Introduction

Evaluating the worth of a company is not about doing calculations; it involves looking at different aspects that reveal its actual value. Like its potential for growth in the future and the crucial members of its team along with market chances it holds. The significance of getting the valuation right becomes clear when you think about situations where an artworks value surged after being recognized as a work, by Rembrandt.

Similar to a piece of arts impact on its perceived worth in the market scene is the role that accurate business valuation plays, in determining a companys market value.

Determining the worth of a company is no task at all! Simply assessing its value through earnings fails to consider aspects such as future growth potential and the significance of key employees in shaping its success trajectory – a factor clearly evident in renowned businesses, like OpenAI, Tesla and Berkshire Hathaway.

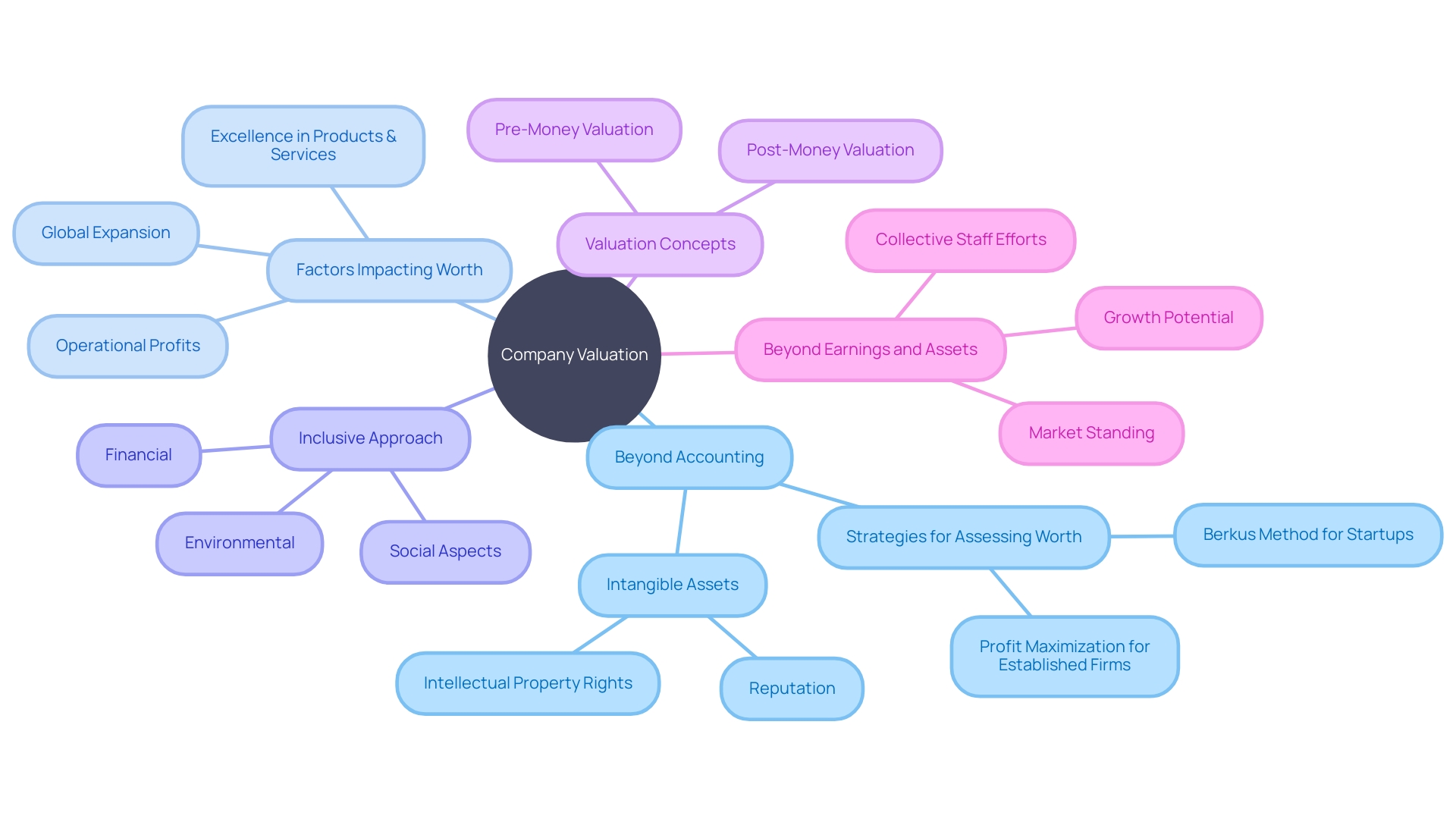

To determine the worth of a company one must take into account the elements that contribute to its prosperity.

Assesssing the worth of businesses brings an extra level of challenge due to their limited financial history.Instances such as the Berkma Approach focus on ventures by highlighting their future promise over past accomplishments.Grasping market needs and consumer profiles is also vital, in gaugig a companys value and growth prospects.

In the world of business it's crucial to understand that value goes beyond just numbers in financial reports; it encompasses the story of a companys evolution and its outlook for expansion.The process of evaluating a business offers a grounded view of its status and unveils possibilities, for future advancement.

By using assessment techniques and taking into account the distinct attributes of the companys operations and offerings¸ organizations can enhance their worth and attain continual progress and triumph.

Why Business Valuation is Important

Evaluating the value of your company goes beyond analyzing figures - it plays a vital role in making strategic decisions for your company's future goals, such as selling it or seeking investments. For example, just like discovering that a painting was indeed a Rembrandt dramatically boosted its worth from $17,000 to $14 million, accurately assessing the actual worth of your business can significantly impact its market appraisal. However calculating this number is far, from simple. Valuing a hardware store based on ten times its yearly earnings overlooks the various factors that actually determine its true value, like future growth prospects and the importance of key staff members.

For instance; the influence of an individual on the value of an organization can be significant. Similar to what we've observed with major players such as Open AI and Tesla or Berkshire Hathaway; their impact extends beyond the top management and permeates every aspect of the organizational structure. This underscores the significance of an evaluation when determining the worth of a company by taking into account the crucial factors that propel its success.

In legal cases such as the Thomas Connelly v United States case, it becomes evident the difficulties in determining the worth of a corporation, particularly in situations involving buy sell agreements and estate tax concerns. The court's ruling to incorporate life insurance proceeds in a firm's valuation while buying shares from a shareholder underscores the significance of understanding the subtleties of appraisal for both legal and financial compliance reasons.

Assessing startups presents an additional level of intricacy as emerging enterprises lack the financial history of established ones; this renders it challenging to accurately ascertain their genuine worth. The Berkus Method caters to fledgling startups by placing emphasis on their future potential rather than previous accomplishments. Seasoned advisors and investors comprehend that evaluating a startup entails considering factors such as innovation, market influence, and growth prospects, thus making it a fusion of art and science.

In the evolving domain of corporate discussions frequently center on statistics and forecasts; nevertheless, it's crucial to acknowledge that worth goes beyond mere numerical information discovered in financial records—it encapsulates the story of a company's progression and its potential for expansion propelled by its committed individuals. Assessing the worth of a company can be intricate. It provides a realistic perspective, on its current position and most importantly shines a light on its future potential.

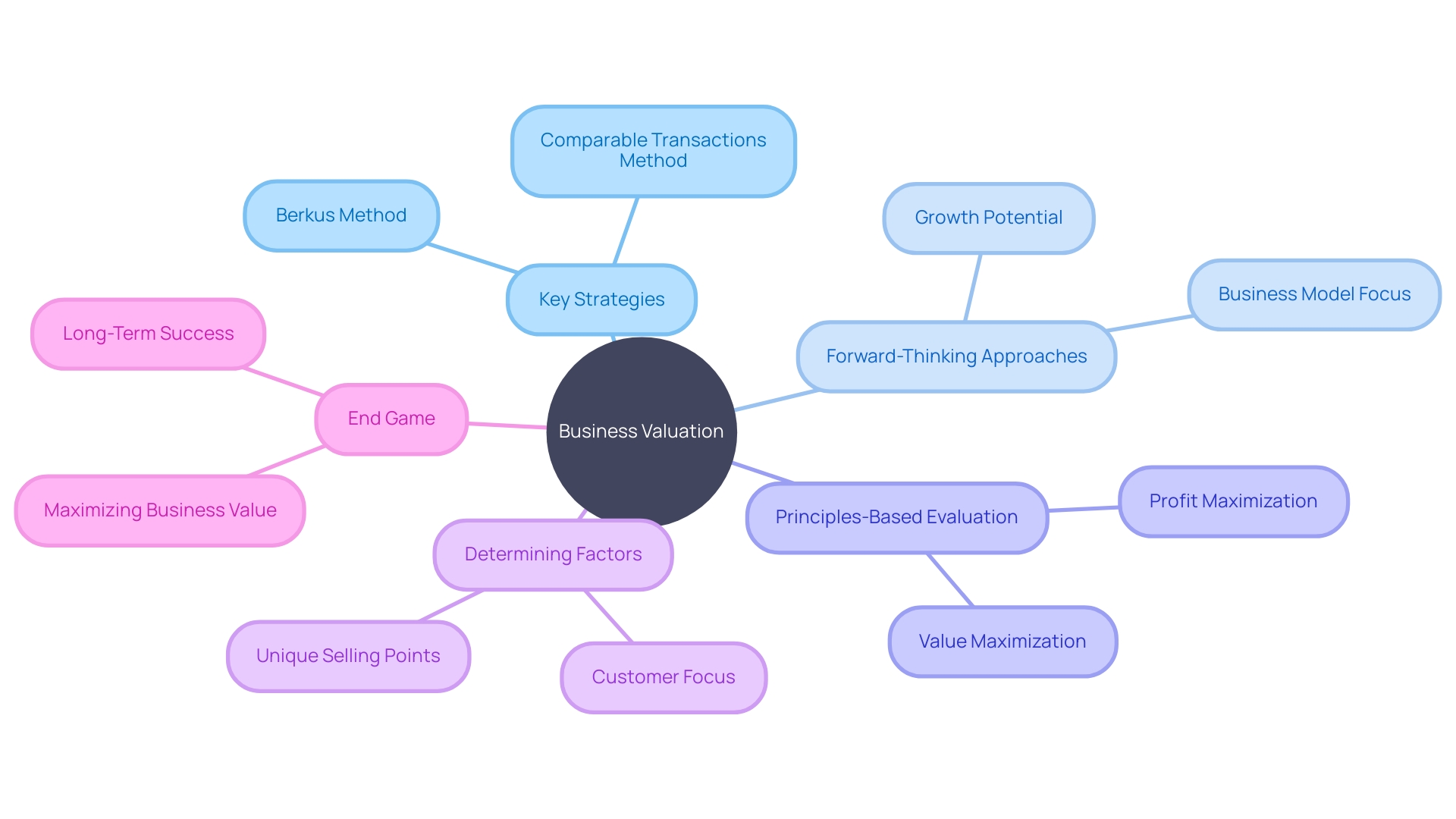

Understanding Business Valuation Methods

Understanding the importance of your company is essential for making strategic choices. Especially when thinking about selling it off! Valuation techniques play a role in uncovering this information by merging creativity and analysis to comprehend the fundamental worth of your company effectively. These approaches evaluate aspects such as financial accomplishments and business opportunities while being tailored to match the unique features of your business. Such, as its sector focus and growth phase.

Investor Dave Berkus developed the Berkus Method in the 1990s tech boom as a way to assess startup value through a scorecard approach that prioritizes elements of the business. This method is beneficial for startups without revenue. Offers a systematic yet flexible strategy, for early valuation.

As your company expands and develops further in its journey of growth and expansion in the business landscape; it is crucial to understand the nuances between money and pre money valuations—especially when seeking additional funding rounds for your ventures progression and sustainability over time. These valuations play a role in determining ownership stakes and equity distributions among stakeholders involved in investment discussions and negotiations—a critical aspect that shapes the trajectory of your relationships, with potential investors moving forward.

Gaining understanding of your target audience through research contributes to assessing worth and also aids in minimizing risks and shaping your strategic path effectively. By investigating market demand and customer characteristics, you can gain clarity on the position of your enterprise in the industry landscape and its possibilities for growth.

The recent occurrences concerning organizations like WeWork emphasize the importance of evaluating their significance during periods of unpredictability and changes in the share price caused by property lease renegotiations and operational cost considerations at WeWork serve as a clear indication of the need for a dependable valuation method to guide businesses successfully through financial difficulties.

Valuing startups can be tricky because they lack financial data and operate in unpredictable innovation driven markets. There are methods, like the Berkus Method and Book Value Method that startups can use to deal with this complexity. Startups must grasp these approaches in order to effectively articulate their worth to investors and manage organizational resources proficiently.

According to analysts and experts in the field of management, the main objective for any organization is to optimize value across all operations and functions within the strategic framework of the organization. Be it allocating funds wisely to investments or catering to shareholder interests with optimal returns at hand using sound valuation methods that pave the way for sustained growth and success rather, than mere survival in today's competitive landscape.

Income-Based Valuation Methods

Understanding an organization's potential revolves around income based valuation approaches that focus on predicting earnings and analyzing, past financial performance to forecast future cash flows while managing risk factors effectively. The Capitalization of Earnings and Discounted Cash Flow (DCF) methods are standout techniques known for simplifying financial scenarios into digestible numbers.

The Earnings Capitalization method evaluates a companys enduring profits by transforming them into a worth through the application of a capitalization rate. It is comparable, to appraising a vessel navigating through familiar waters where the profit flow remains steady and the business strategy has been proven reliable.

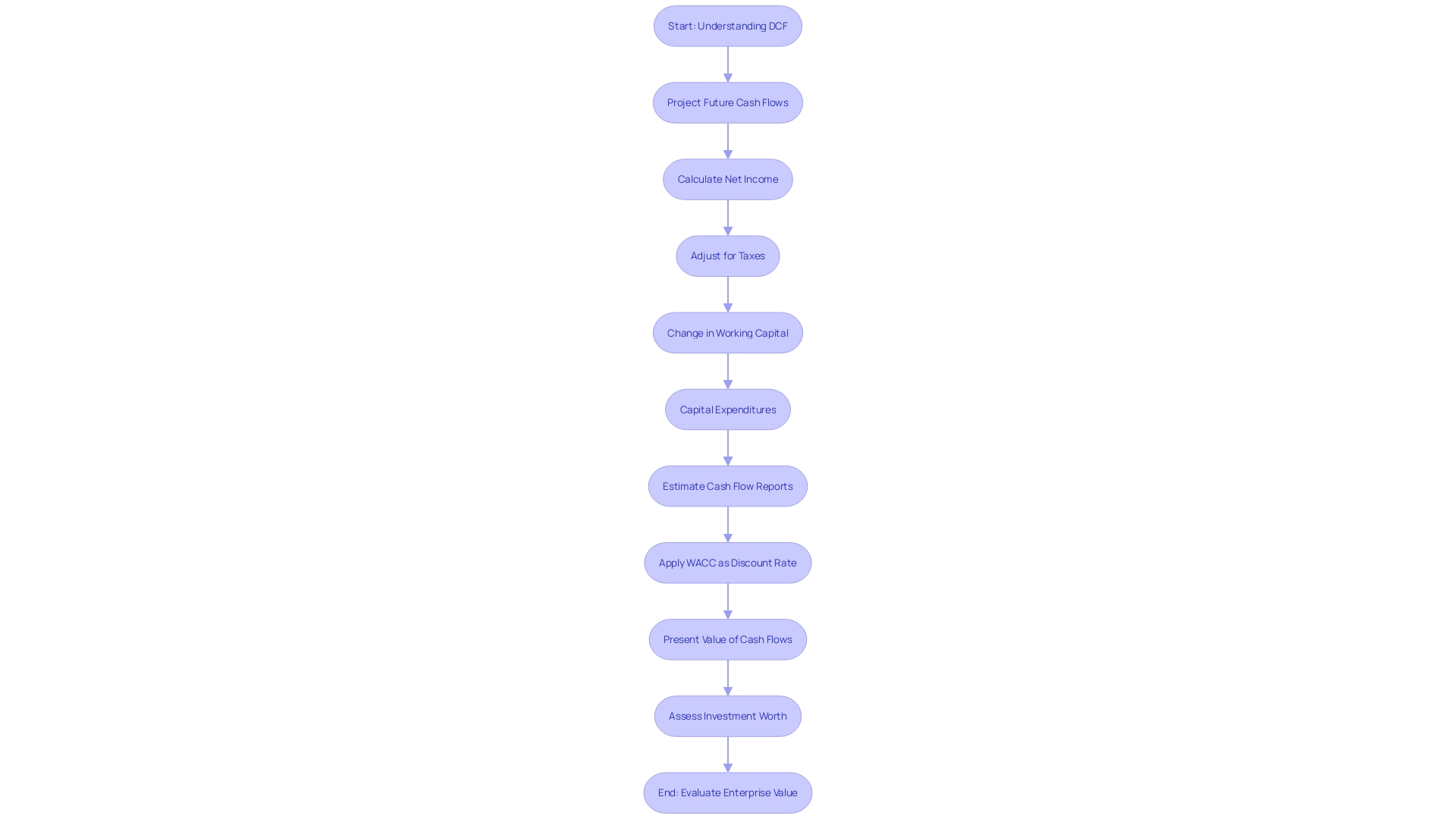

However discounted cash flow ( DCF ) is a method that delves into financial prediction in more detail. It operates on the concept that a dollar today holds more significance than that same dollar at a later time. DCF presents a structure considering factors such as net earnings, taxes, fluctuations in working capital and capital spending to calculate the current worth of an investment's future cash streams. It creates a network linking predictions and current assessments, offering a comprehensive viewpoint, on the worth of a company.

Entrepreneurial ventures find income based strategies useful in the startup world because conventional valuation approaches can struggle to assess the unique and unpredictable aspects of such businesses effectively due to their innovative nature and uncertain paths to success. Startups with financial track records often turn to these forward thinking strategies to showcase their economic value convincingly. Spanning from the customized Berkus Method targeted towards early stage startups to the DCF method, these approaches cater to businesses at different growth stages by providing a framework for assessing and understanding potential and performance.

In a shifting economic environment where the value of an organization can change along with market trends and demands, it is essential to employ income-based valuation methods to successfully navigate this constantly evolving landscape with confidence and openness. This approach provides stakeholders with a foundation for making informed investment decisions and developing strategic plans.

Capitalization of Earnings Method

The Earnings Capitalization Method is a proven strategy for valuing enterprises that works best for organizations with income streams. It looks ahead to projected earnings. Utilizes a capitalization rate to assess the present worth of an enterprise. This approach concentrates on the future prospects of an organization, which is vital in a constantly evolving commercial milieu where past financial records may not entirely capture a firm's true worth, especially those at the forefront of progress or with intangible assets.

Examples from the real world, like the expansion of Alibaba within a 24-year period to become an enterprise empire, emphasize the importance of a company's long-lasting strategy and investments in crucial sectors in determining its worth over time. The focus on evaluating investments by Alibaba highlights the necessity of assessing a company's significance beyond its present earnings. For enterprises, assessing their worth presents a complicated obstacle due to the absence of historical data and subjective elements at play. This guide aims to explain the process of determining the worth of a startup by offering details on eight utilized approaches ranging from the Berkus Method for evaluating startups in their initial phases, to the Book Worth Method that considers a firm's net asset worth.

Experts often stress the significance of grasping the value of a business as fundamental to any valuation approach, like Capitalization of Earnings method when delving into startup valuation methods remember that aiming for value maximization trumps mere profit maximization influencing all aspects of your business decisions from investments to financial strategies. Bear in mind that evaluating the value of an organization extends beyond a theoretical undertaking. It serves as a crucial tool, for shaping investment choices and deciding how resources are distributed to steer the organization in the right direction.

Discounted Cash Flow (DCF) Method

Discounted Cash Flow (DCF) is a method used to assess the worth of an investment by taking into account how the monetary worth changes over time. The technique predicts cash flows and adjusts them to their present worth using a designated discount rate such as the Weighted Average Cost of Capital (WACC). This method provides insights for assessing firms with unpredictable cash flow patterns. The DCF model begins by calculating cash flows which encompass net profit s changes in operational funds and investments, in assets. The predictions are based upon the belief that having cash in hand's better than hoping for future profits—a notion rooted in ancient stories that emphasize the certainty of current resources over potential gains ahead. Since 1987 the DCF technique has been employed to evaluate a firms effectiveness by examining its cash flow reports. These reports play a role in illustrating how activities during a specific accounting period influence cash reserves, across operating, investment and financing sectors. Having a cash flow demonstrates that an organization can generate sufficient funds through its primary operations and emphasizes the importance of effectively managing cash flow when evaluating the overall worth of the enterprise.

Asset-Based Valuation Methods

When evaluating a business for sale and determining its worth accurately is similar to navigating through a maze of intricacies with asset based valuation methods as your trusted guidebook. Therefore meticulously assess the worth of the business by scrutinizing both tangible and intangible assets. The careful examination of assets and liabilities on the balance sheet unveils the true worth of the business. Tangible Assets Valuation focuses on appraising the substantial resources such, as buildings, machinery and equipment that form the foundation of the business's true worth in the real world. Unlike that perspective, the evaluation of Assets explores the intangible but vital aspects, such as brand image, patents, and intellectual property that often have a significant impact on maintaining a firm's competitive edge.

The assessment process reflects the teachings of Aesop's fables by considering the significance of having something now versus the possibility of something better in the future—a reminder of the enduring importance of intrinsic principles in various contexts. In the evolving startup ecosystem where advancement from concept to initial funding can greatly influence a business valuation; these evaluation techniques provide a structured approach, to analyzing both tangible and intangible resources within an organization to gain a comprehensive view of its worth.

Based on guidance from experts we've sought advice from it's evident that the typical accounting methods have a tendency to disregard the significance of intangible assets that require a future-oriented and principle-based evaluation approach. This understanding highlights the significance of using asset based valuation techniques for entrepreneurs who want to assess their organization's overall worth, before putting it up for sale.

Tangible Assets Valuation

Evaluating the assets of your company like real estate, equipment, inventory, and fixtures requires more than just calculations—it's a proficient assessment of the true worth of the physical elements that sustain your company's operations. Evaluating the value of assets involves considering the current value of these resources in the marketplace and subtracting any existing debts. This method provides a perspective of your company's assets after considering its responsibilities.

Previously, enterprises were commonly assessed according to their profit ratio, which is a simple approach that might not be as efficient in today's complex economic environment. The truth is that many factors contribute to determining a company's tangible assets representing only a fraction of the complete picture. For example in industries, like estate and construction where profits and inventory levels can fluctuate widely the valuation of tangible assets can be greatly influenced.

Furthermore accounting procedures frequently face difficulties in representing the total worth of a corporations assets particularly in regard to intangible assets that now play a significant role in the financial statements of numerous prominent companies today The primary firms today most notably those in the technology industry garner a substantial portion of their value from intangible assets underscoring the necessity, for innovative valuation techniques that consider potential upcoming investments and expansion

Ensuring an assessment of tangible assets involves considering not only their historical cost or book value but also their current market worth and the way they impact the financial well being of your business as a whole in order to align with the materiality concept commonly used in the industry to determine an items significance based on its effect, on financial records.

Bear in mind that it's essential to uphold a equilibrium between your assets (such as equipment) and liabilities and owner equity to precisely depict your company's status.. When assessing the worth of your firms assets we also consider their influence, on improving your brand and driving organizational achievement.

When assessing the worth of assets in your business operation. It is important to utilize a principle based approach that recognizes the unique importance these assets hold for your organization and their influence, on your overall worth and industry position.

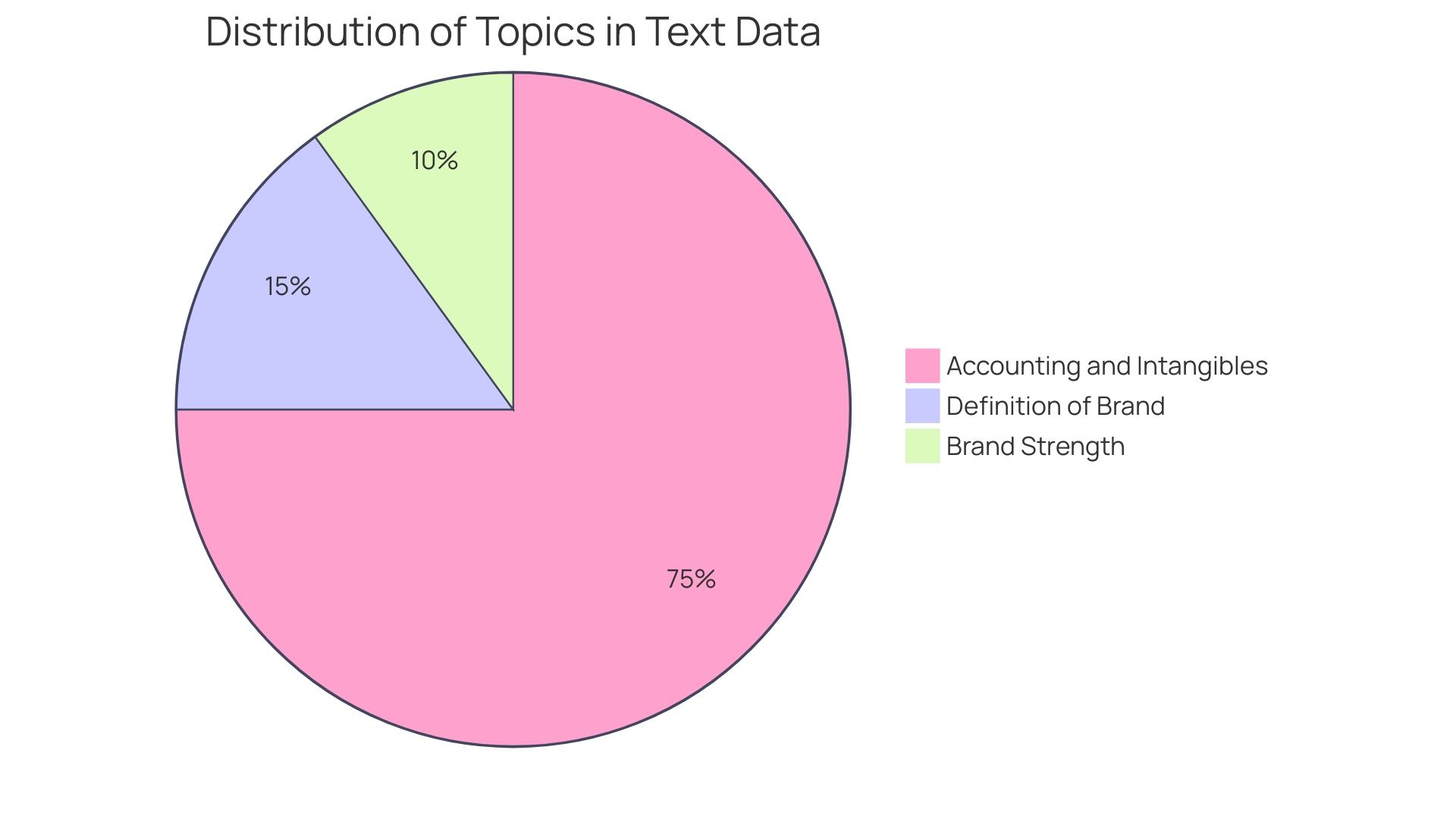

Intangible Assets Valuation

Evaluating the value of an organization involves taking into account not only tangible assets such as equipment and stock but also intangible assets like intellectual property rights and brand reputation that play a vital role in determining the organization's overall value. To accurately determine the value of these assets, it is important to recognize that a brand is not solely defined by its name or logo; it also encompasses the impression and connections it establishes in people's minds. This picture has the ability to create advantages.

The effectiveness of a firm's brand and how well it fares against its rivals can be measured using a Brand Strength Index (BSI) which rates up to 100 to demonstrate the impact of the brand's market investment and stakeholder equity on outcomes. A higher BSI rating can enhance a brands worth by providing it with a grading, to a credit score. Experts point out that dealing with assets poses challenges since conventional accounting methods tend to be retrospective and bound by rules. Contrarily appreciating assets necessitates a proactive and principled methodology.

Furthermore business valuation methods are changing as technology firms—known for their assets—are becoming key players in the market. The shift from an era when the majority of businesses prioritized profit generation in the 1980s to the current environment where fewer enterprises adhere to this approach underscores the increasing significance of prospects over existing tangible assets. This underscores the necessity for an appraisal approach that can precisely depict a firm's inherent worth, particularly those with significant intangible assets.

Market-Based Valuation Methods

Evaluating the value of a business accurately is like navigating through a terrain; valuation methods based on the marketplace act as a crucial guide in this evaluation journey. Value is attributed to a business by comparing it to others in the marketplace. The two primary methods commonly employed for this purpose are Market Capitalization and Comparable Company Analysis.

Market capitalization is frequently utilized for traded firms as a straightforward calculation involving the current stock price and the total number of shares accessible in the market. This metric provides a rapid estimation of a firm's worth in the stock market at any given time, but it's comparable to a snapshot that doesn't encompass all the specifics, such as future growth opportunities or intangible assets that could affect its worth in the long run.

In contrast, Comparable Firm Analysis entails a procedure of comparing a corporation with its counterparts. Those that are similar, in terms of scale, growth direction and industry trends. This approach involves examining the selling prices of comparable businesses scrutinizing them like an investigator to reveal the intrinsic value. It requires a discerning eye to account for variations making sure that the comparison is not accurate but also insightful.

Both approaches imply a belief that the collective insight of the markets is crucial in comprehending the genuine worth of a firm. They mirror the perspectives of investors and consultants who have witnessed unicorns rise and revolutionize sectors, underscoring that market assessments are more than just figures but rather, about grasping the significance of a firm within the broader market landscape.

Market Capitalization

Capitalization is commonly referred to as cap. Acts as a useful gauge of how the industry perceives a firm's worth at a particular point in time. It involves a calculation where the price per share from the marketplace is multiplied by the overall shares issued by the organization. This metric goes beyond being a numerical measurement. It represents the present consensus of the public opinion on the overall worth of the organization. For investors specifically this metric proves valuable as it enables them to promptly assess a firm's scale and compare it with others, in the industry. Having a market capitalization usually implies that an organization has a solid foundation and is likely to be more secure in its operations compared to an entity with a smaller market cap which could indicate it is relatively new or subject to greater fluctuations, in the market.

In the domain of startups today, 'unicorn,' a term introduced by venture capitalist Aileen Lee to describe companies with a valuation exceeding $2 billion and possessing a skilled team and strong potential, holds significant significance. However, due to the growing number of startups surpassing the $2 billion threshold in recent years, the notion of unicorns being exclusive has diminished. What continues to distinguish itself are those exceptional unicorns that can maintain financial stability without continual infusions of venture capital funds.

When public corporations contemplate becoming publicly traded through initial public offerings (IPOs), one crucial aspect to consider is the potential valuation they could achieve in the process. For example; Reddit is planning to release 10% of its shares to the public in an IPO; this would make it the first social media entity to do so since Pinterest did it back in 2019. The size of the market capitalization will be a factor for potential investors of Reddits, as it not only demonstrates how large the organization is but also assists in establishing expectations for its financial future.

Essentially, while market capitalization provides an overview of a company's market worth, it is important to recognize that it may not fully represent the financial stability or true value of a firm as these factors can be influenced by intangible assets and future prospects. It serves as one aspect to consider when assessing investment options and formulating strategic plans.

Comparable Company Analysis

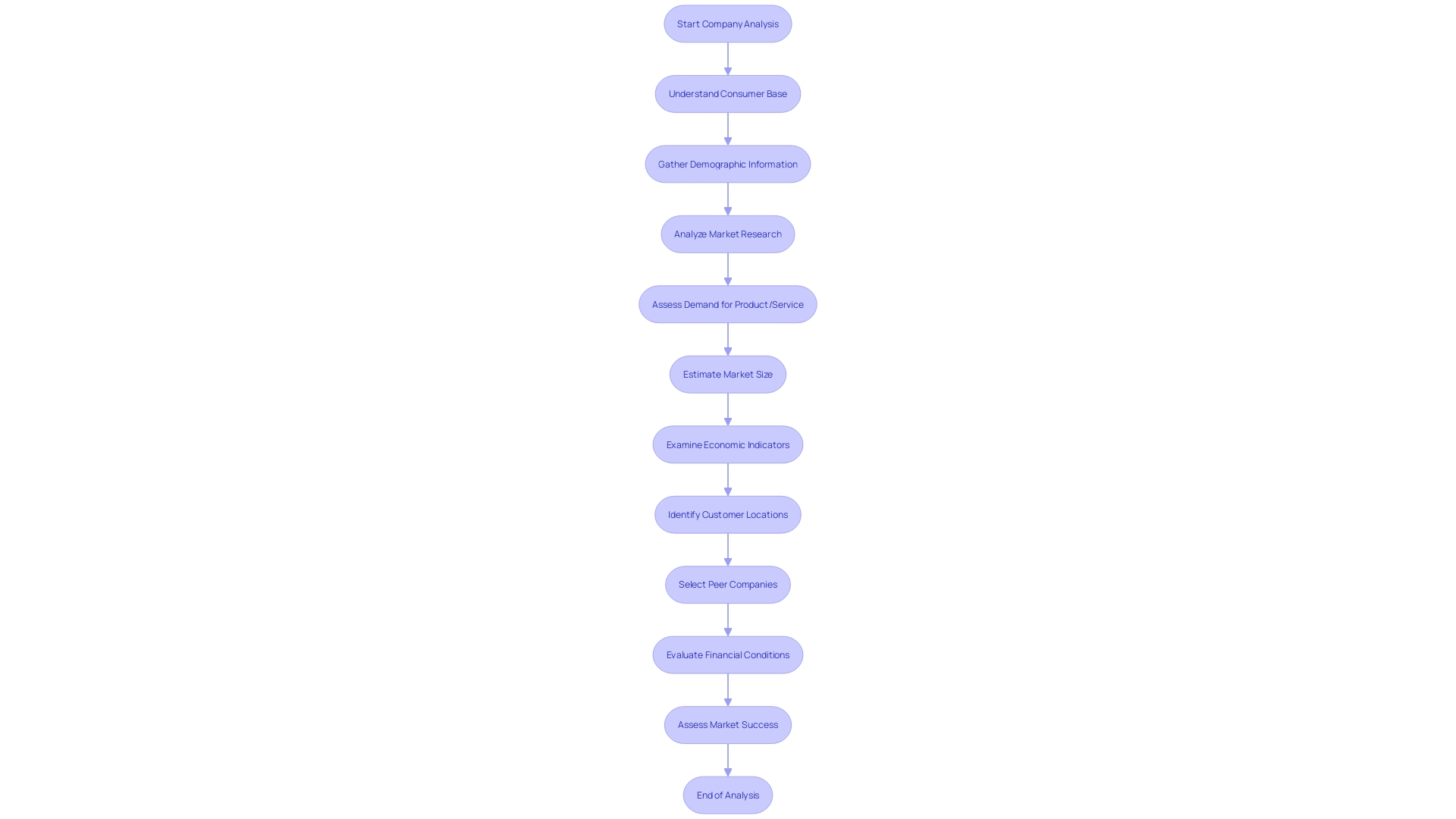

When carrying out a company analysis process, you will examine the financial status of companies that are similar to yours in great detail. It begins by selecting peer companies and then conducting a comprehensive evaluation of their financial conditions and success in the marketplace. Let's consider Italmobiliare as an illustration, an investor that not only acquires but also enhances companies by leveraging its strategic capabilities to target global markets while steering clear of risky scenarios. The approach they employ demonstrates the precision required in a company analysis process.

Making adaptations is crucial because every company is distinctive - similar to the guidance of an experienced consultant in the startup realm Valuing startups involves a blend of art and science; it's all about striking the balance between potential and actual performance while staying savvy about the market trends. Embrace this viewpoint to fine-tune your assessment procedure by utilizing benchmarks, from comparable enterprises as a tool to approximate the worth of your own endeavor.

It's important to bear in mind that examining financial data provides us with a glimpse of the past but concentrating on future trends is crucial to unlocking true significance – particularly for startups where conventional metrics may not reveal the complete picture. This approach combines financial information with future projections to determine a valuation that captures both your company's present situation and its potential for growth.

Steps to Conduct a Business Valuation

Accurately determining the worth of a business involves a process that incorporates various important methods and strategies The Berkus Method is particularly noteworthy among these for its capacity to assess the fundamental aspects of a budding business and is especially beneficial for startups in their initial phases This valuation method developed by investor Dave Berkus amid the technology boom of the 1990s still holds significance today as it provides a systematic approach to predicting the value of a startup even prior, to generating revenue

A key strategy that plays a role is the Comparable Transactions Method or Market Approach which compares a startups worth with recent sales or valuations of comparable companies This method requires pinpointing similar deals collecting comprehensive information, on selling prices financial measures and industry patterns then making adjustments to customize the valuation for the particular business being considered.

The complexities of assessing an enterprise are emphasized by the factors that can impact a firm's worth. Ranging from customer focus and demographic information, to the unique selling points tailored to its target audience. In order to navigate this complexity effectively and accurately assess assets worthiness requires a forward thinking approach grounded in principles rather than relying solely on conventional accounting methods that focus on historical data.

In the evolving economic environment highlighted in the Small Business Index from Fiservs reportage, small enterprises continue to demonstrate resilience and potential for growth. This emphasizes the importance of conducting an evaluation process to prepare enterprises, for assessment by potential buyers and skillfully manage the terms of sales agreements with confidence.

In the end and as financial experts advise us wisely. The aim for any business should be to maximize its value for those with growth opportunities in mind This strategic objective not only impacts daily activities but also guides decisions on long term investments funding strategies and returns for shareholders With proper evaluation methods and a deep grasp of the company's key strengths entrepreneurs can lay a solid foundation, for future triumph and lasting expansion

Gather Financial Statements

To determine the worth of your business if you plan to sell it is crucial to assess its financial status first and foremost.. This process begins with an assessment of the financial records that form the basis of financial reporting and provide a clear view of the organization's financial performance and standing.. These records consist of the balance sheet that outlines the organization's assets, debts, and shareholders' equity at a moment in time, providing a glimpse into what it possesses and owes..

The income statement is a document that shows the organization's earnings and costs, for a specific period and reveals whether it made a profit or incurred losses during that time frame. This report provides insight into how the company operates and its capacity to earn money from its primary operations.

Furthermore the statement of cash flows is an element that tracks all cash transactions illustrating the companys solvency and financial adaptability. It provides an overview of cash coming in from sales or services and going out for costs and investments shedding light on how effectively the company handles and deploys its cash holdings.

In combination, with these statements accomplishes goals; informing potential buyers effectively and complying with global financial reporting guidelines to establish the company's worth based on impartial and standardized data analysis is crucial. Examining these documents enables a comprehensive understanding of the economic basis of your organization and empowers you to convey an accurate and objective evaluation of its worth to potential stakeholders.

Identify and Value Assets

When evaluating the worth of a business being put up for sale it is important to take into account both the hidden aspects that affect its total value. Physical assets such as estate, equipment and inventory are relatively easy to assess. These are items that can be observed handled and valued based on their state and prices. However intangible assets, like brand reputation, patents and trademarks are just as crucial but harder to measure. The items in question are intricately linked to a company's brand. Play a significant role in shaping its standing, in the market by boosting sustained earnings and future expansion opportunities.

According to experts viewpoints and analyses in the field of business and economics intangible assets refer to physical entities that cannot be physically perceived or grasped. These assets encompass aspects like a firm's brand identity, which despite not being physically tangible, possess importance and worth. A strong and reputable brand has the power to evoke images and establish enduring connections, with key stakeholders ultimately resulting in significant financial benefits. The effectiveness of a brand is measured by its performance in terms of criteria when compared to competing entities. It's essential to assess these abstract factors as they significantly contribute to the long term viability and adaptability of a business model while also influencing the choices made by investors and stakeholders seeking to enhance value creation.

Recent financial evaluations of businesses in various sectors have uncovered obstacles like decreased profits and cash flow problems, as well as extended inventory turnover and receivables collection periods. The findings highlight the importance of a valuation strategy that takes into account both tangible and intangible assets - especially critical in industries such as real estate and construction, which face heightened challenges in these aspects.

In summary it's crucial for an organization to maintain a balance between its assets, liabilities and equity to truly represent its worth accurately. For both owners and investors having a grasp of these assets whether visible or not is vital, for making informed choices and safeguarding the financial strength and continuity of the enterprise. Assessing a business involves examining physical assets and assessing the intrinsic worth of intangible factors, which often have a significant impact on the future success of the organization.

Determine Liabilities

Evaluating the value of your company extends beyond just examining your numbers in the bank account—it's about understanding the full spectrum of your resources and obligations at play here! Your resources encompass not the money you have at hand but also various elements like the tools you utilize regularly and the positive image your brand holds within your local areas community fabric. Likewise sitting opposite are obligations such as loans and other debts, for which you bear responsibility.

Determining the assets entails a crucial process that involves summing up all resources ranging from cash on hand and outstanding payments to investments with long term implications to the company's success and reputation on social media platforms can also be considered an asset although quantifying its value may necessitate some investigation work. Don't just concentrate on the account balance—it's about acknowledging the complete value of your enterprise.

Determining your worth involves more than just crunching numbers. It's about gaining a deep insight into the financial status and possibilities of your enterprise. Your equity represents your ownership in the business as an entrepreneur. A value that reflects the combined outcome of your commitment and shrewd decisions, in managing the enterprise.

It's crucial to stay informed about your organization's status to remain on top of things—especially with the ever-changing tax laws and regulations in locations, such as Pennsylvania, that now require yearly reporting requirements have been recently revised in Pennsylvania which now require annual reports. Staying in the loop about adjustments can help avoid adverse consequences and ensure your enterprise stays within the rules.

Keep an eye out for the IRSs inflation adjustments for the fiscal year as they might have a big impact, on your financial plans and tax strategies.

Ultimately the value you assign to your enterprise isn't just a gauge of accomplishments but also acts as a foundation, for future growth as you venture through the complex and exciting journey of owning an organization.

Apply Valuation Methods

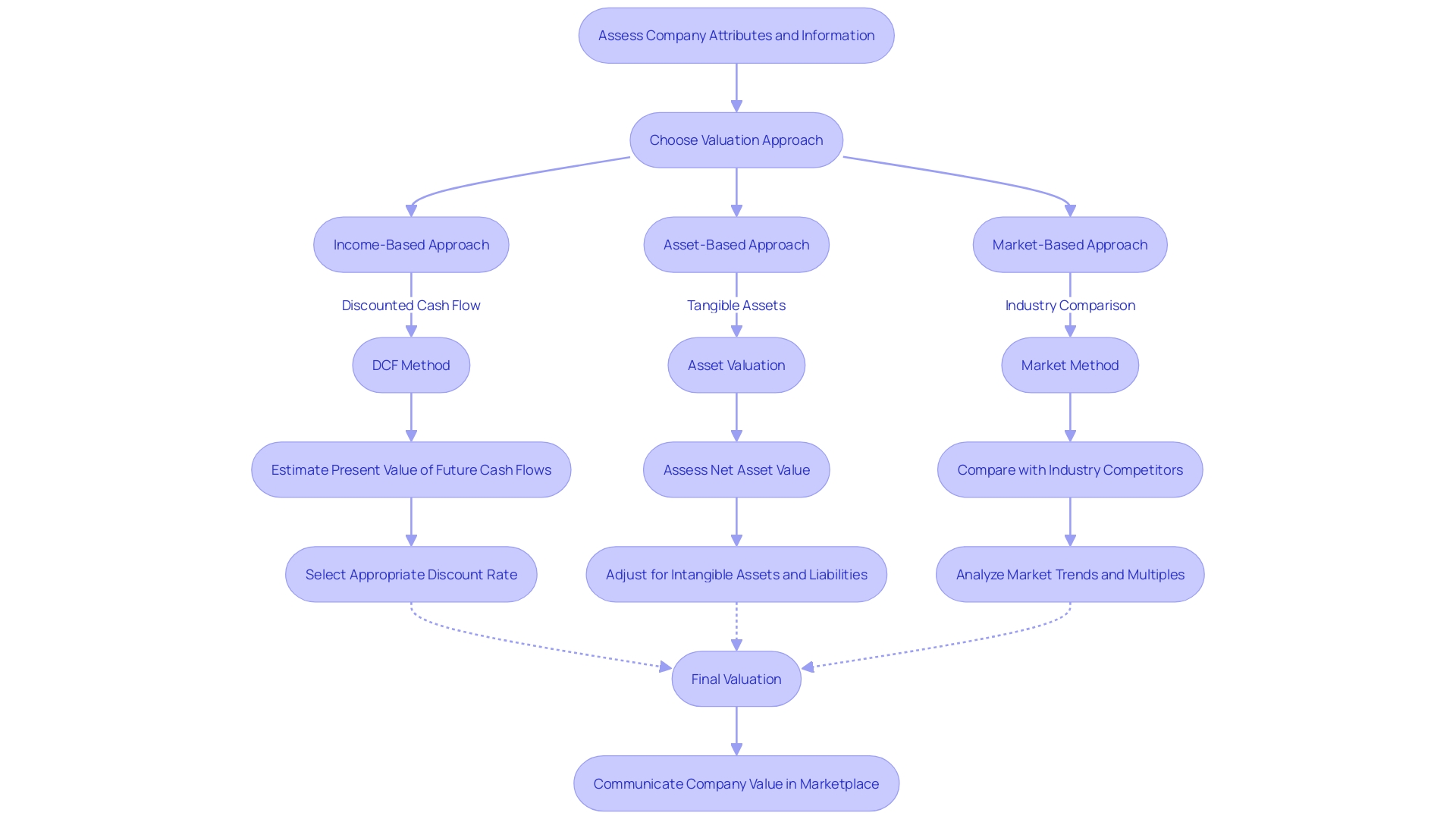

Assessing your enterprise entails a procedure that necessitates employing various assessment techniques customized to the distinct attributes and information of your organization. It is crucial to utilize income-based, asset-based, and market-based approaches to acquire a thorough and accurate appraisal. For instance, the Berkus Method. Specific to early stage startups. Assesses worth based on business factors appropriate for organizations, with groundbreaking ideas but restricted profits. Meanwhile, businesses with monetary streams may opt for utilizing income-based assessment techniques such as the Discounted Cash Flow approach to accurately assess their genuine worth. Asset based valuations come in handy when a company's tangible assets contribute to determining its overall worth. Market based valuations are useful for comparing your company with competitors in the industry and comprehending its actual worth in practical terms. A recent example being WeWorks lease renegotiations and how they influenced share prices. From now on, it is crucial to select the method or a combination of methods to communicate the true value of your enterprise in the marketplace.

Common Challenges in Business Valuation

It's essential to understand the worth of your business before deciding to sell it. However determining a precise valuation can be quite challenging at times. The worth of a company is not always straightforward. Can be impacted by different aspects such as present earnings growth prospects and the significance of key individuals involved. Consider, for example, a scenario where the price of a painting skyrocketed from $17 to $14 million simply by being associated with Rembrandt. The name alone had a significant impact, on its perceived value. The value of an organization may vary based on the individuals leading it or participating in its activities.

In the world of startups and enterprises beginning their journey in the market scene; it's quite customary to utilize what they refer to as the Berkus method when it comes to assessing how much an organization might be valued before it starts generating revenue. This approach takes into account all the important aspects of a budding business venture. However as an organization. Develops further down the line; attention shifts towards its post money valuation which factors in new injections of cash or its pre money valuation that essentially tells you how much the organization is worth before any new investments come in. These assessments have an influence as they affect aspects such as how ownership shares are distributed among stakeholders and also have a significant influence in shaping the overall strategy of the organization.

The recent financial troubles at WeWork illustrate the challenges that organizations can encounter over time due to fluctuations in market conditions and strategic choices made by entities which can swiftly impact their perceived and actual worth.

It is important to consider more than maximizing profits; focusing on maximizing worth is crucial as well since these two objectives can differ significantly for companies that are seeking growth opportunities. Marc Andreessen thoughts, on software firms underscore the significance of worth compared to financial valuation a perspective that resonates across various sectors.

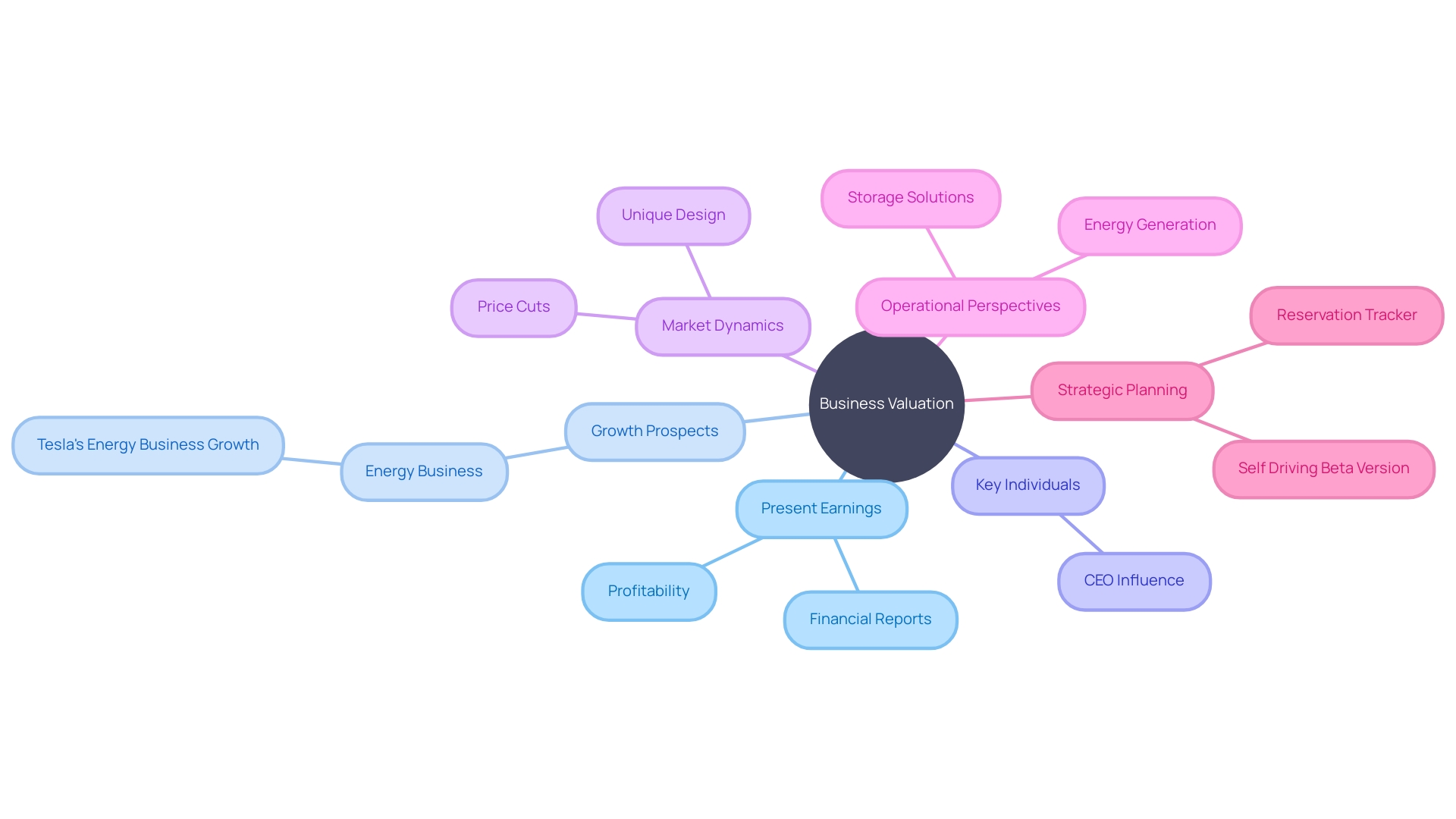

To accurately evaluate the worth of your enterprise and gain a comprehensive understanding of its significance, it is crucial to consider a range of factors that go beyond raw data alone. Valuation encompasses more than just numerical figures; it involves a complex combination of comprehending market dynamics, operational perspectives, and strategic planning to grasp the full extent of your company's possibilities.

- Lack of Accurate Financial Data

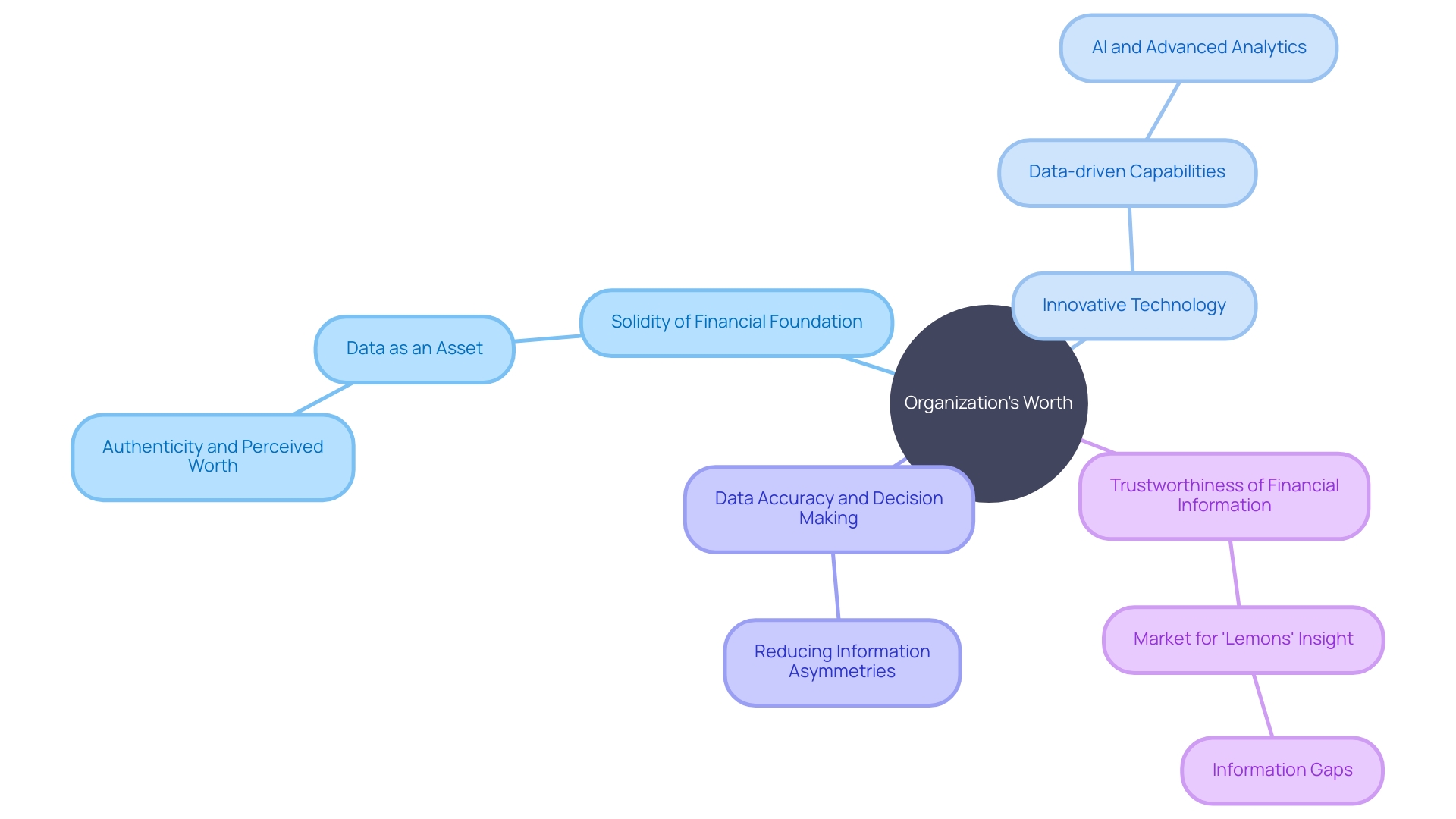

The foundation of assessing an organization's worth depends on the solidity of its financial foundation. Consider the development of Visa as an example – it did not merely exist as a payment card. Rather as an innovative technology that revolutionized transaction methods. Likewise with the reevaluation of a misidentified Rembrandt artwork which showcases how authenticity can greatly impact perceived worth. These anecdotes emphasize the importance of up to date financial information, in the process of valuation.

During times of economic change like the pandemic we've been through recently showed us the limitations of traditional ways to measure things accurately in the financial world. It's essential for financial information to be accurate and current to represent its worth – just like how Visa has adapted and progressed along with advancements, in technology to remain pertinent.

In the realm of commerce today data stands as an asset in its own right. Its precision plays a role in shaping the worth of an organization for inaccurate data may result in decisions based on false information and overlooked chances. The objective is to enhance the effectiveness a strategy that impacts all aspects of organizational operations. Maintaining data accuracy is not about abiding by regulations; it also serves as a critical necessity that has a profound impact, on where the company stands in the market and how efficiently it operates.

In summary, to understand the worth of art is tied to the artists credibility the value of an enterprise is linked to the trustworthiness of its financial information. To effectively maneuver through today's business environments it is crucial to maintain the precision and reliability of financial data just as much as the quality of services and products provided.

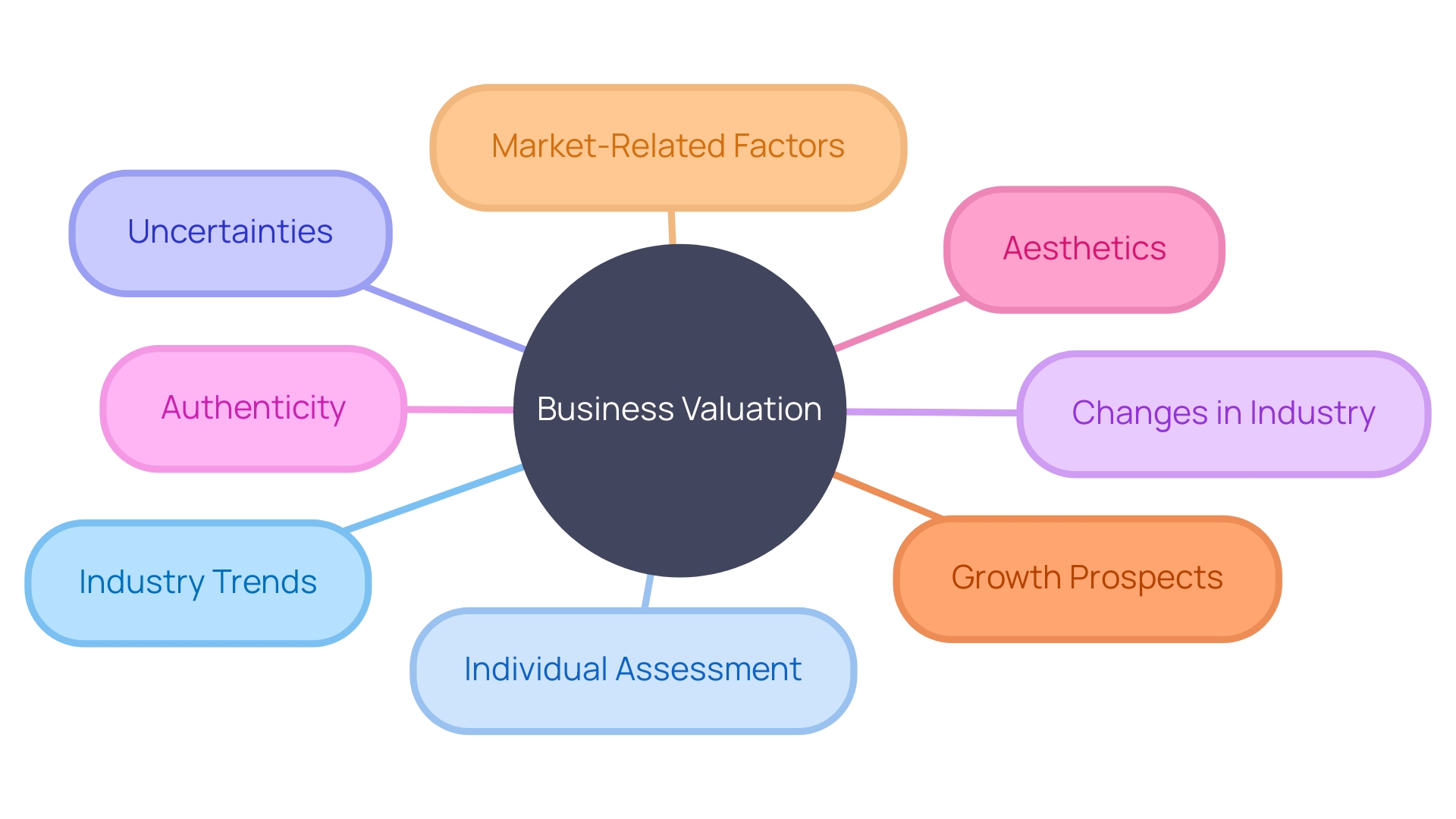

- Subjectivity in Valuation Methods

Assessing a business encompasses both a scientific approach due to the various methods utilized and the subjective judgments involved in the process. Different appraisal techniques can lead to evaluations of a company's worth because of elements such as industry trends and individual assessment. For example, traditional appraisal methods such as discounted cash flow analysis depend on forecasting asset prices, which can be difficult in the presence of uncertainties. Real option valuation considers these uncertainties and changes in the industry by presenting a range of potential outcomes and offering a set of tools based on financial mathematics to facilitate implementation

The importance of selecting the appraisal approach is evident in practical scenarios; for instance; a piece of art initially valued at $17K escalating to a staggering $14 million valuation upon being linked to Rembrandt—a clear indication of how authenticity outweighs aesthetics in appraisals. Likewise in matters; professionals defending a prominent fraud case highlighted the subjective nature of property valuations and the array of methods available, for assessment—emphasizing that valuation is not a universal procedure.

Marc Andreessen made a thought provoking remark about how we assess the worth of startup companies in Silicon Valley during a period of investment in software ventures. He emphasized the necessity to take into account more, than financial numbers when evaluating their significance since their potential and growth prospects often challenge conventional financial metrics.

The challenge of determining a firm's value arises from the necessity to combine evaluations with a profound understanding that each organization is unique and influenced by different individual and market-related factors that shape its worth in a distinctive way. When examining the eight techniques for valuing startups—ranging from the Berkus Method to the Book Value Method—it is crucial to keep in mind that the best valuation results, from recognizing and embracing the wide range of factors influencing it and understanding the subjective nature of interpreting these factors fully.

- Changing Market Conditions

Valuing a business involves a changing process influenced by market fluctuations and trends.Tesla's foray into the energy sector after acquiring Solar City serves as an example of how market perceptions can swiftly impact a firm's worth.The sectors revenue increase, to 6.

Natural calamities such as earthquakes or widespread diseases and the unexpected departure of a CEO can result in significant risks that can greatly impact an organization's value profoundly. The recent volcanic eruption, in Iceland serves as an example of how external disasters can endanger a company's functions and subsequently influence its financial worth.

In addition to that the economy can be impacted by signs like when the Federal Reserve lowers interest rates. This alteration can affect different aspects of the economy including how enterprises are valued. For instance the recent 0..5% rate cut indicates a change that could have reaching effects. It may affect how much it costs for businesses to borrow money, which's an important factor, in deciding their worth.

In the realm of sports is where we find Manchester Uniteds financial journey unfolding amidst a series of five consecutive years of losses. A testament to the clubs efforts, in implementing strategic shifts and new leadership to rebuild its financial standing and overall worth.

These instances emphasize the significance of embracing a principle-guided approach when evaluating worth. Particularly in the evaluation of intangible assets devoid of past data records. The actual worth of an organization must be based on understanding not only its current cash inflows and outflows but also its potential for growth and the risks associated with it, in combination with the dynamics of the marketplace and external influences.

When assessing a firm's viability, it is essential to consider the market dynamics in action and adjust the valuation approach accordingly to fully comprehend the essence of the enterprise within its market environment.

- Unique Characteristics of the Business

When you're considering evaluating the worth of your company for a sale or transactional purposes; bear in mind that depending solely on traditional accounting techniques might not completely capture the true essence of your company's value—especially regarding intangible assets like reputation and intellectual property rights. It's essential to embrace thinking and principle driven strategies to fully grasp the intrinsic value of these intangible assets that play a vital role in determining the overall worth of your organization.

In the realm of startups as an example the Berkus Method provides a tool for assessing the worth of aspects in a budding business. This technique proves beneficial for businesses in their early stages when revenue streams are not yet solidified. On the hand established firms typically see their valuation gravitating, towards maximizing profits.

In real world examples like the one involving Italmobiliare Company showcase how investment approaches emphasizing excellence in products and services and the ability to expand globally can impact the company's worth. Furthermore, in the domain of unicorns. Startups, with valuations exceeding $1 billion. Those exceptional few that generate operational profits without constant injections of venture capital are recognized for their exceptional worth.

The search for an inclusive approach to assessing value continues as businesses work on incorporating financial as well as environmental and social aspects into a cohesive framework to enhance their competitive edge and sustainability, for the benefit of all involved parties.

To navigate through these intricacies effectively it is essential to grasp the concepts of pre money and money valuations. Depicting the worth of the organization prior to and following external investments correspondingly. This knowledge directly influences equity distribution and ownership of shares playing a role, in the valuation procedure.

Always keep in mind that the worth of your company goes beyond its earnings and assets; it also encompasses its capacity for growth and market standing as well as the combined efforts of its essential staff, across all hierarchies. When determining the value of your business take into account these elements to guarantee that you encompass the entire range of its value.

Conclusion

To sum up determining the value of a business is crucial for making informed decisions and unlocking its full potential for success. It entails more than basic computations and entails taking into account different factors that impact its overall value. Elements like growth opportunities the importance of key personnel and prevailing market conditions are all key factors, in assessing the genuine worth of a company.

Various ways of valuing businesses exist that cater to their features – income based methods and market based approaches are among them. Techniques, like the Berkuss Method and Comparable Company Analysis provide structured ways to evaluate startups and measure them against industry counterparts.

Valuing a business can pose difficulties because of issues such as financial information availability and the subjective nature of valuation techniques in the face of evolving market situations and distinct business attributes demand an innovative strategy blending analysis, with profound market insight and strategic foresight.

In the end assessing a company goes beyond figures it involves grasping its complete capacity for development and achievement. By employing valuation methods and taking into account all pertinent aspects companies can make well informed choices entice investors and lay the groundwork, for continued advancement and growth.