Introduction

Exploring the world of securing business acquisition funding can be a game changer on the journey, to entrepreneurial triumphsю Knowing the variety of loan options out there and how they can directly benefit individuals helps buyers make smart choices that match their financial situation and business objectivesю Whether considering conventional business loans or delving into Small Business Administration (SBA) loans or seller financing opportunitiesю each avenue presents distinct perks suited to different requirementsю

Acquiring a loan for a business purchase requires evaluation of important factors such as loan amount, interest rates, repayment terms and collateral demands. Understanding how lenders evaluate these aspects and their impact on the deal is essential. Assessing the status of the business being acquired and the buyers creditworthiness is key, to ensuring a seamless and prosperous acquisition journey.

Although SBA loans offer terms like reduced initial payments and longer repayment periods s they also involve eligibility criteria and lengthy approval procedures.On the side alternative funding choices such as private equity investment. venture capital funding.. Crowdfunding present various opportunities for financing acquisitions. Each, with unique advantages that may align with different business structures and expansion plans.

Diving into these funding choices unveils opportunities for expanding businesses and sparking innovation while paving the way, for growth and lasting achievements in the long run.

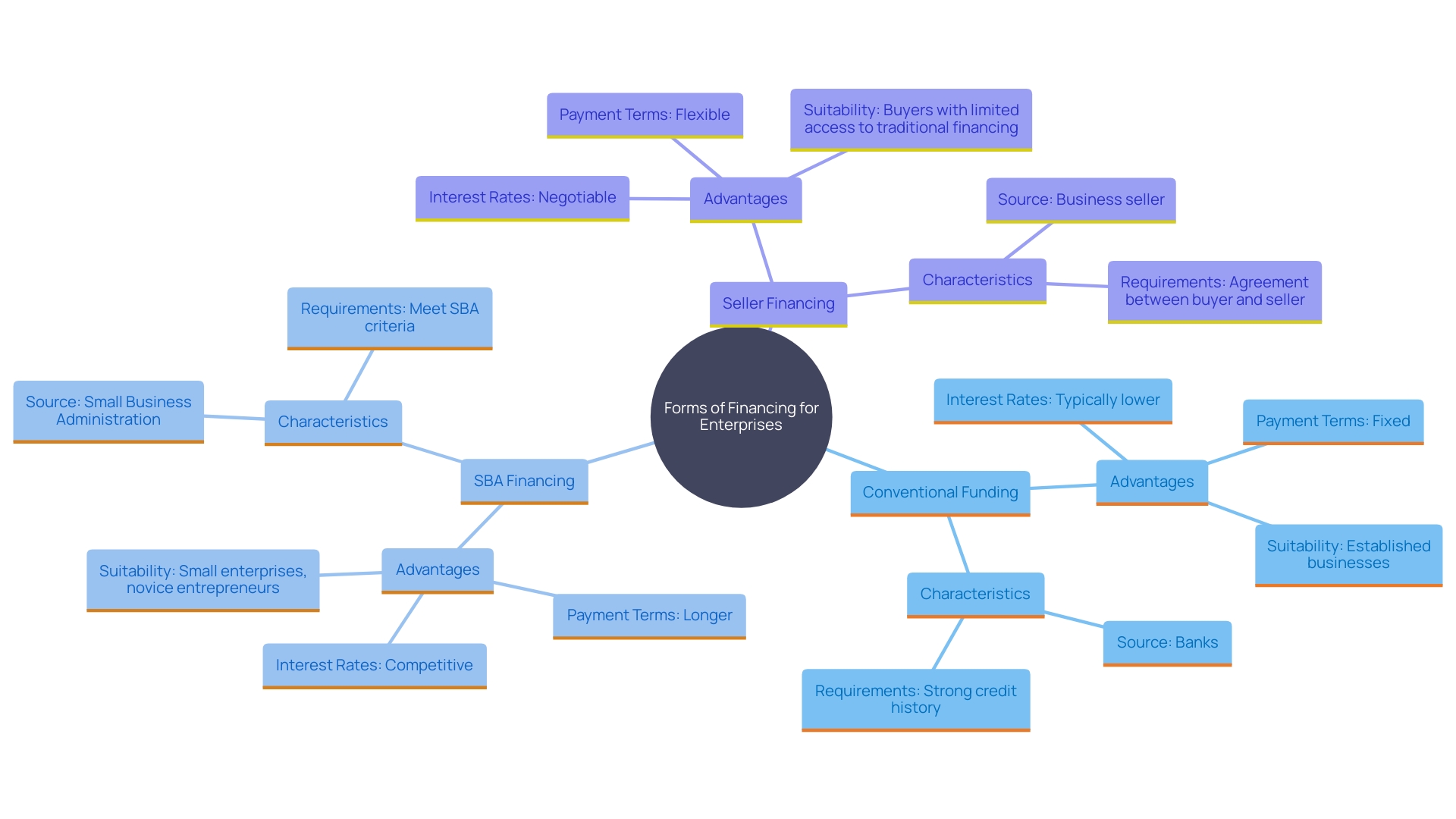

Types of Business Acquisition Loans

There are forms of financing available for obtaining enterprises that are intended to meet the diverse needs of purchasers. Conventional funding from banks or monetary institutions provides sums of money at attractive rates but may appear hazardous for small enterprises and novice entrepreneurs. On the other hand, Small Enterprise Administration (SBA) financing offers more advantageous conditions and demands smaller initial payments, making them a feasible choice for numerous small enterprise proprietors. Another utilized option is seller financing when the seller offers funding to the buyer with flexible terms and lower interest rates instead of a conventional bank arrangement or mortgage alternative. This range of financing alternatives addresses financial situations and enables potential buyers to select the most suitable one according to their needs.

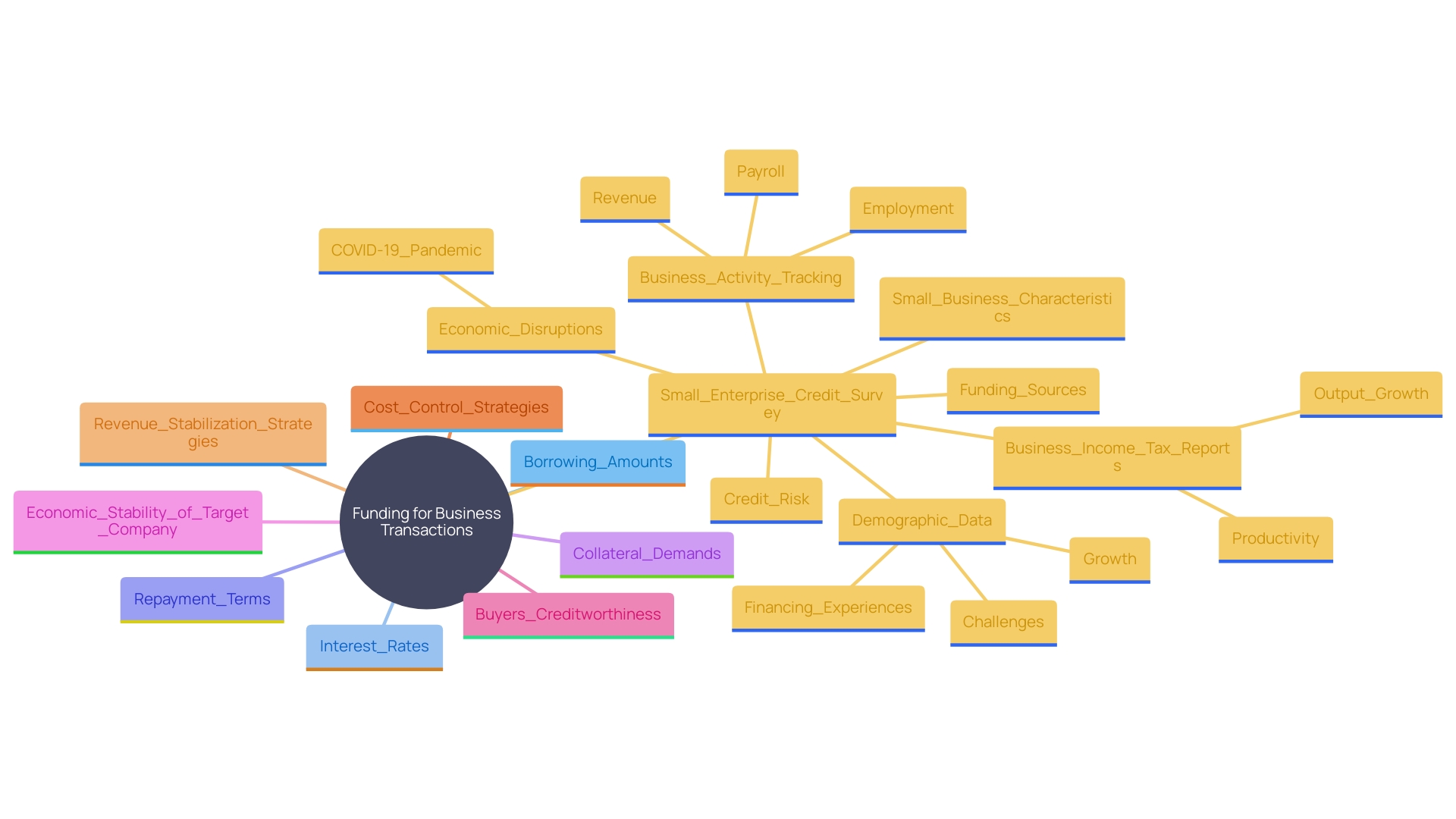

Key Elements of Business Acquisition Loans

It's important to understand the elements of obtaining funding for a smooth transaction to occur successfully. Factors such as the borrowing amount, interest rates, repayment terms, and collateral demands all have an effect. Potential purchasers must consider how lenders assess them; this frequently entails reviewing the economic stability of the target company and the buyer's creditworthiness. While there has been an improvement in the company's ability to generate cash from its operations caution is advised due, to the downward revenue trend and consistent net losses. In the steps should probably focus on stabilizing income sources and cutting costs more effectively while managing debts well to get back to making a profit again. This examination indicates a need for an evaluation of potential future revenues and cost control methods. There was an increase in long-term debts due to a borrowing of $8.85 million which may indicate either refinancing past debts or securing new financing options. Based on information from the 2022 Small Enterprise Credit Survey conducted by the Federal Reserve Banks, some 53 percent of establishments that employ people rely on resources when faced with monetary difficulties. According to the survey findings noted earlier in the research report, it was revealed that 66% of small enterprises interviewed turned to utilizing their own personal resources or obtained assistance from family members as a means of funding over the past five years. When it comes to securing funds, for acquiring enterprises necessitate an assessment of monetary documents and information related to the entity being acquired. To illustrate this point further; there was an instance where a company managed to secure $3..29 million through new notes payable arrangements; this helped them cover their debt repayments and other financial obligations resulting in an overall enhancement of their cash reserves.

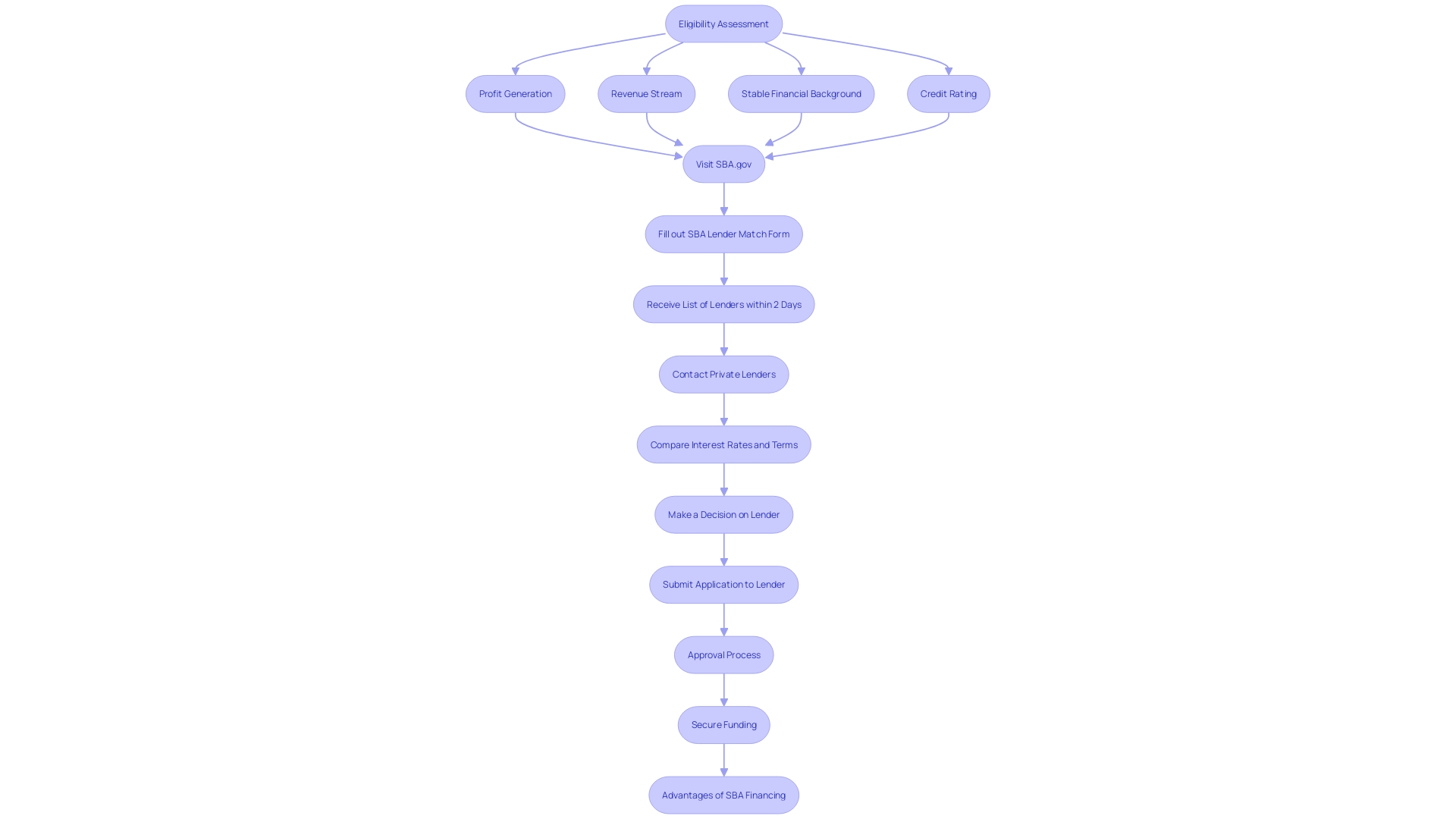

Benefits and Drawbacks of SBA Loans for Acquisitions

Small Enterprise Administration (SBA) financing is viewed as an option for acquiring ventures due to the favorable conditions it provides, such as reduced upfront costs and prolonged repayment timelines. Recent updates in SBA regulations have further enhanced the appeal of these financial products by permitting buyers to fund a portion of an enterprise while also allowing sellers to hold onto equity and foster enduring connections with the company. Nevertheless, it is important to keep in mind the eligibility requirements and time-consuming approval procedures that come with these financial options. In order for enterprises to qualify, they need to demonstrate that they are generating profit and have a revenue stream, along with a stable financial background, while also having owners with good credit ratings or better. The process of applying involves being paired up with lenders through SBA. Gov which can make the process smoother but still requires thorough preparation. In spite of the challenges, the SBA financing initiative remains a component of small enterprise support, offering essential resources for encouraging growth, innovation, and employment opportunities.

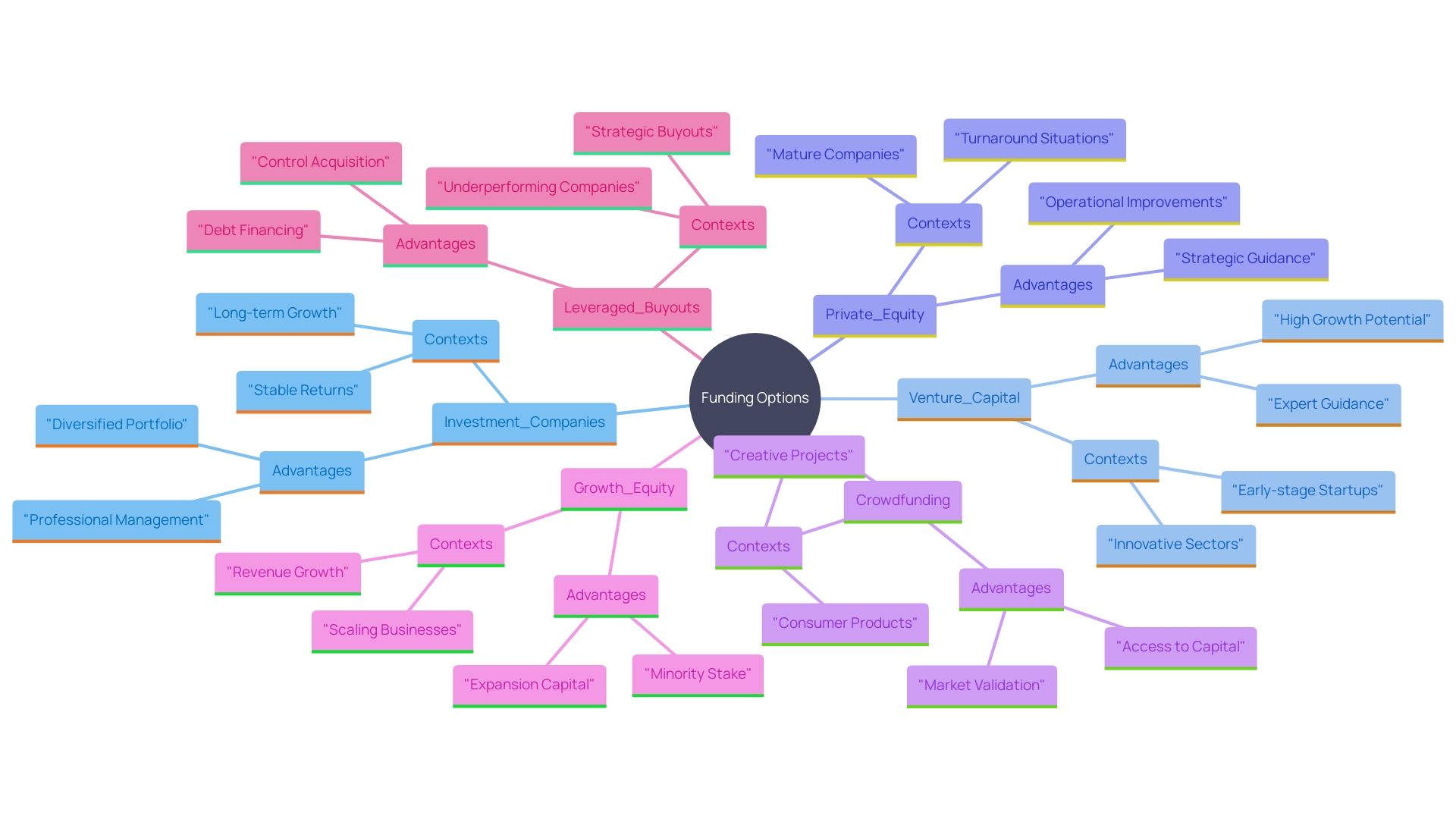

Alternative Financing Options for Business Acquisitions

When considering funding for obtaining a company's ownership stake or assets, it's essential to investigate alternatives beyond loans. Other options such as investment companies, venture capital sources and crowdfunding platforms offer their own advantages and opportunities. Private equity firms play a role in driving economic growth and fostering innovation in the United States. They offer appealing risk adjusted returns. Utilize different approaches such as investing in expanding enterprises (growth equity) or acquiring firms primarily, with borrowed capital (leveraged buyouts). Growth equity investments target established firms seeking to expand their operations with funding, while leveraged buyouts concentrate on mature enterprises that can immediately produce cash flow by utilizing a combination of debt and equity financing.

'Another important method to generate financial resources is through venture capital which targets startups at their stages and possessing high growth potential even though it comes with greater risks involved in comparison to other financing options available in the market. This form of investment usually goes towards supporting initiatives that might not be making profits yet but exhibit a lot of potential for success.'.

Crowdfunding harnesses the strength of the community to raise funds and offers a modern and accessible approach for financing acquisitions. By considering these options carefully buyers have access to funding channels that may prove more appropriate compared to conventional loans enabling them to explore fresh opportunities, for business expansion and achievement.

Conclusion

In the realm of securing funding for business acquisitions lie a plethora of choices tailored towards addressing the requirements of potential buyers. These options range from loans and SBA loans to seller financing; each presents distinct benefits that can cater effectively towards specific business objectives. Being well versed in these avenues is essential, for making choices that significantly influence the success of acquisitions.

Important aspects like the amount of the loan being requested and the interest rates and conditions for repayment play a role, in acquiring financial support successfully. It is crucial to assess the stability of both the purchaser and the business being considered for investment to ensure a seamless transaction process. Buyers can boost their creditworthiness. Increase their likelihood of securing favorable financing by stabilizing their income and managing debts efficiently.

Small businesses find SBA loans appealing due to their terms; however they face strict eligibility requirements and long approval timespans in return for these advantages.The potential benefits are substantial as they offer funds for expansion and creativity.Other financing choices such, as equity or venture capital also bring new avenues that cater to different business structures.

if someone has adequate knowledge and readiness when acquiring a business they can discover various chances for success by delving into the complete spectrum of financial choices and comprehending essential aspects. Seizing these opportunities not aids in fulfilling personal entrepreneurial aspirations but also plays a role, in advancing wider economic development and creativity.

Achieving success in acquiring a business is possible, for those who're ready to seize the opportunity.