Introduction

In the realm of business brokerage expertise is needed to uphold ethical standards and honesty throughout dealings.With trust being crucial for brokers success this piece explores the values of ethical business brokerage stressing the significance of integrity and transparency, in nurturing strong client connections.

By following these guidelines brokers improve their credibility. Help create a fair and trustworthy business environment. Come along as we delve into the concepts of openness, integrity and the legal and moral aspects that support effective broker operations.

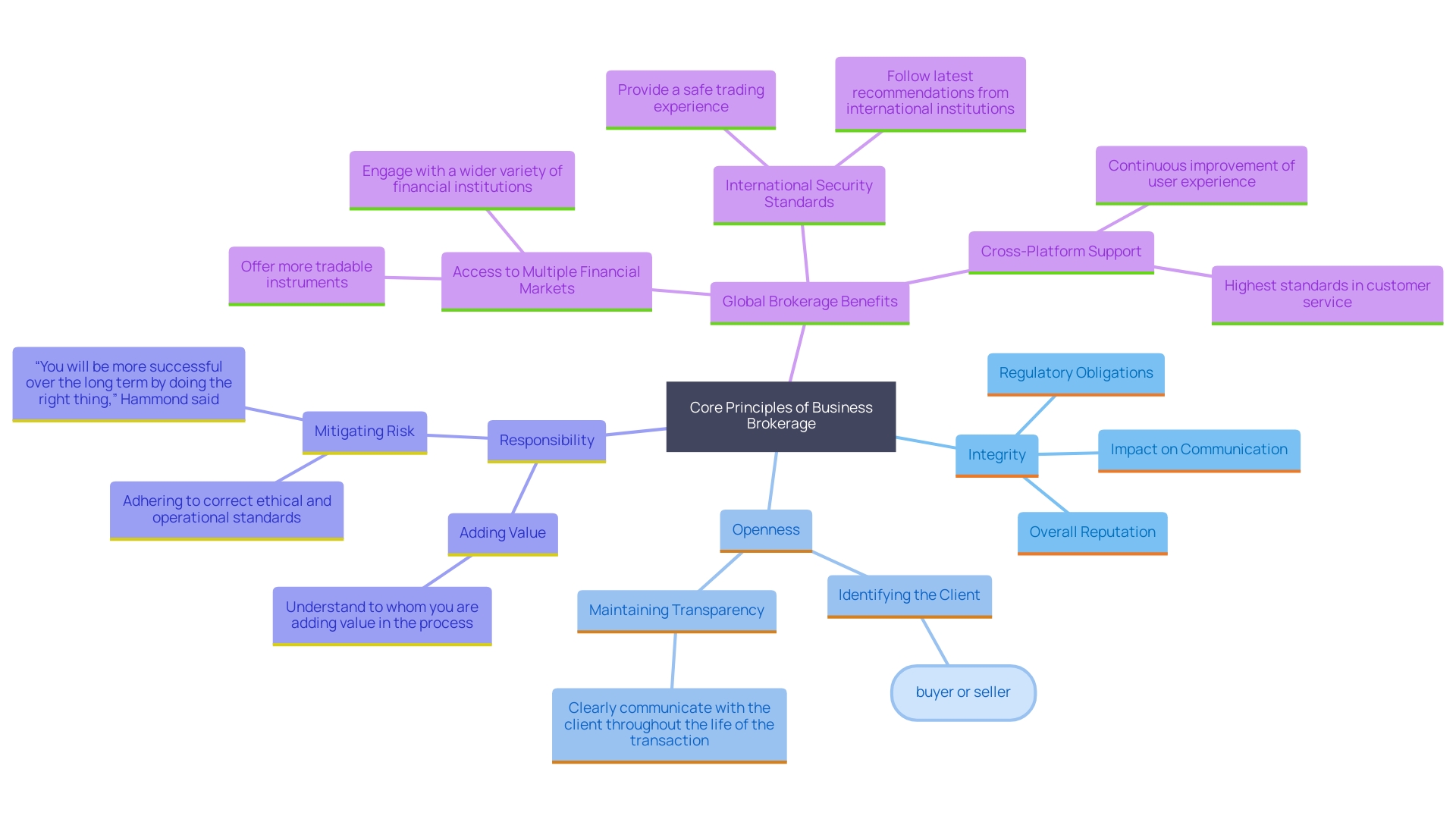

Key Principles of Ethical Business Brokerage

Operating a business brokerage hinges on principles such as integrity and openness at its core foundation. Business intermediaries should prioritize the needs of those they represent while adhering strictly to regulatory obligations. This dedication entails maintaining regular communication channels providing complete disclosure of relevant details and guaranteeing that customers grasp the intricacies of business transactions. In the words of Hammond; "Your success, in the run is tied to doing what's morally sound." By abiding by these values not builds faith but also greatly boosts the standing of the brokerage field itself. By acting with responsibility and integrity, agents contribute to forming a trustworthy and esteemed business environment, thus promoting equitable transactions and transparency among all parties involved.

Transparency in Business Brokerage

Integrity contributes to building trust between intermediaries and those they serve, as it establishes the basis for the strength and dependability of their relationships. Brokers must prioritize communication regarding their offerings including services provided and associated fees to establish a level of clarity. Comprehending how intermediaries charge for their services. Whether through trade fees or commission free structures that may also include costs such as account maintenance or penalties for inactivity. Can significantly influence your financial choices. Having knowledge empowers you to make well informed trading decisions that are both prudent and cost effective, by preventing unforeseen expenses from eroding your profits.

In addition to transparency there is more to it than meets the eye. By offering updates and honest assessments of market trends, professionals show their dedication to keeping customers informed. Kendall Bonner, Vice President of Industry Relations at Exp Realty emphasizes the importance of these steps ; " The goal is to promote transparency and clear communication during every step of the transaction process ensuring that all parties have information right from the beginning." This method not only helps avoid misunderstandings but also establishes a strong foundation for enduring relationships.

In life situations nowadays following transparency guidelines is gaining popularity. For example, in New York City agents are effectively adopting regulations to ensure customers are informed about who will cover the fees and if a buyer representative agreement is necessary. Alyssa Soto Brody, one of the co founders of Powered by DMT highlights that compliance is evident in practice. She mentions how agents, in New York City are successfully incorporating these updated standards.

In the end, it's important to consider a financial advisor's track record of conduct and integrity 'Examining feedback from customers as well as viewpoints shared on discussion boards by specialists can provide you with an understanding of how trustworthy a financial service provider is and help you in choosing a collaborator who aligns with your monetary goals.' Keep in mind that transparency is not about preventing conflicts but also, about empowering clients to make well informed choices and cultivating a reliable and cooperative partnership."

Integrity and Trustworthiness

'Maintaining integrity is crucial for business dealings, in any transaction scenario. Agents must focus on operating fairly to serve the interests of both buyers and sellers with transparency. A reliable agent not only avoids conflicts of interest but also ensures all parties are well informed of the possible risks and gains. As stated by Matt Hammond from Coreland Cos. "Your reputation is paramount. Although taking shortcuts may seem advantageous initially it never leads to long term success."' In the business world it's important to earn respect and confidence. In this manner, other agents will have confidence in your capability to finalize agreements effectively. This not only ensures the seamless execution of each transaction but also aids in creating a solid reputation for the agency over time. Adhering to industry standards by being open during dealings and clearly defining roles are measures to enhance reliability and minimize risks. Financial professionals stress the importance of conduct in building trust and credibility among stakeholders to ensure a fair and beneficial environment, for all parties involved.

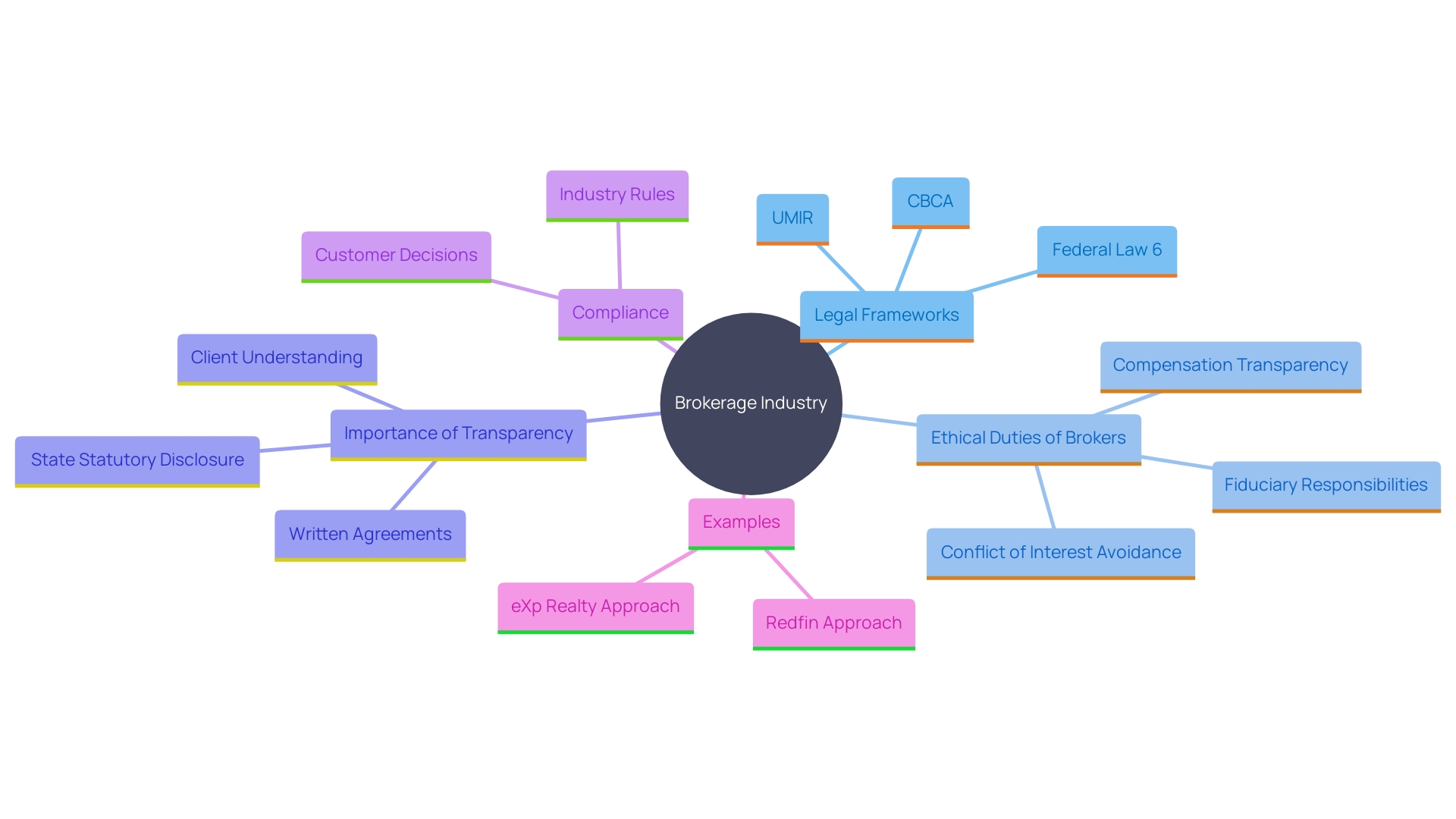

Legal and Ethical Considerations in Referral Agreements

When agents handle agreements in their work, the legal and ethical aspects should be carefully considered. The rules regarding fees are important to understand. This may involve a variety of laws such as Federal Law 6 in Brazil, CBCA, and UMIR, concerning insider trading. The Securities Market Act. These regulations ensure that traders comply with the law and maintain market honesty.

Brokers have an ethical duty to inform their customers about any arrangements they have with others in a genuine way that enables them to make knowledgeable decisions and fosters confidence while avoiding conflicts of interest. Effectively recording these agreements is essential to prevent misunderstandings and create a strong foundation of reliability.

Brokers often draw inspiration from cases such as Redfin approach of sharing data and making settlements to uphold compliance and transparency standards, in the industry—a move that showcases a dedication to ethical practices and regulatory alignment while setting a commendable precedent for others to follow.

By following these rules and moral codes diligently brokers can establish a sense of trust, with their clients thereby promoting the markets integrity and equity.

Conclusion

The study of ethical business brokerage highlights the values that shape effective broker client interactions.Taking into account principles, like honesty and openness is crucial as they form the basis of trust.By putting clients and promoting clear communication brokers can strengthen their reputation and cultivate a more reliable business atmosphere.

Focusing on conduct doesn't just improve individual deals; it also raises the standards of the brokerage industry as a whole.

It's important to be transparent in every transaction you make in business dealings is essential for trust and communication between parties involved.enables clients to make decisions by understanding the different fee structures and staying up to date on current market trends.Brokers who prioritize communication and provide honest assessments play a key role, in preventing misconceptions and building long lasting client relationships.

The industry is starting to acknowledge the importance of being open and transparent more these days. Its seen as a valuable asset, for brokers and clients alike.

Keeping a sense of honesty is crucial in every business transaction.Brokers who conduct themselves ethically and steer clear of conflicts of interest not just protect their image. Also establish a fair environment for everyone involved.By following guidelines and abiding by legal parameters brokers can foster enduring trust and reliability making certain that their actions are in line, with the clients welfare.

Ultimately embracing values in business brokerage leads to success as it fosters trust and openness between brokers and clients while promoting a fair business atmosphere that upholds marketplace integrity for all involved parties in a sustainable career path for brokers who seek respect, within their field.