Introduction

In the paced realm of mergers and acquisitions (M&A) effectively managing challenges is key to achieving favorable outcomes. The complexities of M&A transactions arise from a multitude of factors like corporate cultures, regulatory demands and individual objectives of all parties engaged. Grasping these intricacies on including engaging with stakeholders and external partners is vital, for a successful deal.

Maintaining clear communication with everyone involved. From joint venture partners to employees holding purchase rights. Is crucial for a seamless transition, during mergers and acquisitions (M&A). By recognizing and addressing these complexities effectively all stakeholders can better navigate the M&A landscape. Drive positive business results.

By developing a strategy and delving into detailed analysis work businesses can reveal possible pitfalls and advantages improving the likelihood of fruitful discussions. Relying upon the knowledge of M&A specialists maintaining openness with parties and creating smart approaches for collaborations are crucial. Good communication nurtures. Seamless changes, playing a key role, in the prosperity of M&A endeavors.

In addition to conducting in depth research and implementing risk management practices to mitigate unforeseen problems focusing on cultural integration is key in fostering alignment, among employees and reducing dissatisfaction and turnover risks. It is essential to prioritize understanding and adherance to legal requirements to avoid penalties and maintain seamless operations. By embracing these holistic approaches organizations can successfully navigate the environment of mergers and acquisitions.

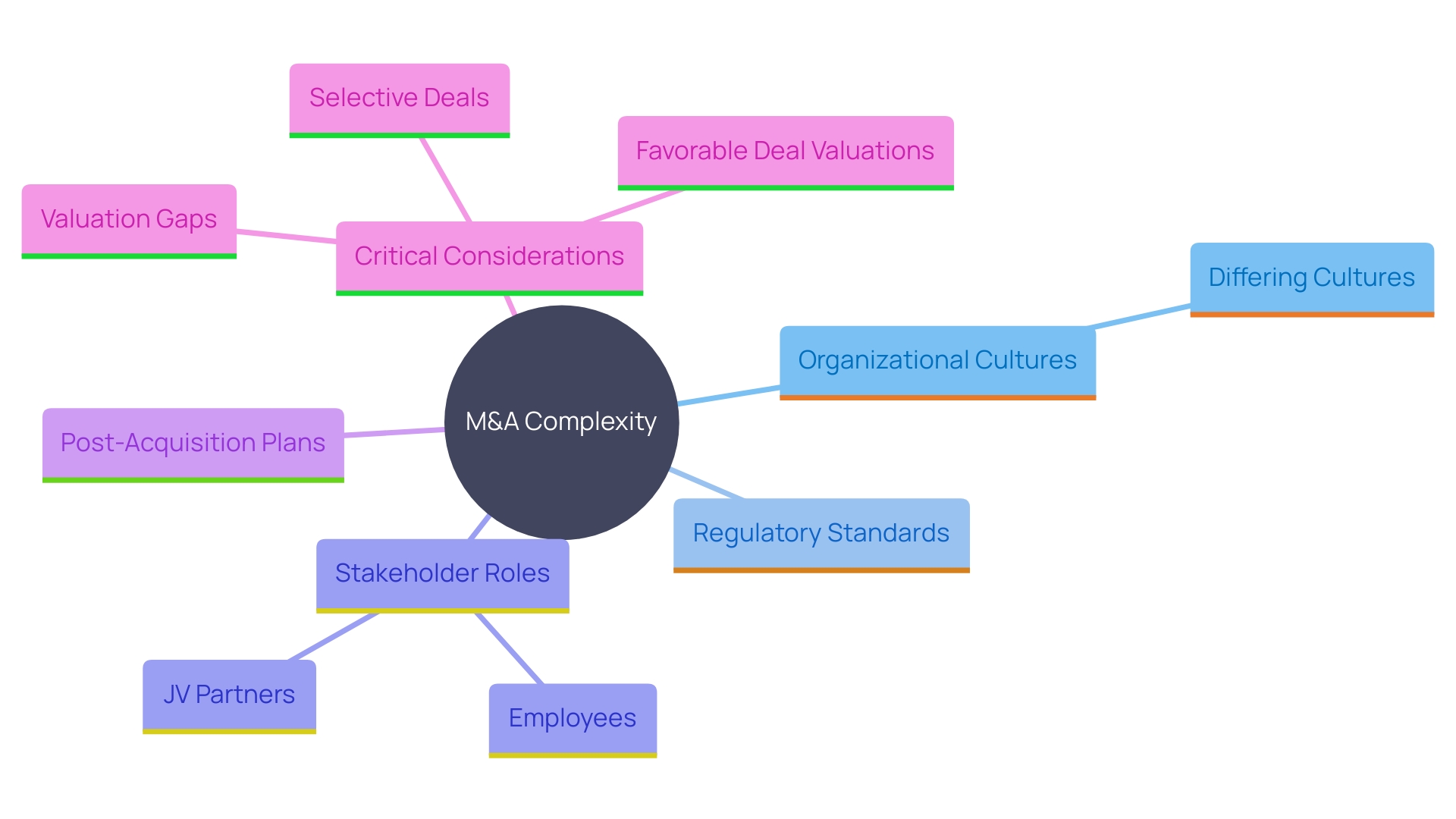

Understanding the Sources of Complexity in M&A

Merger and acquisition transactions can be quite intricate because of the aspects involved in running a business smoothly. Similar to various organizational cultures and regulatory standards that differ across locations, as well as the distinct objectives each side aims to accomplish in the agreement's result, contribute significantly to this factor of complexity.. 'It's right from the start to be open about who is involved in these transactions and any agreements made with other parties outside the main players like stakeholders or third party collaborators. For instance; when acquiring a business that has a venture, with an international partner; it becomes imperative to have a clear plan laid out beforehand for how this partnership will continue post acquisition. When considering how to engage the JV partner and discussing buyout scenarios and their valuation is crucial in this situation.'. It is important not to overlook the significance of stakeholders like JV partners and employees holding purchase rights well as founders since it can add complexity to deals. According to Christian Atzler, from Baker McKenzie M&A teams, insights regarding target firms tend to downplay these elements. Acknowledging and dealing effectively with these intricacies is essential for stakeholders to successfully navigate the M&A environment.

Key Strategies for Navigating M&A Complexities

Developing a strategy is crucial for maneuvering through the intricate realm of business combinations effectively. It requires planning and preparation long before the agreement is finalized. Conducting, in depth research is crucial to uncover any risks and potential benefits. Getting a grasp of the other party point of view and motivations can greatly improve the chances of a successful negotiation. As an expert once said; " think about how much you could learn before entering into negotiations if you truly understood what the other side was thinking and feeling."

Utilizing the expertise of M&A specialists can provide insights on market trends that allow firms to anticipate challenges and formulate effective strategies. Christian Atzler from Baker McKenzie's M&A team emphasizes the importance of being open regarding stakeholders and strategic approaches for collaborations. For example, when a potential company is involved in a joint venture with an international partner, it is essential to plan how to interact with them efficiently and investigate possible purchasing alternatives.

Clear exchange of information among all involved contributes to the success of business consolidations. It promotes alignment. Promotes a collaborative environment that facilitates the transition process seamlessly, as noted by Jason Turner from Venbrook Group, who emphasizes the importance of taking into account human resources and cultural compatibility in mergers, similar to how one would thoughtfully assess in a marriage context. This thorough method, along with insights offered by tools such as BCG’s M&A Sentiment Index, which tracks dealmakers’ preparedness to engage in M&A activities, can greatly enhance the success rate of these complex transactions.

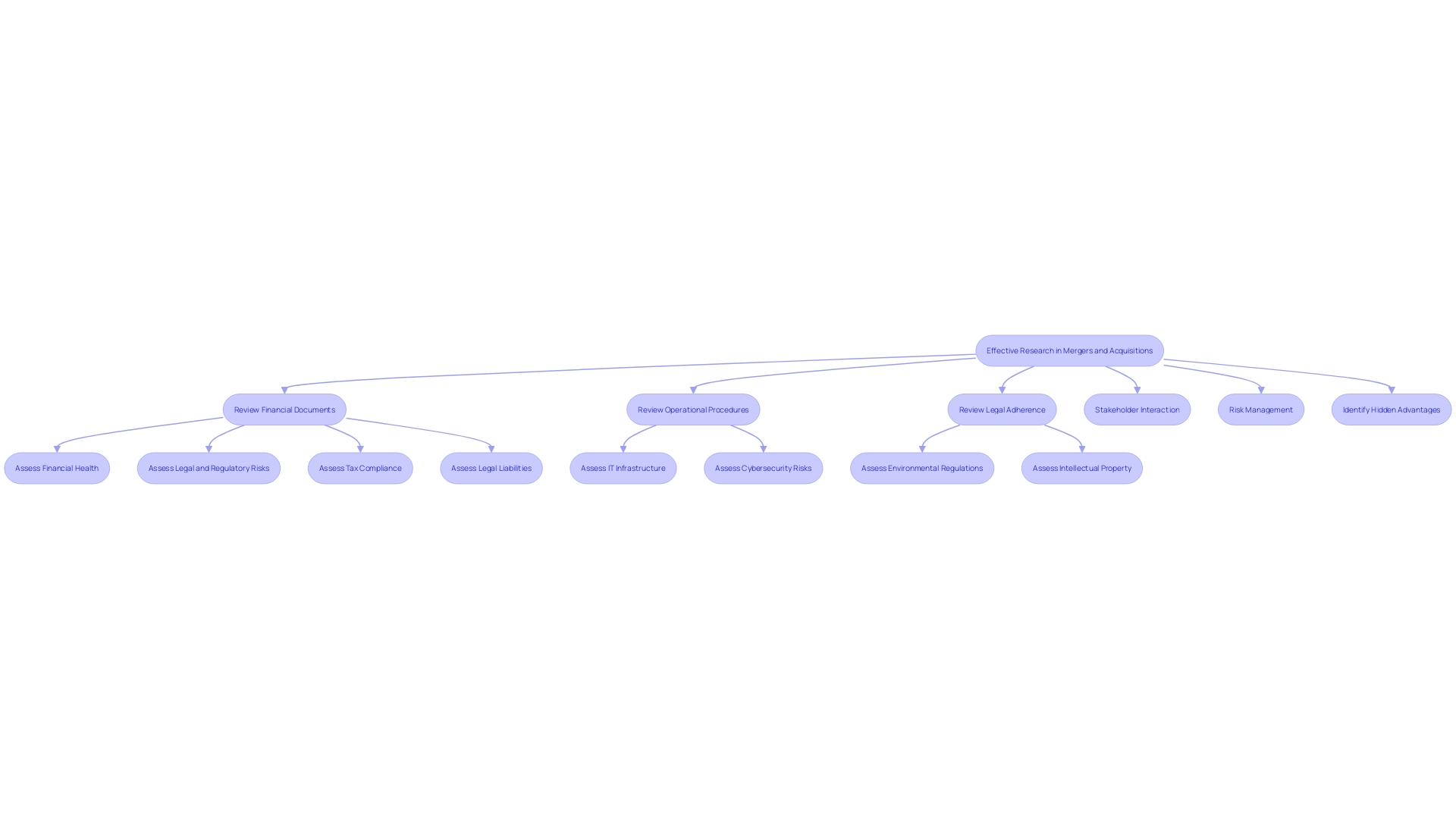

Due Diligence and Risk Management in M&A

Carrying out research is essential for the success of any merger and purchase. It involves reviewing financial documents, operational procedures and legal adherence to identify any possible risks and obligations. Being transparent about players like partners in joint ventures and employees entitled to purchase rights is vital. M&A partner Christian Atzler from Baker McKenzie emphasizes the importance of developing a strategy to interact with these stakeholders, including potential targets. Taking a stance on risk management can help prevent unexpected issues and enhance the opportunity for success. In-depth investigation also reveals hidden advantages in the target firm that contribute to an outcome overall, for example in the corporate consolidation sector gaining momentum with a notable 6 percent growth in new agreements each year and a rise in transaction size, to $550 million. Conducting comprehensive research becomes even more crucial; by scrutinizing all aspects meticulously, businesses can safeguard their interests and optimize the full potential of the purchase.

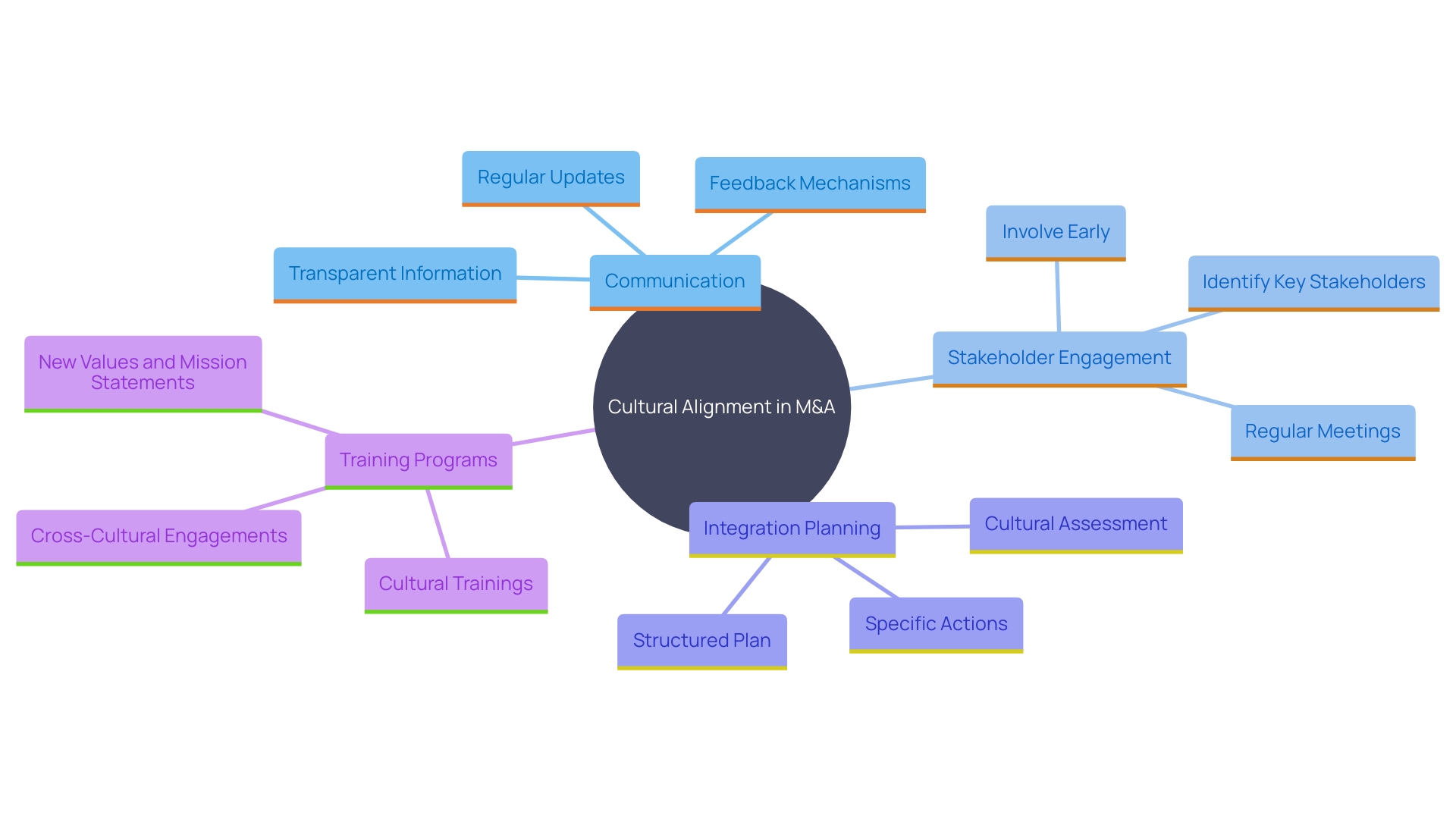

Cultural Integration and Alignment

The creation of a cultural alignment acts as an essential base for the success of combinations and purchases (M&A). When corporate cultures are not in sync with each other it may result in employee discontent. 'Challenges, with retaining talent which could potentially hinder the expected advantages of the combination. For a consolidation process it is essential for companies to create thorough integration plans that place emphasis on common values and objectives.'.

Maintaining communication to recognize significant stakeholders like business partners and employees holding purchase options is vital for successful collaboration and conflict prevention in ventures. For example; Ericsson strategically prioritized establishing trust and credibility by focusing on early stage discussions and engagements with government officials when venturing into the telecommunications sector, in China. This strategy underscores the significance of grasping intricacies and historical backgrounds in global business dealings where renegotiations are frequent occurrences.

It's crucial to analyze the findings from assessments and pinpoint behaviors and management approaches that will enhance the new cultures strength. By putting in place defined strategies with clear objectives and priorities in mind. We have the potential to establish a performing cultural environment. Engaging in activities such as training programs and cross cultural interactions while incorporating fresh values and mission statements lays down a solid groundwork, for effectively integrating cultures.

Applying these strategies can assist in closing divides and fostering a more seamless and effective environment after a combination occurs. Christian Atzler from Baker McKenzie M&A team emphasizes the significance of being transparent with stakeholders and having a defined strategy when dealing with external parties to ensure their significance and rights are not underestimated. Through promoting communication and fostering teamwork among different groups within an organization is key to establishing a unified setting that aids, in the successful outcome of the merger.

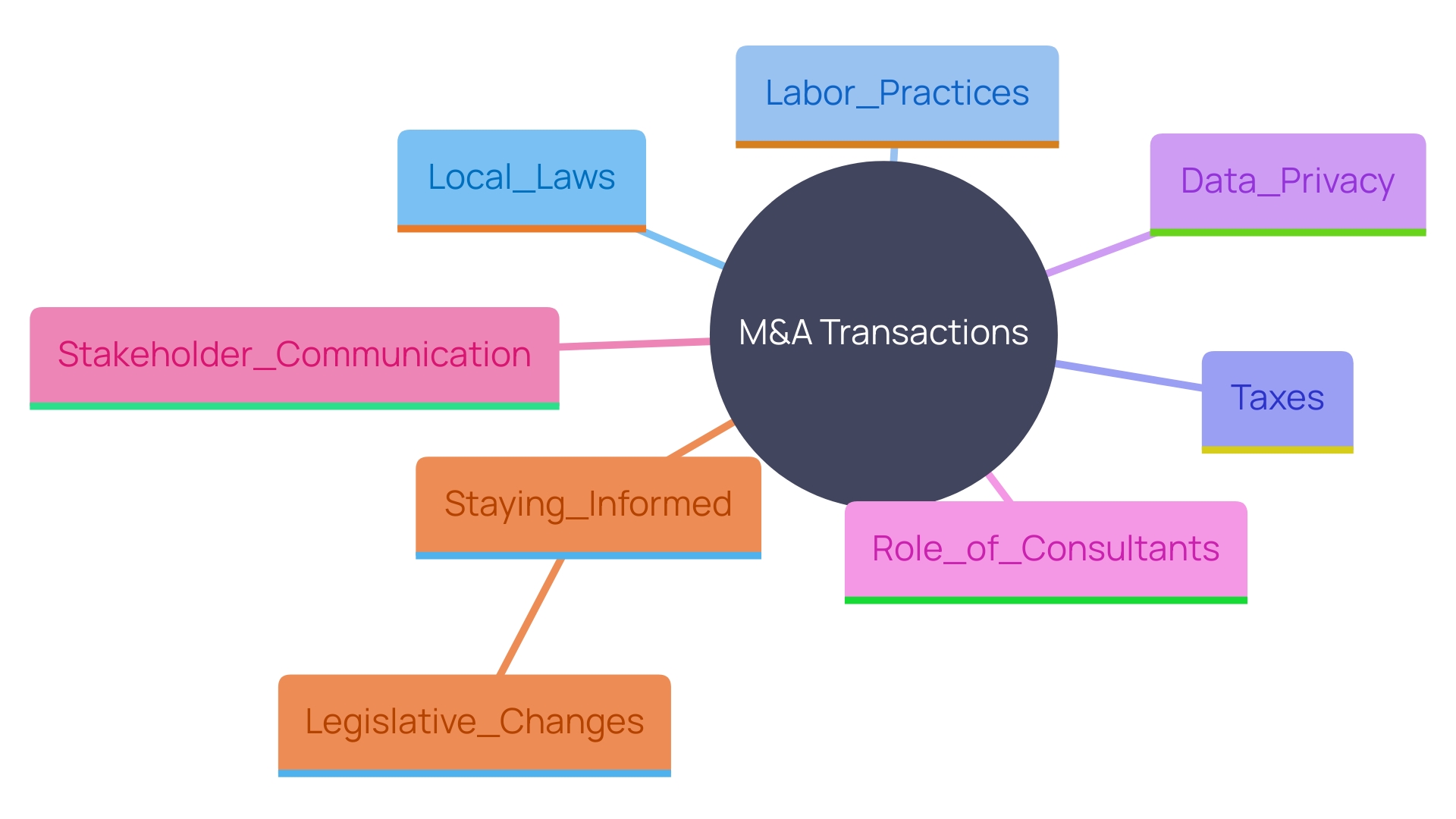

Regulatory and Legal Compliance in M&A

When it comes to M&A transactions, navigating the scene is crucial but also quite complicated; you don't want to mess things up there! Making sure you're on the side of the law at every level. From local to global. Is key to avoid getting hit with hefty fines and keep things running smoothly in your business operations. Having pros who really know their stuff about the rules that apply to your industry can be a real game changer here. Lets take a look at how things play out when it comes to nearshoring – understanding what the local laws say about labor practices or taxes or data privacy is a big deal, in this space. Bringing onboard consultants who have a grasp of these regulations can really help iron out any wrinkles in the process and make things go more smoothly for you.

Ensuring communication with important stakeholders and third party contracts is crucial in this context. According to Christian Atzler from Baker McKenzie M&A team; "It's essential to have transparency from the start, about the stakeholders of the organization being acquired and to establish a common understanding with relevant external parties." This involves planning for collaborations and comprehending the responsibilities of staff members holding purchase rights and the founders of the organization.

Staying informed about alterations in legislation and taking actions to address compliance issues allows businesses to effectively manage these complex circumstances. For instance, in 2023, the TMT sector represented 17 percent of the value of combinations and consolidations, depending on such proactive strategies to navigate rapid digital progress and shifts in regulations. Following regulations in nearshoring and other strategic activities highlights the significance of complying with rules to achieve positive outcomes, in mergers and acquisitions.

Conclusion

Effectively handling mergers and acquisitions involves taking an approach that considers various factors at play. It is crucial for stakeholders to grasp the layers of complexity involved – such, as diverse corporate cultures and regulatory demands. Transparency and clear communication serve as elements in promoting teamwork and ensuring that all involved parties share common goals.

Creating a plan and conducting in depth research are crucial in recognizing possible risks and advantages before starting negotiations. Utilizing the knowledge of M&A experts allows companies to predict obstacles and devise plans to improve their likelihood of achieving outcomes. Open and clear communication nurtures a culture of trust and teamwork that's essential for a seamless transition, throughout the merger phase.

Incorporating blending is also crucial and shouldn't be underestimated in importance. Creating shared beliefs and goals can reduce employee discontent. Hold onto valuable staff members ultimately contributing to the mergers triumph. A outlined plan for harmonizing cultures along, with continuous dialogue sets the stage for a united and efficient work setting.

In the world of M&A (mergers and acquisitions) it's crucial to stay on top of regulatory requirements, for smooth sailing ahead! By staying well versed in both international laws and regulations companies can steer clear of any roadblocks that might throw a wrench in their plans. Bringing in expert consultants who know the ins and outs of these rules can make the acquisition journey a lot easier.

By adopting these approaches companies can not just steer through the complex realm of mergers and acquisitions but also tap into substantial avenues for growth. When key players focus on communication, cultural blending and compliance with regulations they lay the groundwork, for a future filled with possibilities.