Introduction

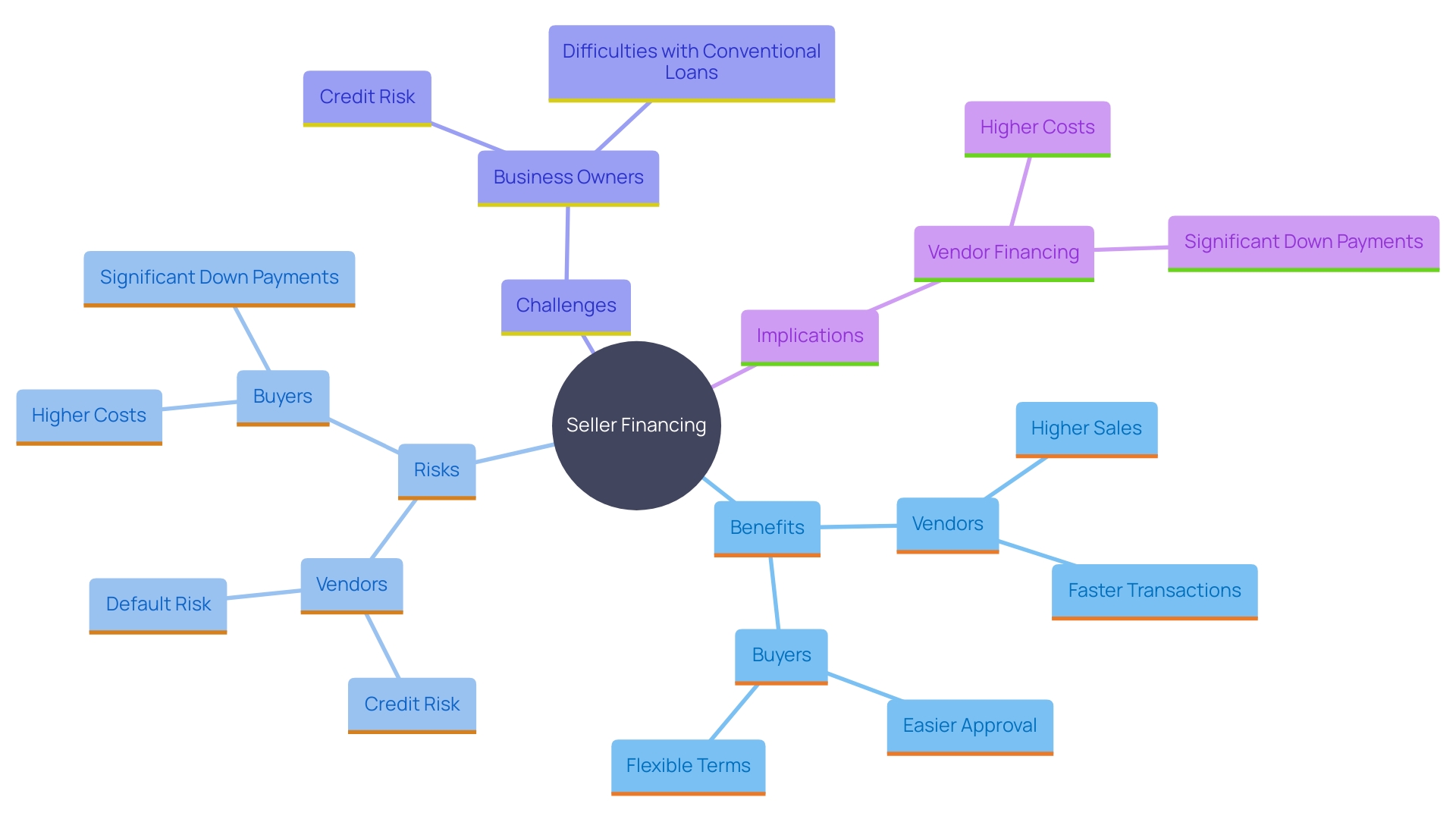

In the realm of business acquisitions lies a revealing strategy known as seller financing that differs from the usual bank loan route. Seller financing involves sellers offering loans to buyers for business purchases instead of relying on traditional bank loans. This method involves creating a note outlining loan specifics, like interest rates and repayment plans to offer a unique level of flexibility not commonly seen in conventional lending practices.

For enterprises looking to simplify operations and maintain control effectively in the changing landscape of small business funding it offers great advantages. With the transformation of financial services to adapt to new approaches seller financing has emerged as a tailored and mutually beneficial resolution supporting success for both sellers and buyers, in the current competitive market environment.

How Seller Financing Works

In the provider loan approach, the provider extends credit to the purchaser to assist them in acquiring an enterprise instead of depending on conventional banks for a mortgage payment arrangement made directly to the provider over a specified period. This procedure includes drafting a promissory note detailing the credit conditions such as interest rates and repayment timelines, offering a level of adaptability rare in typical lending practices.

This approach is particularly beneficial for small enterprises aiming to simplify their procedures and maintain operational oversight. It aligns with the modifications in small enterprise funding that create a balance between conventional financial services and innovative methods, such as vendor funding. In the evolving landscape of funding alternatives for small enterprises, this approach emerges as a practical option offering both vendors and purchasers a tailored and advantageous financial solution.

Advantages of Seller Financing for Sellers

By offering funding alternatives to individuals marketing their residences or products can gain benefits such as broadening the clientele to encompass persons who might struggle to secure traditional loans independently at first, which might result in swifter deals and possibly elevated selling prices in the larger context for vendors, as they also receive interest on the financed amount, thereby enhancing their total earnings while also profiting from tax benefits by distributing capital gains over several years.

In today's economy, small enterprises exhibit resilience and flexibility based on the Fiserv Small Business Index report, which highlights the growing demand for consumer products and services, indicating a market for suppliers offering funding options. Furthermore, utilizing vendor support aligns with strategic choices, such as tax-free stock exchanges, allowing providers to expand or acquire without initial cash outlays.

Experts stress the significance of maintaining stability when applying for loans. Based on an advisor's viewpoint, lenders seek confirmation that their funds are in reliable hands, making alternative payment options attractive to purchasers with strong financial histories. Adopting this approach not only streamlines transactions but also provides vendors a competitive advantage in the market.

Advantages of Seller Financing for Buyers

Purchasers have a benefit with vendor funding when obtaining an enterprise since it provides greater adaptability in relation to conventional bank loans regarding criteria and procedures involved in the acquisition transaction. With vendor payment alternatives, purchasers can gain from customized conditions such as initial payments and repayment plans that are not generally provided through standard loans. In contrast to the guidelines and demanding financial documentation required for traditional bank loans utilized in business acquisitions, financing from the owner offers a more seamless transaction process that is particularly advantageous for new entrepreneurs entering the market.

Additionally interacting directly with the seller could help build a relationship leading to a smoother transition and improved mutual understanding. 'This face to face discussion commonly results in advantageous terms that can greatly benefit the purchaser.'. For example of dealing with the intricate and sometimes inflexible systems of bank loans, individuals have the opportunity to tailor an agreement to suit their individual requirements. This personalized method not only enhances the customers' financial adaptability but also strengthens the entire transaction process, ensuring lasting success for all parties involved.

Disadvantages and Risks of Seller Financing

Seller financing presents benefits. Also poses risks for both purchasers and vendors alike. Vendors need to be cautious about buyer defaults that could result in financial setbacks and legal issues. On the buyers' end, vendor-financed deals often come with interest rates compared to conventional loans. This can raise the cost of acquisition. Additionally, vendors might request significant down payments, making it tough for individuals with funds to engage in such transactions. According to the 2023 Small Business Credit Survey findings 43 percent of business owners with credit risk faced rejection when applying for funding underscoring the challenges in obtaining conventional loans. Consequently, these business owners often seek funding options such as vendor support, despite the heightened costs and uncertainties linked to it.

Comparing Seller Financing to Traditional Mortgages

When you compare vendor support with mortgages, a significant difference in the approval process is clear. Traditional mortgages usually demand a multitude of documentation and comprehensive credit assessments that may take weeks or months to finalize. In contrast, vendor support is more straightforward. 'Does not assign as much significance to the purchaser's creditworthiness. This attribute makes it attractive to people who may encounter difficulties in securing funding options.'.

Traditional loans usually come with interest rates and extended repayment periods compared to other options available in the market over an extended period of time. For example, wraparound mortgages are a type of assistance where the purchaser's mortgage merges with the loan amount of the property owner when acquiring a property. Under this arrangement purchasers reimburse the provider who in turn pays their mortgage lender at a higher rate of interest. This setup can be beneficial, for individuals struggling to secure a mortgage yet it may lead to increased expenses overall when contrasted with conventional loans.

Alongside that point using seller loans could accelerate the purchasing process; however purchasers need to consider the drawbacks such as higher interest rates and shorter repayment durations. It's crucial to assess these aspects to choose the most appropriate funding option for your individual circumstances.

Tips for Sellers Considering Seller Financing

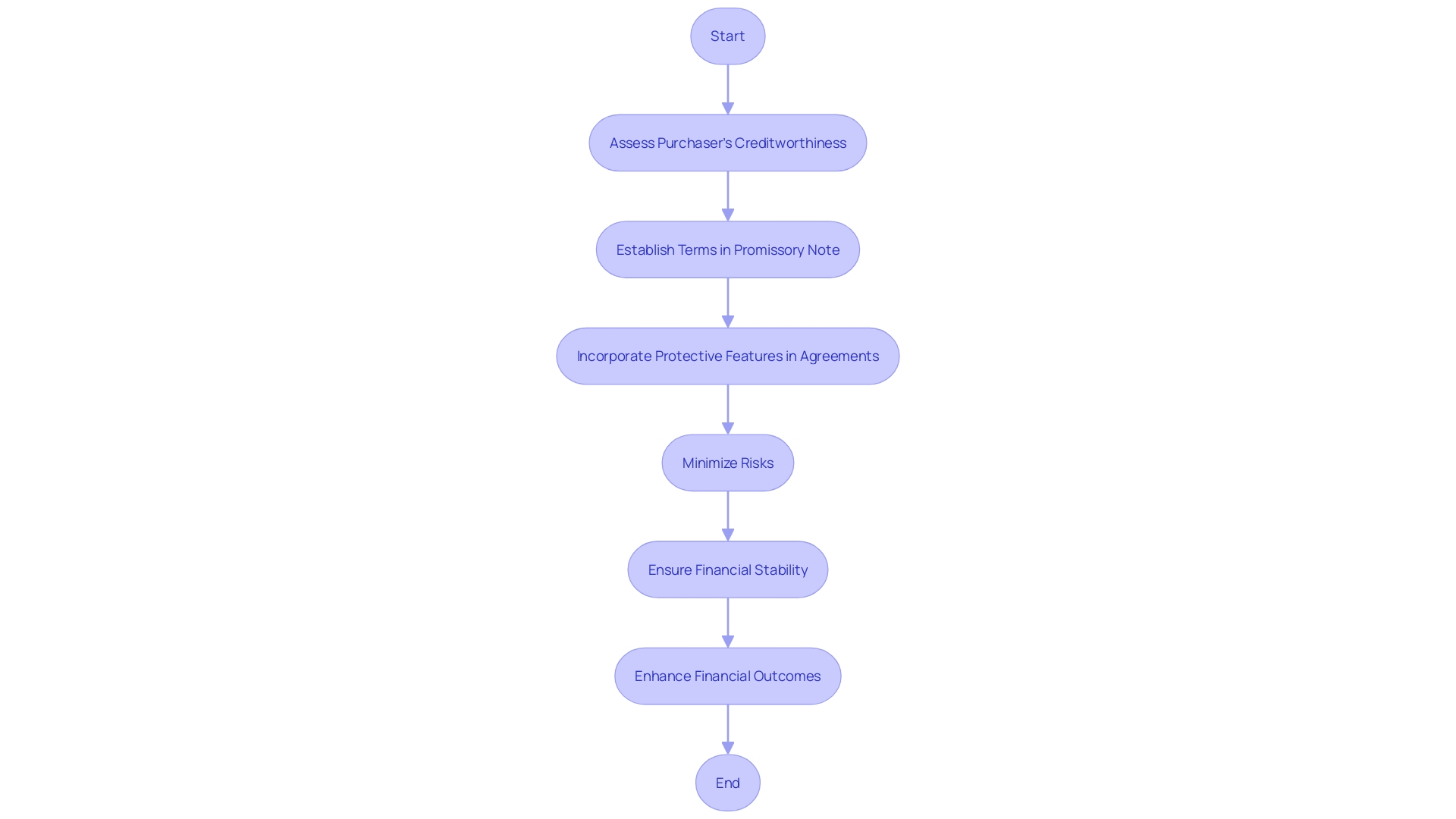

Vendors who are considering offering credit should thoroughly assess purchasers to minimize risks efficiently. This involves assessing the stability and creditworthiness of the buyer to ensure they can fulfill their payment commitments. It's important to establish detailed terms in a promissory note to prevent any misunderstandings or legal issues in the future. 'Seeking advice from a consultant can assist in understanding the tax consequences and advantages of the transaction offering a better insight into how this choice may affect your financial situation.'. Moreover arranging the agreement to incorporate features such, as balloon payments or other protective measures can safeguard your interests guaranteeing you receive the amount previously arranged. 'Don't forget that the option for funding goes beyond facilitating a transaction; it represents a strategic choice that has the potential to enhance your financial outcomes when executed with care and consideration.'.

Tax Benefits of Seller Financing

Choose vendor financing to enjoy tax advantages that are often overlooked in typical transactions. By opting to receive payments in installments of a lump sum at once when transferring ownership of a venture or asset can assist individuals in spreading capital gains over several years and possibly lower their overall tax obligation. This approach enables the postponement of tax obligations. Can be especially beneficial, for effectively handling cash flow concerns.

Vlad Rusza CPA with Centaur Digital Corp emphasizes the importance of long term tax planning to maximize benefits from investments and underscores the necessity to ensure investments are financially stable and lucrative, before considering their tax benefits—a principle that remains applicable for transactions financed by the vendor as well.

Tax-free stock exchanges provide an alternative for companies seeking to acquire enterprises without the requirement for upfront cash payments by exchanging their own company's stock for another's shares. This method offers flexibility in expanding the company's capital base and obtaining assets and services as required.

Hiring a tax advisor can be highly beneficial due to the intricacies involved in the process.Gaining insight from a tax professional early can help sellers in enhancing their business structure for tax advantages and streamlining operations for better profitability.Getting advice, from a tax advisor guarantees sellers readiness to handle the tax consequences of seller financing resulting in improved financial planning and control.

Conclusion

Seller financing provides a captivating option compared to financing approaches and brings distinctive benefits for buyers and sellers involved in business acquisitions. Buyers appreciate the flexibility in terms and conditions that facilitate a transaction process and find it an attractive choice. Particularly beneficial for aspiring entrepreneurs. Direct negotiations with sellers enable the establishment of relationships that pave the way, for tailored agreements and enrich the purchasing journey.

Sellers can benefit from this financing approach by attracting customers and speeding up transactions to possibly boost profits from interest revenues too. Moreover making use of the tax advantages linked to seller financing could greatly enhance results and help sellers handle capital gains more efficiently. By crafting agreements and evaluating the stability of potential buyers sellers can reduce risks while taking advantage of opportunities, in the market.

Although there are risks associated with seller financing its ability to facilitate transactions cannot be denied. With the changing landscape of business funding adopting this approach can result in mutually advantageous results. It is advisable for both parties to carefully assess the benefits and drawbacks of this option to make choices that pave the way for a prosperous future, in business acquisitions.