Introduction

In today's digital age, buying or selling a business has never been more accessible. Online marketplaces like BizBuySell offer a wide range of options across industries and budgets, providing a wealth of opportunities for entrepreneurs. But before embarking on this transformative journey, it's crucial to understand the true value of the business you're interested in.

A comprehensive assessment, including adjustments for non-operational expenses and accounting inaccuracies, can provide a detailed view of normalized cash flow. Additionally, industry leaders emphasize the importance of evaluating your company's future trajectory and being clear on your price target when considering a sale. Whether you're looking to acquire a strategic business or make a well-timed sale, the digital landscape offers a multitude of avenues to advance your entrepreneurial journey.

With the convenience and resources provided by online marketplaces, entrepreneurs can confidently navigate the complexities of buying and selling businesses with success in mind.

Top Business Sale Websites

Venturing into the territory of buying or selling a business can be a transformative move, and doing so online has never been more accessible. Marketplaces like BizBuySell stand out as the largest digital hubs, where a spectrum of options awaits, from franchises to independent ventures. This marketplace is not only abundant in choices across industries and budget ranges but also offers resources like the 'BizBuySell Guide to Buying a Small Business' to navigate your acquisition journey.

While embarking on this path, it's essential to grasp the enterprise value of the business you're eying. This isn't just about the financial figures like EBITDA, revenue, or Free Cash Flow; it's about a comprehensive understanding that includes adjustments for extraordinary events, non-operational expenses, and accounting inaccuracies. A Quality of Earnings (QOE) report might just be the compass you need, going beyond raw numbers to provide a detailed view of normalized cash flow, setting you up for an informed transaction.

When pondering the prospect of selling, consider the wisdom of industry leaders. Abhijeet Kaldate of Astra WordPress Theme underscores the need to evaluate your company's future trajectory, as this foresight is key to discerning the true worth of your business against any offers. Nanxi Liu from Blaze.

Tech advises that being clear on your price target is crucial to decide if you should engage in the intricate M&A process. And Samuel Timothy of OneIMS reminds us that selling may involve reaching specific milestones within a set timeframe, challenging one's confidence in their business's growth potential.

As you navigate these decisions, remember that each step, from establishing a digital marketing strategy to keeping operational costs manageable, plays a pivotal role in shaping the success of your online presence. Whether it's a strategic acquisition or a well-timed sale, the digital landscape offers a multitude of avenues to advance your entrepreneurial journey.

BizBuySell

BizBuySell stands out as a premier online marketplace for those looking to embark on the journey of buying or selling a business. It offers an extensive array of listings that span across diverse industries, providing a pivotal resource for buyers and sellers to forge connections and negotiate transactions that best serve their goals. The platform is engineered with a user-centered design and a powerful search function, making the exploration of business opportunities both efficient and effective.

Navigating the waters of business transactions, whether buying an established entity or starting from the ground up, involves careful consideration of various costs and strategies. For instance, acquiring an existing business often entails a significant upfront investment alongside ongoing expenses to foster growth and stability. Conversely, creating a business from scratch requires expenditures in areas such as branding, website development, and marketing.

A vital aspect of selling a business is understanding its true value, which hinges on a thorough valuation. This process takes into account financial statements, assets, customer base, and industry trends. As experts like Stephanie Wells from Formidable Forms suggest, anticipating the future trajectory of your business over the next decade can inform your decision to sell, ensuring that the offer aligns with the business's intrinsic worth.

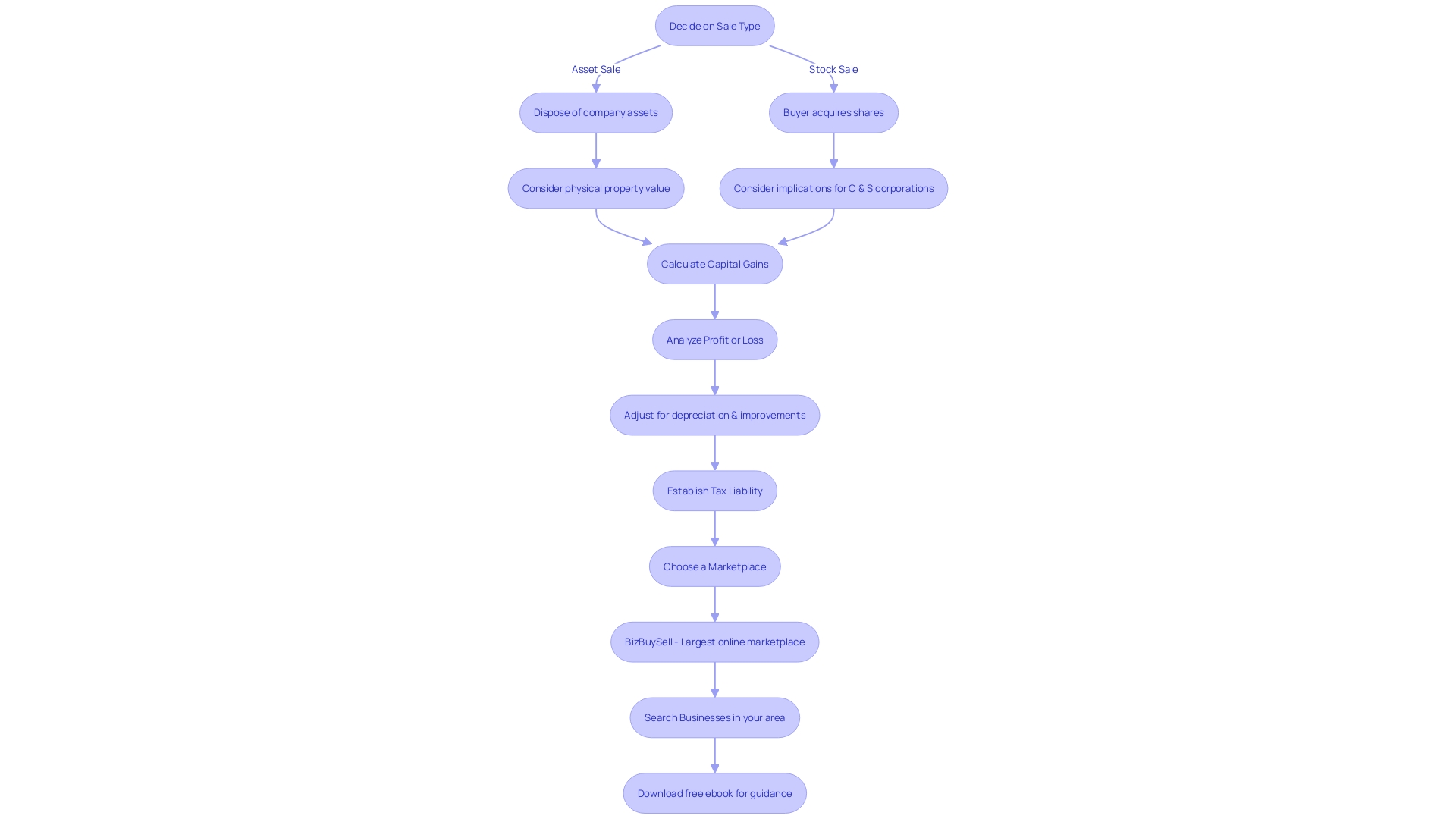

Moreover, when contemplating the sale of a business, one must consider the nature of the transaction—be it a stock sale or an asset sale—each bearing its unique tax implications and effects on capital gains. The choice between these methods can significantly influence the financial outcome for both parties involved.

For those seeking to finance the acquisition of a business, lenders will meticulously scrutinize financial records and perform a rigorous business valuation to assess the risk of their investment. A solid financial foundation and a compelling business case are fundamental to securing the necessary funds.

In light of these considerations, BizBuySell serves as a critical tool, equipping entrepreneurs with the necessary resources to make informed decisions and navigate the complexities of business buying and selling with confidence and clarity.

Flippa

Flippa stands out as a premier destination for entrepreneurs looking to acquire or divest online properties, including entire businesses, websites, and domain names. Catering to a diverse range of digital assets, Flippa's platform is bustling with opportunities, from nascent e-commerce ventures to well-oiled web operations. With an expansive community of users, the marketplace offers an abundance of choices for every type of buyer or seller.

It's not just about the variety, though. Flippa ensures that each transaction is underpinned by a robust escrow service, providing peace of mind with secure and seamless exchanges. Whether you're taking over an existing enterprise or offloading your digital brainchild, Flippa facilitates a clear path to your next business chapter.

Empire Flippers

Empire Flippers has become a go-to marketplace for entrepreneurs looking to acquire or divest profitable online businesses. With a stringent vetting process, they ensure that each business listed on their platform meets high-quality standards, providing confidence to prospective buyers. The platform's commitment to due diligence and migration support further streamlines the transaction process, offering a comprehensive solution for those entering or exiting the digital marketplace.

This seamless approach is particularly beneficial for those who understand the financial commitment and logistics involved in setting up an online business from the ground up—considering expenses such as branding, website development, and marketing strategies. Empire Flippers simplifies the transition for new owners to take the reins, making it a valuable resource in a rapidly evolving e-commerce landscape.

Side Projectors

Side Projectors stands out as a specialized marketplace tailored for entrepreneurs who are eager to dive into new ventures or divest from their current ones. It offers a unique space for those with side projects or startups developed from passions or hobbies that have the potential to flourish into lucrative businesses. The platform is perfectly aligned with the entrepreneurial spirit, providing a stage for individuals to showcase their side projects that have evolved into tangible products or services.

Users can effortlessly navigate through a variety of listings, organized into accessible categories, making it simple to pinpoint opportunities that align with their business interests. By facilitating direct connections between buyers and sellers, Side Projectors ensures a seamless transition for both parties involved, making it an ideal destination for those looking to either acquire a fresh project or find a new steward for their startup.

Niche Investor

For entrepreneurs with an eye for unique opportunities, Niche Investor stands out as an invaluable platform. It's not just a marketplace; it's a hub for those seeking to buy or sell businesses that are as distinctive as their ambitions. With a focus on specialized industries, Niche Investor isn't about casting a wide net but about precision—matching buyers with businesses that resonate with their specialized interests and know-how.

The selection of listings is not just broad; it's curated, ensuring that each business aligns with the specific needs and desires of potential buyers. This level of detail is akin to the approach of Nets, a digital payment solutions company that tailors its offerings to the nuanced needs of its clients in the finance and banking sectors. Their commitment to making technical data accessible and engaging is mirrored in Niche Investor's dedication to providing resources that guide stakeholders through the complexities of business transactions.

Echoing the ethos of niche marketing, Niche Investor provides a platform where the small market dreams of startups can flourish. It's about identifying and serving a specific clientele with precision—much like how instructional designer Karmela Peček at eWyse Agency transformed dense information into compelling content to engage users. This philosophy is supported by Adam Cormier of JAC Comm, who emphasizes the importance of knowing one's audience—a principle that is paramount in the realm of Niche Investor.

The realm of niche markets is vast and varied, but one thing remains constant: the need for a targeted approach. As evidenced by the success stories in publications like Chemistry World, which delves deep into the specifics of material science, Niche Investor understands that the key to standing out is not just in offering a product or service but in offering a solution.

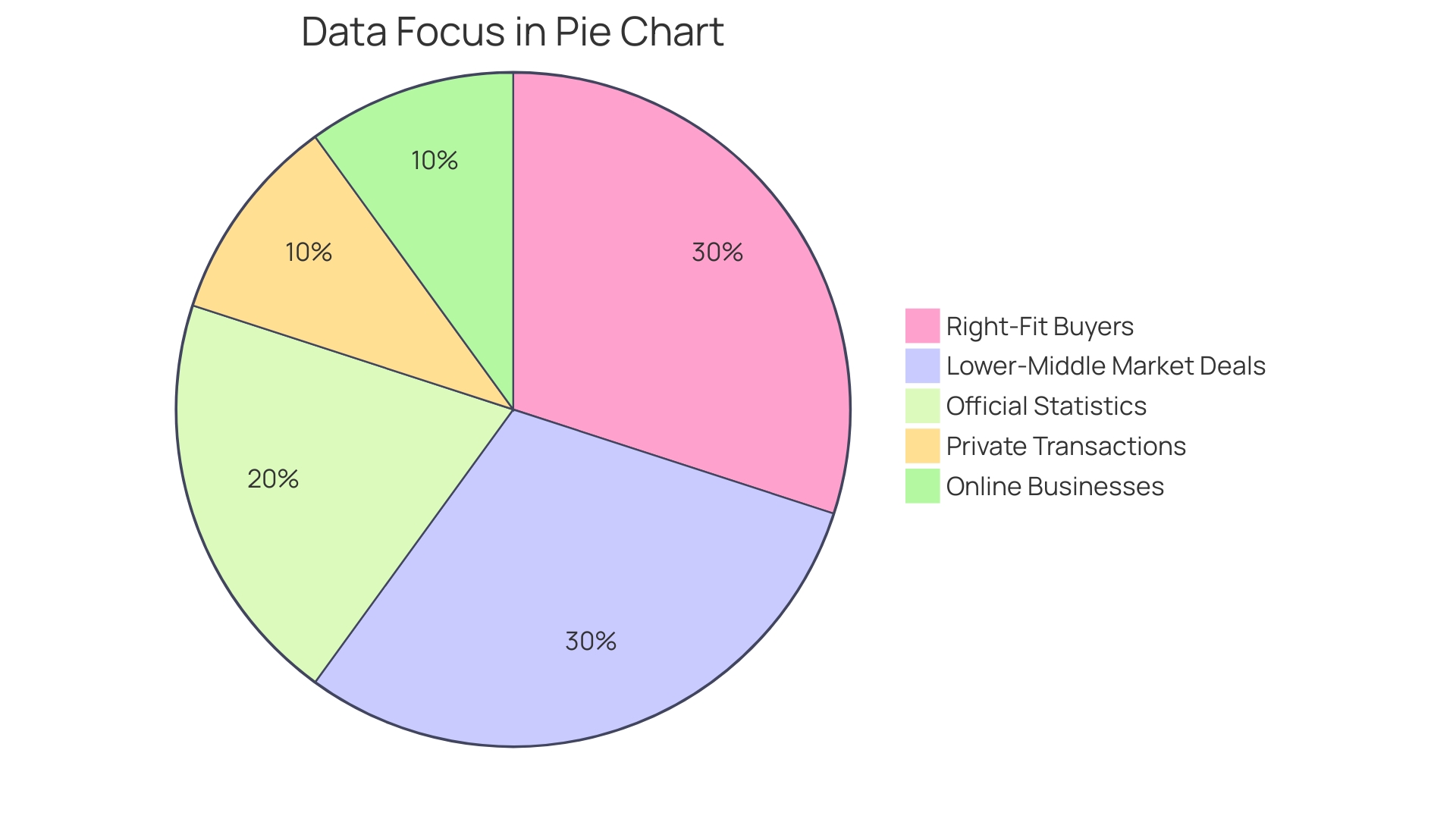

The potential for profit in such a targeted market is evident with online business niches demonstrating consistent demand, as reported by official statistics. Investment advisers have seen substantial growth over time, managing regulatory assets in the trillions. This level of success is what Niche Investor aims for—facilitating connections that not only meet but exceed the unique demands of a niche market.

Motion Invest

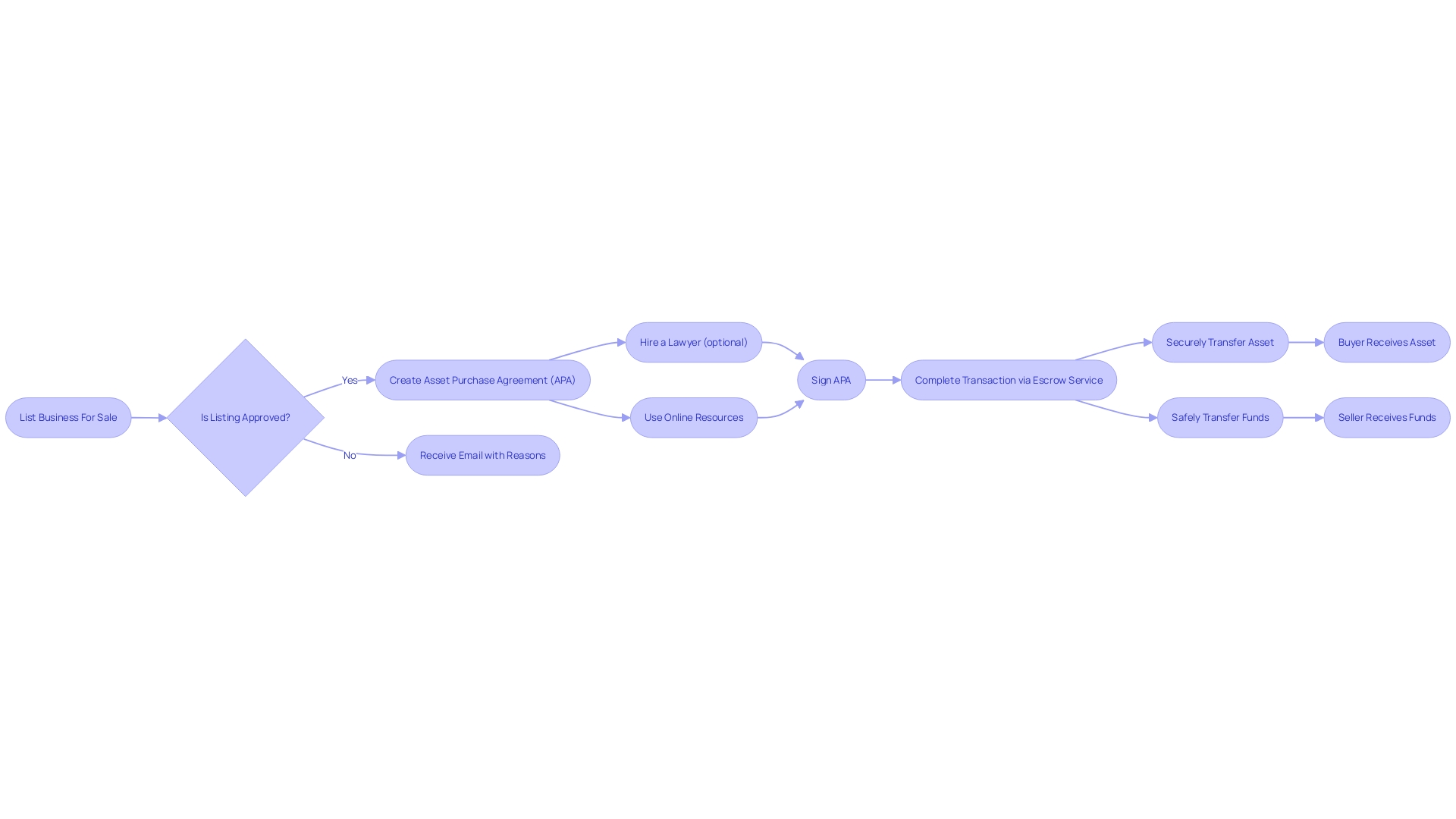

Motion Invest stands out as a specialized marketplace dedicated to the buying and selling of content-driven online businesses. With an emphasis on facilitating deals for sites that have a proven track record of traffic and income, it offers a unique service for investors who are looking to step into established digital real estate. The process at Motion Invest is streamlined to ensure a seamless asset transfer, supported by the implementation of an Asset Purchase Agreement (APA).

By utilizing an escrow service as part of the transaction, both buyers and sellers can transact with confidence, knowing their interests are safeguarded. It's a platform that not only simplifies the complexities associated with legal and financial details but also provides notifications and guidance throughout the approval period of listings, which typically ranges from a few hours to a week. For sellers, the platform offers a straightforward submission process for offers, and for buyers, it provides an assurance that each transaction is handled with the utmost attention to security and transparency.

Business Exits

Imagine turning a small community meetup into a thriving business that captivates the attention of eager buyers. This is the story of Tech Ladies, which began as a simple gathering in New York and blossomed into a business with a 200,000-strong membership before it was successfully sold. Their journey underscores the potential of building a community-centered business that transcends the personality of its founder, focusing on scaling the collective experience.

Enter Business Exits, a platform specifically designed to bridge the gap between buyers and sellers of businesses like Tech Ladies. With a myriad of listings spanning diverse industries, Business Exits simplifies the complex process of business transactions. Not only does it connect people, but it also equips them with the necessary tools to navigate sales seamlessly, including valuation services to ascertain the true worth of a business.

Selling a business involves crucial decisions like opting for a stock sale or an asset sale, each with distinct tax implications and effects on capital gains. Business Exits provides the insights needed to make these choices wisely. A sale could result in a lucrative offer, but understanding the true value of your business is paramount.

As Stephanie Wells from Formidable Forms suggests, contemplating the future trajectory of your business is key to deciding whether to sell.

Business Exits doesn't just offer a database of transactions; it provides a specialized report for those looking to delve deep into their niche, saving invaluable time and effort. With comprehensive financial data, including sales, operating profit, and more, Business Exits offers a resource akin to a one-click treasure trove for sellers, buyers, and investors.

In a world where women entrepreneurs are carving out their space, platforms like Business Exits are instrumental. They serve not just as marketplaces but as catalysts for growth, allowing businesses to reach their full potential and owners like Allison Esposito Medina to realize their dreams.

Latona’s

Latona's stands out as a premier destination for entrepreneurs looking to make strategic moves in the online business landscape. This marketplace specializes in connecting sellers of online businesses, websites, and domain names with serious buyers, providing a comprehensive and secure environment for high-stake transactions. The platform is renowned for its diverse range of listings, catering to various niches and industries, ensuring that buyers can find an established business that resonates with their vision and expertise.

The marketplace goes beyond simple listings; it offers invaluable services that are crucial for the due diligence process, ensuring that buyers have all the information they need to make an informed decision. Additionally, Latona's facilitates transactions through its escrow service, adding an extra layer of security and peace of mind for both parties involved. With a focus on high-quality listings and a supportive network, Latona's has cultivated a community where experienced digital entrepreneurs can learn, share, and collaborate, making it a vibrant hub for those aiming to buy or sell a substantial online business.

Acquire.com

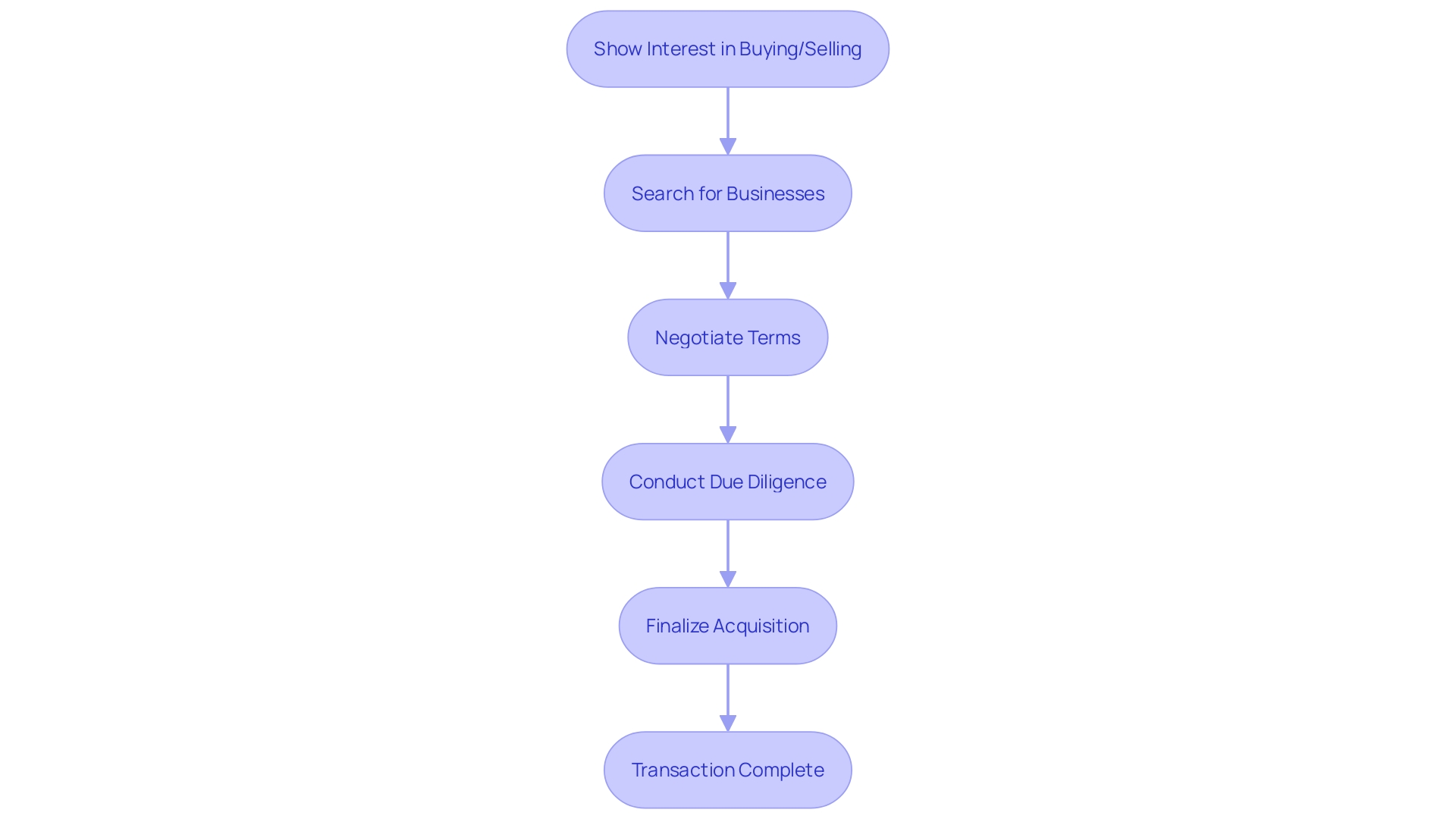

Acquire.com stands out as a premier platform for those interested in buying or selling online businesses. With its intuitive interface and powerful search capabilities, it simplifies the process of finding businesses that align with specific purchasing criteria. Beyond mere matchmaking, Acquire.com extends a suite of resources and support, guiding both parties from initial interest to the final handshake of the transaction.

Engaging their services means having an ally every step of the way—whether it's navigating negotiations, due diligence, or the intricacies of escrow arrangements. Their commitment to your success is echoed in the tailored experience and expert advice provided by dedicated M&A advisors, ensuring your business finds its ideal match for acquisition, at a value that truly reflects its potential.

BuySellEmpire

BuySellEmpire stands out as a premier platform for entrepreneurs looking to acquire or divest their established online businesses. With its handpicked collection of online business listings, the marketplace is dedicated to streamlining the complex sales process for both parties. It ensures a smooth and secure exchange of assets, bolstered by comprehensive support.

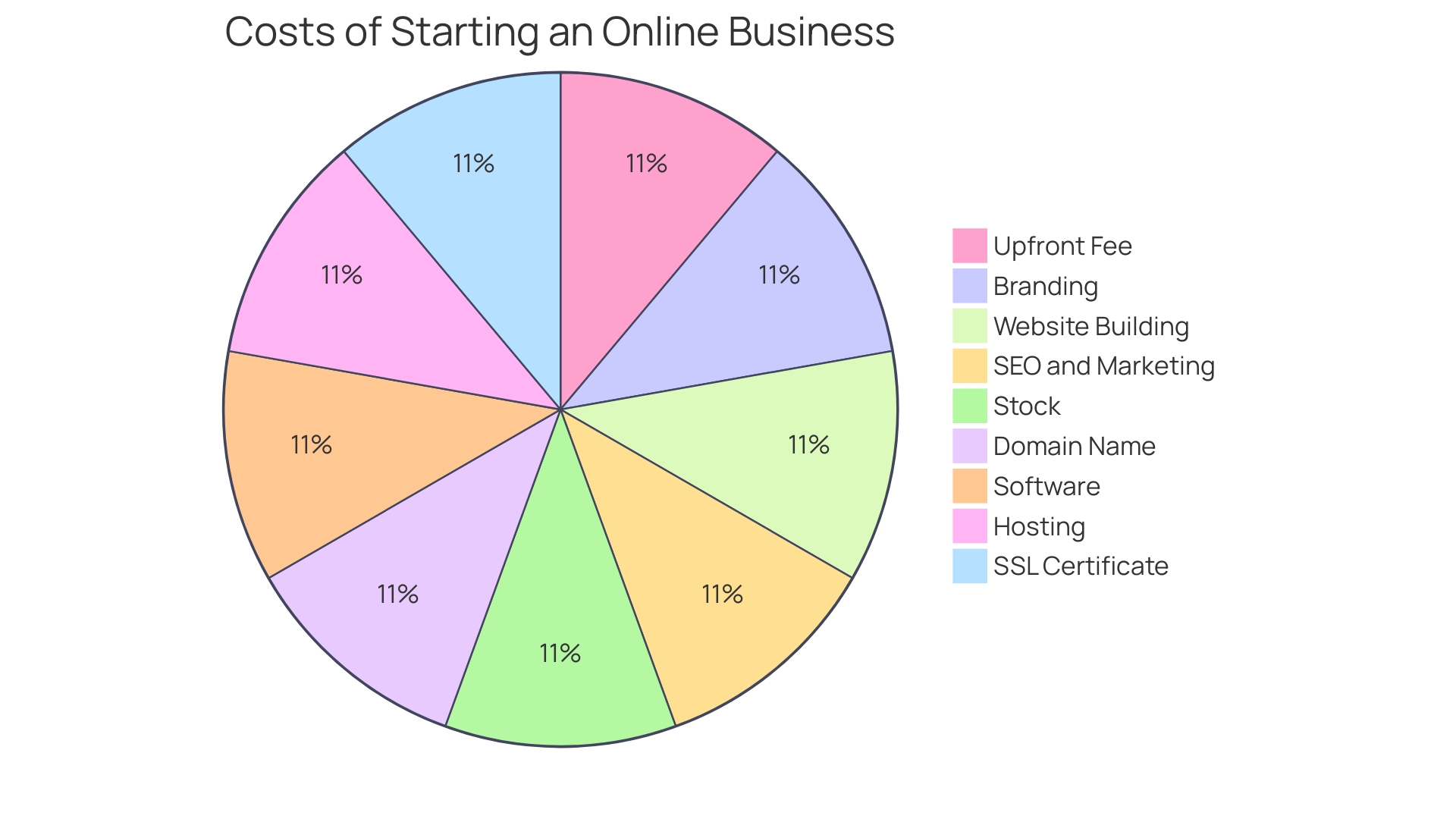

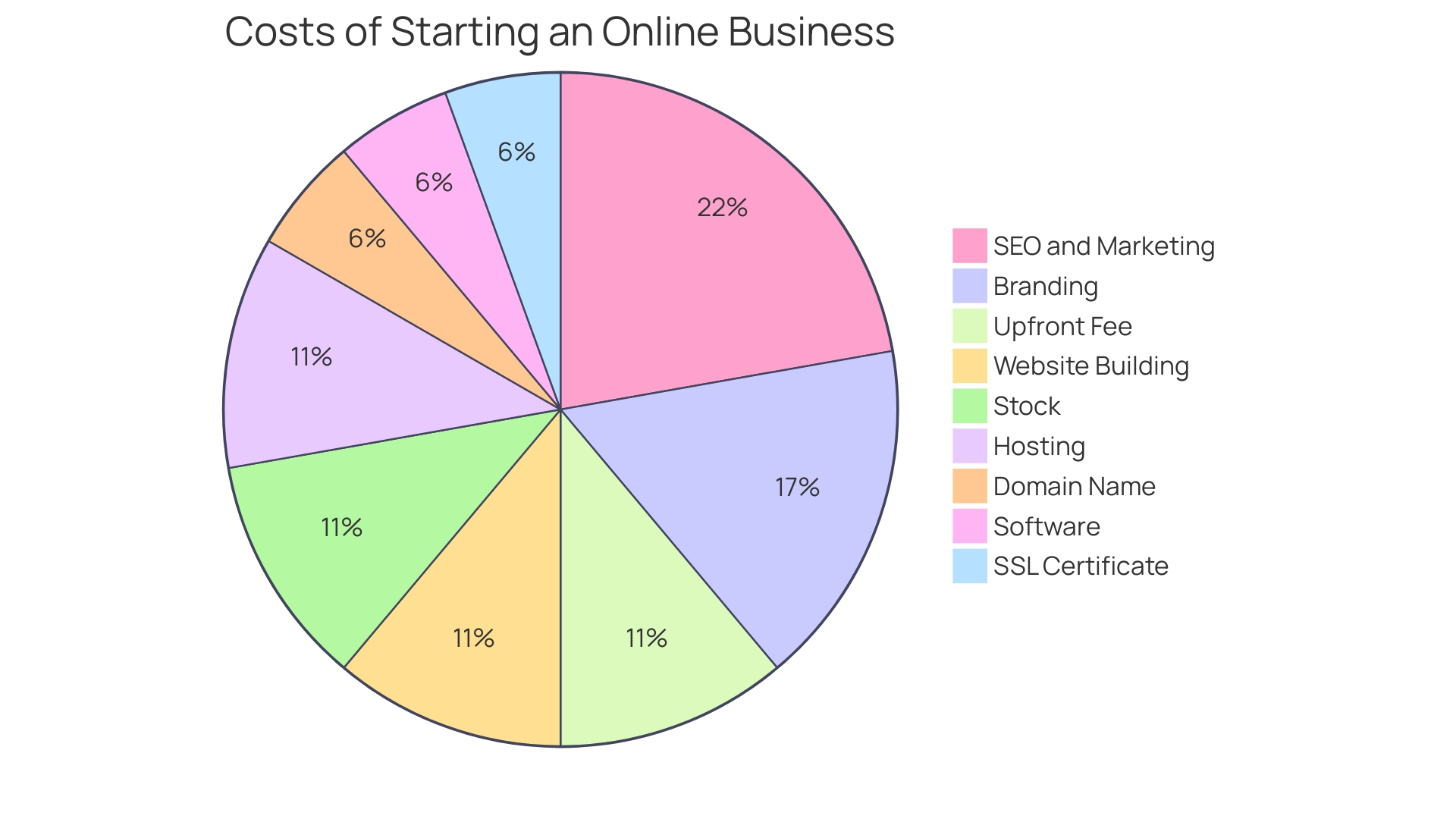

Diving into the world of online business ownership often means weighing the initial investment against future growth and maintenance expenses. When acquiring an established business, entrepreneurs face a single upfront cost alongside ongoing investments to scale and sustain the venture. Conversely, starting from scratch can involve substantial outlays for branding, web development, SEO, marketing, inventory, domain names, software, hosting, and SSL certificates.

The digital realm demands a clear understanding of one's niche and unique selling proposition. Prospective business owners must not only consider their target audience but also devise a robust strategy to stand out in the competitive market. Crafting a digital marketing strategy, minimizing operational costs, and navigating the logistics of e-commerce are pivotal steps toward success.

For those who nurture an exit strategy from the outset, meticulous record-keeping becomes a cornerstone of business operations, adding value and credibility in the eyes of potential buyers. Maintaining transparency through tools like Google Spreadsheets can offer a clear history of financial transactions, signaling a well-documented and legitimate enterprise.

Selling a business, particularly to larger corporations or private equity firms, requires an acute awareness of the industry's valuation landscape. Recognizing the key factors that define a business's worth—profitability, proprietary assets, intellectual property, and market position—can significantly influence a buyer's interest and the ultimate sales price.

To facilitate a secure transaction, creating an Asset Purchase Agreement (APA) is highly advisable, possibly with legal assistance. Following the agreement, utilizing an escrow service ensures the safe transfer of funds and assets between seller and buyer. Platforms like BuySellEmpire take the reins on these complex legalities and logistical details, including the approval process for listings, which typically concludes within 48 hours, and the communication of any necessary revisions.

As the e-commerce landscape flourishes, understanding these nuances can empower entrepreneurs to make informed decisions, whether they're stepping into an existing online business or building one from the ground up.

Benefits of Using These Platforms

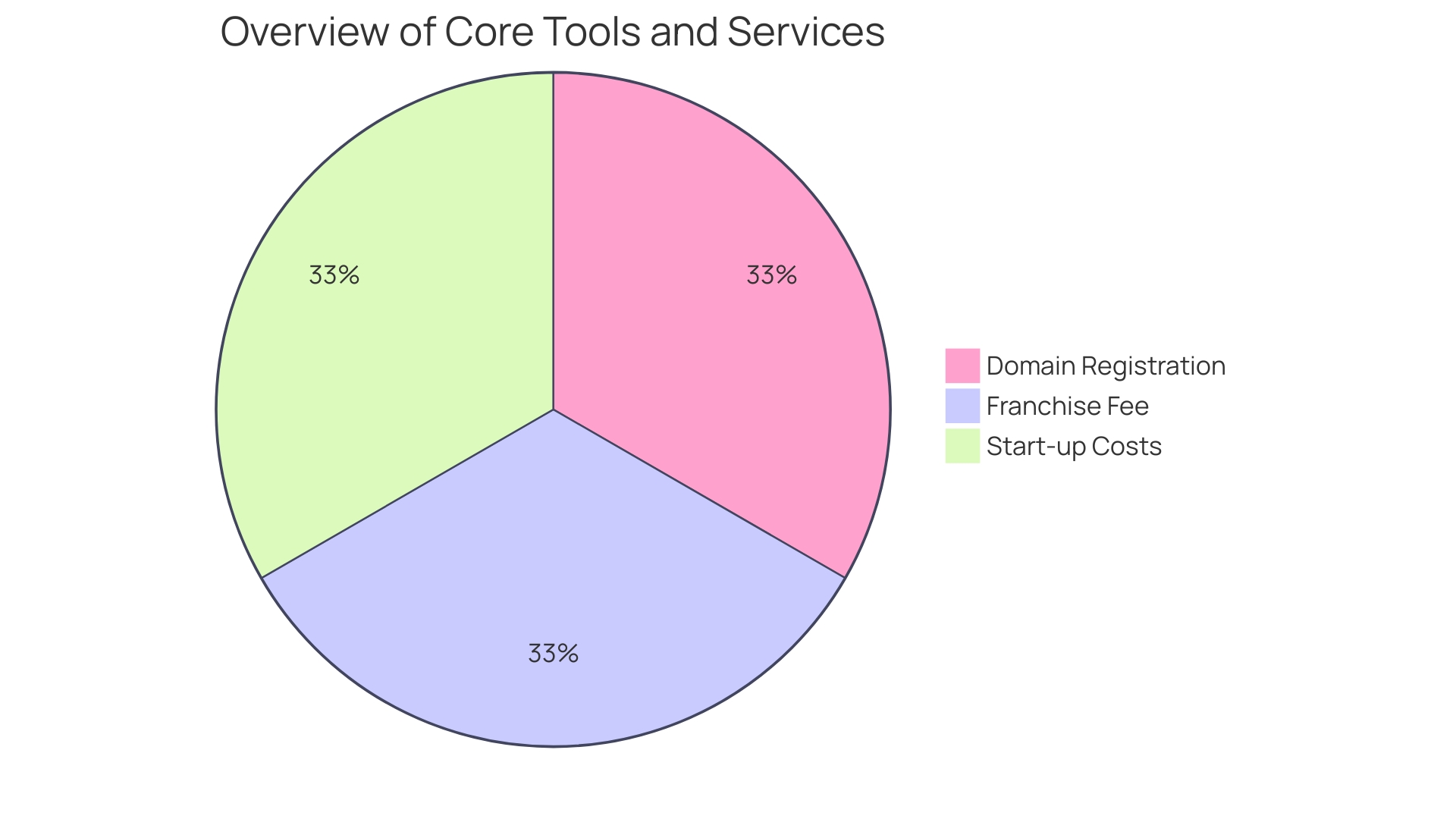

Venturing into the marketplace for buying and selling businesses offers a wealth of advantages, particularly when opting for an established entity. This decision bypasses the array of initial costs typically associated with launching a business from the ground up—costs such as branding, website development, SEO, marketing, and product inventory. Not to mention the technical expenses of domain registration, software investments, hosting, and securing your site with an SSL certificate.

By acquiring a business that's already operational, you're investing in a pre-existing foundation, complete with its niche and unique selling proposition—factors crucial for carving out a competitive edge in today's digital economy.

Moreover, when you opt to purchase through online marketplaces, such as BizBuySell which boasts a vast array of businesses across various industries and price points, you gain access to tools like their 'Business for Sale' feature that simplifies finding opportunities in your locality. Additionally, resources like the free ebook 'The BizBuySell Guide to Buying a Small Business' can prove invaluable.

However, it's not just about finding a business; it's about knowing its worth and potential growth. As highlighted by industry experts like Abhijeet Kaldate and Stephanie Wells, understanding where your business could be in the next decade is paramount. Conducting a thorough valuation, ideally one that's certified, grants a detailed assessment of your business's true value, comparing it to similar businesses in the market.

This approach not only saves time but also provides a comprehensive outlook for those serious about delving deep into a niche market.

In essence, the decision to buy an established online business is a strategic move that can mitigate initial costs and set you on a path of growth, armed with a clear digital marketing strategy and an understanding of your market position. It's a calculated step towards capturing your corner of the market with the assistance of data-driven insights and expert valuations.

Wide Range of Listings

Platforms specializing in the sale of businesses have revolutionized the way entrepreneurs approach buying and selling their enterprises. These marketplaces are a treasure trove for buyers, offering a diverse array of listings across various industries, which enables them to align their purchases with their business aspirations and objectives. It's a playground of potential where one can strategically browse and pinpoint the perfect business venture.

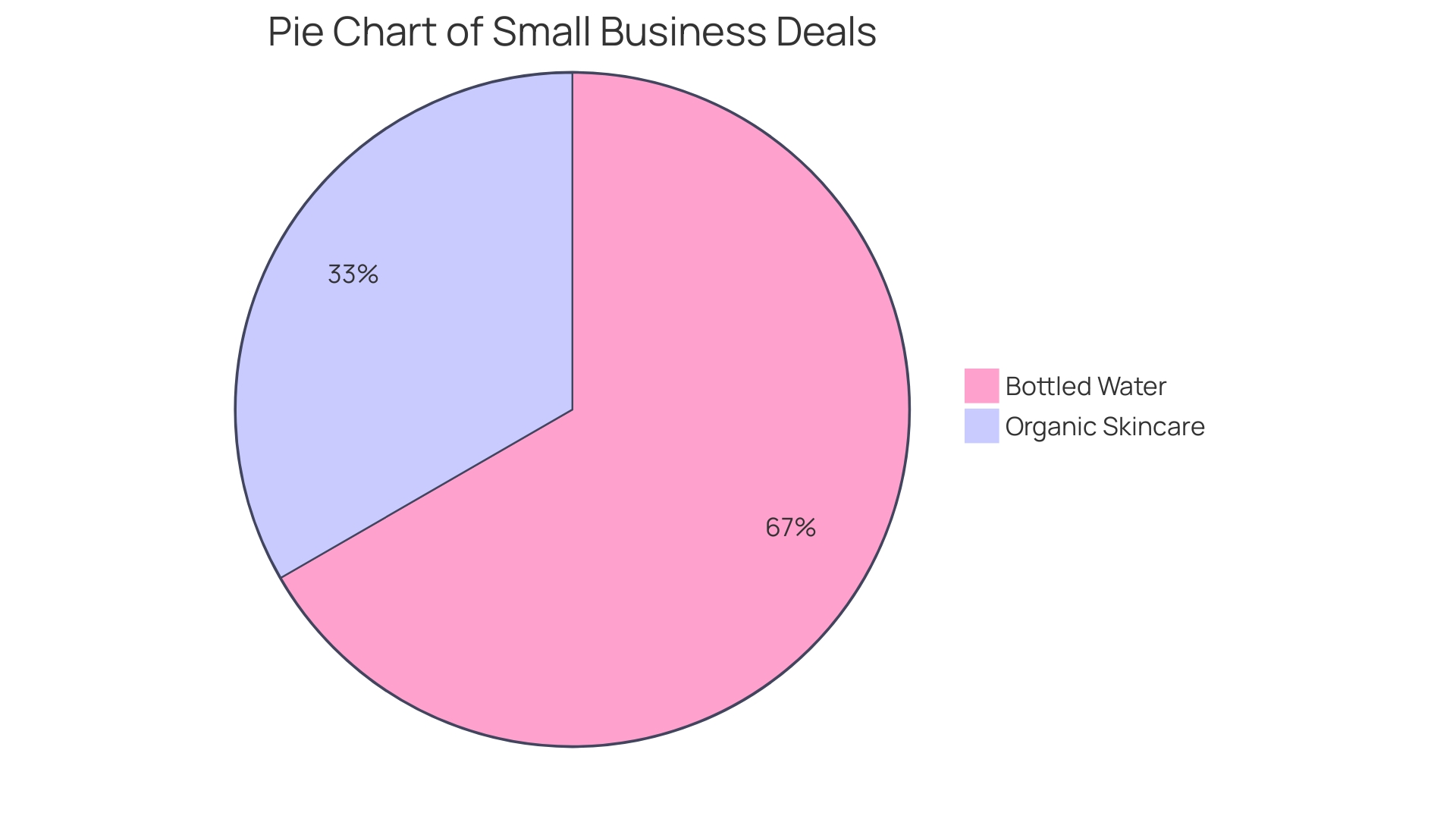

For sellers, these platforms represent a significant expansion of their reach, exposing their businesses to a broad spectrum of potential buyers, which can greatly enhance the likelihood of matching with an ideal purchaser. Take, for instance, the insights provided by a platform that focuses on lower-middle market deals ranging between $100K and $50M, which is often overlooked by other platforms. This niche targeting brings forth private transactions and buyers with proven experience in these specific deal sizes.

Moreover, the emphasis on online businesses, as opposed to brick-and-mortar establishments, caters to modern entrepreneurs looking to capitalize on the digital economy. This focus is well-suited for hybrid companies that primarily operate online or remotely, offering them a unique market space.

Such platforms not only facilitate connections but also equip users with invaluable data that aids in identifying suitable buyers, arm them for negotiations with reliable comparisons, and help them stay ahead of industry trends. This wealth of information is essential for informed decision-making, whether you are a seller assessing the future trajectory of your business or a buyer calculating the total investment required for an established business versus starting from scratch.

The insights and accessibility provided by these online marketplaces empower both buyers and sellers to make strategic, informed choices in their business transactions, transforming the landscape of business ownership one deal at a time.

Convenient Search and Filtering Options

When it comes to buying or selling a business, the modern marketplace offers a plethora of online platforms that streamline the process with sophisticated search and filtering capabilities. Buyers can efficiently sift through listings to pinpoint businesses that align perfectly with their requirements. On the flip side, sellers are empowered to strategically position their offerings to attract serious, well-matched buyers.

These digital arenas are invaluable for entrepreneurs who understand the significance of targeting their market effectively, whether they're planning to launch an e-commerce venture or take over an existing operation. With the right strategy, a comprehensive understanding of your niche, and a focus on minimizing overhead while maximizing digital outreach, these platforms can facilitate a smoother transaction and set the stage for future business growth.

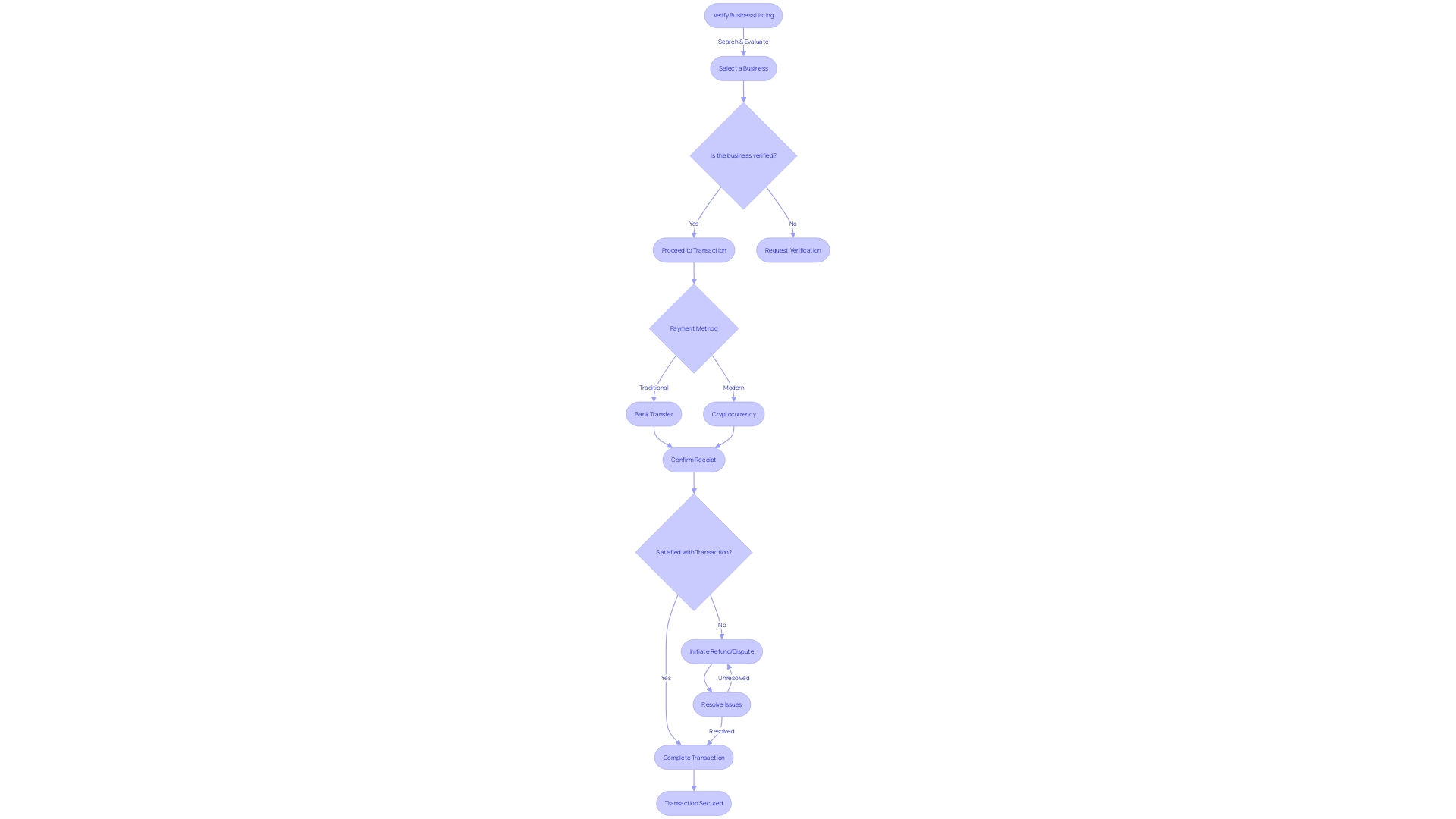

Secure and Efficient Transactions

Leading online platforms for buying and selling businesses are revolutionizing the market with secure and efficient transaction methods. For instance, Germany's prominent automotive marketplace, mobile.de, has enhanced its user experience by integrating Mangopay's payment infrastructure. This allows buyers to safely transfer funds only after confirming receipt and satisfaction with their vehicle purchase, ensuring a seamless transaction within a trusted environment.

Similarly, other platforms are adopting cryptocurrency processing technologies, which provide a robust structure for verifying and securing transactions. These advancements in digital payment systems, backed by legal protections and clear payment terms, offer peace of mind to both buyers and sellers. They underscore the platforms commitment to fostering a safe and user-friendly ecosystem for business transactions.

Valuation and Due Diligence Support

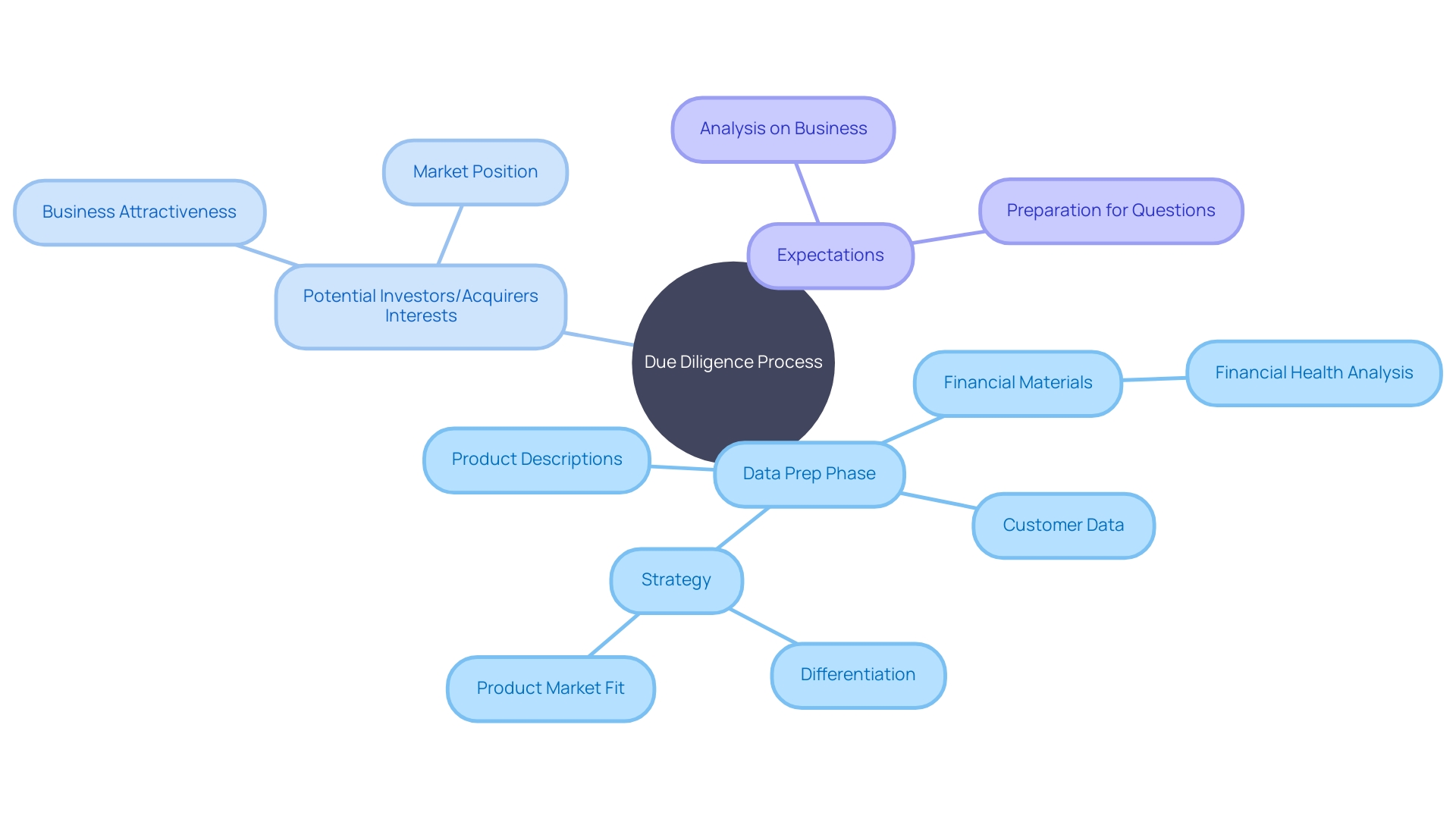

Top online marketplaces for buying and selling businesses provide more than just listings; they offer a suite of tools designed to assist both parties in making sound, informed decisions. Business valuations are a cornerstone service, relying on an intricate analysis of financial health, sustainability of key performance indicators (KPIs), and the profitability per user. Seasonality trends and customer concentration risks are also considered to ensure a comprehensive valuation.

Entrepreneurs like Alvaro, who sold his online marketing agency for $155,000 on Flippa, benefit from these platforms' intelligent valuation engines that draw on vast sales data and live buyer demand to determine a business's worth.

In addition to valuations, these websites provide white-glove support through the entire sales process, including due diligence—a pivotal step where the Quality of Earnings (QOE) report plays a vital role. The QOE report transcends standard financial audits by adjusting for non-recurring events and non-operational expenses, presenting a clear picture of a business's financial standing. This level of support is instrumental in achieving an effortless sale, covering everything from legal documentation to asset migration.

As a seller, understanding whether a stock sale or an asset sale best suits your situation is crucial, as it affects both the capital gains calculation and taxation. When it comes to mergers and acquisitions, the expert advice of lawyers, accountants, and brokers can be invaluable, helping avoid common pitfalls and ensuring a fair and strategic negotiation. The human element cannot be understated; understanding the motivations and perspectives of the person across the negotiation table is key to a successful transaction.

Whether a business is valued at $3 million or $30 million, a partnership between buyer and seller forged through mutual understanding can make the difference in closing the deal.

Tips for Buying and Selling Businesses Online

When venturing into the realm of online business transactions, whether you're considering purchasing an existing enterprise or selling one you've nurtured, it's crucial to approach the process with a strategic mindset. Buying an established business typically involves a substantial initial investment along with ongoing expenses to foster growth. This contrasts with the ground-up approach of starting fresh, which includes costs for branding, establishing a web presence, and marketing, among others.

In determining the trajectory of your online business, identifying a specific niche and a compelling unique selling proposition is paramount. This requires not only understanding your target audience but also crafting a strategy to capture your segment of the market effectively. Delving into the practicalities of running an online store, ask yourself how you can optimize costs and what your digital marketing plan will entail.

BizBuySell stands out as a premier online marketplace brimming with opportunities, ranging from franchises to independent businesses. It offers invaluable resources like the 'Business for Sale' feature and a complimentary ebook, the 'BizBuySell Guide to Buying a Small Business', to guide you through the intricacies of business acquisition.

As advised by industry experts like Abhijeet Kaldate of Astra WordPress Theme and Stephanie Wells of Formidable Forms, a critical aspect of selling your business is a forward-looking assessment. Understanding the potential future trajectory of your company can inform your decision to sell. It's not just about the immediate attractiveness of an offer but also about the long-term value of your business.

A vital step in this process is ensuring a thorough valuation, ideally with the expertise of a professional appraiser, to avoid undervaluing or overvaluing your business, which could either leave money on the table or deter prospective buyers.

Statistics from the U.S. Bureau of Economic Analysis shine a light on the breadth of the digital economy, encompassing infrastructure, e-commerce, and priced digital services. These insights into ICT goods and services, retail and wholesale trade, and various fee-based digital services underscore the dynamic nature of the online marketplace.

Armed with these insights and resources, you can navigate the complex landscape of buying or selling a business online with confidence and strategic acumen.

Do Your Research

When considering the sale or acquisition of a business, diving deep into industry analytics, market dynamics, and the nuances of the specific enterprise in question is not just beneficial—it's imperative. An accurate assessment of a business's value is the cornerstone of any negotiation. Engaging a professional business appraiser or valuation expert can provide you with the financial, asset, and industry insights needed to establish a fair market value.

This knowledge is your strongest asset when entering the negotiation room, ensuring that you neither undervalue your life's work nor demand an unrealistic price that deters viable prospects.

In the realm of Industry 4.0, for instance, the integration of modern technology stack elements and supporting technologies enables manufacturers to connect disparate data sources, optimize overall equipment effectiveness (OEE), and enhance key performance indicators (KPIs). It's a prime example of how understanding the value drivers within your industry can significantly impact the perceived and actual worth of your business.

Moreover, market research is not something to be overlooked. It's the foundation upon which you can build and refine your understanding of who your customers are and what they need. By analyzing demographic data, you can gauge the market size, demand for your product or service, and economic indicators such as income ranges and employment rates.

These insights enable you to pinpoint where your potential customers reside and the extent of your business's market reach.

To underscore the importance of a solid valuation and market understanding, consider the words of seasoned business owners: knowing the value that your company brings to the table, and how it compares to others in your industry, is a critical element that shapes the perspective of potential buyers. Whether they are larger companies within your vertical or private equity firms, these buyers have a keen eye for acquisitions that align with their understanding of industry benchmarks and valuation standards.

Remember, the journey to selling your business is unique, and there's much to be learned from those who have successfully navigated this path. By arming yourself with a comprehensive understanding of your business's worth and the market it operates in, you position yourself to achieve a favorable and deserved outcome in the complex yet rewarding process of buying or selling a business.

Seek Professional Advice

When contemplating the sale of your business, the expertise of seasoned professionals is invaluable. Business brokers, legal advisors, and financial experts bring a wealth of knowledge and experience to the table, ensuring you navigate the complex process with confidence. They can provide comprehensive valuations, aligning with Stephanie Wells' advice to avoid common pitfalls like failing to accurately gauge your business's worth.

They'll scrutinize your financials, consider market trends, and help you understand your customer base's value, which is essential before negotiations begin.

A case in point is the experience of a hotel company that sought to enhance their bookings. By working with professionals who implemented tools like Google Analytics and Conversion Tracking, they were able to build a solid foundation for their advertising strategy, leading to more successful outcomes. Similarly, when engaging in the sale of your business, these professionals can deploy their strategic acumen to your advantage.

Additionally, it's crucial to look ahead and consider the future trajectory of your company, as Abhijeet Kaldate from Astra WordPress Theme suggests. Professional guidance can help you weigh the long-term prospects against the immediate allure of a lucrative offer, ensuring you make an informed decision that aligns with your business's potential growth and value.

Prepare Documentation

Navigating the process of buying or selling a business can be complex, but rigorous documentation can simplify the journey. Essential paperwork such as financial records, agreements, and licenses are the backbone of any transaction. They tell a story — not just of the business's current standing, but of its history and potential future.

For instance, loan documents, including forms like promissory notes and security agreements, provide lenders a clear picture of what to expect and set the terms of engagement.

Compiling these documents demands attention to detail and a deep understanding of the business's operations. As seen in recent years, the role of bookkeepers has evolved from mere data entry to a more analytical and comprehensive role. They're now expected to take ownership of the financial reporting process, ensuring that every number tells part of your business's financial narrative.

This shift has been driven by the increasing automation of data entry jobs and the need for more strategic financial oversight.

Moreover, the documentation process is not just about having all papers in order; it's about crafting a story that resonates with potential buyers or lenders. A well-documented business is like a well-tested product; it showcases reliability and preparedness for the market. In the tech world, for example, detailed documentation has been crucial for cybersecurity firms like Dectar, which not only had to ensure their products were well-understood internally but also needed to communicate complex systems to an audience of IT experts.

As consumers look for innovative ways to manage finances, such as using split-pay services for grocery bills, businesses also need to be innovative in how they present their financial health. Whether it's to secure a loan or to complete a sale, the thoroughness and clarity of your documentation can greatly influence the outcome. Remember, in a world where details can make or break a deal, your business's documents are the foundation upon which successful transactions are built.

Communicate Clearly

When it comes to the intricate dance of buying or selling a business, the linchpin of success lies in the power of clear and strategic communication. It's not merely about voicing your expectations and concerns; it's about engaging in a dialogue that fosters trust and alignment between both parties. Consider the case of a client seeking to purchase an Akiya property, where a keen understanding of the project's scope and cost was crucial.

By meticulously listening to the client's preferences and requirements, a list of properties matching the client’s vision was curated, ensuring a transparent pathway to a successful transaction.

Similar transparency and empathy are essential when navigating the high-stakes negotiation of a business sale. As sales expert and author Chris Voss explains, grasping the other side's perspective—in all its complexity, beyond mere figures—can make the difference between a deal that falls through and one that seals the promise of a new beginning.

Indeed, research underscores the value of thorough preparation before stepping into negotiations. By uncovering what the client truly values and aligning it with business goals, negotiations are more likely to yield favorable outcomes—shorter sales cycles, higher close rates, and fewer concessions. This thorough understanding of both the tangible and intangible aspects of a deal is echoed by professionals across industries, from real estate to high-level merger strategies.

In the realm of mergers and acquisitions, trust is the cornerstone, built on the foundation of open and timely communication. Strategies that embrace transparency, such as live Q&A sessions with leadership and comprehensive online FAQs, go a long way in maintaining stakeholder confidence during transformative business phases.

Ultimately, the art of negotiation transcends the transactional; it's about crafting a partnership through careful listening, understanding, and aligning interests. As we delve into the statistics of communication, it's clear that a significant portion of our interaction—approximately 55%—is dedicated to listening. This reinforces the pivotal role that effective listening plays in not just communication, but in the very essence of successful business negotiations.

Due Diligence and Verification

Engaging in a business sale or purchase is a significant decision that demands rigorous scrutiny. This process, known as due diligence, involves a thorough examination of various facets of the business in question. To illustrate, imagine the meticulous process involved in acquiring an Akiya property in Japan, which requires understanding every detail from financial implications to potential renovation needs.

Similarly, when assessing a company, one must analyze its financial health by reviewing statements, assets, debts, cash flows, and future projections. This is not purely a financial audit; it is an investigative journey through the company's operations, regulatory compliance, tax affairs, and legal liabilities.

Consider trademarks, for example, they represent a company's identity in the marketplace and can range from logos to unique product designs. Their importance is underscored by the fact that, while not all trademarks are registered, they are nonetheless legally protectable, with some gaining extra clout through registration with institutions like the USPTO.

The importance of due diligence cannot be overstated. In the realm of finance, Alaska's high rate of financial fraud—approximately 210 victims per 100,000 population—serves as a stark reminder of the risks involved in business transactions. The state has responded by instituting stringent measures to combat deceptive practices.

On a broader scale, the United States leads in financial fraud victims worldwide, highlighting the critical need for comprehensive due diligence to safeguard against potential losses.

For those navigating mergers, acquisitions, or any business sale, the expertise of lawyers, accountants, and brokers is invaluable. They not only provide legal protection through well-drafted contracts but also help avoid common pitfalls that plague buyers and sellers alike. The consultation with these professionals can reveal underlying issues and arm you with the knowledge to make informed decisions, ensuring a smoother transition and a more secure investment.

Conclusion

In today's digital age, online marketplaces like BizBuySell offer a wealth of opportunities for entrepreneurs looking to buy or sell businesses. Understanding the true value of a business is crucial, and a comprehensive assessment can provide insights into normalized cash flow. Evaluating a company's future trajectory and having a clear price target when considering a sale are key factors highlighted by industry leaders.

These marketplaces provide convenience, resources, and support to navigate the complexities of business transactions. With a wide range of listings across industries, entrepreneurs can find established businesses that align with their vision and expertise. This allows them to invest in a pre-existing foundation with a niche and unique selling proposition, setting them up for success in the competitive digital landscape.

To make the most of these opportunities, entrepreneurs should conduct thorough research, seek professional advice, prepare documentation, communicate clearly, and perform due diligence. By following these steps, they can make informed decisions and increase their chances of success.

In conclusion, online marketplaces for buying and selling businesses offer a multitude of avenues for entrepreneurs. By understanding the value of a business, evaluating its future trajectory, and utilizing the resources provided by these platforms, entrepreneurs can confidently navigate the complexities of business transactions and achieve their goals in the digital landscape.