Introduction

Assessing the worth of a company holds importance for both entrepreneurs and investors as it plays a pivotal role in shaping decisions regarding mergers and investment ventures.It serves as a guiding compass, amidst the process of evaluating the value and future prospects of a business.In this piece different valuation techniques are examined including the Berkus Method,value based on assets the discounted cash flow (DCF) approach the market method,the market capitalization technique,the revenue approach the earnings multiplier technique,the book value method and the liquidation value technique.

Different approaches provide viewpoints on the value of a business by taking into account aspects such as assets, cash flows, market comparisons and earnings. Additionally we touch on the procedures for determining a companys worth and the significance of selecting the valuation approach. Nevertheless assessing a companys value presents difficulties such, as predicting cash flows evaluating assets managing subjective judgments acknowledging the influence of key personnel and tailoring valuation methods to suit varying business structures.

By grasping these techniques and conquering obstacles in their path companies can acquire an insight into their real value within the ever evolving market environment.

Understanding Company Valuation

Comprehending the realm of valuing a company is crucial for both company owners and investors alike as it serves as a guiding tool for important decisions related to acquisitions or investments in a company's equity stake or assets. It's like having a compass that helps you navigate through the complexities of assessing the worth of an organization entity and its potential growth prospects in the market landscape. Examining methods for determining the worth, such as the Berkus Method, provides insight into the value of startups in their early stages before generating revenue. During the technology boom of the 1990s, Dave Berkus introduced this approach which evaluates factors related to companies and offers a pre money assessment that is crucial for startups, without previous financial records.

The field of assessing worth is constantly evolving and intricate with phrases like 'pre money' and 'post money' worth playing a significant part in determining stakeholder equity and ownership after investment rounds take place. There are techniques for valuing startups such as the Berkus Method and the Book Value Method; selecting the appropriate one is critical to align with a firm's unique characteristics and industry standards.

The procedure of evaluating the worth of an enterprise is riddled with hurdles such as the absence of companies or the reliance on funding rounds that may introduce personal opinions and prejudices into the equation. However challenging it may be, at times; embarking on this assessment journey is truly worthwhile. By mastering valuation techniques thoroughly; you set your business up to appeal to investors and steer your strategic planning with assurance. This ultimately directs your organization towards its financial worth.

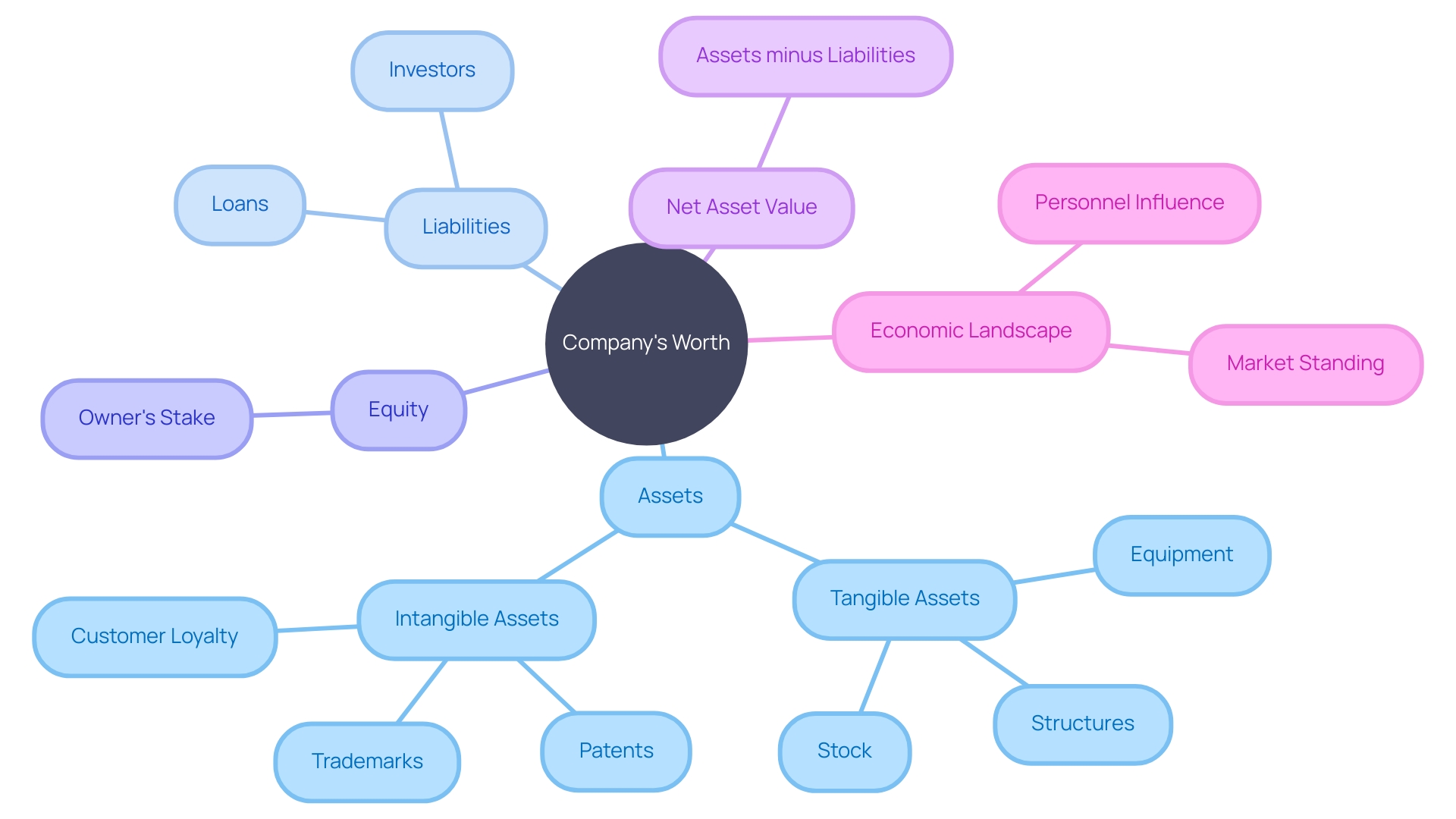

Asset-Based Valuation Method

Assessing a company's worth based on its assets is an approach that closely examines the tangible and intangible possessions of the organization. Tangible assets include structures, equipment, and stock, all of which contribute directly to the organization's overall market worth. On the other hand, intangible assets such as patents, trademarks, and customer loyalty may not have a physical presence but hold significant importance in enhancing the overall market value of the organization.

The method is simple yet crucial – when we deduct the liabilities from the assets we get the net asset value which holds significant importance particularly in industries with high asset investment such, as manufacturing or real estate sectors. This approach not showcases the present financial position of the company but also offers a comprehensive view of its future expansion and security.

In todays evolving economic landscape where the decisions of the Federal Reserve influence market trends significantly; it is increasingly important to understand the true value of assets. The increase in real estate activity after the pandemic demonstrated by Indian investors rushing to Dubai's property sector underscores the need for an approach to appraising that takes into account both physical properties and intangible assets, such as desirable locations and tax advantages.

Valuation isn't about the figures listed on a financial statement. It entails a intricate interplay of factors like the influence of significant personnel at every level, in an organization and the standing of the enterprise itself that can significantly impact its worth.

To summarize, asset-based assessment acts as evidence of a business's assets and intangible market position, offering a realistic evaluation of its true worth in a demanding economic environment.

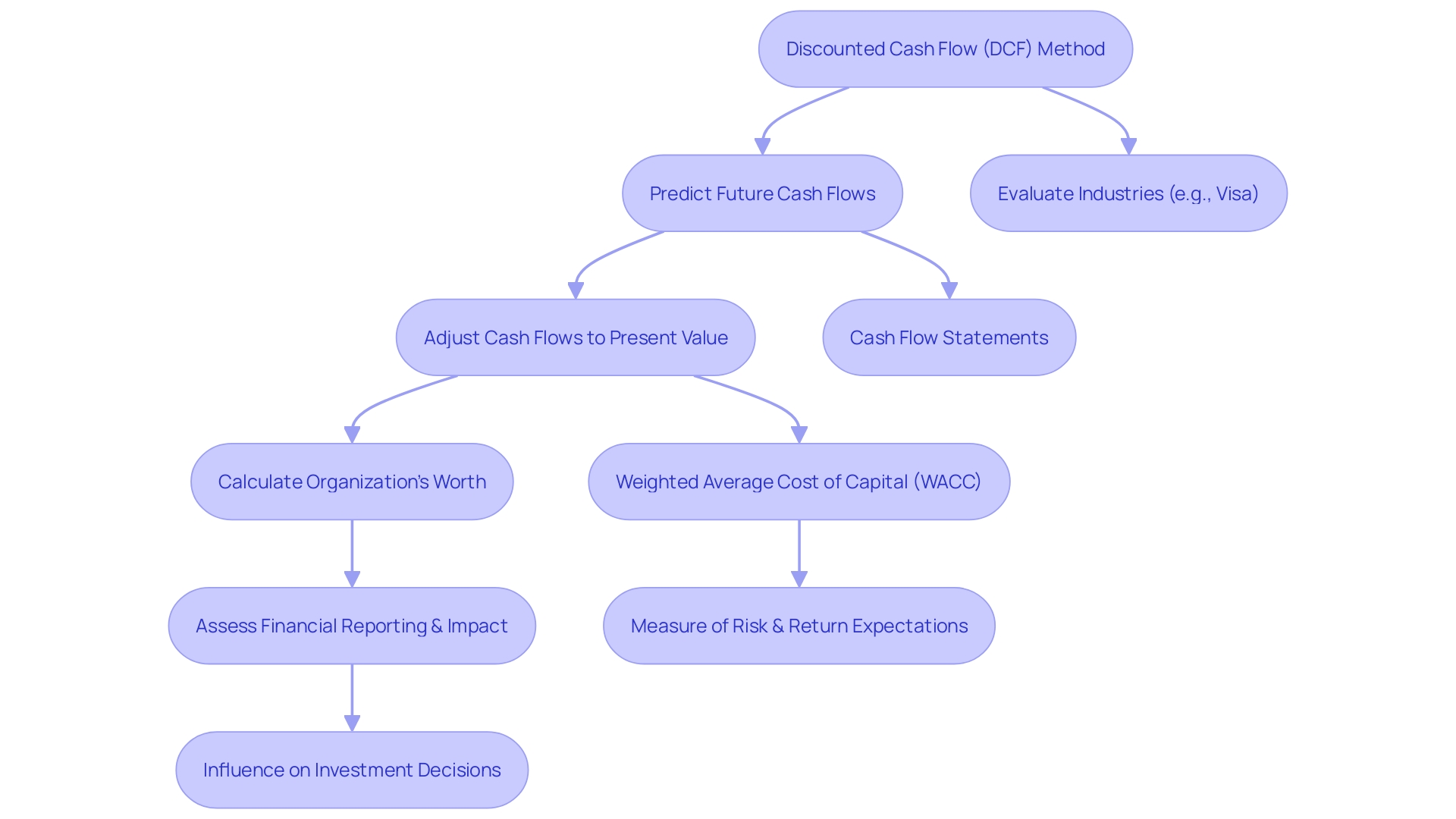

Income Approach: Discounted Cash Flow (DCF) Method

When we delve into the realm of business valuations, the Discounted Cash Flow (DCF) method comes forward as a technique for evaluating the worth of an organization. This method utilizes the financial concept known as the time value of money acknowledging that the present day worth of a dollar surpasses its future worth. When predicting a firm's cash streams and adjusting them to their current value – a method that resonates with the timeless teachings found in Aesop's fables – DCF offers a thorough evaluation of a firm's true worth. For instance, the DCF method plays a role in assessing industries like Visa, which revolutionized the payment sector and has consistently generated dependable cash flows since its inception as BankAmericard in 1958. Furthermore the DCF techniques dependence on cash flows helps avoid the discrepancies that may arise from conventional accounting methods providing a straightforward perspective on a company's financial stability. As seen in the cash flow statement detailing inflows and outflows from business operations investments and financing activities. This simple approach has been a factor since 1987 emphasizing its importance, in financial reporting and assessment. Using the DCF approach allows us to see how effectively an organization operates and understand the impact of its financial choices since the discount rate. Usually shown by the Weighted Average Cost of Capital (or WACC). Reflects investors risk and return expectations.

Market Approach: Comparable Transactions and Public Company Multiples

Evaluating the value of a corporation is similar to deciphering a riddle where each component represents a unique facet of the organization's financial condition and performance landscape. The market assessment approach is one component of this puzzle; it compares the corporation with its counterparts in the industry to determine a justified market worth. This approach works under the assumption that corporations, within the industry and market circumstances, will demonstrate comparable financial characteristics and consequently possess similar appraisals.

In the market approach process that stands out are two techniques. Examining similar transactions and utilizing publicly traded firm multiples for assessment of worth. When examining firms' recent sale prices using the first approach mentioned above, appropriate multiples for assessing the value of the target entity are extracted and adjusted. An illustration of this is Visas evolution from its name "BankAmericard," which played a significant role in transforming the consumer card industry and now serves as a standard for valuation, in its sector.

When examining firm valuations officially traded on the stock market, it is essential to carefully evaluate financial metrics such as the price to earnings (profitability indicator) or the price to sales (revenue ratio) in comparison to comparable entities in the market. Teslas recent strategic pivot, towards energy storage technologies highlights how essential it is to understand what distinguishes a business when considering these valuation measures.

These methods are important because Apollo advises an approach to forecasting statements to highlight the importance of thoroughly evaluating potential risks and uncertainties when assessing an organization's worthiness. In today's environment where the Federal Reserves interest rate measures have prevented an expected economic downturn; it is crucial for an organization's value estimation to be adaptable, to both market stability and volatility.

In the changing landscape of business valuation requirements staying updated with industry developments is crucial to understanding market trends like mergers and acquisitions that provide valuable perspectives on valuations. To effectively assess an organization in such a dynamic market, it's important to adopt a comprehensive evaluation strategy that is thorough in its examination and flexible enough to accommodate the distinctive attributes and narratives of each entity.

Market Capitalization Method

Market capitalization or market cap is a widely used expression that gives a current assessment of a business by multiplying the share price with the total number of shares in circulation. This approach is especially valuable for traded organizations where public opinion and sentiment have a substantial influence on market dynamics. For example; 'unicorns which are startups valued at over $1 billion each. Have seen a rise to nearly 2500 in the past two decades based on research by Bain. The market cap essentially represents how investors and the overall market perceive the worth of an organization at any given point in time.

For example; Italmobiliare is an investment company that stands out for not just investing but also actively influencing the companies it invests in with a focus, on expanding globally and implementing strong long term plans. This investment strategy highlights the evolving nature of market capitalization as it reflects not a companys current financial status but also its future growth opportunities and global reach.

In this era of technology and digital advancements market worth now includes not just the conventional sectors but also the emerging field of cryptocurrencies. As Bitcoin gains popularity as an investment option noted tech entrepreneur Michael Saylor highlights the growing significance of market capitalization, for investors navigating the world of digital money.

Understanding the market cap is crucial for assessing startups because evaluating their economic worth presents a significant challenge due to their emphasis on innovation and potential rather than past financial performance. Market cap serves as a metric for startups as it offers a concrete value that aids in planning strategies and making investment choices. By employing the market capitalization method in startup valuation processes can indicate the organization's size and attract investor attention. This metric plays a role, in shaping investment plans and managing portfolios across different markets.

Times Revenue Method

Evaluating the value of an organization requires an assessment that depends on various methods according to the company's growth phase and distinctive attributes it possesses. The revenue multiple method offers a strategy that is especially valuable for startups or firms demonstrating fast growth despite not being profitable yet. This approach involves calculating the organization's worth by multiplying its income with information obtained from comparable businesses, in the market. This approach goes beyond computation—it showcases a deep faith in an enterprise's scalability and its future revenue stream potential based on the achievements of organizations such as Monday.com that managed to scale efficiently and achieve positive free cash flow rapidly.

The times revenue approach also considers the earnings quality. Acknowledges that not all income holds the same value—a key point emphasized by the changing investment trends of 2021 when investors prioritized gross margins to emphasize sustainable profitability rather than just revenue numbers alone. In a shifting landscape where companies like Grant Thornton are delving into equity partnerships for technology and automation investments and The Telegraph faces scrutiny for financial improprieties, the times revenue method continues to be a valuable tool for assessing organizations with potential, for advancement and innovation.

Although traditional accounting measures give an understanding of the financial condition of a firm, methods like the times revenue approach provide a future-oriented perspective that is essential for comprehending the intangible assets that have a substantial impact on determining a firm's worth today. This approach is one aspect of different evaluation techniques specially crafted for diverse organizational models and developmental stages; it assists in acquiring a comprehensive understanding of a firm's monetary worth, within the constantly changing market situation of today.

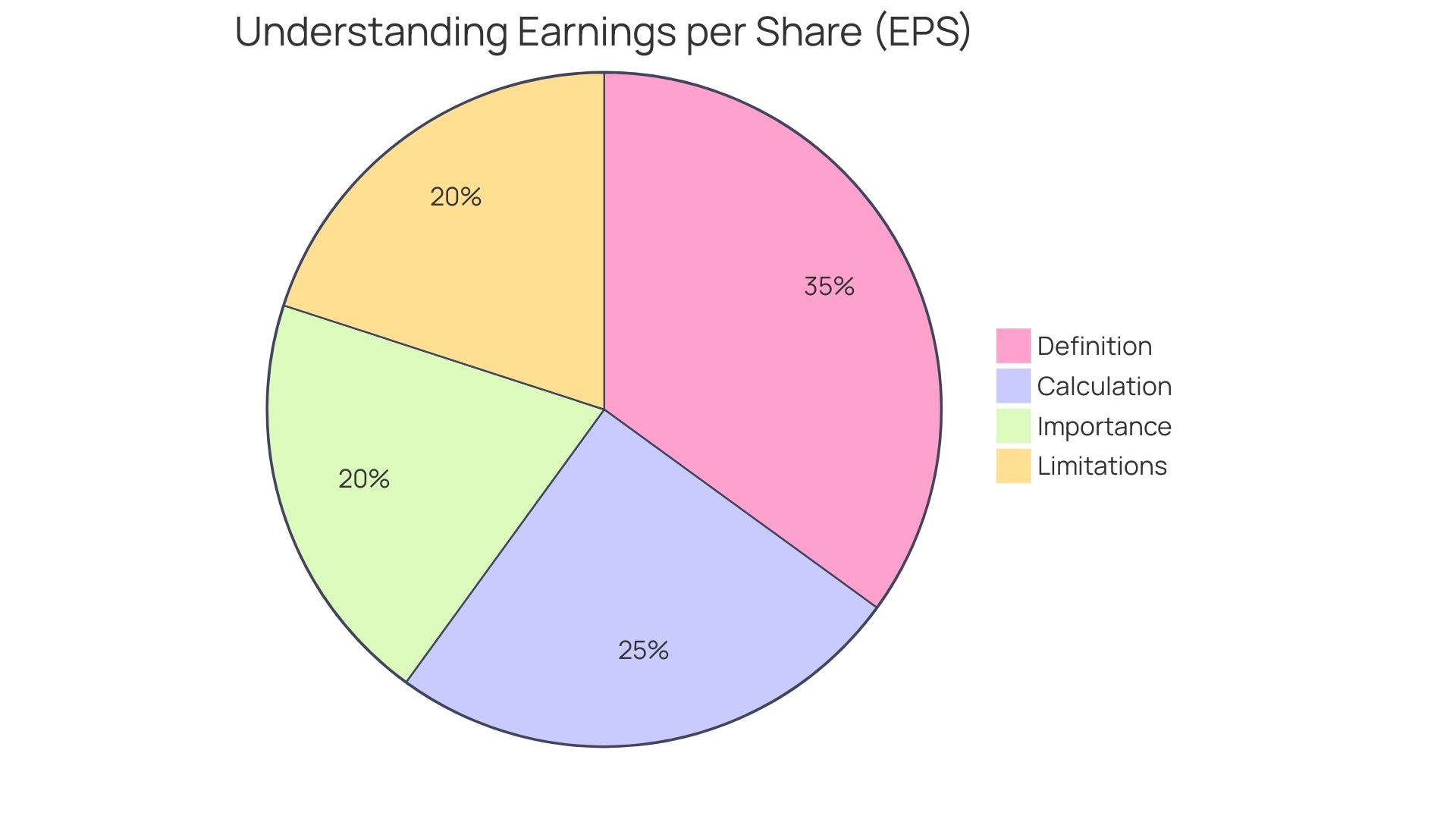

Earnings Multiplier Method

Investors utilize the earnings multiplier or the price to earnings (P/E) ratio as a tool to assess a firm's value by multiplying its profits with a figure aligned with industry norms or similar businesses multiples. This measure proves handy for established firms, with consistent profits as it provides a snapshot of the business's potential value based on its income generating capacity. Profit per share (EPS) plays a role in this scenario as it denotes the earnings assigned to each common stock share within a designated timeframe like a quarter or year specifically. By using the earnings technique, we can assess the market value of a business and this assessment is crucial for making investment decisions. This approach not aids investors in grasping a businesses profitability but also serves as an indicator of its potential, for growth and general financial stability. To obtain an assessment of the situation, when examining the status of an organization thoroughly, it is advised to consider other financial indicators apart from EPS.

Book Value Method

The book appraisal approach is a utilized strategy for assessing enterprises that depends on a straightforward idea. Evaluating a company by summing its assets and subtracting its liabilities as outlined in the balance sheet. This method is based on approximations and is frequently utilized for businesses with substantial physical assets found in sectors like manufacturing and industry. Investing based on fundamental analysis has traditionally been associated with metrics such as price to book ratio, which investors closely monitor to identify stocks that may be undervalued.

In todays changing market environment critics have raised concerns about the backward looking nature of the book valuation method especially when assessing intangible assets that require a forward thinking and principle based appraisal approach. Tesla is highlighted as an example in the energy industry with its story influenced by market expectations and shifts towards energy storage solutions. The organization's value is determined not by physical assets but also intangible elements such as market prospects and groundbreaking technologies.

Moreover, considering the evolving state of the sector and occurrences such as Encyclopaedia Britannica Inc.'s pursuit of a billion dollar IPO valuation, the limitations of the book value approach in reflecting a firm's overall worth are becoming evident. The technique provides insight into previous expenses rather than the current or future market worth, a distinction that carries considerable significance for investors and enterprises operating in an environment where the genuine value of companies often surpasses what is documented on their financial statements.

In the world of finance, the book price method is just one of several tools available. As per Professor Raghavendra Rau from the University of Cambridge, businesses encounter financial decisions and approaches such as Net Present Value (NPV) and the Capital Asset Pricing Model (CAPM) provide different viewpoints on assessing a firm's worth. These techniques factor, in cash flows and investment uncertainties offering a comprehensive outlook on an organization's prospects.

In the end, despite the fact that the book worth technique has been advantageous for investors over time, its careful strategy and focus on tangible assets may not entirely grasp the complexities of modern industries. While it continues to be an aspect of valuation it should be combined with other approaches to gain a thorough insight into a firm's actual worth.

Liquidation Value Method

The liquidation worth approach is a technique used to assess a firm's evaluation under the assumption of rapidly selling all assets in a fire sale situation and paying off all debts immediately. This calculation yields an amount – known as the 'liquidation value' – which signifies the remaining funds accessible to shareholders after settling all obligations. Although this approach may seem harsh, it plays a role as a reference point for enterprises dealing with financial difficulties and potential bankruptcy threats.

It's worth mentioning that when determining the value of an enterprise using liquidation value alone may overlook factors such as the long term viability of the organization and the value of intangible assets that are often significant in nature. The approach primarily relies on financial data to assess a company's worth but fails to consider the future potential associated with intangible assets. On the hand investors, like Dave Berkus have developed valuation techniques that evaluate crucial aspects of a young enterprise based on its anticipated growth and potential rather than solely focusing on tangible assets.

The worth of liquidation can be greatly influenced by market trends. How quickly the sale needs to happen according to James Mohs from the University of New Havens statement. The importance of knowing when it's appropriate to think about bankruptcy. Potentially resulting in liquidation. Cannot be overstated.It's a choice made after all options, for refinancing or merging have been exhaustively considered.

In the economic environment we are facing today; sectors like real estate and construction are experiencing notable declines in activity while enterprises are grappling with financial challenges such, as cash flow issues. The liquidation assessment emerges as a poignant indicator of the financial strength of an organization, reminding us that even with a strong history of performance external economic forces can significantly impact asset appraisals.

When contemplating the significance of the liquidation approach in determining worthiness for businesses it serves as a nudge for companies to consistently assess their financial position, with objectivity and explore various techniques that encompass their complete range of possibilities.

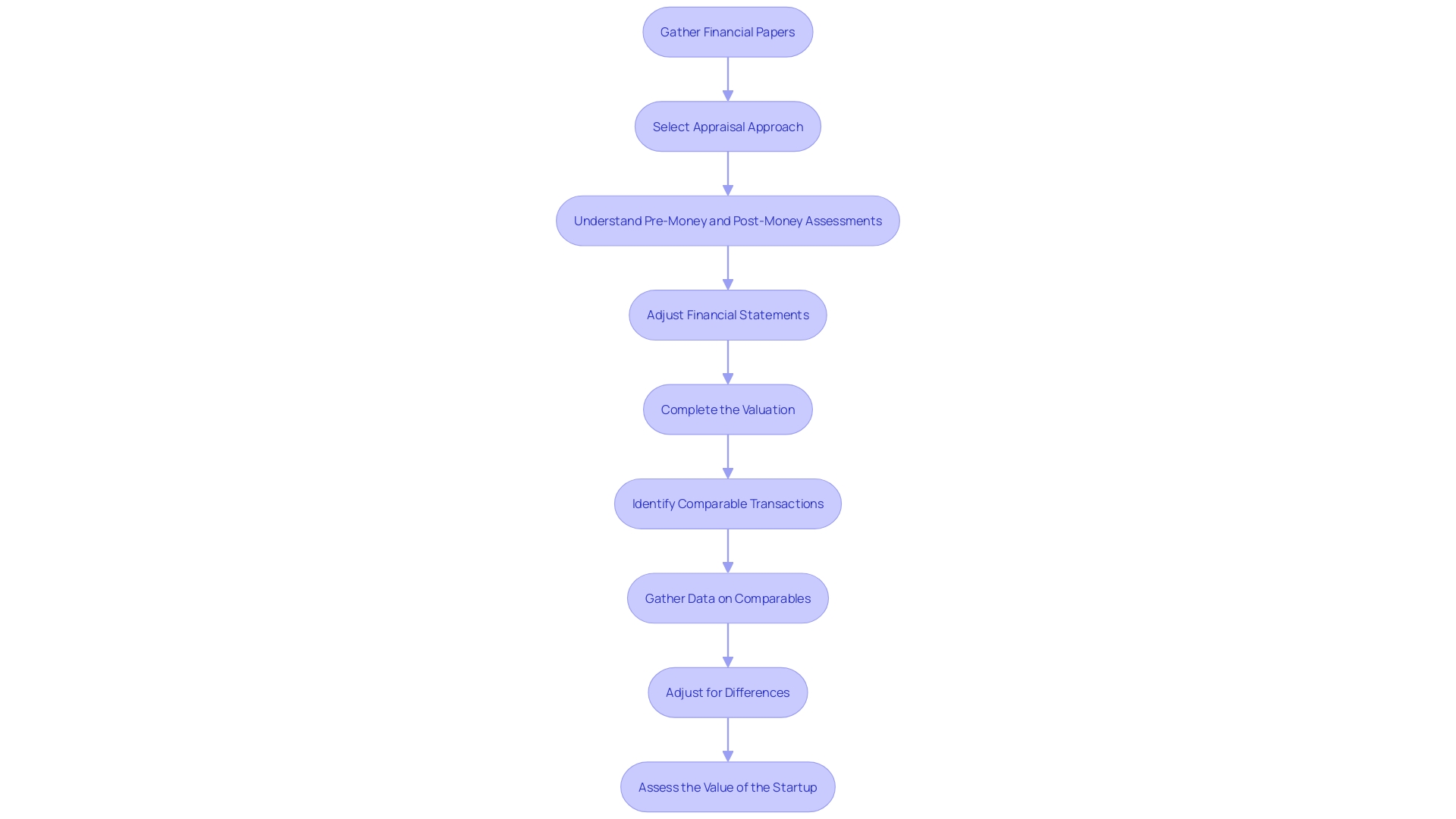

Steps to Calculate Company Valuation

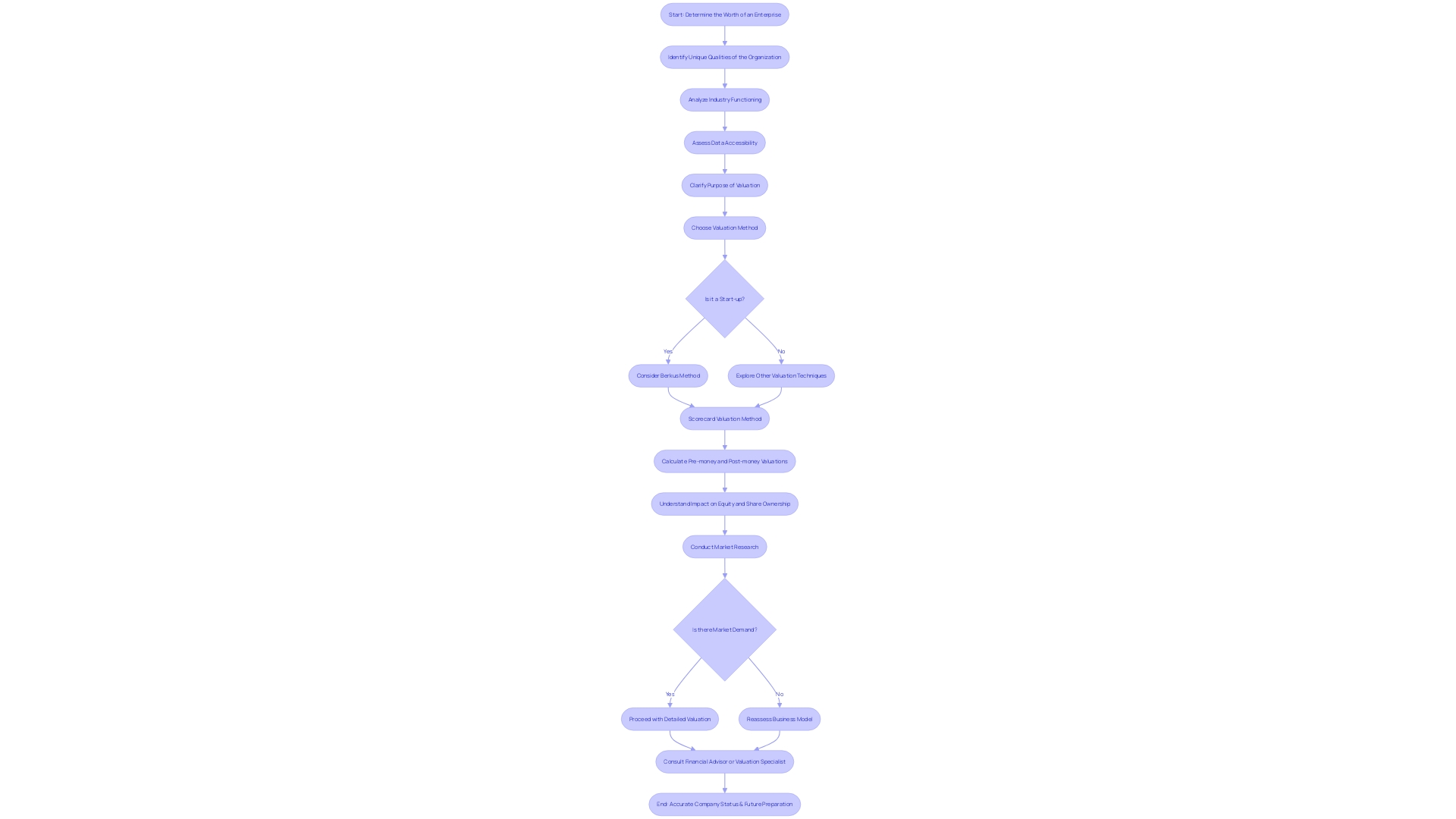

To initiate the process of evaluating your company's worth, you must diligently follow a series of steps that are crucial in determining an accurate estimate of how much your enterprise is valued. Firstly gather financial papers such as your balance sheet, income statement and cash flow statement as these documents form the foundation of this evaluation process. Selecting the appraisal approach is vital and it should be aligned, with the phase and distinctive traits of your organization.

If you're starting a venture and looking for ways to evaluate its potential before making money from it you might want to explore the Berkus Method. It's a scoring system that focuses on aspects of your company and is especially suitable for tech innovators who don't have a long financial history. This approach was developed by investor Dave Berkus during the tech boom of the 1990s. Offers a organized yet flexible approach to evaluate the worth of your company prior to it commences generating income.

Understanding the differences between pre-money and post-money assessments is essential for any business seeking funding. The pre-investment assessment determines the value of the business prior to any funding, while the monetary assessment takes into account the added capital injection. These numbers play a role in shaping how fresh investments impact the ownership stakes and distribution of shares, within the organization.

Once you have selected a valuation approach that suits your needs bestsowitehblers you should carefully. Adjust your financial statements to precisely capture the organization's standard earnings potential. At last, when finished with this step, combine all the information to complete your valuation. Make sure to double check your numbers against the latest market information and consider consulting with industry professionals for additional validation.

Remember that the worth of your organization extends beyond a number; it represents its future potential and acts as a compass for future endeavors. Stay informed about developments in the industry as you progress through this journey and make use of advanced tools such as cap table management software to simplify your financial analysis.

Choosing the Right Valuation Method

When choosing how to determine the worth of your enterprise, take into account different factors, such as what sets your organization apart, how your industry functions, the accessibility of data, and the reason for the assessment. Every approach to assessing value has advantages and disadvantages, so it's essential to choose one that best meets the needs of your organization. In one example of this concept is the Berkus Method developed by investor Dave Berkus during the 1990s to provide a way to estimate pre revenue worth, for startups in their early stages of development. This method assesses a startup according to business components rather than depending on past financial information that is usually lacking for new businesses.

Grasping the distinction between pre money and money assessments is vital as it impacts how ownership is divided and the total worth of the enterprise after investment rounds are completed. Basically; Pre money worth represents the firm's value before obtaining investments. Post money factors in the capital infusion, into the company.

In this evolving global economy that has managed to withstand various obstacles such as a pandemic and political tensions with remarkable strength and resilience on display; the importance of a strong assessment strategy is heightened even more so now, than ever before. It is important to select an approach for determining value that can adapt to the changing economic landscape in view of the consistent performance observed in both the global and particularly the American economic domains in recent times.

In the end selecting a valuation approach is a decision that greatly benefits from consulting with a financial advisor or valuation specialist. Their knowledge and experience can ensure that the method you choose accurately represents your company's status while also preparing you to tackle future challenges and seize opportunities.

Common Challenges in Company Valuation

Evaluating the value of an organization is akin to solving a puzzle in which each element represents different aspects of the business's financial stability and potential for expansion. At the outset forecasting cash flows and growth rates with precision is essential. It's like looking into a crystal ball and making estimations about the organization's financial prospects while considering variables such as market trends and industry dynamics.

Teslas energy division experienced a rise in revenue from 4. Eight percent to 6. Two percent recently due to a shift towards storage solutions rather than traditional sources of income, like car sales This change highlights the impact that market trends and strategic decisions can have on a company's overall worth

Assessing and appreciating assets, like brand value or intellectual property can present a significant hurdle as well. Accounting standards typically look into the past. May find it challenging to fully grasp the real worth of these assets. To accurately determine their values requires forward thinking and principle based methods.

In my experience evaluating startups as a valuation expert. Subjective interpretations and estimations pose a challenge too. Startups encounter obstacles due to their absence of past data. Which emphasizes the significance of potential, performance, and market understanding, in enticing investments and shaping well informed choices.

Significant individuals contribute to influencing the value of an organization, extending beyond high-ranking executives; their impact is noticeable at all levels of the organizational structure as well. The departure of important contributors can certainly have a significant impact on the overall worth of the organization and requires strategic actions to deal with this potential threat.

The reliability of data is essential when evaluating the worth of something like stocks or enterprises. You need to carefully review annual reports and financial documents to find the important information and differentiate between whats significant and what isn't This process is exemplified in how companies such, as Tesla and P& G are valued.

Finally customizing assessment methods for models or sectors is a personalized process. As an illustration the wide variety of products and services offered by Apple requires an evaluation of its activities in order to classify it within a specific industry, for evaluation purposes.

Effectively maneuvering these hurdles requires more than a deep understanding of assessment techniques; it also involves seamlessly blending stories and numbers to create a compelling assessment narrative. As businesses progress through phases of their existence. From fledgling startups to established corporations. The interplay, between narratives and numbers changes significantly; this calls for an adaptable yet principled valuation strategy.

Conclusion

In summary\comma{} grasping the value of a business holds importance for both business owners and investors\period{} Various valuation techniques such, as the Berkus Method\comma{} asset based valuation\comma{} discounted cash flow (DCF) method\comma{} market approach\comma{} market capitalization approach\comma{} times revenue approach\comma{} earnings multiplier method\comma{} book value method and liquidation value method offer distinct insights into determining a companys worth.

Valuing a company comes with its set of hurdles – forecasting cash flows accurately assess assets realistically making subjective judgments wisely recognizing the impact of key individuals and customizing valuation approaches for various business setups.. With adept valuation skills and conquering these challenges companies can grasp their actual worth, in todays dynamic market landscape.

When assessing a companys value accurately is crucial to follow steps carefully; Collecting financial documents; selecting the right valuation technique; adjusting financial records; and cross referencing figures with up, to date market data are key components of an precise evaluation process.

Selecting the method for determining the value entails taking into account aspects like the distinctiveness of the company its industry practices, the availability of data and the intention, behind conducting the valuation. Seeking guidance from an expert or a valuation specialist can offer valuable perspectives and help in selecting a method that truthfully reflects the companys position.

Valuing a company involves typical hurdles such as predicting future cash flows accurately and understanding the value of intangible assets, like brand reputation and intellectual property rights; interpreting subjective factors; acknowledging the influence of key personnel; ensuring data accuracy; and tailoring valuation methods to suit various types of businesses or industries.

By grasping valuation methods and tackling these obstacles effectively businesses can acquire a profound insight into their actual market worth. Such insights draw in investors. Steer the course of strategic planning towards future accomplishments. This undertaking demands flexibility and a rounded assessment approach to maneuver through the constantly evolving market environment.