Introduction

Are you looking to sell your business? Are you a buyer interested in purchasing a business but struggling to secure traditional financing? Owner financing could be the solution you've been searching for.

In this article, we explore the benefits of owner financing for both sellers and buyers, the step-by-step process of how owner financing works, key components of owner financing agreements, strategies for protecting seller interests, blending owner financing with traditional financing options, evaluating the suitability of owner financing for your business, common scenarios where owner financing is beneficial, and the legal and financial implications of owner financing. Whether you're a seller or a buyer, this comprehensive guide will provide you with the knowledge and insights you need to make informed decisions and navigate the world of owner financing successfully.

Benefits of Owner Financing for Sellers

Owner funding can be a potent tool for individuals looking to divest their business. This strategy opens doors to a wider range of buyers, especially those who might find traditional funding routes inaccessible. It's not just about increasing the pool of potential buyers, though. Providing the option of owner funding can also result in a more advantageous purchase cost for the vendor.

Aside from the possibility of a greater selling price, the option of owner-provided funding can provide the advantage of a constant flow of revenue. Instead of a one-time lump sum, sellers receive payments over time, which includes interest on the loaned amount. This can provide a steady flow of income, which is especially beneficial if immediate cash isn't a necessity.

But what about the risks? Owner funding isn't without its concerns. Sellers must consider the possibility of buyers defaulting on their payments. It's crucial to consider the advantages of receiving cash upfront compared to the possible steady income from owner funding. Every seller's circumstance is one-of-a-kind, and the choice to provide owner funding should be taken after thorough examination of both the seller's goals and the buyer's dependability.

Furthermore, when contemplating owner funding, individuals selling must come equipped with reliable financial documentation and an evaluation of their enterprise to showcase the durability and value of their company. These factors are not only important for the seller's peace of mind but also serve to reassure the buyer and any lenders involved in the transaction.

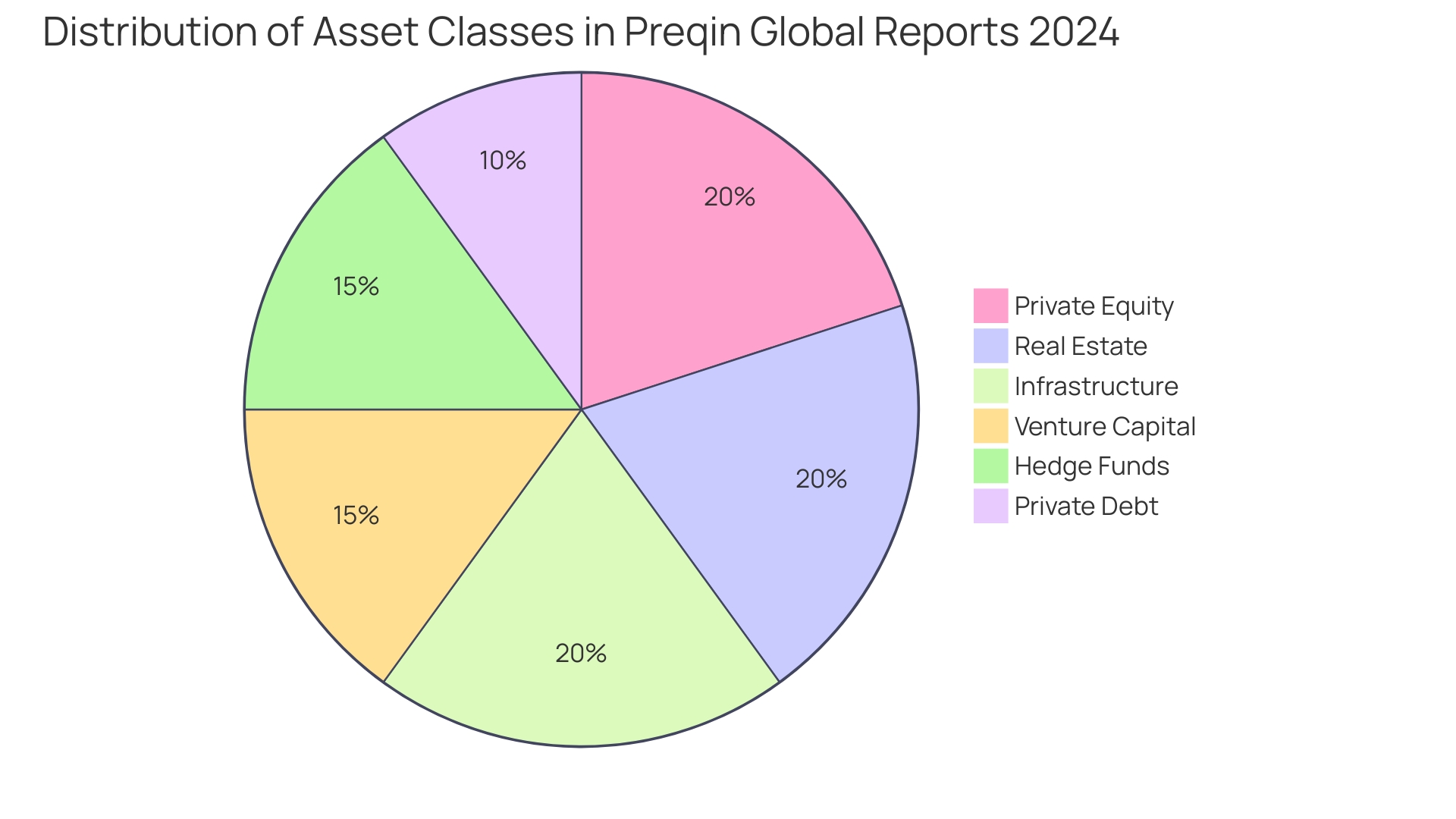

The realm of corporate funding is constantly changing, with new data indicating shifts in the median assessed values for enterprises and a rise in the quantity of assessments. Such changes in the market highlight the significance of staying updated about financial options, whether you're interested in purchasing or selling a company.

Essentially, owner funding could be the solution to unlocking a successful sale, but it necessitates a strategic approach and a comprehensive comprehension of the monetary implications involved.

Benefits of Owner Financing for Buyers

Acquiring a company through owner funding can be an empowering move for entrepreneurs who may not have access to conventional funding sources or who prefer a more customized approach to financial support. This method allows potential buyers to bypass the limitations of traditional bank loans or external institutions, offering a lifeline to those who may find the conventional credit system a barrier to entry due to insufficient capital or less-than-perfect credit histories.

Seller financing opens doors to more flexible and negotiable terms, such as payment schedules and interest rates, making the dream of ownership more attainable and personalized. In addition, actively interacting with the seller can result in a deeper comprehension of the company's monetary path, enabling both sides to negotiate an agreement that corresponds with the future monetary strategies and aspirations of the new proprietor.

Real-world case studies, like the journey of an American in Japan navigating the purchase of a countryside property, illuminate the practical benefits of such personalized monetary arrangements. In this case, the purchaser's vision and financial capabilities were aligned with properties that met their criteria, demonstrating the customized nature of owner funding.

Statistics also support the viability of this approach. The Bureau of Labor Statistics observed a notable trend toward independent ownership, with a surge in nonstore retail sector applications. This movement highlights the increasing attraction of entrepreneurship facilitated by flexible funding options.

In the end, owner funding is not only a method to achieve a goal but a strategic decision that demonstrates a wider change towards more flexible and personalized commercial transactions, empowering buyers to take charge of their economic futures and possess a portion of the market in a manner that suits them.

How Owner Financing Works: Step-by-Step Process

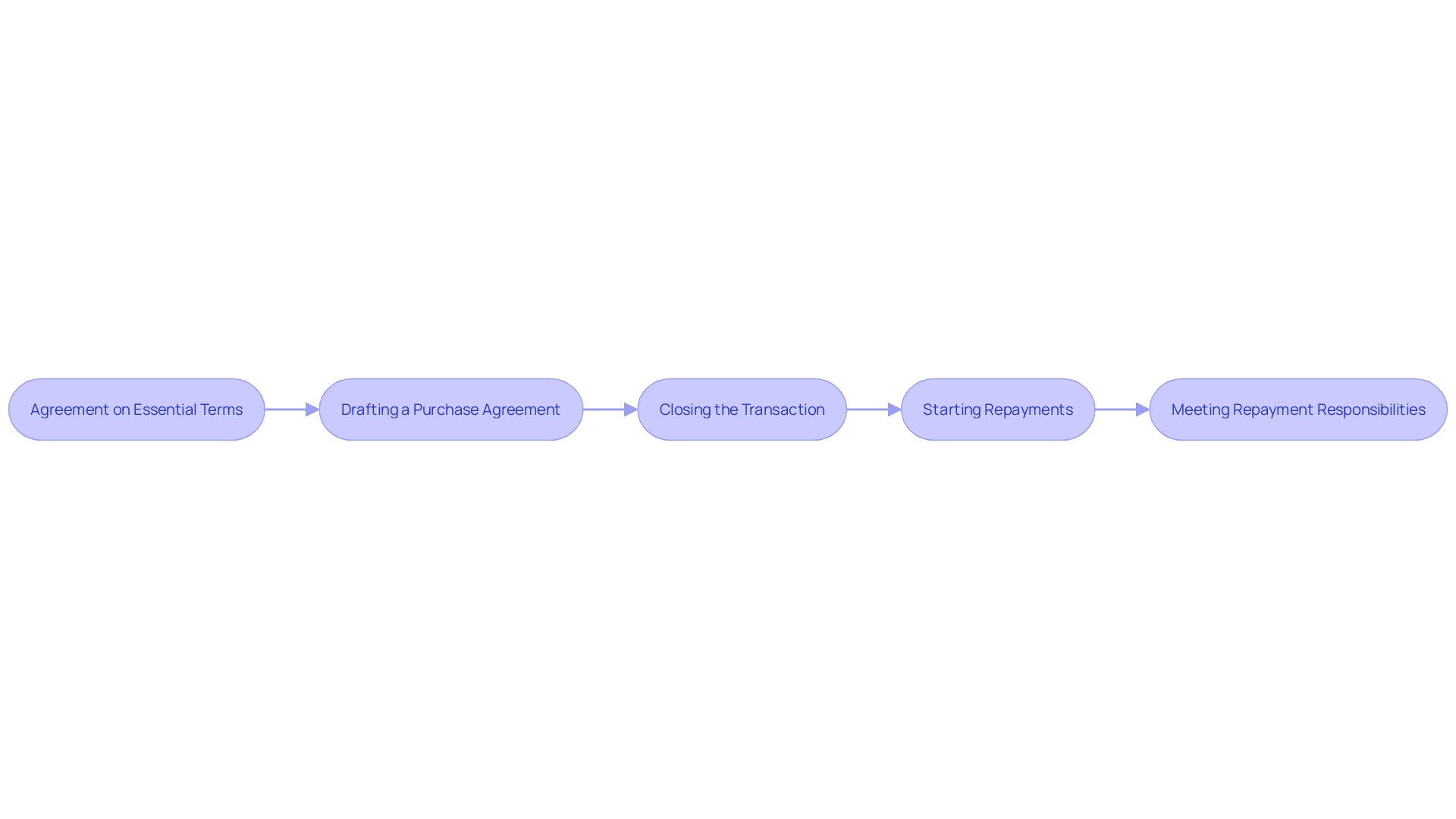

Starting the process of acquiring a company via owner funding requires five essential stages to guarantee a seamless shift and a strong economic basis. At first, both buyer and seller must come to an agreement on essential terms such as the purchase price, down payment, and interest rate, which are crucial to the company's financial well-being, as indicated by the significance of financial records in loan applications. Once these terms are established, a comprehensive purchase agreement is drafted, documenting the details of the sale and the mutually agreed-upon financial aspects, similar to a strategic plan that delineates operational costs and objectives for lenders.

The transaction then moves to the closing phase, where the buyer's down payment leads to the company changing hands, allowing the buyer to assume the helm of day-to-day operations. From here, the buyer starts a journey of regular repayments, dealing with both principal and interest, similar to the repayment structure of purchase order funding, where payments are customized to the value of customer orders.

At last, the culmination of funding happens when the purchaser meets the repayment responsibilities, indicating the conclusion of the seller's monetary interest in the enterprise. This procedure reflects the wider patterns in small enterprise funding, where proprietor equity continues to be a foundation, and entry to capital has developed post-recession, as small enterprises navigate the financial landscape with resilience, as emphasized in the most recent Fiserv report on the small enterprise sector's performance.

Key Components of Owner Financing Agreements

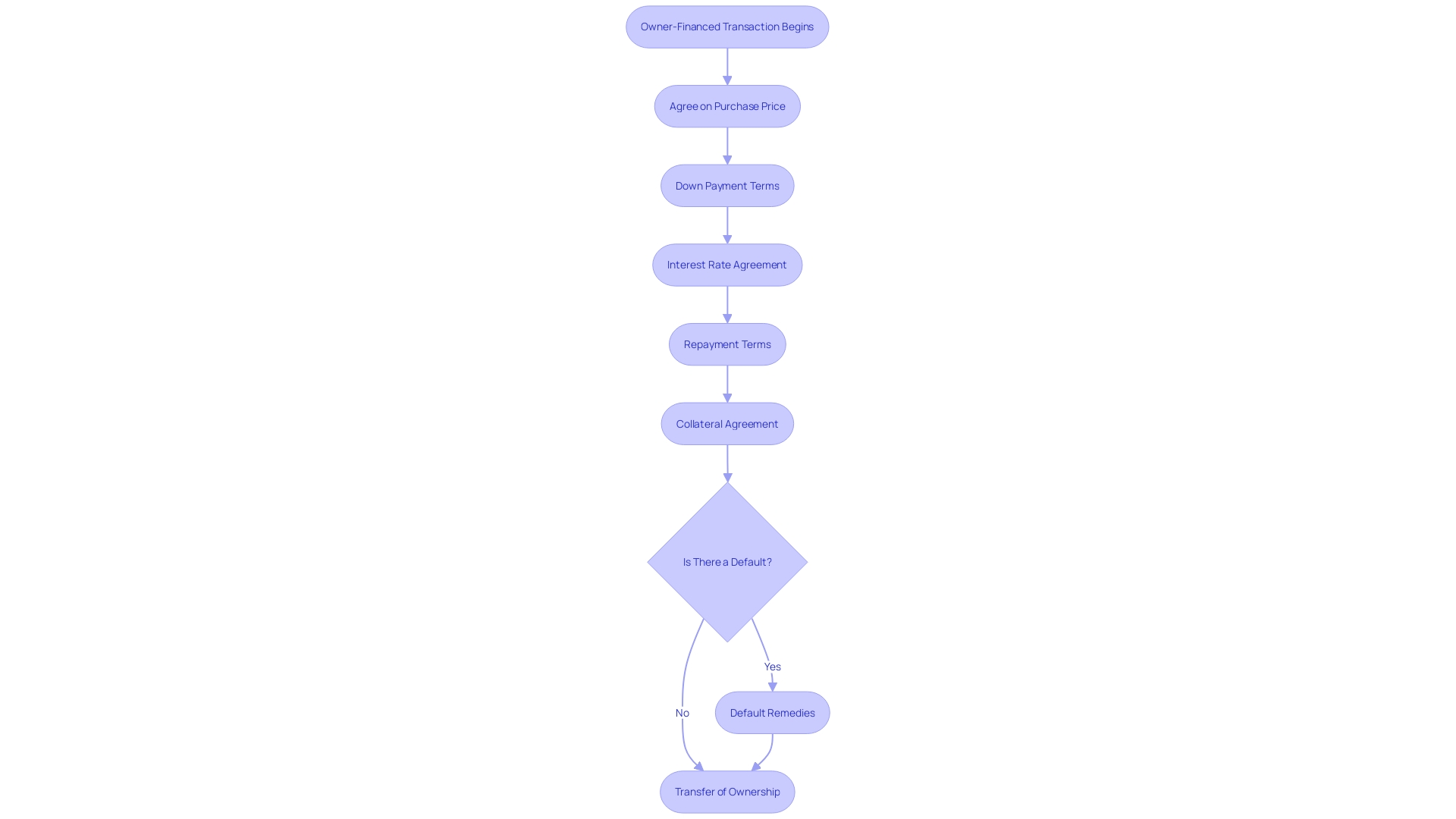

When contemplating owner-funded transactions, it is crucial to have a clear understanding of the elements that compose the financial agreement. Purchase Price refers to the established cost for acquiring the business. A Down Payment is the buyer's initial contribution at the start of the transaction. Interest Rate is applied to the financed sum, influencing the total repayment amount. Repayment Terms outline the payment schedule and the time frame for the finance period. Collateral involves assets pledged by the buyer to secure the financing, providing assurance to the party offering the financing. In the event of a default, the Default and Remedies section stipulates the repercussions and the vendor's recourse. Finally, the Transfer of Ownership details how the business will officially change hands from one party to another.

It's vital to evaluate the advantages of immediate cash versus funding from the person selling. While seller financing can be appealing if you're not in urgent need of funds and are willing to assume the risk of buyer default, it's also important to consider the opportunity costs. Could the lump sum from a traditional sale be more effectively invested elsewhere to ensure growth, such as bolstering retirement savings or funding another venture?

Real-world examples, like the one involving a client seeking property in Chiba Prefecture, underscore the importance of understanding every aspect of a transaction. This client began their journey with a ¥220,000 investment to find the right Akiya property, illustrating the upfront costs and the commitment involved in such deals.

Furthermore, lenders examining your expertise in commerce and credit history emphasize the significance of a strong economic base. A clean business credit history and experience in the industry can be the key to securing favorable loan terms, as collateral alone may not suffice.

In the realm of mergers and acquisitions, the intricacies of contracts emphasize the complexity of monetary transactions. A comprehensive understanding of these agreements is essential for anyone engaged in high-stakes financial deals.

Remember, each component of an owner-financed agreement plays a pivotal role in the success and security of the transaction, impacting both vendor and buyer in significant ways.

Protecting Seller Interests: Collateral, Control, and Expenditure Restrictions

Knowledgeable individuals are increasingly using owner funding to facilitate sales while protecting their investments. Crafting a robust owner financing agreement not only secures the seller's financial interests but also paves the way for a smooth transaction. Essential provisions include:

-

Collateral: This requirement entails the buyer pledging tangible assets—like property—to secure the loan. It's a safety net to fall back on if things go south.

-

Control: Sellers may retain certain rights, such as veto power on important decision-making, until the loan is fully repaid. This helps maintain stability and direction for the company during the transition period.

-

Expenditure Limits: Restrictions on how the buyer can spend money or alter the business are often stipulated to prevent any drastic changes that could affect the business's value or operations.

These measures are akin to the careful steps taken in real estate transactions where every detail, from renovation credits to wraparound mortgages, is meticulously negotiated to protect all parties involved. For example, in a transaction involving a picturesque Akiya property in Chiba Prefecture, detailed terms were established to ensure both the buyer's dream and the party with the interests of selling were aligned.

Furthermore, in the ever-changing landscape of the real estate market, where progressive approaches such as 'rent to own' are gaining popularity, agreements for the provision of funds by the party selling the property are increasingly crucial. Reports of homes being sold with the option for the buyer to rent before owning underscore the trend towards more flexible payment alternatives that appeal to a broader range of buyers in today's competitive market.

Ultimately, these strategic provisions in an owner agreement empower sellers to mitigate risks, ensuring a deal that's not only fruitful but also secure.

Combining Owner Financing with Traditional Financing Options

Combining owner funding with traditional lending options can be a strategic step for enterprising buyers addressing the acquisition of an owner funded company. This approach not only serves to fill potential monetary shortfalls but also offers a broader spectrum of fiscal maneuverability. By tapping into this hybrid financing, buyers unlock enhanced purchasing leverage, improving the odds of a successful acquisition. For example, institutions that deal with money prefer applicants who demonstrate a strong comprehension of the industry by having relevant work experience or extensive training. Throughout the loan application procedure, lenders examine monetary documents and carry out a comprehensive enterprise assessment to guarantee a secure investment. A thorough 'Quality of Earnings' evaluation can be crucial in providing insights into the health and sustainability of earnings, thereby giving lenders confidence in the profitability. Moreover, established enterprises with established histories may discover acquiring funding easier in contrast to fresh endeavors, as creditors perceive them as creditworthy investments. When contemplating the range of funding alternatives, purchasers can investigate different kinds of loans, like lasting and bridge loans provided by banks and other monetary entities, each with unique conditions and objectives that cater to the acquisition needs.

Evaluating the Suitability of Owner Financing for Your Business

When it comes to owner financing, it's crucial for both buyers and sellers to consider several aspects to ensure a successful business transaction. Buyers must examine their economic stability to verify their ability for consistent repayments. It's not just about having the resources but having a strong monetary track record that stands up to scrutiny. For vendors, the emphasis should be on the company's well-being and potential future profits. Can the company produce consistent profits that will not only support its valuation but also protect the seller's economic concerns in the long run?

Moreover, assessing current market trends and the accessibility of conventional funding options is vital for both parties. Traditional term loans typically come with fixed interest rates and a clear repayment schedule, aiding in money management. Nevertheless, the borrowing environment after 2008 has changed, with small enterprises encountering growing difficulties in obtaining funds, thereby rendering owner investment a compelling substitute.

When preparing for loan applications, whether it's a term loan or financing from the vendor, gather your financial documents, valuations, and proof of industry expertise to strengthen your case. Lenders and sellers alike seek assurance in your ability to succeed. Collateral, often necessary for securing loans, should be considered carefully; it not only provides security to the lender but can also improve loan terms and accessibility for the borrower, even those with less-than-perfect credit histories.

Understanding the intricacies of the industry you're aiming to purchase is equally essential. Inquiries regarding the worth of the company, the reasonableness of the asking price, and its operational profitability are common and pertinent. Furthermore, for those interested in franchising, keep in mind that it's not only about capitalizing on a brand name but also presenting a sound operational strategy to steer your venture.

Each of these considerations forms a piece of the larger puzzle. By diligently evaluating financial stability, viability, market conditions, and your preparedness for the loan application process, you can better determine if owner funding is the suitable path forward for your venture.

Common Scenarios Where Owner Financing is Beneficial

Exploring the world of owner transactions reveals a strategic avenue for deals that can be particularly advantageous for both buyers and sellers. This approach to funding provides opportunities for prospective purchasers who may face difficulties in obtaining conventional loans, improving their capacity to acquire a company. Such flexibility can lead to a swifter sale process, as the appeal of customizable payment options is hard to ignore. Sellers, conversely, can frequently bargain for a greater price for their business, as they offer a valuable service through funding. In addition, the ongoing participation of the party providing the product or service can assist in achieving a seamless change, providing assistance and understanding to the fresh proprietor. It's a clear win-win: buyers gain the keys to their entrepreneurial dreams, while sellers enjoy the fruits of their labor and potentially a more lucrative exit.

The importance of owner funding is further highlighted by the intricate dance of primary and secondary stock sales in private companies. In these cases, secondary sales often accompany new funding rounds, creating a dynamic market even without public trading. For the astute entrepreneur seeking to acquire a new venture, showcasing industry expertise and presenting a comprehensive plan are crucial steps in persuading lenders or sellers of their dedication and capacity. The assessment of a company, operational profitability, and the buyer's diligence in the area of money are crucial factors in constructing a persuasive case for owner funding.

Further exploration into economic information demonstrates the significance of comprehending the subtleties of different funding choices and their influence on both immediate operations and future objectives. From the fluidity of commercial lines of credit to the structured terms of conventional loans, each funding mechanism serves specific enterprise needs. Staying informed about industry trends and maintaining a solid economic foundation are essential for businesses looking to thrive in today's competitive landscape.

Legal and Financial Implications of Owner Financing

When contemplating owner funding as either a purchaser or vendor, it's crucial to understand the legal and financial intricacies of such agreements. Funding provided by the individual selling the property can present an appealing alternative to traditional lending, especially when the seller doesn't require immediate cash and is willing to take on the risk of buyer default. However, these arrangements come with their own set of considerations.

For individuals selling products, taking into account the possibility of higher profits from interest accumulated over a period of time is a factor to consider, but this should be balanced with the advantage of immediate cash sales, which can provide the necessary funds for other investments or personal aspirations.

Buyers may find seller funding a useful option when traditional loans are unattainable, but must acknowledge the commitment they are making and the consequences of defaulting on the loan.

Given the complexities involved, including the division of property ownership and tax implications, it's crucial for both parties to engage in open and honest communication and to consult with legal and tax professionals. This ensures that all parties are well-informed about the terms, responsibilities, and potential outcomes of the agreement, thereby safeguarding their interests and paving the way for a successful transaction. Involving specialists is not only a suggestion; it is a crucial measure in maneuvering the complexities of owner funding and making knowledgeable choices that coincide with each party's monetary tactics and objectives.

Tips for Sellers Considering Owner Financing

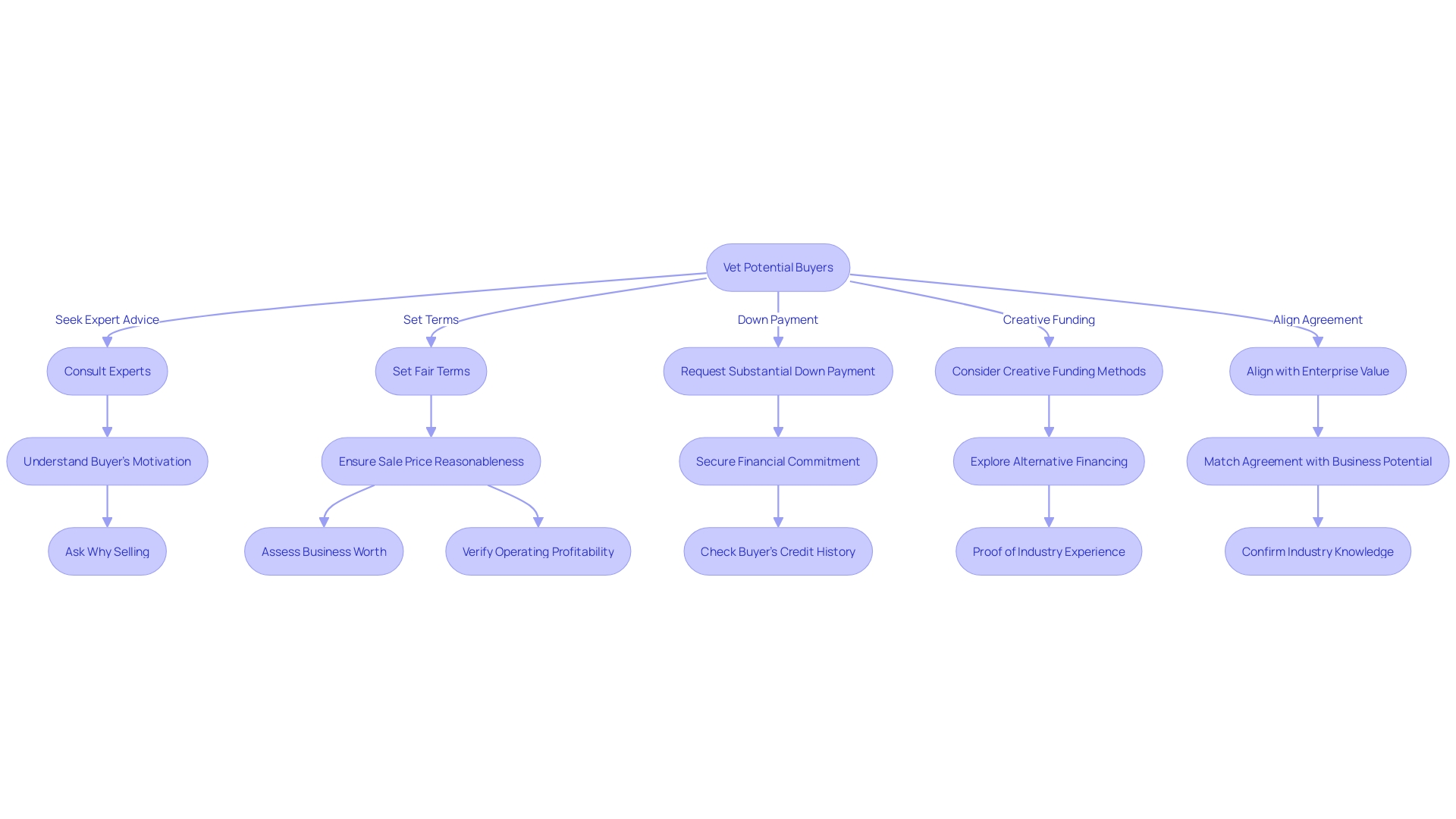

When contemplating owner payment as a seller, it's essential to ensure the process is secure and advantageous to both parties. Begin by thoroughly vetting potential buyers' economic stability to confirm they can sustain regular payments. Seeking advice from experts in legal and monetary matters is crucial for creating an owner funding agreement that protects your interests. When setting the terms, they should be fair and reflective of the buyer's creditworthiness and the company's financial health.

Requesting a substantial down payment can mitigate the risk of default and provide a layer of security. Draw inspiration from the success stories of shared ownership schemes and wraparound mortgages, which showcase creative methods of funding that can serve as examples. Be mindful of the worth of your enterprise and the sector you're entering, as lenders will scrutinize these details. Ultimately, aligning the agreement for funding with the true value and potential of your enterprise, supported by your industry knowledge and experience, can lead to a fruitful owner financing scenario.

Tips for Buyers Considering Owner Financing

Embracing owner funding as a buyer can be a game-changer for acquiring your next entrepreneurial endeavor. To take advantage of this opportunity, start by examining your economic well-being to make sure you can maintain the regular payments associated with proprietorship funding. Due diligence is your next powerful step; just like Tech Ladies, which grew from a humble meetup to a multi-million dollar business, you'll want to ensure the business has a solid foundation and room for growth. When negotiating terms, keep in mind that owner funding provides distinct flexibility - strive for conditions that benefit your monetary plan, perhaps a decreased interest rate or an extended repayment period. Lastly, don't underestimate the importance of professional counsel. Legal and financial experts can be invaluable allies in reviewing your financing agreement, safeguarding your interests as Tech Ladies did on its journey to a successful acquisition. With these strategies, you're not just buying a business; you're stepping into a realm of potential, ready to expand and thrive in your entrepreneurial journey.

Conclusion

In conclusion, owner financing is a powerful tool for sellers and buyers in the business world. Sellers can benefit from a larger pool of potential buyers and the potential for a higher sale price. They also receive a steady income stream over time, providing financial stability.

Buyers, on the other hand, gain access to flexible and personalized financing options that may not be available through traditional avenues.

The process of owner financing involves reaching an agreement on essential terms, creating a purchase agreement, closing the transaction, and fulfilling repayment obligations. Key components of owner financing agreements include the purchase price, down payment, interest rate, repayment terms, collateral, default and remedies, and transfer of ownership.

To protect seller interests, provisions such as collateral, control, and expenditure restrictions can be included in the financing agreement. This ensures a secure transaction and maintains stability during the transition period.

Blending owner financing with traditional financing options can provide buyers with enhanced purchasing leverage and financial maneuverability. Demonstrating industry expertise and presenting a robust business plan are crucial for securing favorable loan terms.

When evaluating the suitability of owner financing, both buyers and sellers should consider factors such as financial stability, business health, market trends, and accessibility of traditional funding options. Understanding the legal and financial implications of owner financing agreements is essential, and consulting with experts in these areas is recommended.

Overall, owner financing offers a strategic avenue for business transactions, providing flexibility, personalized terms, and the potential for a smoother transition. By carefully considering the needs and goals of each party, owner financing can pave the way for a successful and mutually beneficial business transaction.