Introduction

Assessing the value of a company extends beyond calculating its financial value; it delves into uncovering its true economic essence and prospects for prosperity. Valuation, in business serves as a compass for stakeholders to make educated decisions grounded in a grasp of the firms financial status.

This article discusses the significance of evaluating businesses. Covers essential ideas such as ways to calculate business worth and the process of determining a companys value along with typical hurdles faced during valuation and recommended approaches, for precise assessment.

Why Business Valuation is Important

Assessing a firm is akin to solving a puzzle where each component represents a distinct aspect of the organization's operations and market influence. The significance of valuation extends beyond determining a monetary worth for an organization; it explores uncovering its authentic economic foundation and potential for triumph. It acts as a guide, for stakeholders. Owners, investors, lenders and potential buyers. Assisting them in making well-informed decisions based on a comprehensive understanding of the organization's financial position.

Imagine a scenario where a painting that was originally priced at $17k surged in worth to almost $14 million after being recognized as a piece, by Rembrandt himself. Demonstrating the significant impact of genuineness in diverse scenarios, such as art and the corporate world.

The worthiness of an enterprise is determined by considering profits generated by business activities and other factors unique to its industry sector such as cash flow strength and market influence factors into play when determining the enterprises worthiness. Making corrections for exceptional occurrences or inaccuracies is vital because it ensures an authentic representation of the financial standing of the organization. A thorough assessment of the quality of earnings through a report plays a vital role in evaluating both the dependability and long-term sustainability of a firm's earnings performance.

Investors and buyers are interested in understanding a firm's outlook in addition to its past results rather than just relying on historical data for valuation purposes. Expertise of advisors becomes crucial in assessing an organization's growth potential and competitive advantage while also analyzing its direction. Advisors meticulously analyze the aspects of a business and project its future opportunities within the industry segment to anticipate inquiries and doubts, from potential investors or buyers.

In the world of startups where traditional indicators may not offer an assessment of a firm's value; determining its worth becomes a intricate undertaking. A startups valuation is often influenced by its potential for growth and creativity; thus stakeholders must carefully weigh the organization's stage, against market possibilities and uncertainties.

In the end knowing the worth of a company is crucial, for making decisions. It entails an evaluation of different factors that affect both the current and future prosperity of the enterprise. This enables all stakeholders to navigate the corporate environment with certainty and comprehension.

Key Concepts in Business Valuation

Understanding the fundamentals of business assessment is crucial when evaluating the worth of your enterprise. In this discussion, we will explore essential concepts that serve as the foundation of valuation.

The fair market price is the amount at which both a buyer and seller are in mutual agreement without any external influences affecting the transaction, in an open market setting.

Goodwill; It refers to the added value that your organization gains from factors such, as brand reputation and customer loyalty.

"EBITDA is, like a summary of how your organization is doing operationally—it's calculated by looking at earnings before taking out interest expenses and taxes as well as accounting for depreciation and amortization."

When performing a Comparable Companies Analysis, you analyze businesses to establish a benchmark for assessing the value of your organization.

Consider the scenario where a painting valued at $17K skyrocketed to almost $14 million upon authentication as a Rembrandt source a striking example of how authenticity and intangible qualities can significantly impact worth and perception, in art.

In addition to that little guideline, with a touch of humor. It is said that a business could be valued at approximately ten times its annual earnings currently! But hey now. That's the tip of the iceberg; the real worth gets all tangled up in growth patterns and other factors!

When considering the importance of individuals in an organization. From those on the frontlines to executives. Their impact on the value of an organization cannot be underestimated or overlooked. It's clear in cases like Tesla and Berkshire Hathaway that key individuals play a vital role in propelling the value of the organization.

Startups pose a challenge when it comes to determining their worth due to their innovative nature.The valuation of startups can be approached through methods, like the Berkus Method and Book Value Method which offer different perspectives on the startups potential success.

Understanding the strength and stability of earnings through a quality assessment is crucial for prospective buyers as it forms a solid foundation, for making wise investment choices in acquisitions.

By comprehending these valuation principles thoroughly firsthand you are laying the foundation for a deeper exploration, into valuation techniques that will give you the capacity to determine the actual value of your organization.

Methods for Determining Business Value

Valuing a business is a task that involves considering various factors unique to each organization's situation. To demonstrate this idea; one technique called the Asset Based Approach analyzes both intangible resources to offer a holistic perspective of the organization's overall worth. Meanwhile the Income Based Approach delves deeper by assessing profitability through an analysis of income streams and cash flow. The Market Based Approach or comparative analysis provides insights by examining comparable businesses that have recently changed hands and using market trends as a benchmark, for determining worth.

When it comes to delving into the nitty-gritty of appraisal methods for assessing the worth of enterprises, one prevalent strategy is the Discounted Cash Flow (DCF) Method, which entails projecting future cash flows and adapting them to their present worth by considering the notion of the time value of money. This approach is particularly advantageous for businesses with expansion plans, in position. On the other hand, there's the Book Worth Method, a simpler approach that determines a business's evaluation based on figures reported in its financial statements.

Innovative approaches to evaluate a firm's worth can provide valuable perspectives for various scenarios like startups encountering difficulties with traditional appraisal methods because of limited past information or comparable companies where alternative techniques like the Berkus Method can be beneficial instead. As businesses expand and evolve over time, their approaches for determining value must also adapt, considering factors such as funding cycles and the post investment valuation, which indicates the updated value of the organization after investment. Having a grasp of these methods is crucial, for any entrepreneur looking to obtain an precise valuation.

Steps in Valuing a Business

Evaluating the value of an organization necessitates a combination of imagination and accuracy to ensure precision in assessment techniques. It all starts with a gathering of financial paperwork such as statements and tax forms, alongside any other relevant records shedding light on the organization's financial standing. Afterward comes the step of reviewing and adjusting these documents to ensure they accurately represent the true economic state of the company.

After setting up the groundwork of the operational activities are started to assess its worth using a variety of techniques based on collected financial data such as traditional approaches and modern evaluation methods, like the Berkus Method that evaluates the importance of vital components specifically aimed at emerging ventures.

The process of assessing the worth of a company extends beyond numerical figures alone; strategic objectives and the current market circumstances have a significant impact on shaping this assessment since they can heavily influence the result either favorably or unfavorably, partly based on the contributions of essential personnel at different levels within the organization and their impact across operations and potential growth prospects.

Considering what lies ahead is equally important as reflecting on the past experiences we've had so far in our journey; In accordance with insights shared by Abhijeet Kaldate from Astra WordPress Theme - it's recommended to contemplate the direction your company is headed in the decade. This forward thinking approach not only influences your decision making process regarding potential sales but also empowers you to gain a deeper understanding of the true value your enterprise holds. By intertwining these various elements of assessment and vision for the future of your enterprise - the valuation goes beyond mere numbers on a spreadsheet and offers a comprehensive and dynamic view on the true value of your organization, within the vast landscape of commerce.

Common Challenges in Business Valuation

Assessing the worth of a company involves addressing and navigating obstacles to ensure an accurate evaluation is conducted effectively. To begin with; obtaining financial information is fundamental; this is especially critical for smaller businesses that may not maintain thorough financial records. Next, the valuation process involves making estimates about future outcomes and economic conditions. A process that inherently introduces an element of subjectivity. Lastly; determining the value of assets such as goodwill or intellectual property necessitates specialized expertise due, to their intricate characteristics.

Furthermore, in relation to the previously mentioned point about how instability in the marketplace can have an impact, on a firm's value. Consider the recent actions taken by the Federal Reserve to control inflation and the unexpected way stock markets remained stable as an illustration of how external economic factors can affect the valuation of companies.

At times, the value of a business can vary greatly based on how authentic it seems to be perceived. Like what happened with a painting that went from $17 to $14 million after being linked to Rembrandt. Likewise in a business setting. The presence of staff members can really affect how much the company is valued. This isn't about top executives either. Anyone within the organization can play a crucial role, in driving its value up.

When encountering these barriers, it is essential to utilize evaluation methods that consider internal elements like the function of important personnel and external elements such as regulatory changes and economic conditions. For instance, the vulnerability of the cannabis sector to shifts in the marketplace necessitates careful planning of evaluation activities. Furthermore, acknowledging that information is as valuable as gold in today's corporate setting and implementing models based on industry trends to assess data value can lead to improvements in revenue generation.

To navigate through these valuation obstacles effectively. Entrepreneurs with flexibility can aim for accurate and unbiased assessments that reflect the true worth of their enterprise.

Best Practices for Accurate Business Valuation

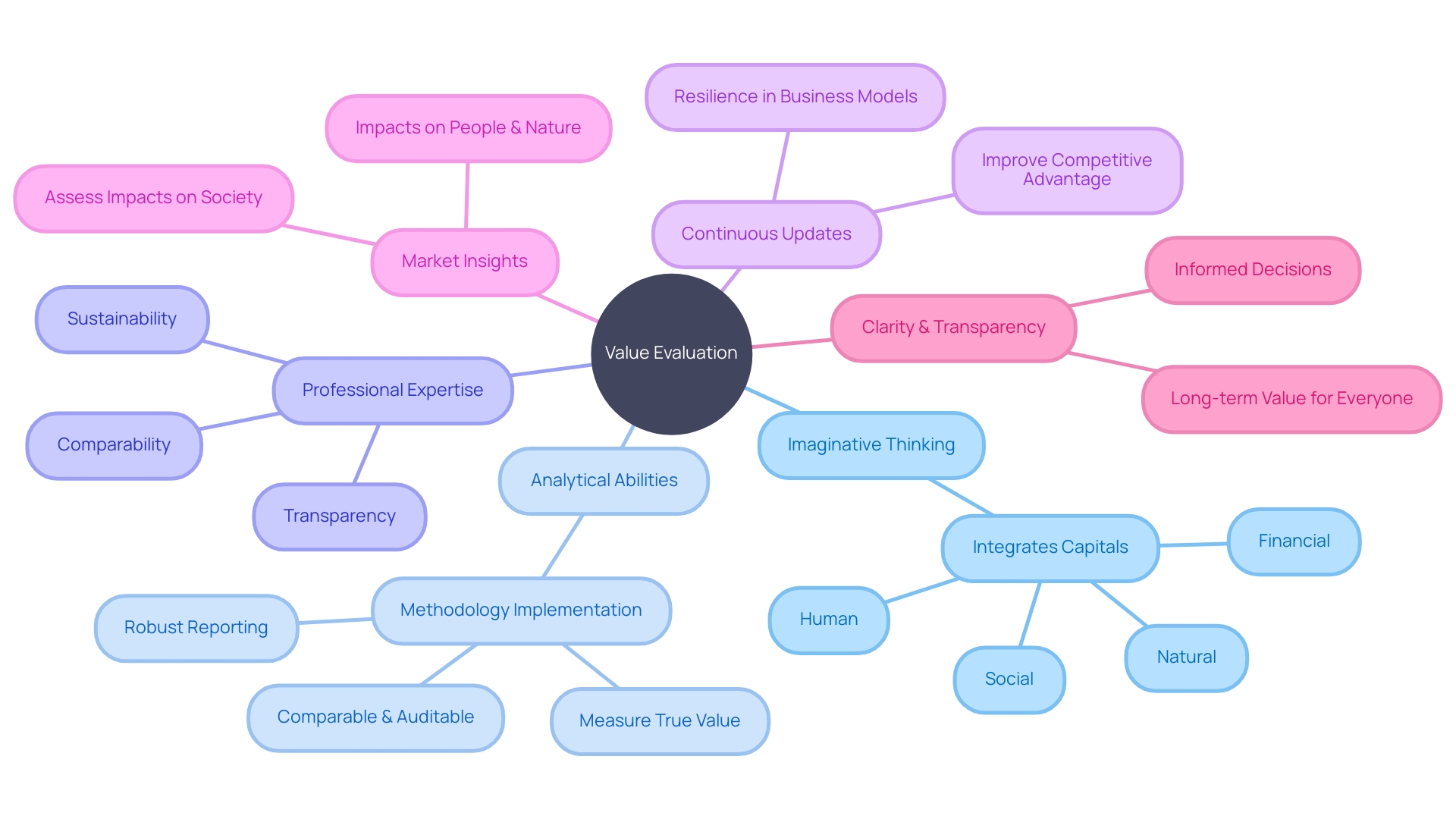

Evaluating the value of an organization requires a combination of imaginative thinking and analytical abilities, where precision and a deep understanding of industry patterns intersect flawlessly. For instance in the art realm illustrates how valuation can evolve dramatically; consider a painting initially priced at $17 that skyrocketed to $14 million once recognized as a Rembrandt. Likewise, within the corporate realm, appraising a company involves elements other than its current earnings ratio; it encompasses a complex fusion of market circumstances, growth potential, and the actual worth of its assets.

When assessing the worth of a company efficiently.

Find the expertise of a professional for an impartial evaluation of your organization's true value - just like how art connoisseurs discern the genuine worth of a Rembrands masterpiece based on current industry norms and unbiased insights. To evaluate the value and comprehensiveness of an organization, it is important to utilize a combination of various approaches instead of relying solely on one method. Investor Dave Berk us introduced the scorecard approach specifically for valuing start ups as a tool, in this regard. "Continuous Updates"; The corporate environment is constantly changing and necessitates evaluations to reflect the current financial condition and position of the company. Just like the way real-time data affects asset prices, in the market. Understanding Market Insights is crucial as it aids in comprehending the economic scenario better. Especially in circumstances like the 5% inflation rate shifts in consumer behavior and the rising adoption of renewable energy have a noteworthy impact, on determining enterprise principles.

Inject clarity and transparency into your evaluation process, by providing updates to navigate the complex process of determining your business value accurately. Whether it involves assessing the worth of intangible assets or analyzing concrete performance metrics the valuation process is a journey of ongoing exploration and adjustment.

Conclusion

To sum up the evaluation of a business extends beyond crunching numbers on a spreadsheet; it delves into understanding the core economic identity and potential for growth of the company itself.. Essential elements in determining the worth of a business encompass aspects like reputation value goodwillearning before interest taxes depreciation and amortization (EBITDA) and examining companies, for comparison analysis.

Assess the success of startups can be tricky due, to their unique nature that may not fit traditional valuation methods.

Different ways to assess the value of a business include looking at its assets and income well as considering market trends and specific circumstances in order to determine an accurate valuation that takes into account strategic objectives and the impact of key team members.

Focusing ahead and considering the companys path are elements to ponder.

In business valuation tasks it can be tough to get financial data predict future results and assess the worth of intangible assets. To overcome these hurdles successfully one must be adaptable. Utilize evaluation methods that take into account both internal and external influences.

Achieving business valuation involves consulting with experts and using various methods while continuously updating the assessment process for optimal results. Market knowledge and openness, during the evaluation enhance the accuracy of determining the businesss value.

To sum up the assessment of a companys value requires a mix of innovation and accuracy while staying attuned, to market dynamics.