Introduction

Starting the adventure of purchasing a business is a move, towards realizing entrepreneurial aspirations. The experience of acquiring a business can be exciting yet overwhelming as it presents opportunities and obstacles. This post acts as a manual that dissects each stage to make the process easier and enhance the chances of a prosperous purchase.

In the process of finding the business to assessing its actual value and negotiating terms while securing funding and guaranteeing a seamless handover process; all these aspects are thoroughly explained with practical guidance and expert recommendations in mind. By adhering to these procedures potential purchasers will possess the necessary tools to maneuver through the intricacies of acquiring a business successfully; thereby laying the groundwork, for future prosperity and expansion.

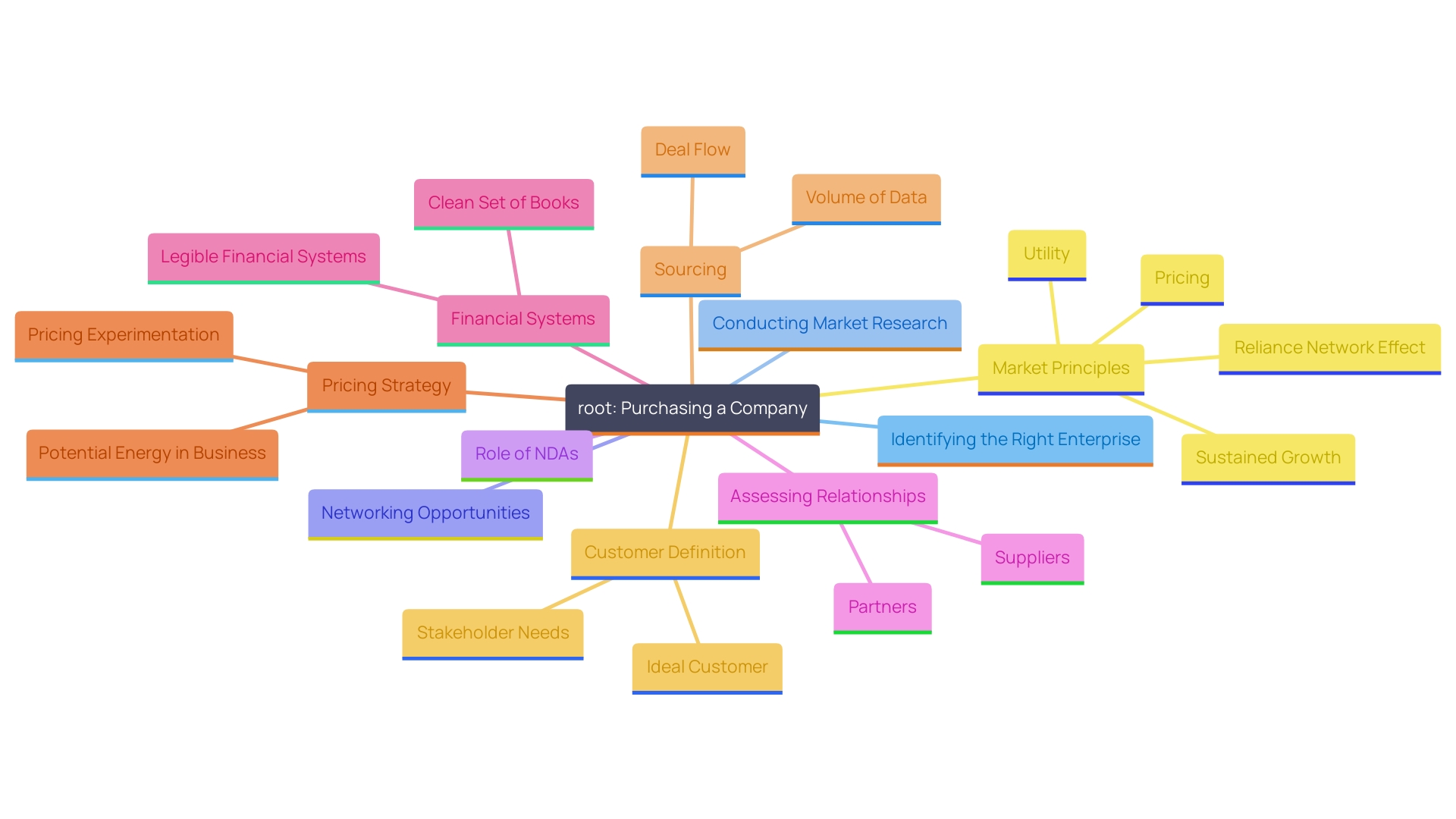

Step 1: Find a Business to Purchase

Begin your journey to purchasing a company by determining the kind of enterprise that aligns with your interests and skills while fulfilling market demands. Extensive research is key here. Explore industries through online resources like websites and social media platforms as well as reaching out to brokers and local connections to discover opportunities available for purchase. Attending industry gatherings and trade exhibitions can also be advantageous as they offer chances to network with sellers and experts, in the field.

The latest report from Fiserv focusing on enterprises underscores how resilient they are in the face of changing economic landscapes and showcases a significant interest in consumer goods and services from customers. This positive perspective could serve as a reference point when making decisions, about entering a specific industry.

"It is broadly recognized by experts that having a well-prepared non-disclosure agreement (NDA) is essential when it involves sharing sensitive company details. Doug Bend of Bend Law Group indicates that rivals may occasionally express interest in acquiring an enterprise to collect detailed information about it without any genuine intention of completing the purchase deal.".

When considering what aids an enterprise in thriving and examining its relationships with partners and suppliers is crucial to assessing its efficiency level. The impact these relationships have. It's important to define your price target to determine whether pursuing a merger and acquisition (M&A) deal is worth the investment in terms of both time and money as advised by Nanxi Liu, from Blaze.tech.

Investors Club presented a case study demonstrating the impact of assessment and valuable connections on success Entrepreneur Ivo Rejchrt expressed his satisfaction with the process; "The Investors Club team conducted a detailed evaluation of my venture in a responsive and well organized manner The fair valuation they provided ultimately led to the sale of my venture, within just one month of listing."

By following these tips and tactics you can greatly improve your odds of successfully locating and acquiring the ideal venture that aligns with your entrepreneurial aspirations.

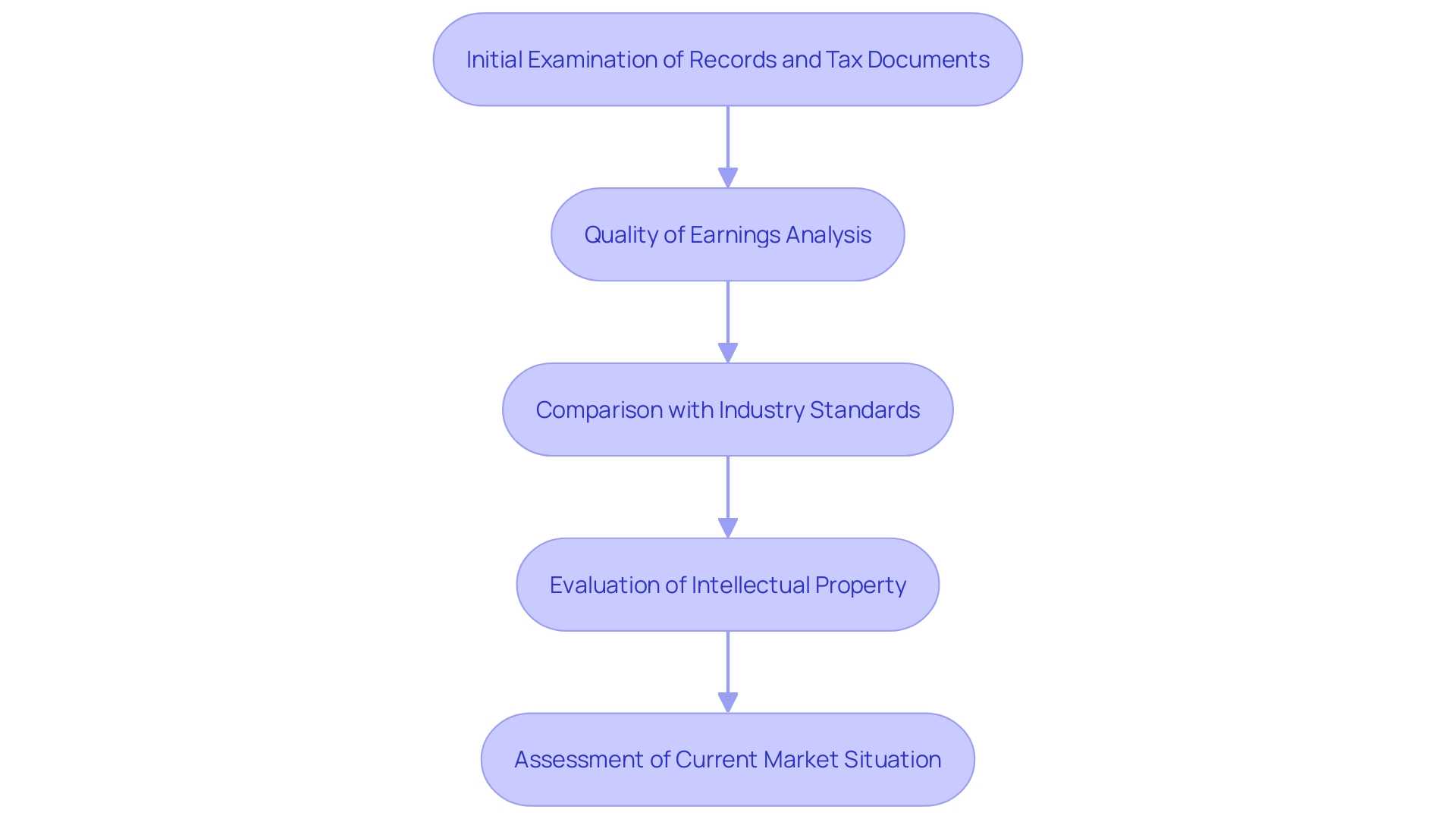

Step 2: Evaluate and Value the Business

Once you've pinpointed a promising company to acquire it's essential to conduct an assessment. Begin by scrutinizing records tax documents and operational summaries to get a detailed understanding of the business profitability. This thorough examination should encompass a Quality of Earnings (QOE) analysis that offers insights into the reliability and precision of the disclosed economic outcomes. For example the QOE evaluation will emphasize the origins of revenue. Confirm their regularity and sustainability which are essential factors for making well-founded investment choices.

After that step is completed, it's important to analyze the company's financial data in relation to industry standards to gauge where it stands among its peers in the market sector. This examination can unveil whether the company holds a position in the market with dedicated customers offering unique products or cutting-edge technology. In addition, an evaluation of the firm's edge should include a review of its intellectual property and history of innovation, as these elements play a crucial role in determining its overall market worth.

Have you thought about looking at the market situation? This includes checking out whats going on with the economy and trends, in the industry now. For instance; The IRS recently announced that they're keeping interest rates for the quarter starting on July 1st. This could affect how you plan your finances and handle taxes. By considering all of this when evaluating aspects of the market realm for your value assessment. It helps make sure your investment is solid and brings strategic benefits.

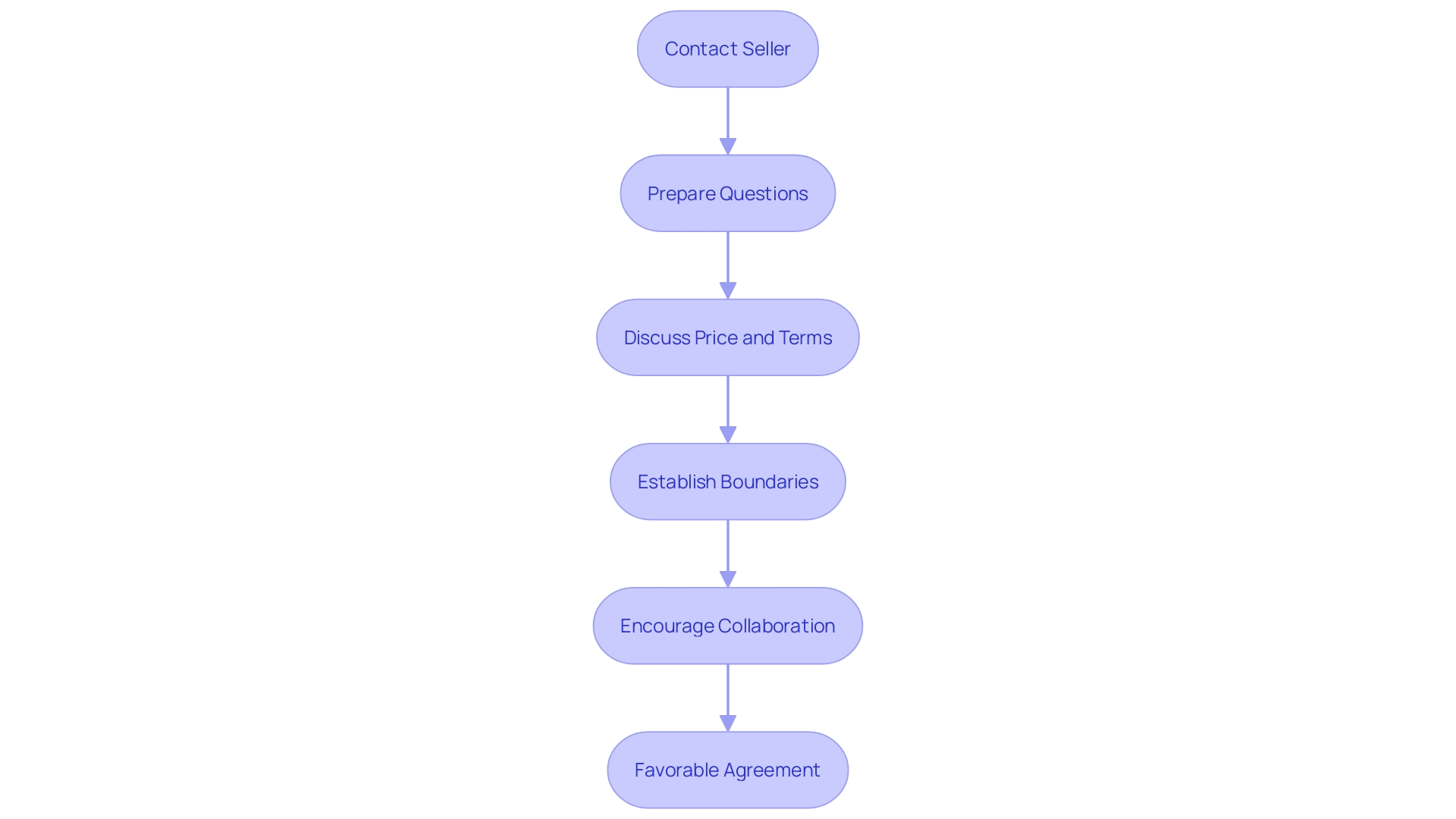

Step 3: Initial Contact and Negotiation

Contacting the seller to express your interest is the action to pursue when exploring a commercial opportunity. It's important to be ready with questions about the company and how it operates. Start the bargaining process by talking about the price and terms of the sale along with any conditions. Keep a mind during these conversations and aim for a negotiation that leaves both sides feeling happy, with the outcome.

Establishing connections and ensuring client satisfaction depends significantly on effective negotiations, as stated by Boris Diakonov from the app ANNA co-founder team. He recommends starting negotiations with a clear statement of your needs and boundaries while encouraging the other party to do the same. This approach fosters an atmosphere of respect and collaboration. He recalls how applying this technique transformed a pricing discussion that was at an impasse with an important partner, resulting in a mutually beneficial outcome.

Andrey Yashunsky believes in setting up agreements in a way that encourages all parties to actively participate in the process. With a track record of finalizing than 250 deals amounting to $700 million he stresses the significance of persuading the other party that a collaborative future is more advantageous, than going their separate ways. This approach has enabled him to attract high caliber talent and establish an enterprise.

Making preparations before entering negotiations is essential beyond what words can convey; it is vital to confirm the information given and uncover any potential risks or liabilities effectively through due diligence efforts. Boosting your negotiation prowess can be achieved by grasping the methodology and honing your skills through engaging in role playing scenarios. Furthermore a profit sharing arrangement can serve as a strategy to guarantee that the seller fulfills specific performance objectives prior, to obtaining the complete purchase amount; this approach aligns interests and minimizes risks for the buyer effectively.

Ultimately, favorable agreements lead to opportunities, enhanced profits, and enduring partnerships. These outcomes show that your negotiation skills are valuable and contribute positively to your company's success.

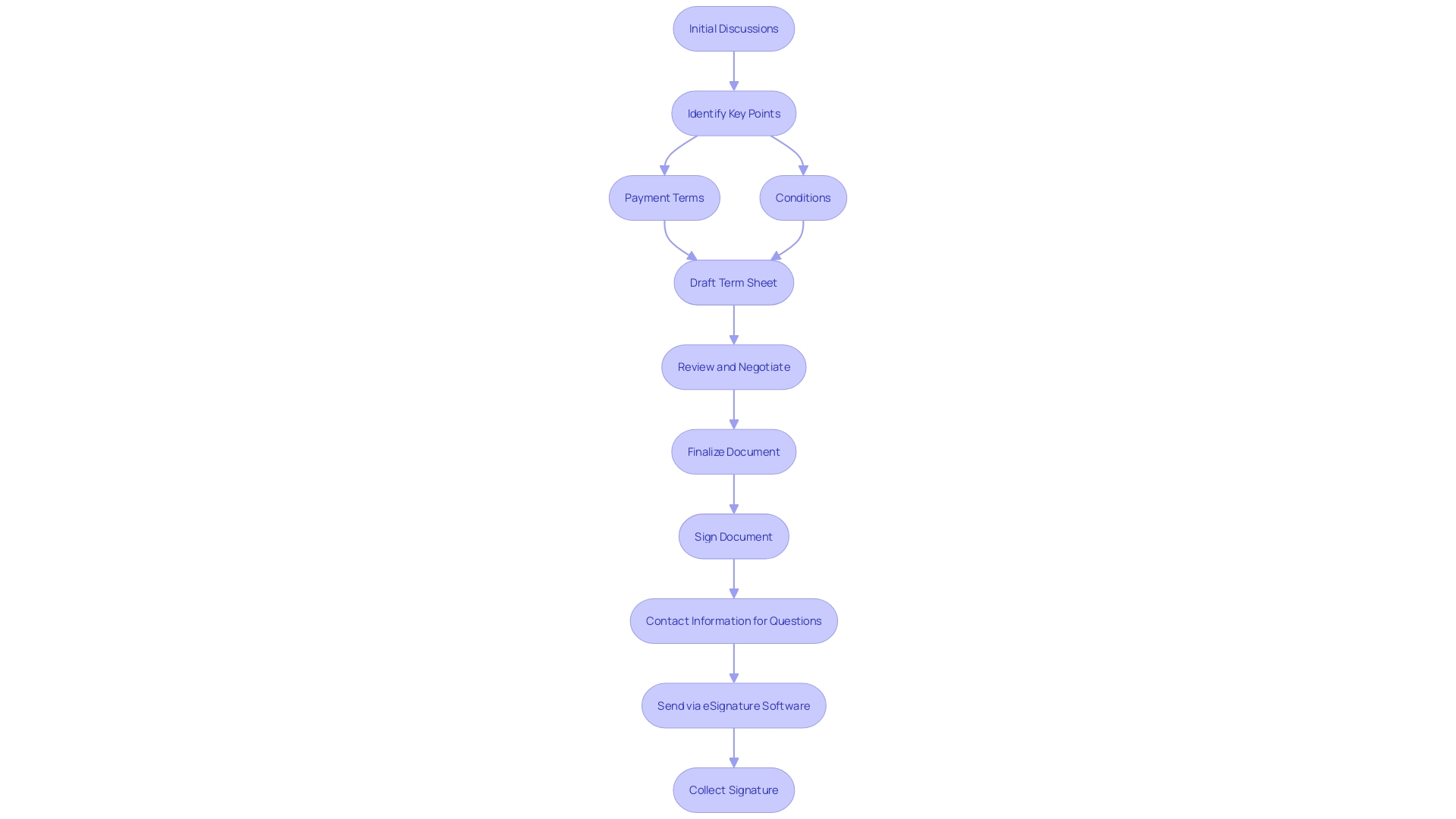

Step 4: Submit a Letter of Intent (LOI)

When you start talking about the deal with the party and things get serious it's time to put together a Term Sheet that lays out all the key points you've been talking about so far in a more official way – it's like a formal agreement in writing that shows you're really committed and sets the stage for more detailed discussions ahead. You'll want to address aspects like how much you're willing to pay and when payment is due, along with any important conditions that need to be resolved before you can proceed together. Having a Term Sheet makes negotiations smoother since it gives everyone involved a roadmap to follow in order to finalize the deal and make sure everyone's clear, about what they're agreeing to.

Step 5: Conduct Due Diligence

Conducting research is an important part of confirming the details given by the seller and evaluating the real worth of the business entity. This includes an examination of the legalities, fiscal matters and day to day operations of the company.It's crucial to grasp the significance of figures like collaborators in joint ventures personnel entitled to purchasing rights and the originators of the business. Christian Atzler, a partner in M&A, at Baker McKenzie stresses that neglecting to involve these individuals can significantly impede the deal.

An extensive investigation procedure should encompass a Quality of Earnings (QE) evaluation. This includes an assessment of the targets earnings integrity and financial health with a focus on the durability and accuracy of disclosed financial results. It provides insight into the reliability and risks associated with earnings that are essential for making thoughtfully considered decisions.

It's essential to analyze the trends in revenue and profit margins and take into account valuation metrics like earnings per share (EPS) and price to earnings (P/E). It's also essential to have a grasp of the industry landscape and competitive environment to get a comprehensive understanding of how the target company stacks up against its rivals.

Doug Bend, an expert, at Bend Law Group recommends establishing a robust mutual non disclosure agreement before divulging any sensitive data to others. Rely on your intuition. Establish clear pricing goals to guide your decision making on whether to move forward with the deal.

To sum up the situation at hand; carrying out diligence involves more than just confirming figures; it entails grasping the wider scope of the organization along with its stakeholders and standing within the industry sector as well. This comprehensive method will reveal any possible risks or obligations that could impact your choice to go ahead with the acquisition.

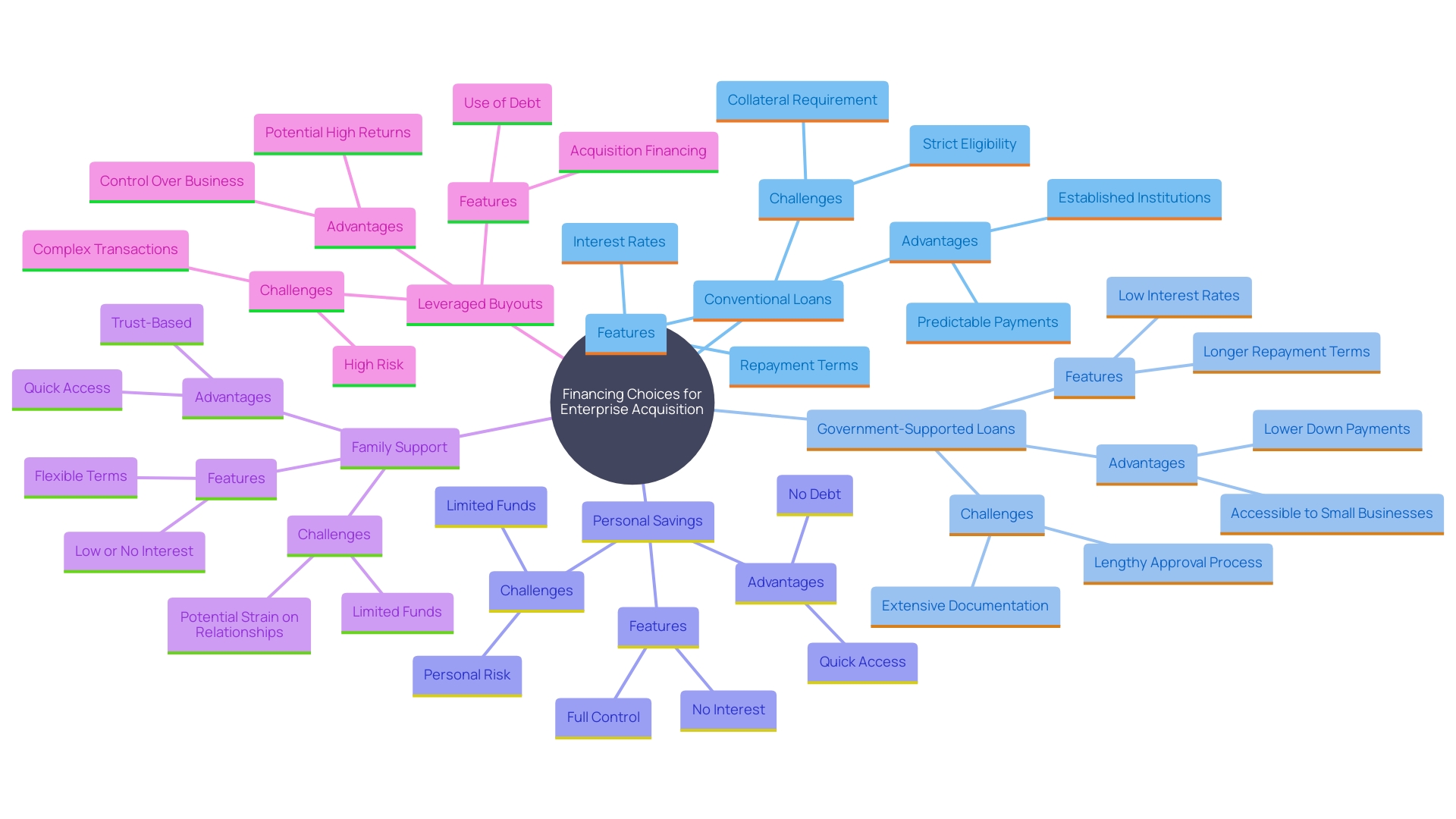

Step 6: Secure Financing

Examine the monetary choices available for financing your enterprise acquisition journey! 'Conventional loans provided by banks or lending organizations come with rates and substantial funding potential; however, obtaining them might present a challenge for small companies or startup owners due to risk factors involved.'.

According to internal information obtained from Lendio records, small enterprise owners on average acquire loans totaling $47k and generally have about five employees when seeking assistance for the first time.

Loans supported by the government like those provided by the Small Business Administration (known as SBA) provide an option worth considering too! These loans cater not for well established enterprises but are also within reach for startups that meet certain qualifications and standards. SBA loans usually come with strict requirements and bring advantages such as the potential for building credit and quicker access to funding.

When looking for ways to finance a venture or project outside of traditional sources like banks or investors many people find that dipping into their own savings or turning to friends and family can be viable options. Based on a study carried out in 2022 concentrating on companies and their monetary strategies, it was shown that a notable 66% of these companies depended on personal resources or support from relatives for financing. Additionally, leveraged buyouts provide another option for planning by utilizing borrowed funds in conjunction with the company's assets.

Ensure your plan is thorough and current before you reach out to lenders. Be sure to include information about your operating costs and monetary history well, as your future objectives. A well-structured plan can significantly enhance your chances of obtaining a loan by demonstrating that you are organized and future-oriented.

It's an idea to start the conversation, with banks or financial institutions early to understand your funding choices and ensure you have the funds you need before finalizing the deal. Take your time comparing offers to get the most favorable terms and lower interest rates that will help your business grow and stay secure in the long run.

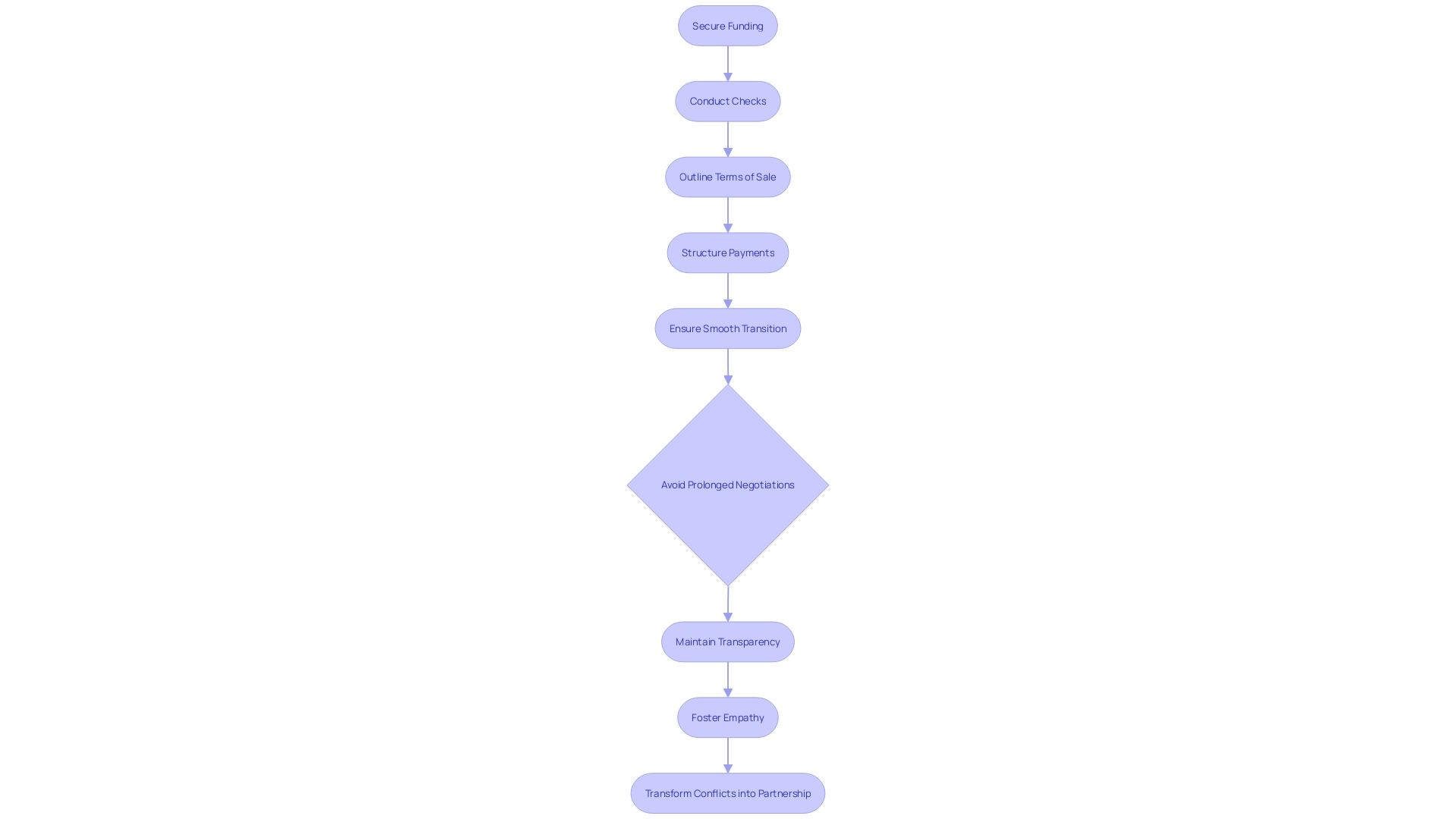

Step 7: Negotiate and Finalize the Purchase Agreement

After finishing all the checks and securing the funding required for the deal ahead of us it's time to sit down and hash out the final details of the purchase agreement. This essential document outlines all the terms of the sale. From the price to how payments will be structured to plans for a transition ensuring that both parties have a clear understanding of what's expected. Including elements like earn outs can help align everyone's interests after the acquisition is complete lessening any risks for the buyer. It's essential to avoid any back and forth negotiations that could damage trust and prolong the entire process. Maintaining transparency and showing empathy between both sides is key to ensuring an seamless transaction, between buyer and seller. Before sealing the deal with signatures on the line it's important for both parties to come to a mutual understanding, on all fronts transforming what could be seen as a conflict situation into a mutually beneficial partnership.

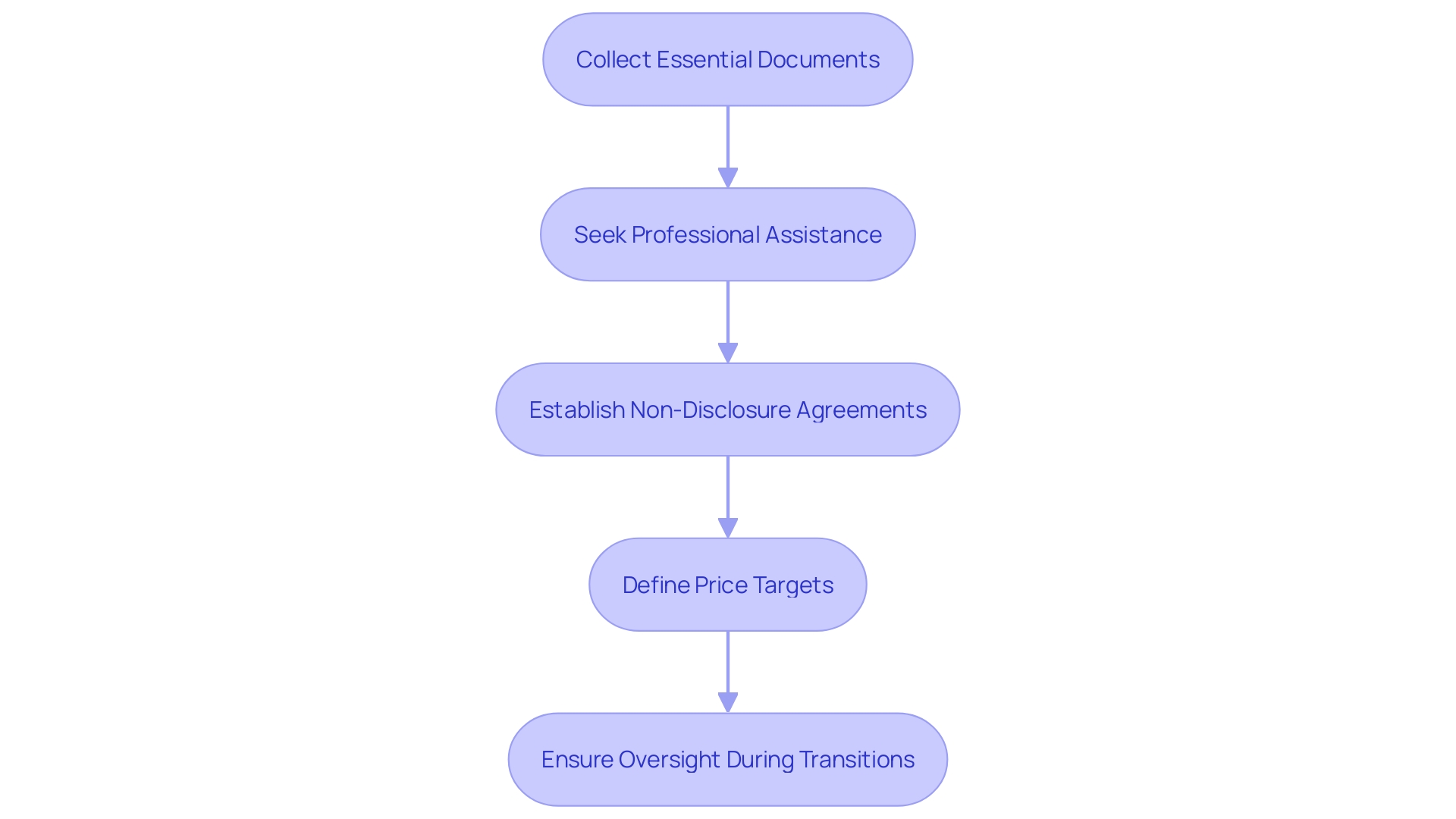

Step 8: Close the Deal

To get ready for the closing phase requires planning and a proactive attitude; start by collecting all essential papers like the signed purchase contract and financing paperwork as well as any other legal documents needed for a smooth transfer of transition is crucial in guarantee its success Seek assistance from professionals such, as lawyers and accountants to examine the paperwork with their expertise to prevent any possible issues.

Doug Bend from Bend Law Group emphasizes the importance of having a mutual non-disclosure agreement before revealing confidential information to protect your company from competitors seeking to gain insights without genuine interest in purchasing your products or services. Moreover... Nanxi Liu of Blaze. Tech highlights the significance of defining your price target as it aids in deciding whether to move forward with the intricate and frequently expensive mergers and acquisitions procedures.

In actual situations such as the partnership between Bardell Venture Management and Sage Intacct demonstrate how crucial it is to have guidance and oversight during changes that lead to success. Bardells skill, in uncover ing financial perspectives and enhancing profits highlights the importance of experienced support during the final stages of a transaction.

Furthermore, that report from Fiserv in February 2024 emphasizes a need for consumer goods and services and showcases the capability of small enterprises to adjust to evolving economic conditions. The optimistic viewpoint presented could enhance confidence among both sellers and buyers in the current market environment.

In essence, careful preparation, expert advice, and clear goals are essential for a smooth and successful transfer of ownership.

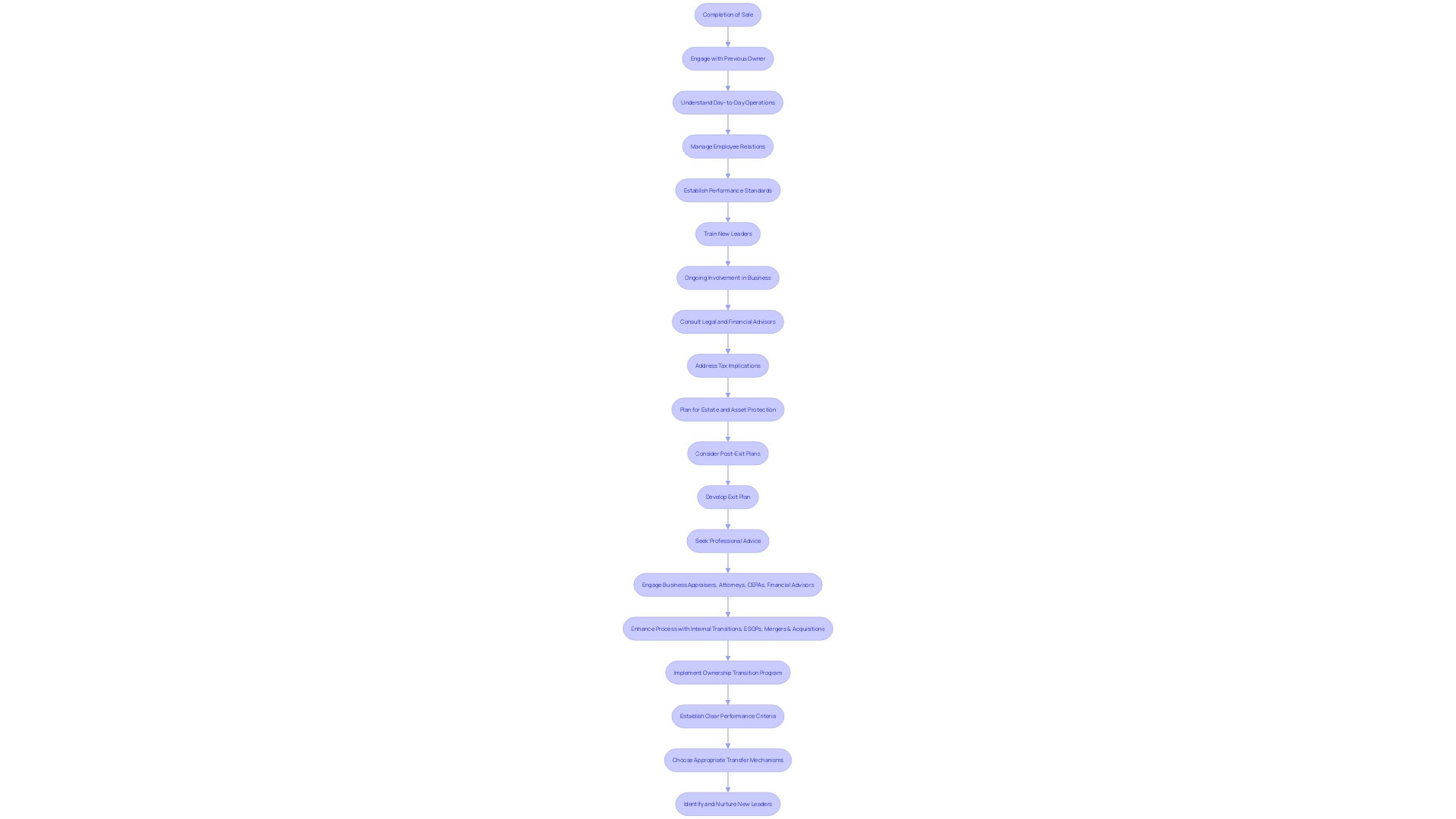

Step 9: Training and Transition

Once the sale has been completed successfully it is important to pay attention to the transition period to ensure a handover. Working closely with the owner can provide valuable information about day to day activities employee management and customer interactions. This step is crucial to keep the operation running and guarantee a seamless transfer of ownership. According to Givelle Lamano of Oakland DUI Attorneys your level of engagement after the sale can have an impact, on the future direction of the business. Deciding whether to continue in a position or depart entirely involves striking a harmonious blend of releasing control while maintaining ties with the organization. A period of training aids in setting up performance standards and fostering the development of future leaders in line, with the objectives of a successful ownership transition initiative.

Conclusion

Buying a business involves a yet fulfilling journey that demands meticulous navigation through various crucial phases like finding the right business and assessing its worth before negotiating terms. Each step playing a vital role in ensuring a successful purchase process Research backed decisions and clear communication form the foundation for a seamless transition and aid, in managing potential risks effectively.

Securing funding and completing the purchase contract are steps that require careful consideration and thoughtful strategizing. This stage not confirms the dedication but also sets up a well defined structure for what lies ahead. Furthermore the significance of conducting research cannot be emphasized enough grasping the intricacies of the business environment is essential, for making wise choices that resonate with future objectives.

In the end focusing on training and transition highlights the significance of maintaining growth and continuity after acquiring a business. Connecting with the owner can offer valuable insights that improve operational effectiveness and promote a positive work environment, in the company. By following these defined steps potential buyers can fulfill their entrepreneurial dreams and set the stage for long term achievements and growth in a challenging business environment..