Introduction

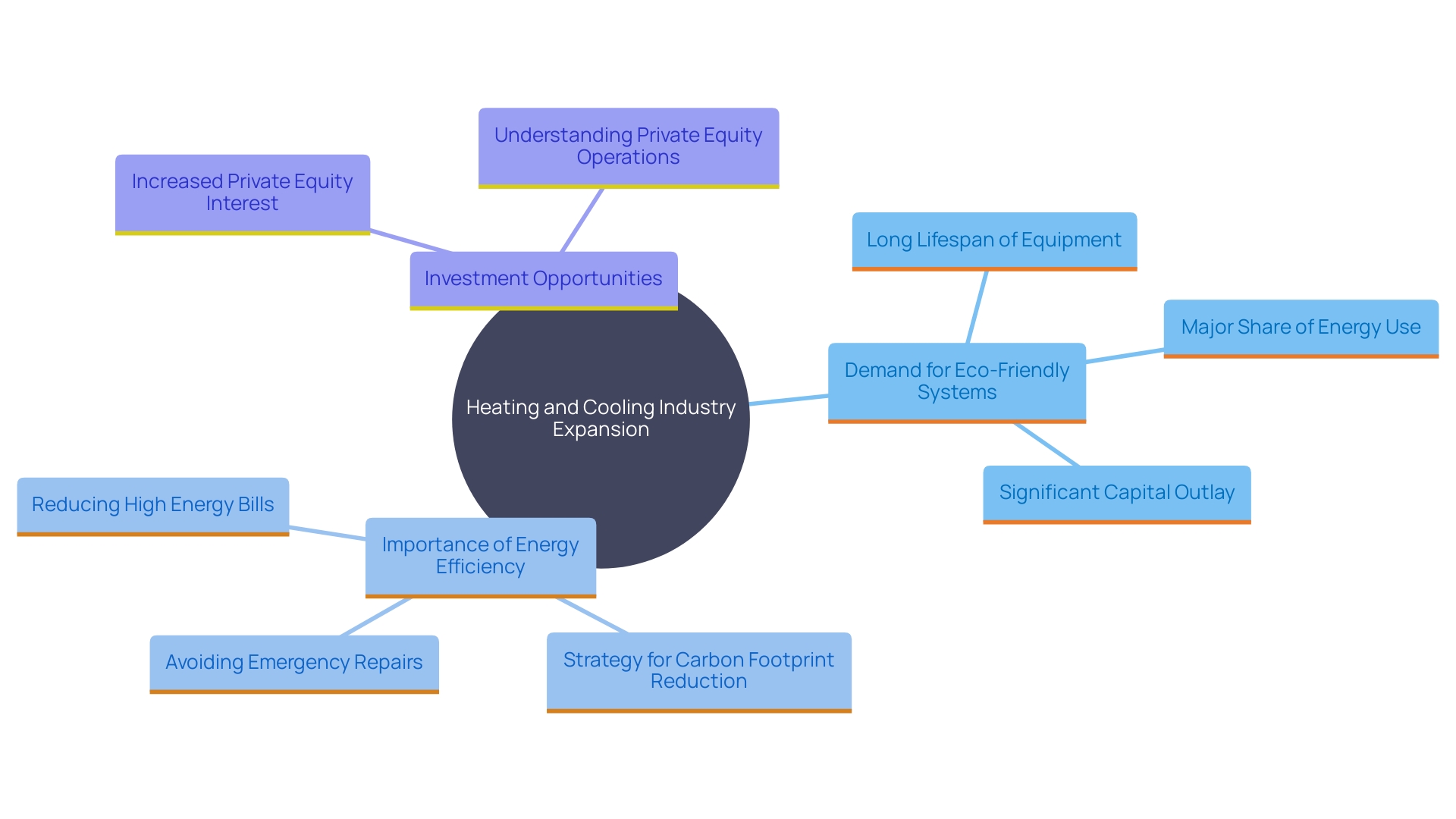

The heating and cooling sector is currently experiencing a shift towards more environmentally friendly systems and innovative temperature control solutions that cater to the growing demand for sustainable options in residential and commercial settings. HVAC companies are now seen as appealing investment opportunities because of their consistent revenue streams and strong customer loyalty base while also playing a role in improving energy efficiency and comfort levels in buildings. Recent developments in the market landscape and notable industry actions like the sale of Johnson Controls’ HVAC assets highlight the promising investment opportunities present, in this industry segment.

In todays evolving landscape of striving for better efficiency and eco friendliness in operationsselction1...HVAC companies stand out as promising avenues for solid expansion and profit potentialselction2. Attracting astute investors seeking to seize opportunities, in this rapidly growing sector.

Why HVAC Businesses Are Attractive Acquisition Targets

The heating and cooling industry is experiencing expansion due to an increase in the need for eco friendly systems and temperature regulation options. Its attractiveness stems from its revenue structures and loyal clientele base. The essential role it plays in providing services further adds to its appeal. 'As per a study conducted by Forrester Consulting, at the request of Johnson Controls there is an increasing urgency for organizations to operate with enhanced efficiency and environmental awareness which raises the importance of heating, ventilation, and air conditioning solutions.'. Furthermore, the potential divestiture of Johnson Controls' climate control assets, valued at approximately $4 billion, indicates the strong dynamism and investment opportunities in the market today. As homeowners and commercial property owners prioritize comfort and energy efficiency, there is a substantial opportunity for considerable growth and profitability in investing in climate control companies.

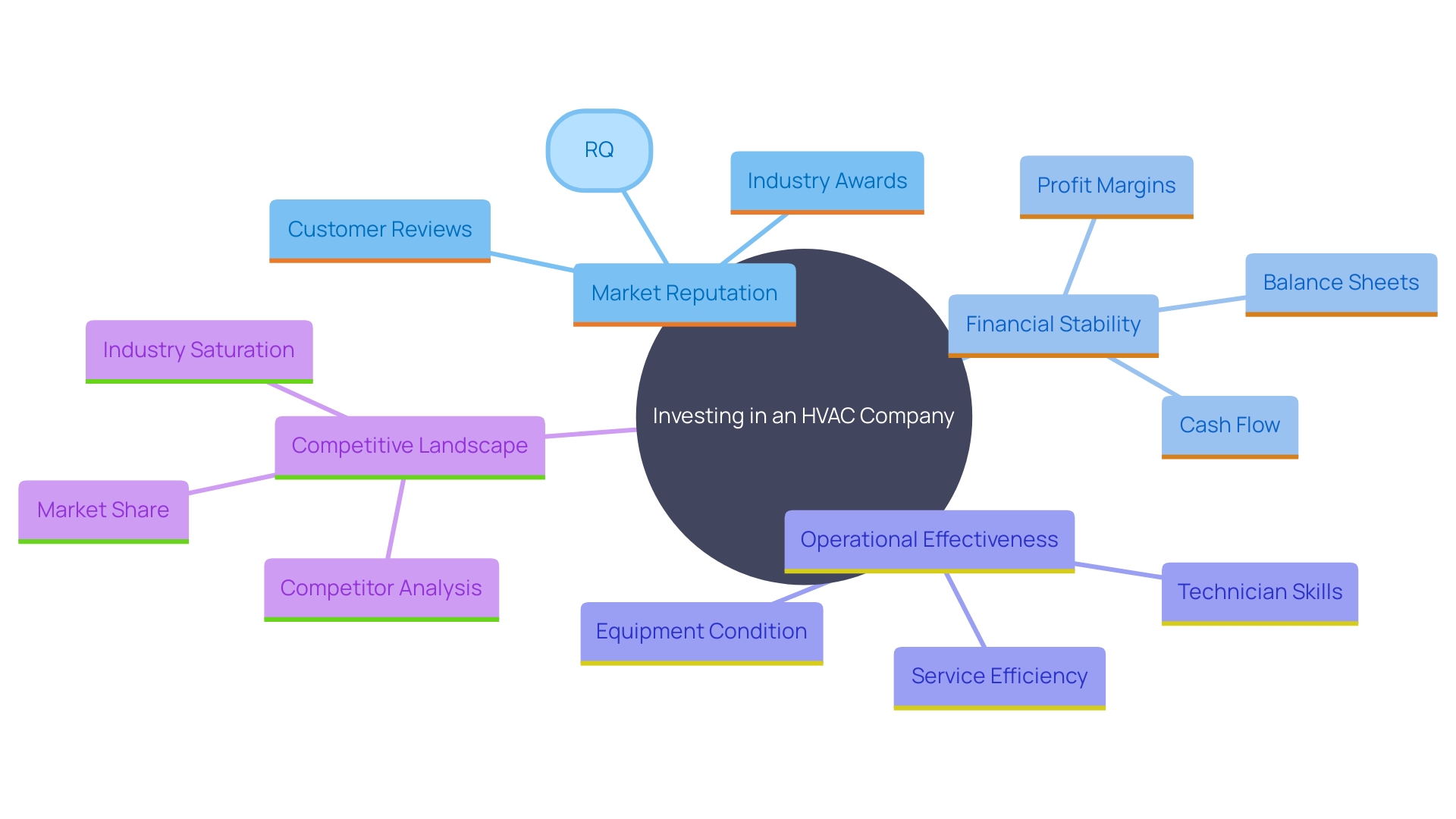

Key Factors to Consider When Buying an HVAC Business

When considering purchasing an HVAC company as an investment opportunity, it's crucial to take factors into account to make a smart decision. First and foremost, it's important to evaluate the entity's standing in the market. This involves assessing its reputation, customer connections, and overall market share. Another vital aspect is the well-being of the organization. Examining its balance sheets and cash flow statements. Profit margins can provide insight into how stable and profitable the company is.

'The operational effectiveness of an enterprise heavily relies on factors like the proficiency of its technicians and the state of its equipment, in shaping its success prospects. It is crucial to assess if the current team possesses the competencies to uphold excellent service levels and if the equipment is modern and dependable.'.

Alongside rivalry and industry saturation are crucial factors to consider. Examining the concentration of heating, ventilation, and air conditioning services in the area and identifying the unique characteristics of competing firms can provide useful insights into the long-term viability of the enterprise. For example, the possible divestiture of its heating, ventilation, and air conditioning assets by Johnson Controls International Plc highlights the continually changing environment of the sector, where tactical decisions can significantly impact competitiveness and industry opportunities.

To conclude effectively; When you examine the industry position and financial soundness along with operational advantages and competitive landscape altogether provides a clear insight into how promising an investment can be, in the heating, ventilation, and air conditioning sector.

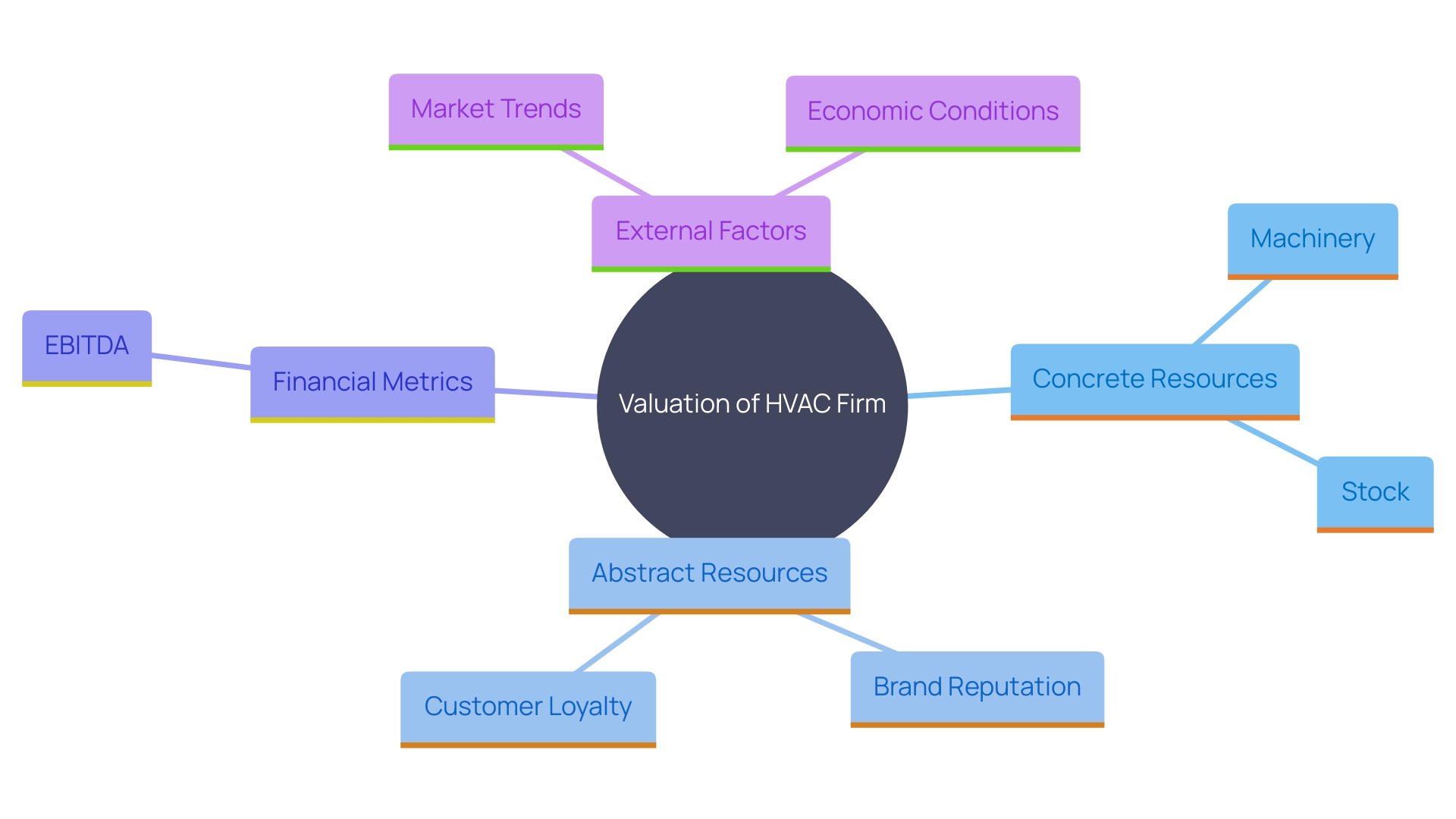

Understanding the Value of an HVAC Company

Evaluating the worth of an HVAC firm requires a plan that considers both concrete and abstract resources. A valuation technique focused on resources examines elements such as machinery and stock vital for effective operations. Nevertheless, the actual worth of an HVAC enterprise frequently extends past physical resources. Factors like brand reputation and customer loyalty are significant in creating a solid presence in the industry. A trustworthy brand can enhance customer retention rates. Enhance audience reach. Both crucial, for gaining a competitive edge.

Conduct a financial assessment to ensure an accurate valuation of the enterprise is achieved. Metrics such as EBITDA (Earnings Before Interest Taxes, Depreciation and Amortization ) play a crucial role in grasping the profitability and operational efficiency of the enterprise. 'Recent industry trends suggest a growing attraction towards HVAC companies, among equity investors, where the potential buyer base has tripled over the past few years.'. This notable upsurge emphasizes the significance of providing a financial overview.

When assessing an organization, it's essential to consider the trends in the sector as well as the circumstances of the economy and potential for expansion in the future too. Calculating forecasts and projections based on past financial data and market dynamics can offer a clear perspective into how well the organization might perform in the coming days. These insights contribute to strategic decision making and allocation of capital to ensure sustainable growth for the organization. By incorporating scenario analysis and sensitivity testing methods into their evaluations process business owners can assess outcomes and associated risks. Leading to informed choices that enhance value for all stakeholders involved.

Financial Considerations and Profit Margins in HVAC Businesses

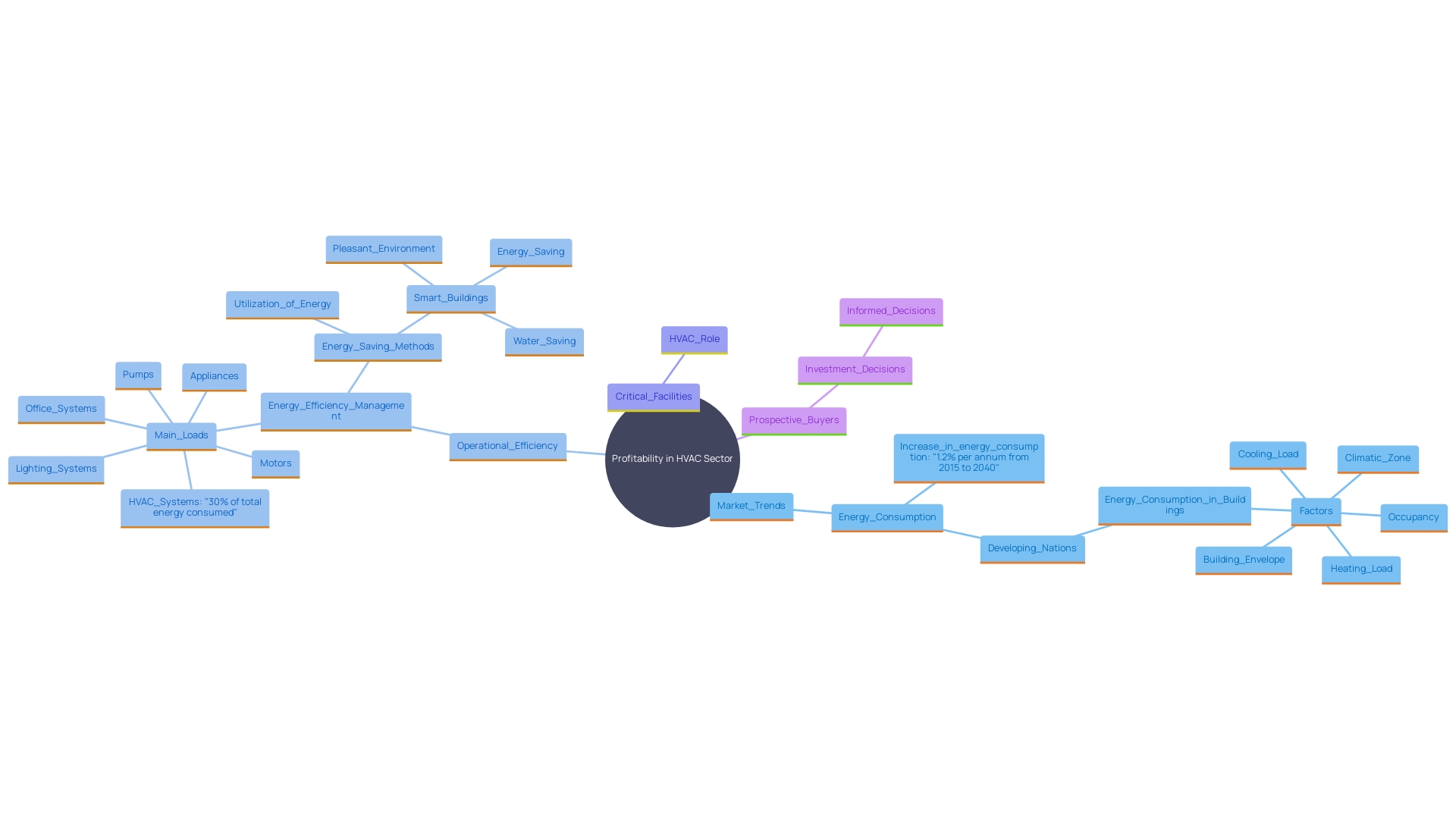

The profitability in the HVAC sector has risen significantly. Is now catching the eye of private equity investors due to its expanding popularity among buyers over the past five years in particular – marking a notable shift from its previous status, as a specialized market segment.

Prospective buyers should consider both the net profits when assessing a business financial health before making a purchase decision. Heating, Ventilation, and Air Conditioning businesses typically encounter variations in income due to factors that can impact their overall profitability. Scrutinizing these ups and downs can provide investors with an understanding of the company's financial standing throughout the year. Furthermore, the effectiveness of daily operations influences the profit margins for a heating, ventilation, and air conditioning company. Effective operations not help cut costs but also improve service quality thereby giving the business a competitive edge, in the market.

It's important to consider the significance of heating, ventilation, and air conditioning systems in facilities such as data centers as well. These systems are designed to uphold environmental standards to guarantee consistent operation and effectiveness. This essential function underscores the profitability of efficiently run heating and cooling companies.

To sum it up nicely; grasping the aspects and operational effectiveness in the heating, ventilation, and air conditioning sector can empower purchasers with the information essential, for making knowledgeable investment choices. Armed with knowledge and understanding of the market trends and demands; investors can capitalize on the promising prospects offered by this expanding industry.

Tips for Finding and Acquiring the Right HVAC Business

To effectively locate the heating, ventilation, and air conditioning company's service provider firms and dealerships by utilizing industry connections and online sources as well as consulting with nearby business agents is crucially important for a successful deal completion process while avoiding typical pitfalls requires careful planning and flawless execution practices to be carried out without any hitches. Conduct a comprehensive investigation process including a thorough review of financial records and legal papers to guarantee complete transparency. Developing strong relationships within the sector may offer valuable insights on exclusive opportunities that are not publicly available which can ultimately increase the likelihood of discovering a lucrative purchase. The heating, ventilation, and air conditioning industry has witnessed a notable surge in interest, particularly from investment firms. The increasing trend suggests a rising acknowledgment of the sector's profitability and growth prospects according to industry experts who emphasize the importance of visibility and expertise for brand positioning in the leadership domain. Moreover recent reports shed light on deals in the HVAC industry like Johnson Controls Internationals consideration to sell its heating and ventilation portfolio potentially worth up to $5 billion. These occurrences highlight the markets nature and indicate promising opportunities, for strategic acquisitions.

Conclusion

The HVAC industry is set for expansion as a result of the rising need for energy efficient and eco friendly solutions.The sectors stability in generating revenue and retaining a customer base makes it an appealing choice for investments.In addition to that the growing emphasis on sustainability emphasizes the impact of HVAC firms, in improving comfort and energy efficiency across homes and businesses alike.

Before making a decision to acquire a business in this industry niche it's crucial to assess aspects such as its reputation in the market financial stability and operational efficiency. Having an understanding of where the company stands in the market along with its financial indicators can offer important perspectives on its opportunities, for expansion and profitability. Moreover acknowledging the importance of both non physical assets will help in accurately determining the real worth of an HVAC enterprise.

Investors looking to invest should stay alert to changes in the market and operational effectiveness that could impact profits positively or negatively. Given the growing interest of equity investors, in the HVAC sector lately the possibility of earning substantial profits is clear. By utilizing industry networks and carrying out research investors can discover special investment chances that match their long term objectives.

In summary the HVAC industry offers an investment opportunity due to its focus on sustainability and advancement. With an approach, to acquisitions and a deep grasp of market trends investors can set themselves up for prosperity in this growing field. It's a time to take advantage of the potential ahead and help shape a more eco friendly tomorrow.