Introduction

Starting a business acquisition is a decision that needs careful planning and strategic thinking involved in choosing an advisor can greatly affect the success of your purchase; therefore it's essential to thoroughly check their qualifications and experience this piece explores the key factors in picking the perfect consultant from analyzing their industry knowledge to grasping how they communicate and their network connections.

By delving into these key companies can better maneuver the intricate terrain of acquisitions and attain their expansion goals, with assurance and accuracy.

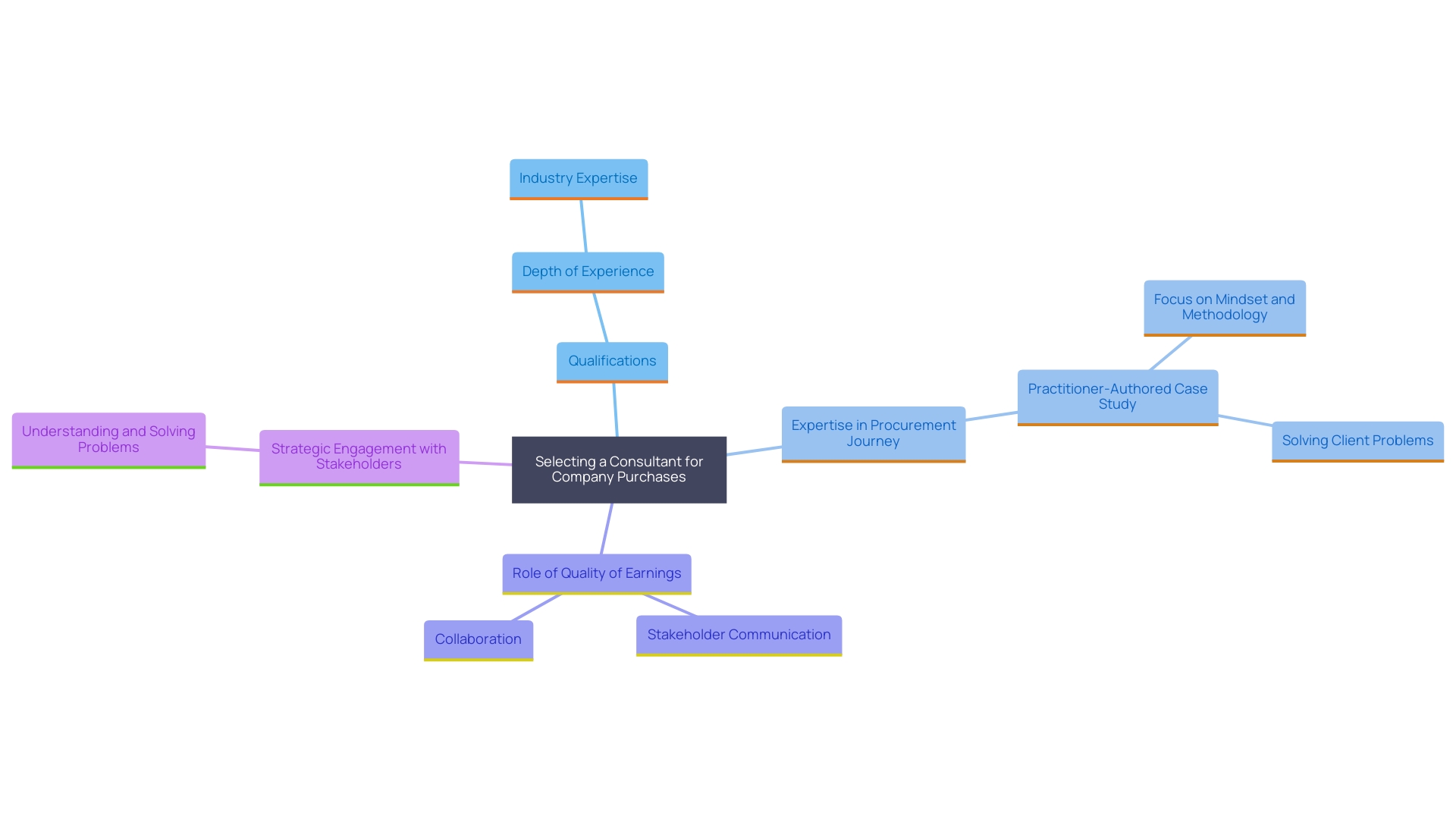

Evaluating Credentials and Experience

Selecting the consultant for your company purchase can significantly impact the result of your agreement. It's crucial to assess their qualifications and background. Seek out individuals with certifications and a strong history in managing business purchases. Their expertise should encompass an understanding of the entire procurement journey. From negotiating agreements to conducting due diligence and overseeing post purchase merging processes.

An important part of this procedure involves evaluating the Quality of Earnings (QOE). This thorough examination assists purchasers, investors and lenders in making informed choices by scrutinizing the longevity and precision of the entity stated financial outcomes. The QOE offers perspectives into the dependability and potential hazards linked to earnings to guarantee that income sources are consistent and enduring. It also investigates for any surges or reliance, on significant clients.

Employing an expert with demonstrated proficiency in these fields can skillfully guide you through dealings and prevent typical mistakes. It's essential to be open about stakeholders and strategic tactics when interacting with third parties such as joint venture partners from the very beginning—this meticulous engagement and strategic foresight set superior professionals apart from the rest.

Furthermore, the earlier noted increase in transactions within the market recently involving firms generating under $10 million in revenue emphasizes the necessity for an expert skilled in managing the complexities of such small-scale purchases and proficient at navigating through a competitive market environment effectively.

In essence, the key factor is selecting an advisor who possesses a blend of expertise and practical know-how with strategic vision to facilitate a prosperous acquisition process that enables you to make informed choices and reach your business objectives in a profound manner.

Assessing Industry Expertise and Specialization

Various sectors come with their unique obstacles and chances for growth. When selecting an advisor, it's important to ensure they possess the expertise and experience in your specific field. This specialized knowledge enables them to provide tailored guidance and insights that align with industry standards and best practices. Advisors such as those at Kearney, an established global management consulting firm with a long history of success, reveal the significance of in-depth industry expertise. Thanks to their work with top Fortune Global 500 enterprises, Kearney advisors can offer creative solutions that address the diverse needs of different sectors.

In the way as companies such as Frost and Sullivan specialize in providing market research and advisory services spanning various industries like healthcare and automotive industry expertise appears vital in illustrating its significance. By understanding the specifics of your area of expertise, an advisor can skillfully navigate its nuances, thus significantly enhancing the chances of a successful purchase. As highlighted by Christian Atzler from Baker McKenzie openness regarding stakeholders and strategic methodologies plays a pivotal role, in merger and acquisition endeavors. Hiring an expert, in your field can help streamline and enhance the success of this procedure.

Furthermore, advisors who work with experts, like those at Cranfield School of Management, broaden their perspectives and improve their understanding in specific fields. This cooperative method allows them to provide thorough and efficient resolutions. By choosing an advisor with the skills you can ensure that your company is adequately equipped to tackle the challenges and take advantage of the opportunities in your industry.

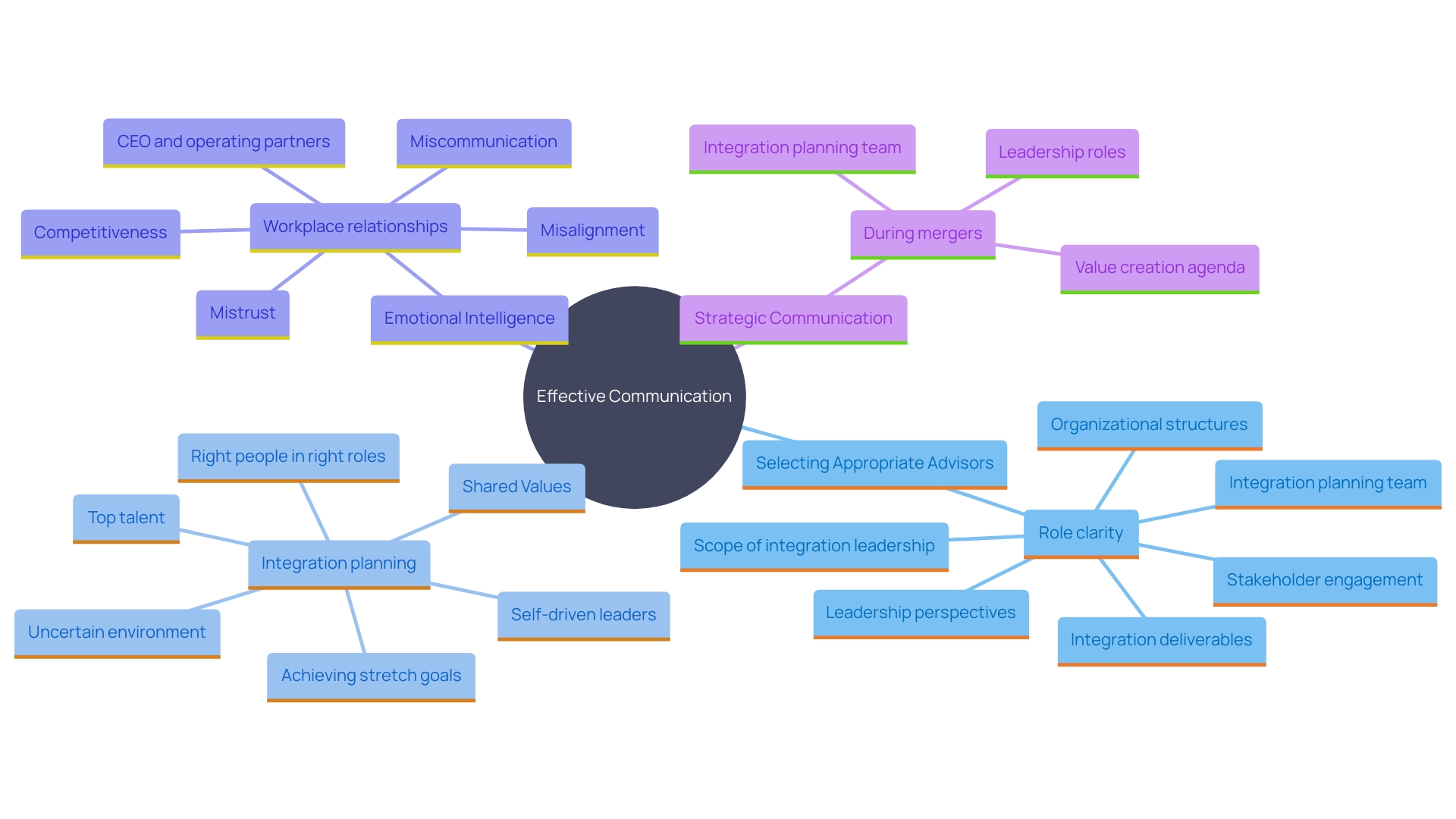

Considering Communication Style and Compatibility

Effective communication is important in the process of obtaining something new or successfully finalizing an agreement, as selecting the appropriate expert for the task is vital since communication style is significant in such situations! A high-quality advisor should be able to explain information in a simple manner and should also be a careful listener who genuinely understands your concerns and objectives. Moreover it's essential to establish a connection. Having a consultant who shares your values and visions can bring a sense of teamwork and cooperation into play. This type of harmony encourages productive discussions and clears the path for a smoother learning journey. Studies indicate that intelligence. The skill of comprehending and handling emotions. Is crucial for effective workplace relationships by improving decision making and problem solving capabilities. Furthermore, the success of merger integrations heavily relies on strategic communication and preparation. One example is the integration of staff from the acquired company, which demands planning and continuous dedication to ensure active involvement during the pivotal period from the announcement of the takeover to its finalization. By concentrating on communication and comprehending feelings effectively, you can successfully navigate the complexities of the purchasing procedure and drive your enterprise towards growth and achievement.

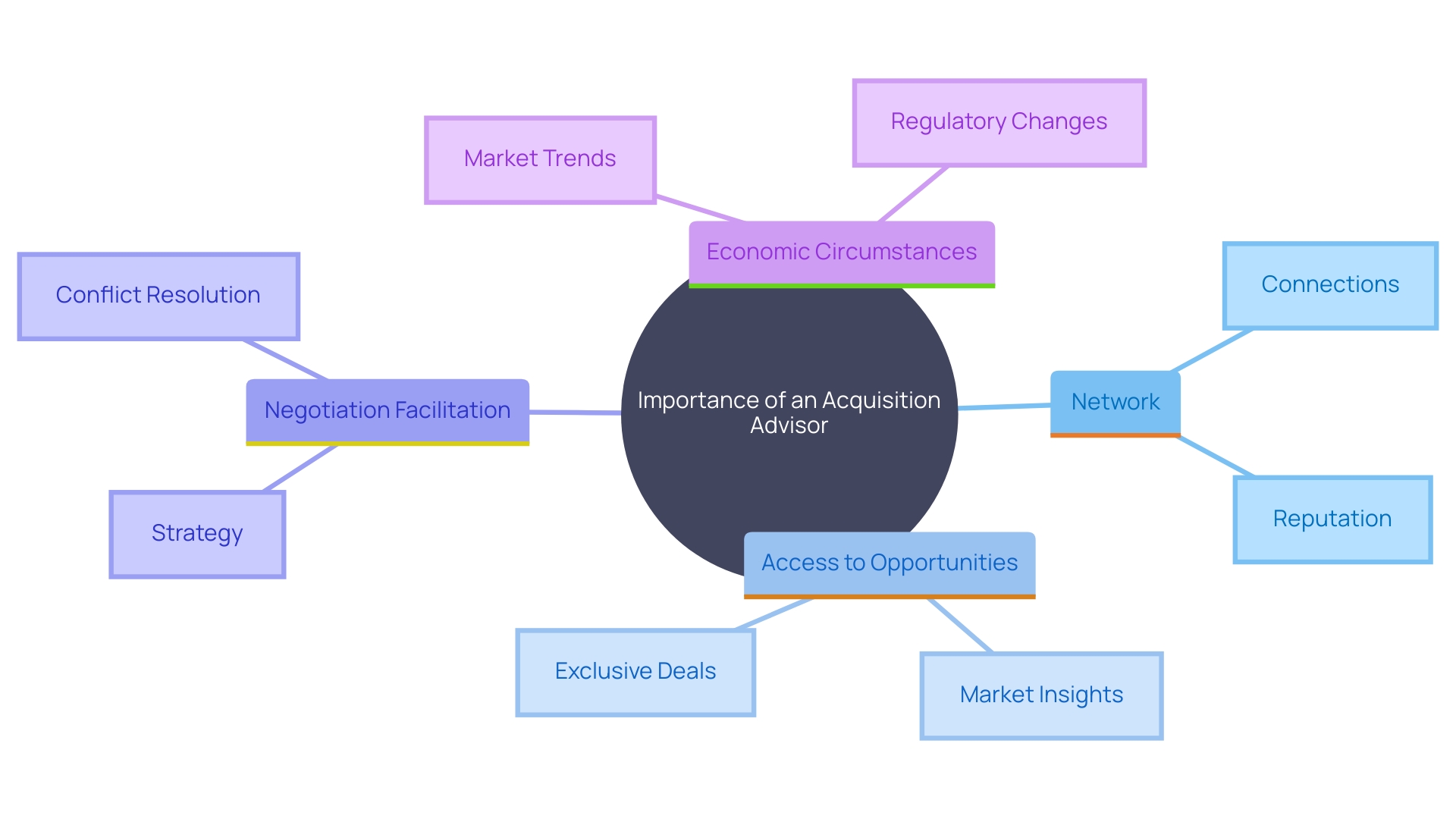

Understanding the Consultant's Network and Relationships

Having an established acquisition advisor by your side can prove to be extremely beneficial in your endeavors. An advisor with a broad network in the industry can offer access to various opportunities that might not be readily available otherwise. While evaluating the advisor's connections within the field is essential for an acquisition process as it opens doors to potential buyers and sellers and streamlines negotiations. According to insights from Frank Williamson, at Oaklyn Consulting it is important to note that simply having a company does not automatically ensure a smooth sale. 'The group of purchasers may differ significantly and general economic circumstances could affect the availability of funds in various ways. This fact emphasizes the significance of having an advisor with a network. Establishing connections is crucial by engaging consistently with people who may reveal fresh business possibilities and help take advantage of them. Gaining expertise in these networks could be vital for navigating intricate M&A procedures.'.

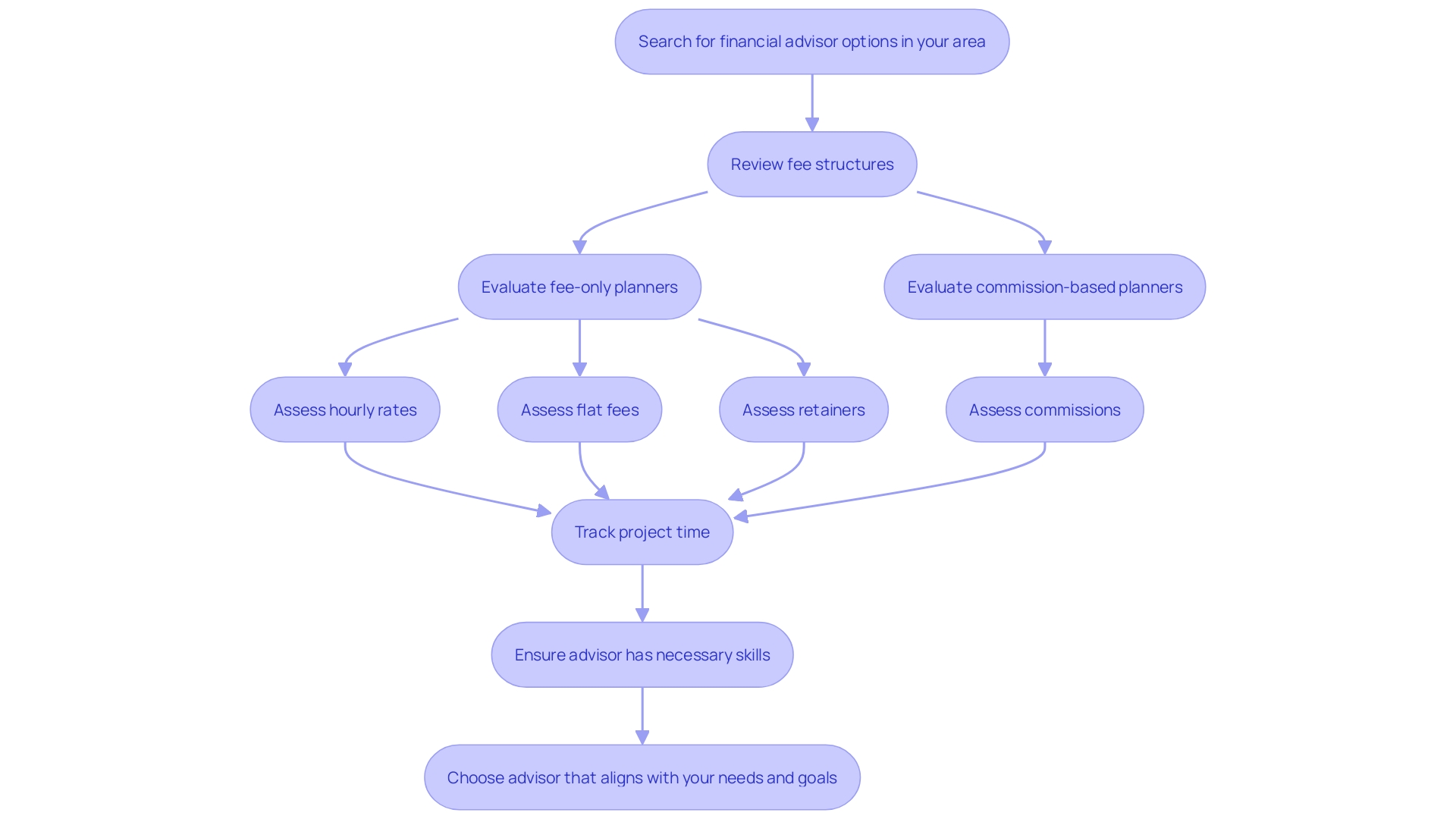

Evaluating Cost and Service Packages

When selecting an advisor for your needs, it is crucial to understand their pricing approach and the services they provide for that cost. Like a hourly rate of $130 which gives you a clear idea of what you're getting into financially. Evaluate the benefits you receive in comparison to the expenses incurred to ensure you are making a choice, in investing your resources. For example, a professional should present records of the time spent on your project so that you can track where your funds are being utilized efficiently. Make sure that the service package encompasses skills such as sales tactics marketing initiatives project coordination and technology solutions This transparency will assist you in evaluating whether the consultant possesses the requisite capabilities to address your distinctive requirements and goals resulting in enhanced creativity in both product development and operational procedures, for your company.

Conclusion

Choosing the advisor, for a business acquisition is a crucial choice that can greatly impact the overall outcome of the venture. Reviewing qualifications and experience is key; an advisors credentials, industry expertise and established history can assist in navigating the intricacies of the acquisition process. Recognizing the significance of Earnings Quality and effective communication also emphasizes the need to engage an advisor who offers clear guidance and understanding along the way.

Having an understanding and focus on a particular industry is crucial in making sure that personalized guidance matches the unique trends and obstacles of the market sector at hand. An expert consultant who is well versed in the field can provide perspectives that improve decision making and boost the chances of a successful business deal. Additionally establishing communication and ensuring a good rapport, between the consultant and the company sets up a cooperative environment that eases discussions and merges operations seamlessly.

Finally the consultants connections and relationships in the industry could open doors to opportunities that might not be easily reachable. Review ing their network can lay the groundwork, for discussions and meaningful partnerships. It is also crucial to consider the pricing and service options provided by a consultant as clear pricing and services guarantee allocation of resources.

To sum up the discussion; dedicating time and energy to choosing the suitable acquisition advisor can result in significant expansion and triumph for a company or organization. By prioritizing skills and knowledge, in the field of acquisitions maintaining communication channels nurturing strong relationships and emphasizing value creation businesses can effectively navigate the world of acquisitions with confidence and determination to fulfill their strategic ambitions.