Introduction

Determining the worth of a company is a task that involves using tailored strategies to fit the specific characteristics and stages of development of the business in question.It considers valuation methods suited for startups or established companies such, as market based or income based approaches while addressing the challenges and key considerations involved in assessing a companys value.

To become proficient in these methods and tactics is key for stakeholders to make choices and successfully maneuver through the constantly changing and competitive market environment. Lets delve into the realm of business appraisal and reveal the strategies for precisely evaluating a companys genuine worth.

Understanding Business Valuation Approaches

Evaluating the value of a company poses a complex challenge that demands various approaches tailored to the distinctive characteristics and growth stages of the entity in question. For fledgling startups in their early stages of operation where conventional assessment techniques may prove inadequate owing to the lack of historical financial records and the considerable unpredictability associated with future prospects; this is where inventive methodologies such, as the Berkus Method step in to provide insight. In the 1990s entrepreneur Dave Berkus developed a method known as the scorecard assessment approach that assesses the aspects of a new business to determine its value effectively, particularly for startups that have not yet generated revenue.

Understanding the difference between pre money and money assessments holds great significance for investors and entrepreneurs alike. Pre money worth depicts the value of an organization before obtaining funding while post money worth includes the extra investment. These assessments play a part in determining equity distribution and ownership of shares highlighting the need for accuracy, in the appraisal process.

Assessing a startup encompasses more than analyzing figures; it's about creating a captivating narrative that intertwines with the firm's financial information as it progresses from the inception of the idea to the initial stages of growth, with unique hurdles and appraisal methods tailored to each stage – from gauging the viability of the concept to tracking rapid customer and revenue expansions.

In today's evolving world of startups where pricing is a key focus over value – especially for new businesses, with minimal track records – it's crucial to understand various assessment methods thoroughly to guide investment assessments and strategic decision making effectively for acquisitions and other evaluations.

Market-Based Approaches

Calculating the value of an enterprise entails a combination of art and science when utilizing market driven valuation methods. These methods depend on market data and comparable transactions to evaluate the worth of a firm utilizing variables such as market multiples and stock prices. It's not just about number crunching. Also necessitates a thorough assessment of market fluctuations and comparisons, with peer companies to determine the equitable worth of a company. Scott Alexander examination of impact markets emphasizes the significance of assessment based on fundamental principles rather than superficial metrics. Aligning with the Berkus approach entails establishing a revenue appraisal, for startups by assessing vital enterprise factors. This strategy recognizes that accounting concentrates on events and rigid regulations while appraisal is forward-thinking and principled - particularly when taking into account the intangible assets that contribute to a firm's overall worth.

Furthermore as the business environment changes over time it is crucial to grasp the true worth of businesses especially unicorns that used to be scarce but are now more prevalent with 2 500 attaining valuations exceeding $1 billion However what's harder to come by are those unicorns that have attained autonomy without relying heavily and continually upon venture capital funding This situation demands valuation methodologies that not only reflect the present situation but also consider the capacity, for creating enduring value in the long run

When looking at market driven strategies it's important to take into account how a company affects society the environment and the economy as a whole. By integrating natural human and social capital into the approach, a more comprehensive and transparent method of quantifying the actual worth produced by companies is provided. This holistic perspective promotes competitiveness, adaptability and informed decision making, by stakeholders. Given the changing landscape of industries as highlighted in the 2024 Preqin Global Reports these perspectives are truly invaluable. They enable those involved to make informed choices throughout the investment journey with the help of data analysis that reveals the narrative behind the figures and offers an impartial perspective, on the worldwide alternative market.

The main objective of market driven assessment is more, than assigning a numerical worth; it aims to grasp the core factors that contribute to a company's present and future proposition effectively. It involves recognizing that as John Maynard Keynes famously expressed it; the expectations of investors regarding opportunities are what truly propel creation ahead. This recognition holds significance for any company aiming to assess its worth accurately and enhance its positioning in a constantly changing and highly competitive market landscape.

Income-Based Approaches

Assessing a company's worth by considering its income is crucial for understanding its capacity to generate money and profits efficiently. These techniques delve into the stability of an enterprise by examining anticipated future cash inflows, earnings and overall financial success providing insight into its capability, for creating wealth.

An example of an approach to determining the worth is the Berkus Method that emerged in the 1990s through the efforts of investor Dave Berkus to tackle the complexities of valuing startups in the ever changing tech sector when conventional models were inadequate. The method introduced a scoring system, for evaluating early stage startups without revenue by attributing value to their elements and acknowledging their distinctive growth prospects.

Understanding the concepts of money and pre money in business is crucial as well. Post money assessment takes into account external funding while pre money assessment determines worth before investment. These valuations aren't figures. They play a significant role in how equity is shared and who owns shares affecting investor choices and plans as well.

In the realm of startups where creativity reigns financial backgrounds are frequently lacking in depth evaluating a firm's worth can pose a significant challenge. With methods like the Berkus Method and Book Value Method at hand different strategies provide a way to tackle these complexities. Every approach has its advantages. Is customized to simplify the intricacies of assessing the worth of startups a vital endeavor for both investors and individuals, within the organization.

In the realm of commerce and finance, specialists emphasize that an organization is not solely focused on generating profits but also on optimizing worth in every aspect of its activities and choices. The impact of individuals such as creators and crucial personnel, on an organization's overall significance is unquestionable and crucial.

In the evolving realm of commerce where sectors and markets are constantly changing, income-based assessment methods persist as an essential instrument for accurately comprehending the authentic worth of an organization. As we delve into these approaches, it is crucial to take into account the broader economic landscape, incorporating insights from the Annual Integrated Economic Survey that underscore the importance of effective operational practices and efficient data collection procedures.

Asset-Based Approaches

'Assessing the value of a business through the examination of its assets is essential in comprehending its worth, considering both tangible and intangible assets.'. This method meticulously evaluates factors like assets, asset recorded in the books and intangible assets like intellectual property that play a vital role in presenting a comprehensive financial overview of a business. By focusing on the value created from a company's core resources the asset based approach provides a foundation, for evaluating its overall value.

For example grasping the worth of intangible assets can be quite complex since they typically call for a forward thinking and principle based strategy rather, than the retrospective rule based approach used in conventional accounting. These methods are not merely theoretical. Are put into practice in actual real life situations. The recent decision by a bank to change how it manages a subset of corporate bonds highlights the real world use of pricing techniques. This strategic adjustment was made to stabilize the banks surplus funds and adapt to shifts, in its operational framework—an example of how asset appraisal influences corporate financial plans.

Furthermore asset valuation considers the significant influence of individuals in a company such as founders senior management and employees, at different levels This influence can greatly impact the valuation process As companies work to safeguard against the potential loss of these key personnel the valuation is adjusted to incorporate these risk management tactics

It is important to mention that there is no one valuation method that is used exclusively on its own in evaluating a company's worth; multiple strategies can be utilized to encompass the range of a companys value assessment process. For example, the Berkus Method, initially introduced in the 1990s, offers a scorecard-based appraisal technique specially customized for startups in their early stages by assigning a worth to each vital element of the enterprise. This method demonstrates its worth in situations where conventional assessment instruments may be insufficient, like in the instance of cutting-edge technology firms that prioritize growth, instead of immediate profitability.

In the evolving world of finance today businesses may choose to prioritize future growth over immediate profits and sometimes even accept losses as part of their strategy. Asset based assessment continues to assist organizations navigate through the different phases of their growth starting from the beginning of a startup to the later stages of well established corporations. By utilizing techniques and methods related to asset based valuation organizations can adeptly align their choices with the overarching objective of enhancing long term worth, for sustained success..

Key Business Valuation Methods

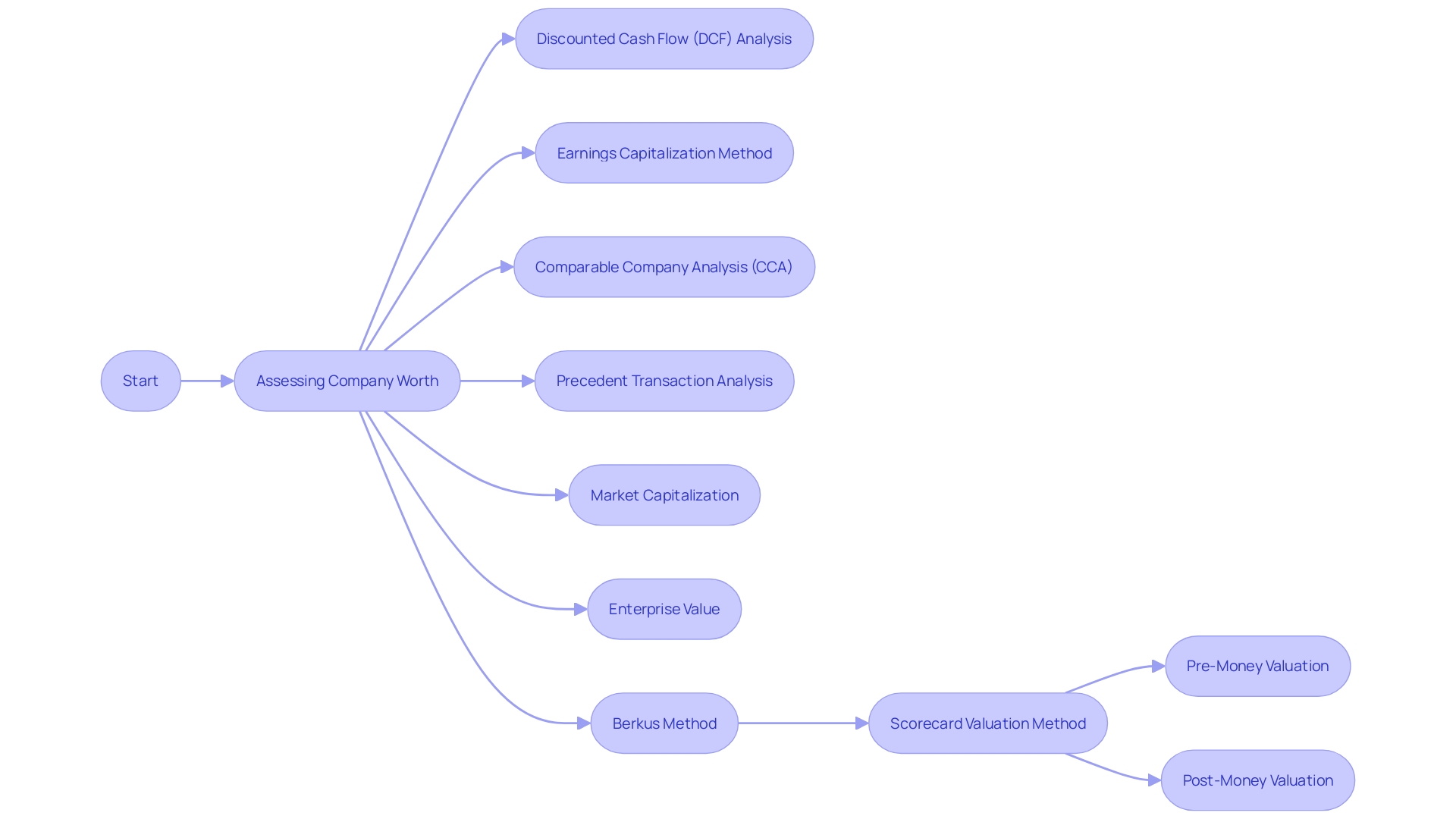

Assessing the worth of a company requires employing different established methods to accurately and systematically evaluate its market position. One standout method is the Discounted Cash Flow (DCF) analysis which looks ahead by evaluating the worth of expected future cash flows. The foundation of this approach lies in the principle of the time value of money which suggests that money received today holds worth than an equivalent amount, in the future because of its potential to earn returns.

One alternative approach is the Earnings Capitalization method which assesses a firms projected profitability by adjusting its earnings to factoring in a capitalization rate; it proves beneficial for enterprises with consistent profits throughout the years. On the hand Comparable Company Analysis (CCA) adopts a distinct strategy by comparing itself to similar businesses, within the industry permitting a relative valuation centered on market comparables.

Examining transactions through Precedent Transaction Analysis provides valuable insights for firms seeking to sell or merge by studying prices paid for similar entities in previous acquisitions. On the other hand, Market Capitalization provides a quick estimate of a firm's worth in the stock markets by multiplying the current stock price with the total outstanding shares.

To gain an understanding of a firm's value, beyond its ownership interest alone the Enterprise Value takes into account all aspects of the firm's worth including debt, minority interest and preferred stock while deducting total cash and cash equivalents. This comprehensive approach provides stakeholders with a transparent view of the organization's financial health.

Various approaches such as the Berkus Method can be tailored to fit types of enterprises at various stages. Whether they are just starting out or already established companies are worth mentioning here too! As an illustration, The Berkus Method is suitable for startups in their early stages as it provides assessments before any revenue is generated by assigning importance to significant components of the company! This method of valuation using a scorecard was created by investor Dave Berkus back in the 1990s as there was a need, for a way to value the rapidly growing tech startups during that time period.

Valuation methods are more than abstract concepts. They are essential tools for guiding strategic plans and investment choices in industries that are constantly changing due to factors like inflation and interest rates. Recent economic trends have shown that events like the inflation challenges faced by leading banks in 2023 can greatly affect how businesses are valued. This highlights the significance of becoming proficient in these techniques for businesses seeking to sustain a competitive advantage, in the market.

Choosing the Right Valuation Method

Deciding the suitable method for appraising is essential for determining the actual worth of a company. This decision relies on aspects such as the type of enterprise, the accessibility of information, and the objective of the assessment. We will examine the elements to take into account when selecting a method for determining value and offer advice on choosing the suitable approach, for various circumstances.

To begin by evaluating the company's growth phase is essential as it influences the selection of the appropriate method for determining worth. For example The Berkus Method was introduced in the 1990s by investor Dave Berkus. Offers an evaluation framework for assessing nascent enterprises that have not yet commenced generating income by assigning significance to the vital components of a novel entrepreneurial endeavor. As the organization progresses further in its journey, valuation methods may become more suitable.

In the paced world of startups it's crucial to accurately assess the current worth of an asset especially when it comes to investment evaluations or acquisition deals. This task is particularly tough for startups given the lack of financial records uncertain future prospects and potential biases, at play.

The evaluation of an organization's worth can also be impacted by factors like government regulations and market incentives such as the 'Corporate Value Up Program' in Korea that provides tax benefits to businesses demonstrating an increase in corporate worth. Emphasizing the importance of considering the broader economic and regulatory environment when assessing a firm's worth.

Besides that, Contigent assessment is a technique utilized in economics relying on surveys that can be employed to ascertain the worth of items and services without a market price by evaluating how much individuals are willing to pay or accept as compensation. This method can be valuable in areas, like healthcare where the cost of treatments may not be fixed in the market.

Choosing the appropriate assessment method is crucial not only for investors and external stakeholders, but also for the strategic planning and allocation of resources of the organization. Grasping and executing appraisal methods empowers stakeholders to assess a firm's true value more precisely and make knowledgeable decisions.

Best Practices for Business Valuation

Business valuations play a role in making informed financial decisions. The key, to a valuation lies in thorough research using trustworthy data sources and various valuation techniques. The assessment of 'quality of earnings(QoE) exemplifies these principles by evaluating a firm's financial status and the longevity of its profits. Quality of experience (QOE) evaluations often involve examining revenue figures to confirm the stability of income sources and evaluate risks related to customer concentration in order to ensure that reported earnings accurately reflect the organization's future prospects.

Evaluating the worth of a company entails a combination of intangible elements. It goes beyond simply using a basic formula to calculate earnings for the current year because it needs to consider various elements and potential growth paths involved in the process. For instance determining the worth of a company can be greatly affected by staff members whose positions and contributions to the companys overall value may differ depending on their roles, within the organizations structure.

Implementing techniques to promote clear communication and openness is crucial in the business world today. It's crucial to express and give reasons for the assumptions, behind assessment techniques to ensure everyone involved understands the rationale behind it. This way stakeholders can evaluate the models constraints. Acknowledge the trustworthiness and reliability of the assessment outcomes.

In the realm of strategies available to startups without revenue yet to take off smoothly into profits and success in operations is the Berkus Method. A distinctive approach that evaluates the essential elements of a growing business with a perspective on worth at its core. When it comes to assessing the value of an organization after acquiring funding (post money assessments) or addressing the worth for startups amidst obstacles, such as subjective perspectives and restricted financial background (startup assessments) it is vital to embrace approaches that align best with the growth phase and sector specificity of the enterprise.

To summarize the examination of business worth involves assessing factors such as financial stability, growth opportunities, key staff members, and market trends. By following established guidelines and utilizing appraisal methods, it allows stakeholders to navigate the complexities of determining a company's worth effectively.

Common Challenges and Considerations

Evaluating the worth of a business is akin to unraveling a puzzle where every twist and turn brings its own set of challenges and considerations to the table. Residing at the core of this procedure is the recognition that a firm's true value transcends mere financial figures. It takes into account a multitude of elements such as the contributions made by key individuals across all levels of the organization. These influential individuals. Be it founders and top executives or indispensable employees and external collaborators. Contribute to influencing the company's overall worth through their unique impact, on its value.

The inherent worth of assets like intellectual property or brand reputation adds complexity to the process of valuation assessment in the financial landscape. Conventional accounting methods tend to face challenges in evaluating these assets due to their forward looking and principle based nature compared to the backward looking and rule driven approach typically used. Having a forward-thinking approach is essential, for an accurate determination of their worth.

Within the changing landscape of startups evaluating their worth becomes a complex task. Balancing aspects like growth prospects, performance and understanding the market is essential to attract investments and make sound choices. Evaluating the future worth of a startup is crucial, for investment assessments, acquisition deals and other forms of analysis.

To protect the worth of the enterprise adequately and guarantee that financial resources are efficiently utilized to generate profits, finance teams must create and supervise measures against substantial risks. Highlighting this approach to uphold importance is just as vital, as seizing new opportunities.

Understanding the assessment procedure involves unraveling the levels of intricacy that are frequently obscured by specialized terminology such as 'applying practical judgment' and dedicating oneself to grasping the basic concepts of finance; this empowers interested parties to enhance their ability to accurately assess the true worth of an organization.

In brief, assessing the worth of an organization includes factors such as scrutinizing the duties of crucial personnel, appraising intangible assets, and analyzing the future course of new enterprises. By utilizing a structure and valuable advice entrepreneurs and investors can successfully navigate this intricate process to reach a precise valuation that captures the true potential of the company and protects its current value.

Conclusion

Ultimately evaluating the value of a business necessitates customized tactics that correspond to its features and growth phases. Utilizing methodologies based on market conditions revenue, and assets offer perspectives into its authentic valuation..

In deciding which valuation method to use for a business assessment the consideration of factors such as the businesss nature and data accessibility is crucially important.Thorough research reliance upon data sources and effective communication are pivotal, for achieving successful valuations.

Startups encounter difficulties when determining their value; however when they carefully consider growth opportunities and grasp market dynamics enough they can draw in investments and make well informed decisions. To protect the value of a business it is important to take steps to mitigate risks and use resources effectively.

In short. Applying valuation methods empower stakeholders to make informed financial choices and optimize the worth of their investments. Through employing approaches and advice an accurate valuation can be achieved that reflects the genuine potential of the business and safeguards its present value.