Introduction

In today's competitive business landscape, understanding customer value and market segmentation is essential for maximizing profits and attracting potential buyers. This article explores the significance of customer value and how it drives success in various industries, from retail to professional services. By aligning your business operations with value drivers such as revenue growth, cost management, customer satisfaction, and brand reputation, you can showcase a business model poised for growth and sustainability.

Additionally, the article delves into the implementation of value-based pricing models, leveraging technology for scale and cost efficiency, analyzing competitor pricing and market dynamics, optimizing pricing strategy through data and feedback, and adopting a strategic sales approach from commodity to value-based selling. These strategies, combined with a focus on increased sales, profit margins, customer retention, and maintaining price consistency and discipline, can greatly enhance your business's profitability and market appeal. So, whether you're aiming to sell your business or simply maximize its worth, understanding customer value and implementing effective strategies are key to success.

Understanding Customer Value and Market Segmentation

Understanding your customer base is not just beneficial; it's essential for maximizing profits when selling your business. Take a cue from Costco's disciplined approach to business decision-making. The retail giant rigorously evaluates new services or products by asking three critical questions that focus on profitability, competitive pricing, and complexity management.

This strategy has enabled Costco to remain focused on its core values and avoid unnecessary distractions, even during the pandemic when analysts were pushing for changes like curbside delivery.

Similarly, Instacart's business model demonstrates the significance of market segmentation and customer convenience. By connecting customers with personal shoppers and providing options for both pick-up and home delivery, Instacart caters to the varying preferences of its customer segments. Moreover, their Instacart Express subscription service exemplifies how understanding customer value can lead to innovative pricing strategies that enhance both customer loyalty and company profitability.

In the realm of professional services, such as consulting, the importance of customer value becomes even clearer. As reported by IBISWorld, the management consulting industry achieved a revenue of $365.8 billion in 2022, growing by 2.1%. This growth can be attributed to a deep understanding of business client needs and delivering tailored, value-driven services.

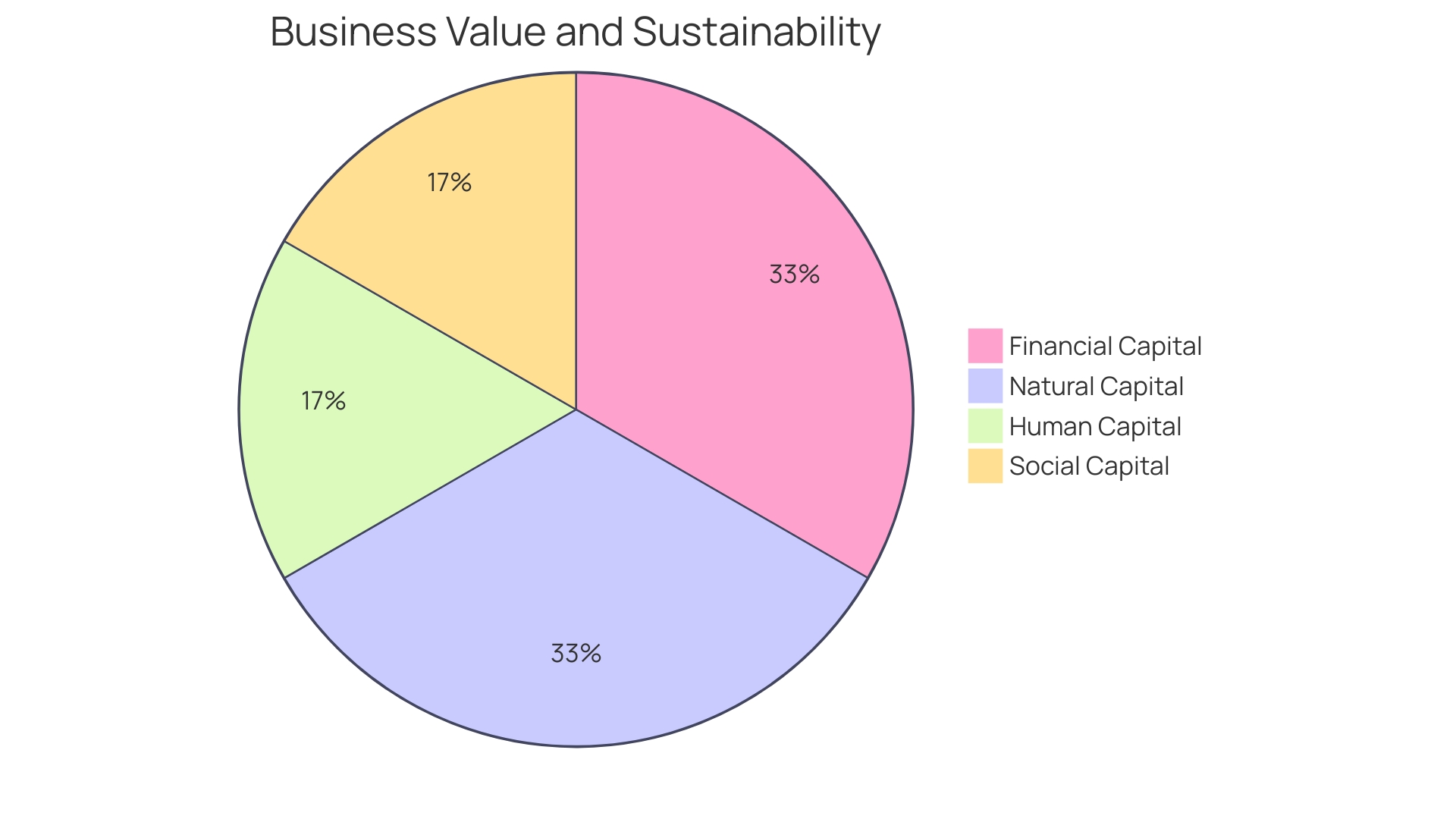

To position your company attractively to potential buyers, it's imperative to identify and capitalize on your value drivers – those elements that directly impact your company's worth. Whether it's through revenue growth, cost management, customer satisfaction, or brand reputation, these drivers are the pillars of a successful strategy that maximizes appeal and profitability. By aligning your business operations with these value drivers, you're not just showing profitability; you're showcasing a business model poised for growth and sustainability.

Implementing Value-Based Pricing Models

Applying a value-based pricing model is an innovative approach to maximizing profits when parting with a company. It centers on the unique concept of pricing based on the customer's perceived value of the product or service rather than traditional cost-plus or competitive pricing strategies. By understanding and leveraging the actual worth that customers assign to a company's offerings, it's possible to determine a price point that truly reflects the value delivered, thereby enhancing profitability.

The essence of value-based pricing is encapsulated in the journey of AnyCable Pro, which transitioned from a fixed pricing model to a more nuanced strategy that reflects the evolving nature of their service and its growing value to customers. As the product developed, it became evident that a fixed price could not capture the increasing value provided to clients, prompting a shift towards a pricing model that adapts to the product's worth.

A poignant example comes from the late Charlie Munger, an investment savant, whose insights on value creation have left an indelible mark on the business world. His approach to investing, which often mirrored value-based principles, emphasized the significance of understanding intrinsic value and its role in decision-making.

When considering the implementation of value-based pricing, it's crucial to conduct a self-evaluation to determine if your current pricing reflects the true value your product delivers. A simple test involves contemplating the impact of a significant improvement in your product's value on your pricing.

Statistics underscore the importance of this approach, revealing that a mere 4% of companies feel equipped to extract and act upon meaningful insights from data. This suggests a gap in the understanding and application of value-based strategies, pointing to the potential for significant competitive advantage for those who can effectively harness these principles.

The transition to a value-based model is not without its challenges, as it requires a fundamental shift in perspective, viewing data not as a mere commodity but as a source of valuable insights that can drive business strategy and customer satisfaction. It's a move from seeing data as a cost to recognizing it as an invaluable asset that, when properly utilized, can lead to greater efficiency, effectiveness, and, ultimately, an impressive market valuation. The key lies in the ability to extract predictive insights from data that inform value-driven decisions, aligning price with the benefit provided to the customer.

Leveraging Technology for Scale and Cost Efficiency

Embracing digital transformation presents a compelling advantage for businesses aiming to enhance their market value and profitability. Implementing sales automation software tools, for instance, not only simplifies tasks like customer prospecting and sales tracking but also amplifies the effectiveness of sales teams. These tools are designed to automate routine emails, smoothly integrate with customer databases, and provide actionable insights, thereby optimizing workflows and bolstering sales performance.

Consider the insights shared by Pipedrive CEO Dominic Allon, who notes the substantial impact of AI-driven innovations in business. The integration of AI in sales tools allows for a more profound analysis of sales data and interactions, pinpointing trends that might elude human detection. Such tools can forecast the most promising leads, the likelihood of purchases, and even the optimal times for engaging with prospects.

With the power of AI, sales teams can operate with unprecedented speed and intelligence.

Case studies like that of Delivery Hero demonstrate the potency of leveraging technology to streamline operations. Their initiative to automate account recovery processes significantly reduced the time employees were locked out of their accounts, thereby increasing productivity and operational efficiency.

Furthermore, statistics underscore the influence of digitization on workplace dynamics, including the enhancement of wellbeing and inclusivity. With the rise of groundbreaking AI technology, companies are witnessing Ai's role in fostering business growth through precision and efficiency. Yet, as AI reshapes the landscape, the enduring value of human relationships and value-based selling remains crucial.

By adopting technological solutions, businesses not only sharpen their competitive edge but also craft a more compelling narrative for potential buyers, who are increasingly valuing tech-savvy, forward-thinking companies.

Analyzing Competitor Pricing and Market Dynamics

Understanding the competitive landscape is not just about looking at the prices of your competitors. It's about recognizing the value your business brings and how it stands out in the marketplace. With today's savvy consumers, who on average examine 3.2 products before making purchasing decisions, differentiating your offerings is more crucial than ever.

They are well-informed and have the tools at their fingertips to compare a myriad of solutions. Hence, just focusing on customer needs without consideration of the competitive context is no longer sufficient.

Your pricing strategy should reflect both your understanding of the market and the unique value your business provides. Cost-plus pricing, while straightforward, may not capture the full value of your offerings, nor does it adapt to market changes or competitive pressures. Instead, consider a comprehensive approach that includes cost structure, value proposition, target market, market demand, and your business objectives.

Market research is key to this strategy. Demographic data can illuminate opportunities and limitations for customer acquisition. It's vital to answer questions about demand, market size, economic indicators, and location to ensure you understand your consumer base.

Aligning your product with market needs is also paramount, as shown by the story of Cribl, whose initial product diag.ai evolved through close interaction with design partners. This iterative process is emblematic of a market-driven approach, where product development and go-to-market strategies are built together.

With current economic trends prompting businesses to 'do more with less,' enterprise sales professionals are navigating a more complex sales environment. The insights from a comprehensive market and competitive analysis could be the difference between a strategic investment and a missed opportunity for your clients.

In essence, to maximize profitability when selling your business, go beyond competitor pricing. Dive deep into the market dynamics, understand your customer's informed perspective, and clearly articulate the distinct value your company offers. This multi-faceted approach to analysis will not only help in positioning your business effectively but also in crafting a pricing strategy that reflects the true worth of your enterprise.

Optimizing Pricing Strategy Through Data and Feedback

Optimizing your pricing strategy is not just about assigning a value to your business; it's a complex process that integrates a multitude of market factors, including customer behaviors, their perceived value of your service or product, and the competitive landscape. In the intricate dance of buying and selling businesses, striking that perfect price point is both an art and a science. A robust pricing strategy doesn't simply slap a price on a product; it carefully considers cost-plus margins and value-based perceptions to arrive at a figure that not only covers costs but also resonates with customers' willingness to pay.

A fundamental aspect of this strategy is data collection and analysis. By tapping into the wealth of information available through customer surveys, focus groups, and product analytics, you can gain invaluable insights into what drives your customers' purchasing decisions. This knowledge allows you to tailor your offerings to better meet market demand, which can be the difference between a languishing listing and a successful sale.

Indeed, McKinsey's research underscores this point, showing that organizations harnessing customer behavioral insights outperform their peers significantly in sales growth and gross margin.

When considering the pricing of a business for sale, it's essential to recognize the power of upselling and how it can increase both revenues and customer satisfaction. Upselling, fueled by a keen understanding of customer usage and preferences, is a strategic approach to enhance a customer's journey with your business. It's about offering them something more when the timing and orientation are right—ideally when they are most receptive to learning about additional features or services that could benefit them.

In the quest for the perfect pricing strategy, one must remember Peter Sondergaard's wise words: "Data is the precious oil of the 21st century, and analytics is the combustion engine." Employing data as your guide through the complexities of the market ensures that each decision is enlightened by solid evidence rather than guesswork. It illuminates the path to progress with the bright light of knowledge, enabling you to adapt and thrive in an ever-changing business landscape.

For those who may not find data analysis their forte, enlisting the expertise of data analysts or business intelligence consultants can be invaluable. These professionals can provide the analytic prowess necessary to distill vast amounts of data into actionable insights, driving strategic decisions that propel your business forward.

Strategic Sales Approach: From Commodity to Value-Based Selling

Embracing a value-based selling approach can significantly enhance the profitability of your business when you're ready to sell. This strategy pivots from simply selling a product or service to showcasing the distinctive benefits and unique value your business brings to the marketplace. By articulating this value, you set your company apart from the competition and justify premium pricing.

Consider the journey of Stora Enso, an age-old paper manufacturer that redefined itself as a renewable materials company in response to declining demand for paper. They invested in innovative products like eco-friendly building materials, demonstrating the transformative power of a value-centric business model.

A comprehensive valuation is crucial in this process; it's not just about numbers but understanding the intangible assets that define your business's worth. According to a speaker passionate about peak sales performance, negotiation has shifted away from price to value. Research indicates that thorough preparation can result in more efficient sales cycles and fewer concessions.

It's about discerning what the client values most—be it quality, features, price, or brand reputation—and how your offering positively impacts their business.

Statistics further emphasize the importance of value over mere profit maximization. For instance, while older, established companies might find profit and value alignment, growth-oriented businesses could prioritize expansion over immediate profitability, aiming for long-term value creation. This approach can lead to a more attractive proposition for potential buyers who are looking for businesses with a clear growth trajectory and a solid value proposition.

In essence, selling your business is not just a transaction but a strategic maneuver that necessitates understanding both your company's intrinsic value and the buyer's expectations. By adopting a value-based selling mindset, you're not only poised to attract better offers but also to negotiate from a position of strength, ensuring that the legacy and future of your business are in good hands.

Results and Outcomes: Increased Sales and Profit Margins

Leveraging a strategic blend of customer-centric approaches and technological advancements can significantly enhance a business’s profitability and market appeal when contemplating a sale. A focus on customer retention is paramount; it is far more cost-effective than the pursuit of new clientele. HubSpot has highlighted that increasing customer retention by just 5% can lead to a revenue increase of up to 95%.

This striking statistic demonstrates the power of loyalty and the importance of nurturing existing customer relationships.

Incorporating value-based pricing models is another strategy that cannot be ignored. The philosophy of 'value pricing' is to align the price with the perceived value to the customer, which can be far more profitable than traditional pricing methods. This approach resonates with the insights shared by leaders in the field, emphasizing that pricing should reflect the added value your product or service brings to customers.

It’s a shift from a cost-plus mindset to one that is customer value-oriented.

Embracing technology to streamline operations can also contribute to a more robust bottom line and a more attractive acquisition target. Efficiency gains from technology not only improve operational workflows but also increase customer satisfaction by delivering better service. With the right metrics in place, as Peter Drucker famously advised, 'What gets measured gets managed,' businesses can make informed decisions that enhance financial health and operational efficiency.

Lastly, understanding your brand's identity and ensuring that it speaks to your target customers is essential for creating a strong market position. A brand with a distinct 'personality' that aligns with customer values and needs is likely to stand out in a crowded marketplace, thus fetching a higher valuation.

By focusing on these strategic areas, businesses can not only maximize their profitability but also positively influence their valuation in the eyes of potential buyers, setting the stage for a successful sale.

Best Practices for Maintaining Price Consistency and Discipline

Achieving the right balance in pricing policies is a critical component of enhancing a company's value in preparation for a sale. Consistent pricing strategies, backed by market research and adaptation to economic trends, can safeguard profit margins against erosion. For instance, during times of inflation, proactive businesses, akin to those in the regulated public utilities industry, audit salary, labor, and equipment costs to inform pricing decisions, as noted by industry leaders such as Nooshin Behroyan.

This approach aligns with the wisdom of investment gurus who advise that the best investment strategy is to avoid losses by valuing assets correctly. Costco, a retail giant, embodies this principle by resisting trends that don't align with profitability, thereby maintaining a strong focus on customer value and operational simplicity. This disciplined approach to pricing and product selection has allowed them to grow sustainably without sacrificing their core business model.

Similarly, companies aiming to attract buyers must demonstrate a commitment to value maximization, which is distinct from profit maximization, as per corporate finance principles. Maintaining pricing discipline is not just about immediate profits; it's about building a company's value over time, ensuring it remains appealing in a competitive market and to potential investors.

Conclusion

In conclusion, understanding customer value and market segmentation is essential for maximizing profits and attracting potential buyers. By aligning your business with value drivers like revenue growth, cost management, customer satisfaction, and brand reputation, you can showcase a business model poised for growth and sustainability.

Implementing value-based pricing models, leveraging technology for scale and efficiency, analyzing competitor pricing and market dynamics, optimizing pricing strategy through data and feedback, and adopting a strategic sales approach from commodity to value-based selling are key strategies to enhance profitability and market appeal.

By focusing on customer retention, incorporating value-based pricing models, leveraging technology, maintaining price consistency and discipline, businesses can enhance profitability and positively influence their valuation in the eyes of potential buyers.

These strategies pave the way for success in selling your business or maximizing its worth.