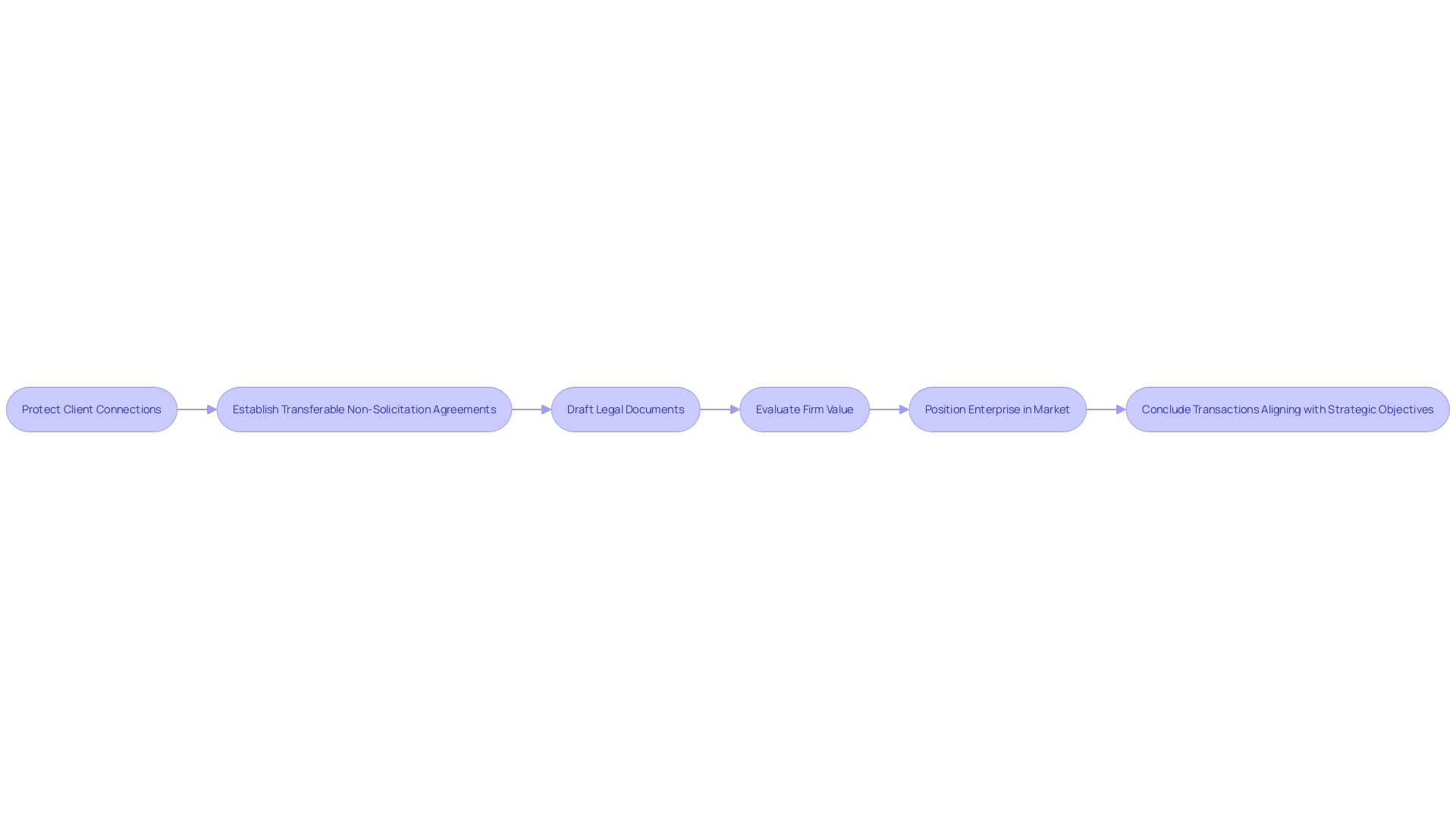

Transition of ownership for your accounting firm marks an event that involves protecting the important client connections you've built over the years. Experienced M&A advisors play a role in this process by helping establish transferable non solicitation agreements. These essential agreements act as a safeguard, against the owners contacting your clients directly after the sale concludes. This ensures that your client base remains intact and secure during the transition period.

Moreover these M&A experts offer an amount of experience in drafting necessary legal documents and skillfully maneuvering through the complexities of legal processes. Their expertise expands beyond legal aspects as they adopt a holistic approach to evaluating value that encompasses financial analysis, examining market trends, and conducting a thorough assessment of your organization's assets, liabilities, and potential for growth. The consultants understand the importance of positioning your enterprise in the market and possess the expertise to organize and conclude transactions that align with your strategic objectives while upholding the heritage of your organization.

According to Abhijeet Kaldates perspective on the matter; 'When a different enterprise expresses interest, in acquiring your venture the crucial aspect to ponder is where your organization is headed in the five to ten years.' Therefore a thorough assessment conducted by professionals becomes imperative; this notion is echoed by industry insiders who advise against undervaluing your enterprise or establishing a price point arbitrarily that might discourage potential buyers. By collaborating with M&A experts or consultants you are positioning your company for success, in attaining a just value and guaranteeing a seamless handover that upholds and reinforces the vital client connections that establish the basis of your enterprise.

Negotiating the Sale: Setting Realistic Terms and Securing the Best Deal

Negotiating a deal while selling your accounting or bookkeeping enterprise is more about skill than exact science. To handle this situation well, comprehend the specifics of the market and what your enterprise specifically requires. The price you set how payments are made, when the transition happens and any potential conditions in the deal are all aspects that need your focus. Considering that recent market trends indicate a growth in transactions for companies generating more than $25 million in revenue and an increase in smaller transactions, there are favorable opportunities to strategically time things. Chris Voss valuable insights highlight the importance of taking an approach to negotiating when selling your company – advice based on his experience as a former FBI lead international kidnapping negotiator. In today's market conditions where smaller transactions are less affected by interest rate fluctuations; it is crucial to grasp the actual value of your company and its future path forward. Abhijeet Kaldate stresses the significance of making an evaluation of your firms value in the upcoming decade. To guarantee a result in selling your enterprise; it is recommended to seek assistance, from a seasoned broker or attorney. With their assistance in negotiation using a term sheet that outlines informal offers and the terms for progress can safeguard your interests effectively. They can contribute to ensuring a smooth and profitable transaction, in today's landscape where international transactions often extend beyond a year.

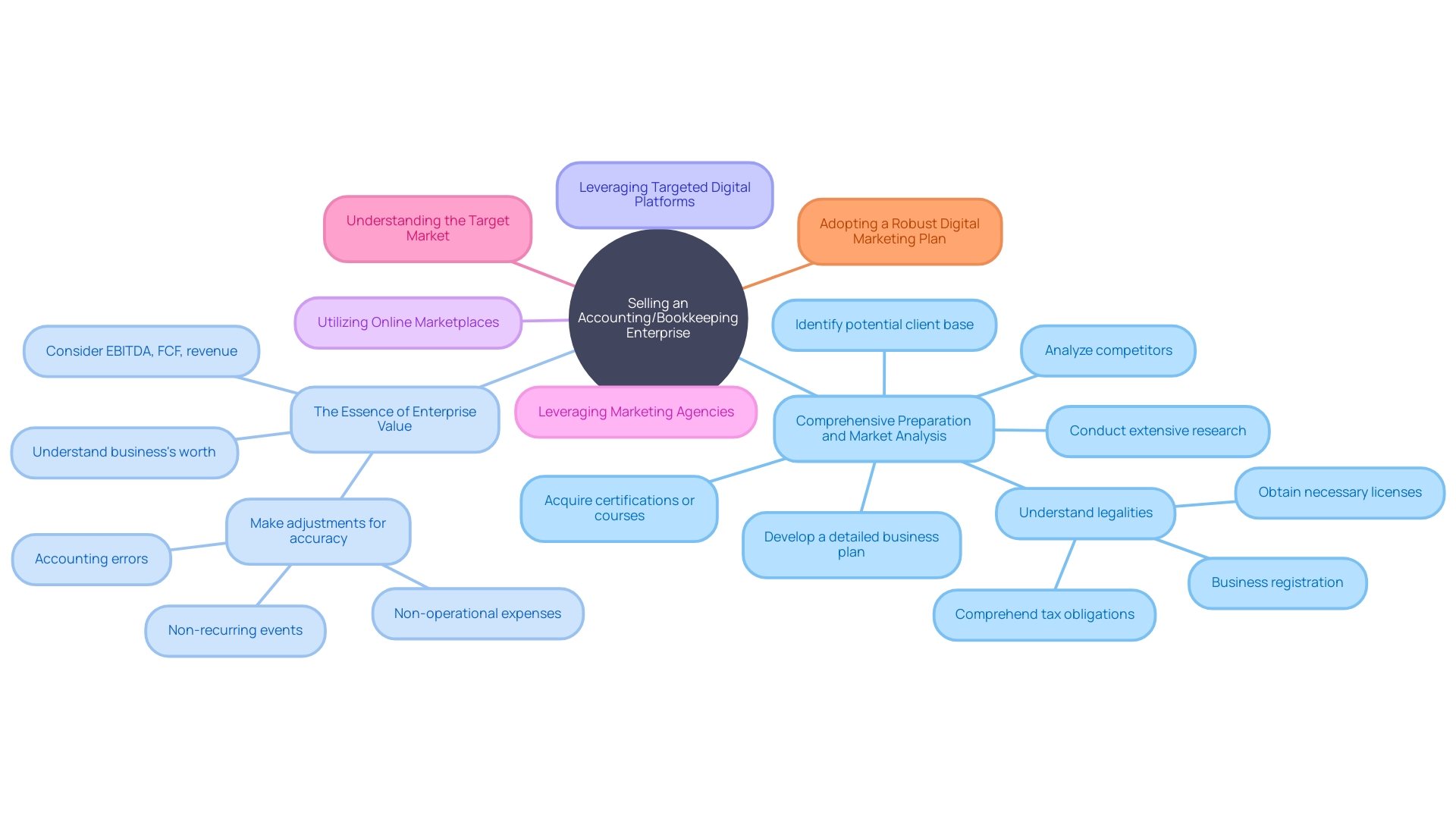

Marketing Your Firm: Using Business Listing Websites and Specialized Services

In the realm of selling your accounting or bookkeeping enterprise, achieving success in this endeavor relies on visibility as a crucial factor. By utilizing targeted digital platforms specifically designed for facilitating the transfer of accounting enterprises and practices, you have the chance to highlight the unique qualities that set your firm apart from others. This will appeal to potential purchasers and effectively showcase your firm's strengths. Leveraging these online marketplaces that cater to individuals seeking to acquire enterprises similar to yours can serve as a powerful tool. This way, you can use these platforms as a strategic avenue to highlight the distinctive aspects of your business and attract interested buyers, effectively aligning your firm's offerings with those actively seeking opportunities in the accounting industry. This will enable you to present your enterprise in the best possible light and catch the attention of prospective buyers who share an interest in enterprises like yours, aligning with potential buyers who are actively seeking opportunities within the accounting or bookkeeping realm.

Moreover leveraging the knowledge of marketing agencies that specialize in promoting accounting firms for sale can expand your reach significantly. Companies like Dunn, Pariser & Peyrot known for their financial management offerings highlight the significance of tailored expertise in professional services. Their commitment to addressing the financial needs of a diverse client base in the entertainment and corporate sectors highlights the significance of specialization in the management and promotion of an accounting enterprise.

Understanding your target market is crucial in the way that grasping industry nuances is important for success in professional services like accounting and consulting industries which are experiencing substantial growth opportunities as indicated by market trends data where management consulting sector alone saw a revenue of $365 billion this year 2022 By effectively conveying the unique value proposition of your firm within this dynamic market segment can increase the likelihood of attracting investors who see the potential, for a profitable partnership.

In the fast-paced world of commerce today it's crucial to have a robust digital marketing plan in place. Examining the accomplishments of individuals such as Tim Rayne, who succeeded in expanding an enterprise without depending on conventional promotional strategies, it becomes clear that diligence and a robust entrepreneurial mindset are crucial elements. When it comes to selling your organization adopting a strategy that emphasizes establishing connections and utilizing your network to reach out to buyers who appreciate the history and future prospects of your enterprise can be highly advantageous.

When you use these tactics effectively in your business operations you're not just seen as another company in the market; instead you become an entity with a solid history of success and the promise of future expansion, for a potential buyer to lead.

Conclusion

To sum up the process of getting your accounting company ready for sale entails focusing on details and market awareness while enhancing technology capabilities to stand out in the market and draw interest from buyers by highlighting your firms strengths and success history Both internal and external sale opportunities should be explored with assistance from experts, in the field.

It is vital to plan your finances and staffing needs for your business presentation to be successful The timing of the sale and using technology effectively can also boost your chances of success.

Assessing the worth of your business entails taking into account income sources and growth prospects while also factoring in your customer base. Collaborate with experts to safeguard your client relationships and navigate the sales process adeptly. Promote your company through online channels and unique offerings tailored to your target audience.

By following these guidelines outlined above you can successfully sell your accounting firm while maximizing its worth effectively and efficiently in a way that preserves its history and sets a foundation, for future development and expansion opportunities.