Introduction

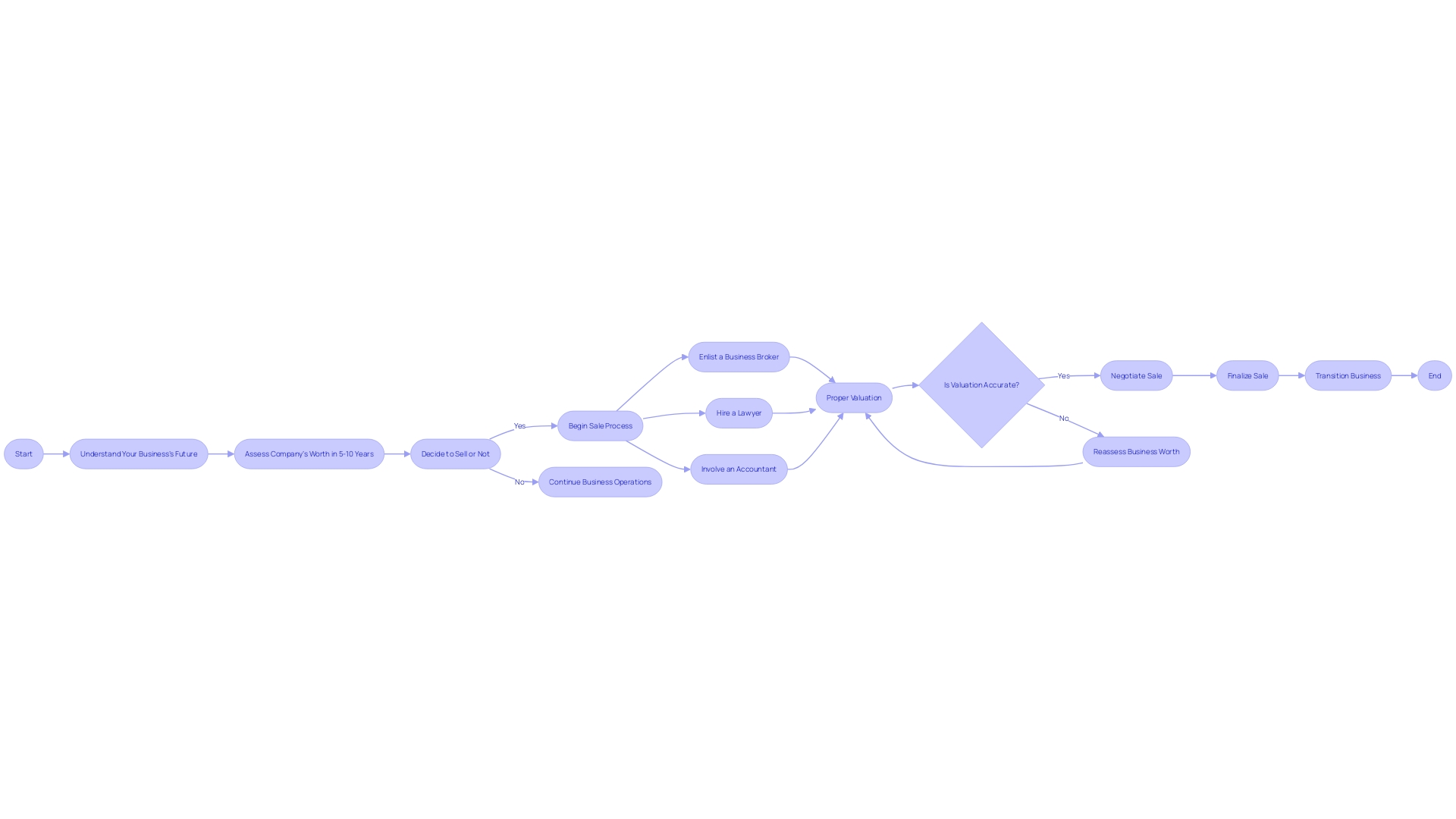

When preparing to sell a company, there are crucial steps to take that go beyond simply putting up a 'For Sale' sign. Success lies in meticulously evaluating the business and strengthening its financial health. Ensuring pristine financial records and operational efficiency are essential to make the business an attractive proposition for potential buyers.

Understanding the long-term trajectory of the company is invaluable in determining if a sale is the right move. A shrewd valuation, conducted by a professional appraiser, provides a strong negotiation position and prevents underselling or overshooting the mark. Ultimately, a thorough valuation considers not only the numbers but also intangible assets, market conditions, and industry trends.

By setting the stage for a sale that truly reflects the business's worth, you can maximize its potential for success.

Preparation for Selling a Company

When the prospect of selling your enterprise arises, it's not just about putting a 'For Sale' sign up. The groundwork for a successful sale is laid by meticulously evaluating your business and fortifying its financial health. This includes taking a hard look at your financial records, ensuring they're pristine and reflective of your company's profitability.

Operational efficiency too must be at its peak, making your business a more compelling proposition for potential buyers.

An astute business owner knows their company's trajectory over the next decade. This foresight is invaluable in discerning whether a sale is the right move. The price tag a buyer is willing to pay might seem attractive, but only with a deep understanding of your business's true value can you gauge its worth.

Abhijeet Kaldate of Astra WordPress Theme underscores the importance of this long-term perspective when considering offers.

Moreover, a shrewd valuation of your business is non-negotiable. Stephanie Wells of Formidable Forms and other experts have highlighted the pitfalls of neglecting this step. An informed valuation, ideally conducted by a professional appraiser, provides you with a strong negotiation position, preventing you from underselling or overshooting the mark.

Remember, a thorough valuation considers not just the numbers on your balance sheet but also intangible assets, market conditions, and industry trends. This comprehensive approach ensures the price reflects every facet of your business's worth, setting the stage for a sale that truly benefits you.

Building a Team for the Sale

Embarking on the journey to sell a company is akin to steering a ship through complex waters. It requires a seasoned crew, each expert in their own right, to navigate towards a successful transaction. Enlisting an experienced business broker is akin to having a skilled navigator, charting your course through the market's ebbs and flows.

A lawyer with a deep understanding of mergers and acquisitions is your legal helmsman, ensuring that every contract and regulation is meticulously observed, thus safeguarding your interests. The accountant's role is to keep a watchful eye on the financial horizon, deciphering tax implications and ensuring your fiscal matters are in impeccable order.

A successful sale is often a tapestry of detailed preparation and strategic foresight. It is a narrative punctuated by meticulous valuations, as highlighted by the insights of industry experts like Abhijeet Kaldate and Stephanie Wells, who emphasize the significance of understanding your business's worth and its future trajectory. As the narrative unfolds, it becomes clear that the sale is not just a transaction but a partnership, with each party's history and expectations interwoven into a complex agreement, as described in case studies and supported by statistics from LLCBuddy's research.

In the grand scheme, the sale of your business is more than a mere exchange; it's a life-changing event that demands not only an understanding of numbers but also of the human elements at play. Quotes from thought leaders echo the sentiment that knowing the market and the unique value of your business is crucial when seeking the right buyer. Remember, the goal is not just to sell but to thrive post-sale, with a well-crafted exit that honors the legacy of your business and your future aspirations.

Therefore, build your team with care, for they are the compass by which your final business voyage will be charted.

Valuation and Financial Preparation

When you're ready to sell your business, knowing its true value is paramount. It's not just about the assets and cash flow; it's about understanding the market dynamics and the unique value of what you've built. Bringing in a professional valuator is a wise move, as they use a 409A valuation to gauge the fair market value of your common stock, which is vital for tax compliance and setting stock option prices for employees.

This assessment isn't only about compliance; it's about positioning your business advantageously in the eyes of potential buyers.

It's essential to consider whether you're looking at a stock sale or an asset sale. The former involves selling shares and is common for corporations, while the latter is the sale of the company's physical assets. The type of sale you choose affects the capital gains calculation and taxation.

For instance, if you invested in capital improvements, this could reduce the capital gains tax you owe, depending on how it's calculated.

To optimize your return, you must meticulously organize your financial statements and tax records. This clarity not only facilitates the due diligence process but also boosts buyer confidence. Remember, fair market value fluctuates and is influenced by many factors, such as the perception of your brand and the regulatory environment.

A strong brand or niche expertise, as seen in the acquisition of Succinct by OPEN Health for its oncology specialization, can significantly increase value.

Moreover, the timing of your valuation can capitalize on market trends. For example, a surge in green technology interest could raise the value of companies in that sector. Ultimately, selling your business is about presenting it not just as a set of numbers, but as a living, thriving entity with potential for growth and success in the right hands.

Identifying and Engaging with Potential Buyers

Before you hang the 'for sale' sign on your business, ensure you've taken the right steps to entice the ideal buyer. This begins with an in-depth market analysis to pinpoint potential acquirers who have both the interest and resources to take over. Crafting a strategic marketing plan that highlights your business's unique value propositions, tapping into your industry network, and presenting your business on suitable online marketplaces will increase visibility to the right audience.

When you've captured their attention, discreet and focused negotiations are key, offering comprehensive insights into your business to those who are seriously considering the purchase. The journey to a successful sale is nuanced, often requiring personalized strategies over a one-size-fits-all approach, as exemplified by a company that meticulously reviewed properties to meet a client's specific demands in the Chiba Prefecture case study. The pool of buyers varies greatly, some may seek a business with distinctive products or services, while others are drawn to contractual stability or robust organizational structures.

Expert insights echo the importance of understanding your company’s true market value, a task best handled by valuation professionals who can dissect financials, assets, customer bases, and industry movements. Armed with this knowledge, you're not just selling your business, you're engaging in a strategic transaction that aligns with your business’s future and your financial goals.

Negotiation and Closing the Sale

Mastering the art of negotiation is pivotal when navigating the complexities of buying and selling companies. It's not just about haggling over numbers; it's a strategic exercise in value exploration and alignment. The crux of the matter lies in understanding and articulating the unique attributes of your business that separate it from the pack.

A meticulous preparation phase, often referred to as Data Prep or Diligence Preparation, is where you compile financials, customer insights, and deep analyses to highlight your company's competitive edge and market fit. This serves as the foundation for informed discussions with potential investors or acquirers who are keen to understand the nuances and potential of your business.

As you approach the negotiation table, remember it's about more than just the price—it's about structuring a deal that reflects the true value of your business. Payment terms, potential contingencies, and the strategic fit all play critical roles in shaping a fair agreement. With a clear understanding of your business's value drivers and a solid grasp of what the buyer holds in high regard, you can steer the conversation towards a mutually beneficial outcome.

This strategic approach to negotiation, backed by thorough preparation, can lead to more effective communication, swifter sales cycles, and favorable terms.

Closing the deal marks the culmination of your efforts, where legal documents are signed, ownership is transferred, and the business seamlessly transitions into the hands of the new owner. It's a delicate phase where the ability to maintain control over your emotions and understanding the motivations of others can pivot the situation towards a win-win resolution. By aligning your goals with those of the buyer and keeping in mind the long-term trajectory of your company, you can ensure that the legacy of your business is preserved and its future, secured.

Understanding the Target Company's Value Proposition

Navigating the acquisition of a business requires a deep understanding of its core strengths and potential for growth. By examining the company's business model, you can identify whether it employs unique or innovative technologies that set it apart in the market. It's also crucial to recognize the loyalty of the customer base, which can be indicative of a company's capacity for upselling and expanding its service offerings.

This, in turn, could spiral into continuously improving financial performance.

In the MRO sector, for instance, where the pace may seem slow to some investors, a company utilizing cutting-edge technology to enhance service delivery can gain significant competitive edges. A strong insider ownership, such as a 67% stake held by key personnel, suggests confidence and commitment from those who intimately understand the business.

Assessing a company's value also involves looking at the financial statements and market conditions, but equally important is understanding the strategic fit with your business goals. Consider the insights of expert investors like Benjamin Graham and Warren Buffett, who emphasize the importance of discerning the 'fair' market value—what the market is willing to pay—and the price that delivers on investment goals.

Moreover, an assessment of potential risks and opportunities should inform your decision. As Stephanie Wells of Formidable Forms suggests, imagining where your company will stand in the next decade is crucial in evaluating an offer. This forward-looking approach is vital in determining the true value of the business you're considering acquiring.

Remember, the sale or purchase of a business is more than a transaction; it's the beginning of a partnership that requires understanding and alignment between buyer and seller. Through comprehensive due diligence, aligning strategic objectives, and valuing the unique aspects of the business, you can navigate the complexities of buying a company with confidence.

Creating Urgency and Compelling Value in Sales Conversations

When aiming to acquire a company, it's not just about creating a sense of urgency; it's about crafting a narrative that resonates with the seller. Understanding that people engage in transactions not solely based on desire but also for the stories they can share, it's imperative to communicate how your acquisition aligns with their aspirations. By demonstrating the strategic benefits and growth potential your acquisition offers, you appeal to the seller's desire to be part of a success story.

Ensure that your narrative is supported by compelling data and contemporary examples that showcase the value of your offer. For instance, consider leveraging current trends such as the explosive growth in telehealth, which has seen a 38-fold increase since the pandemic, to illustrate the opportunity for innovation and expansion. Moreover, with half of small businesses failing within the first five years, your ability to articulate a clear vision for mutual success can be the deciding factor for the seller.

A successful sales strategy hinges on your understanding of the client's core values. Is it the quality of service, the price point, or perhaps the reputation of your brand that will clinch the deal? Sales professionals who excel in today's market recognize that selling value precedes negotiating terms.

Research has consistently shown that preparation before negotiations leads to higher close rates and fewer concessions.

Referencing the insights of Marco Bertini, a professor of marketing, it's crucial to recognize that value is co-created with customers. Your pitch should reflect a partnership where both parties contribute to achieving the desired outcomes. This collaborative approach not only builds trust but also enhances the perceived worth of your proposition.

In the backdrop of renewed mergers and acquisitions activity, as noted by Ben Schippers, co-CEO of HappyFunCorp, it's essential to assess the cultural fit between companies. A well-planned cultural integration strategy that acknowledges and unites the unique strengths of both organizations can be the underpinning of a successful acquisition.

Ultimately, your offer must be more than just numbers; it should represent a shared vision for the future that excites and motivates the seller to embark on this new journey with you.

Effective Sales Strategies for Buyers

Navigating the intricacies of acquiring a company requires a buyer to master the art of strategy. At the heart of a successful acquisition lies the ability to conduct exhaustive market research and identify not just any, but the right acquisition targets. Crafting a persuasive offer is just as critical, leaning on a deep understanding of the target's operational, financial, and strategic facets.

A savvy buyer will recognize the power of building robust relationships with key stakeholders. Showcasing strong financial capabilities along with a clear vision for the future of the company can significantly elevate a buyer's credibility, thus solidifying their stance in negotiations. It's not just about the numbers; it's about demonstrating a commitment to the joint success of both entities post-acquisition.

Understanding the nuances of the market and industry, such as the rollup strategy—where a platform company integrates other businesses to enhance its operations—is essential. This knowledge can be leveraged to streamline management technologies, marketing strategies, and supply chains, leading to a more successful, cohesive business model post-acquisition.

In the current economic landscape, where disagreements on valuations are commonplace, being equipped with the right insights is crucial. The tides of the stock market and economic outlook can dramatically affect the perceived value of a target company. Thus, a well-prepared buyer must approach negotiations with a firm grasp on their own long-term strategy and vision, ensuring a shared understanding of value is reached with the seller.

To set the foundation for a fruitful acquisition, it is imperative to define clear goals and valuations. Utilizing tools for industry valuation norms can provide invaluable insights, assisting in bridging the gap between the current state of a business and its potential. The journey towards a successful acquisition is a partnership, one that requires alignment, understanding, and strategic forethought on both sides of the deal.

Post-Sale Considerations and Transition

The journey beyond the handshake and signed contracts often holds the real challenge in buying and selling companies. It's about the harmonious blending of systems, processes, and people to unlock the true value of the acquisition. The task is far from trivial, as integration complexities can make or break the expected benefits of the deal.

A critical starting point is the data architecture—understanding how the data is stored, protected, moved, analyzed, and the diversity of technologies employed. This knowledge forms the backbone of the integration as the systems from both entities need to communicate effectively. Front of the house operations, the revenue generators, and back of the house, the analytical minds, must find a way to align, often requiring a rethinking of the IT organization's design.

The absorption of a new company involves careful planning to mitigate the risks while capitalizing on opportunities. Cybersecurity, system infrastructure, application portfolios, and technical debt are all aspects that must be scrutinized. Comprehensive due diligence is not just a retrospective validation of financials and operations but a forward-looking blueprint for post-merger success.

The integration process demands clear communication with stakeholders, securing a shared vision for the future, and retaining the key employees who will drive it forward. It's about uniting cultures and goals, a task that, when done well, compounds the strengths of both organizations.

Statistics reflect a cautious approach in the M&A arena, with a trend towards selectivity in deal pursuits. Yet, the market is showing signs of recovery, suggesting that those who can effectively navigate post-sale complexities are poised to thrive.

As the M&A landscape evolves, the mantra remains the same: be prepared, be strategic, and be ready to integrate, not just acquire.

Conclusion

In conclusion, when preparing to sell a company, meticulous evaluation and strengthening of its financial health are crucial. Pristine financial records and operational efficiency make the business attractive to potential buyers. Understanding the long-term trajectory of the company helps determine if a sale is the right move.

A thorough valuation, considering intangible assets, market conditions, and industry trends, maximizes the potential for success.

Building a team of experts, including a business broker, lawyer, and accountant, is essential for a successful sale. The goal is not just to sell but to thrive post-sale, honoring the legacy of the business. Knowing the true value of the business is paramount, and a professional valuator positions the business advantageously.

Organizing financial statements and leveraging brand strength or niche expertise boosts buyer confidence.

Engaging potential buyers requires in-depth market analysis and strategic marketing plans. Personalized strategies and understanding buyer preferences contribute to a successful sale. Negotiation is about aligning values and closing the deal requires emotional control and consideration of long-term goals.

When acquiring a business, understanding its strengths, potential for growth, and strategic fit is crucial. Assessing financial statements, market conditions, and risks informs decision-making. Cultural fit and a shared vision for the future are important considerations.

Crafting a narrative that resonates with the seller and selling value precede negotiating terms. Building relationships and cultural integration contribute to a fruitful acquisition. Navigating the acquisition process requires strategy, market research, and relationship-building.

Post-sale, managing integration complexities unlocks the true value of the acquisition. Data architecture, communication with stakeholders, and retaining key employees are critical. Being prepared, strategic, and ready to integrate is key.

In conclusion, successfully selling or acquiring a company requires meticulous evaluation, strategic planning, and understanding of market dynamics. Building a strong team, knowing the true value of the business, engaging potential buyers or sellers effectively, and navigating negotiations and integration complexities are crucial steps. By aligning goals, valuing expertise, and embracing a partnership mindset, the potential for success is maximized in the landscape of mergers and acquisitions.