Introduction

Entering the realm of business brokerage may seem overwhelming at first glance; however grasping the nuances of broker fees and payment systems can greatly simplify the journey ahead. Business brokers utilize a range of fee structures to accommodate the requirements of sellers. Ranging from flat fees and hourly rates to the commonly favored commission based setups. These charges not signify the services rendered but also ensure that the brokers goals are in harmony, with those of the sellers nurturing a cooperative and mutually advantageous partnership.

The choice between success fees and retainers is crucial for sellers because it can impact the brokers drive and dedication to selling the property or business in question. Both fee structures come with their pros and cons that sellers need to understand in order to make informed financial choices. Variables like the businesss complexity, market conditions and the brokers skills and reputation also play a role in determining the fee structure highlighting the need, for consideration before making a decision.

Selecting the fee arrangement is essential, for maximizing earnings and guaranteeing a seamless deal process. Sellers need to evaluate the advantages and disadvantages of pricing strategies while considering their individual situations and goals. Working with a business intermediary has its advantages and disadvantages; thus it is crucial to choose a broker who shares the sellers objectives.

Sellers can enhance their sales process. Achieve positive results by having a good grasp of different fee structures and their impacts.

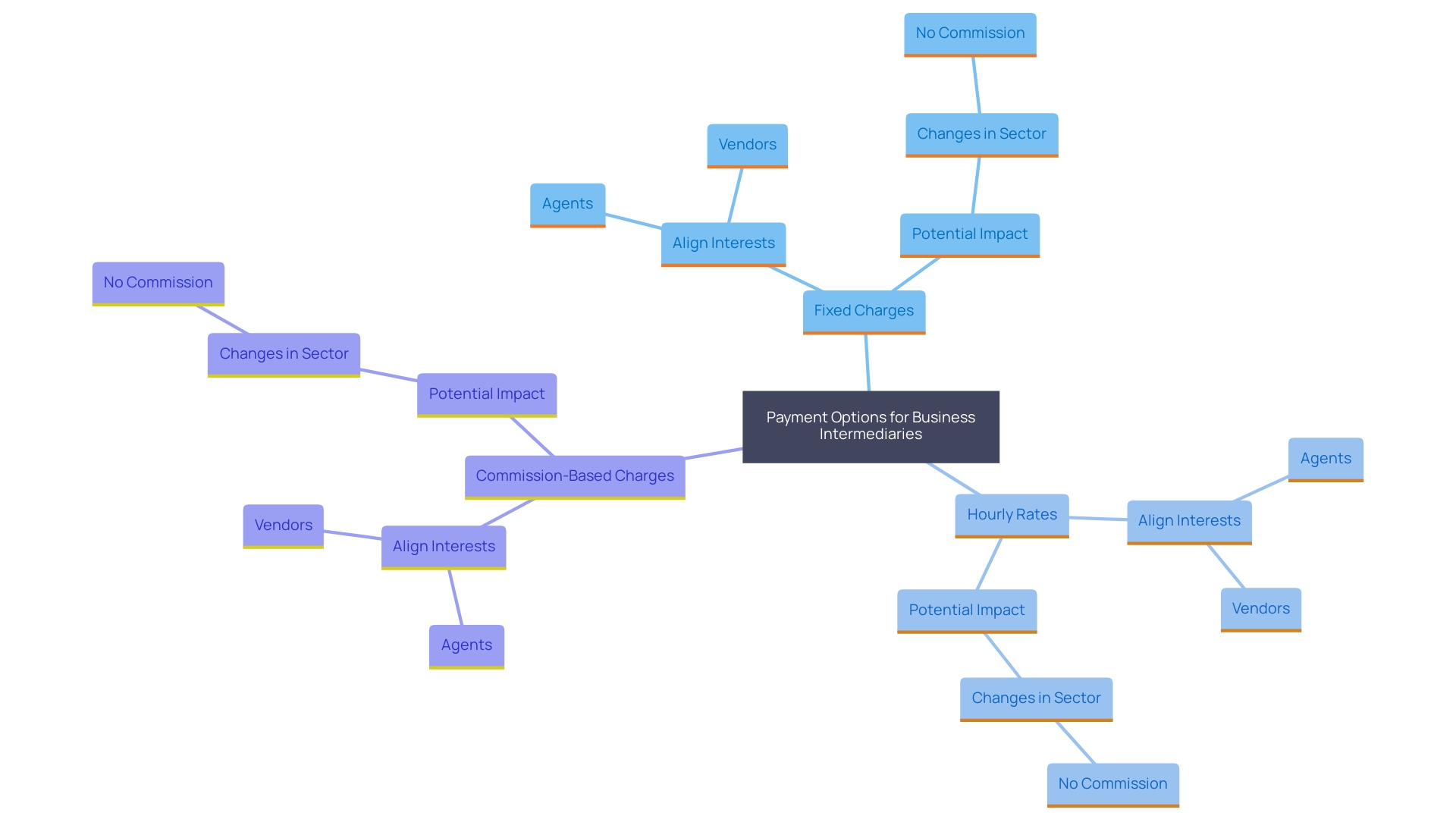

Types of Business Broker Fees

"Business intermediaries utilize payment options to address the requirements of clients in different scenarios and conditions, such as set charges for particular services, with fixed expenses to guarantee predictability and hourly rates that bill based on the time invested assisting clients for adaptability in providing consultation services as extensively as necessary; although commission-based charges remain highly favored by many.". This arrangement is usually determined as a portion of the selling price. Aims to ensure that the objectives of the agents are aligned with those of the vendor to establish a positive and mutually beneficial relationship between them both. Changes happening in the sector like contemplating not charging any commission to selling agents signal strategies that could be advantageous for everyone implicated.

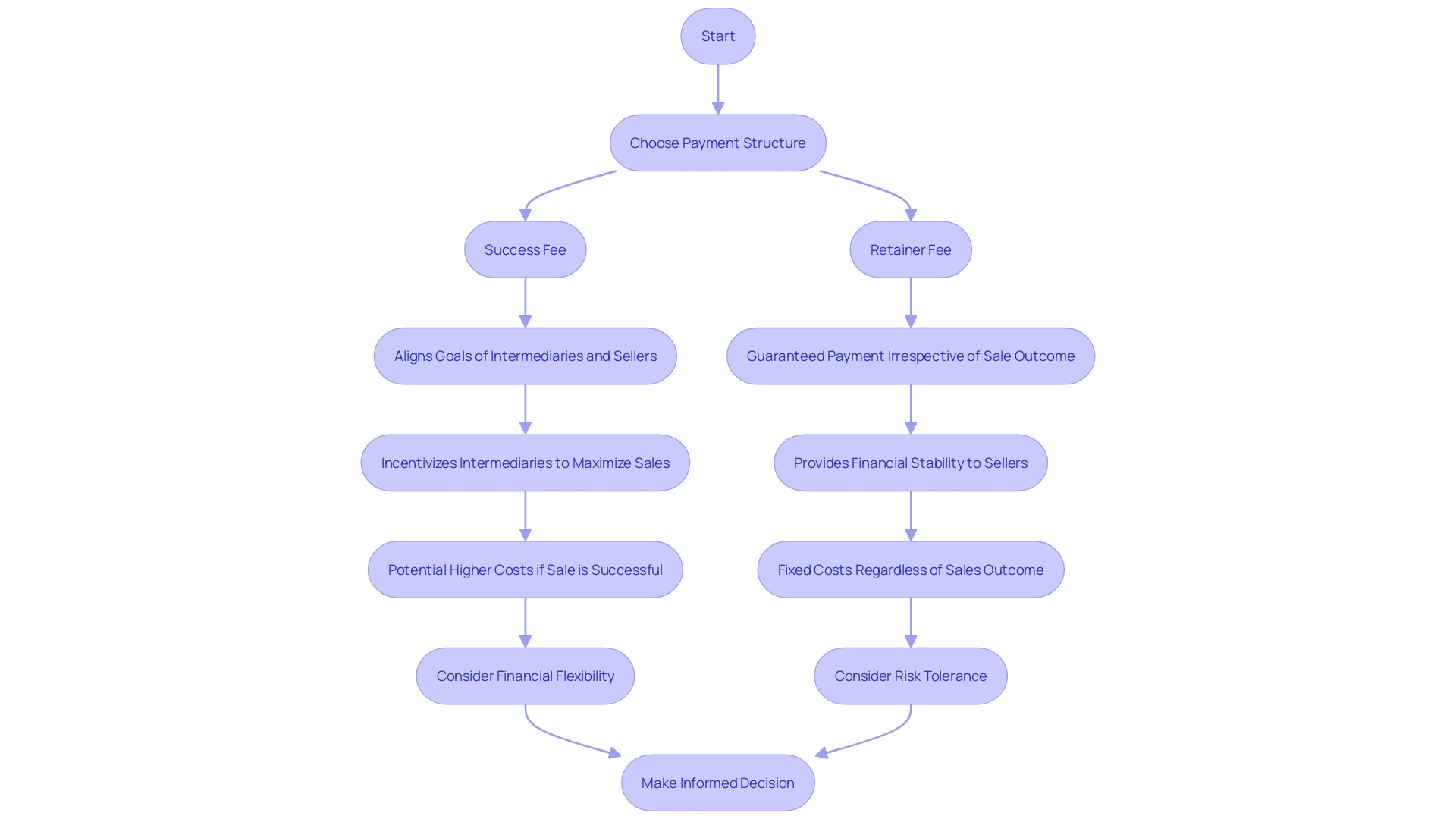

Success Fees vs. Retainers

When vendors choose to collaborate with a commercial intermediary's offerings, they encounter the decision between success payments and retainer payments to evaluate. Success fees are linked to the sale of the business and encourage intermediaries to put in extra effort to finalize deals successfully. This method brings the objectives of the intermediary and seller into alignment. Ensures that intermediaries will exert maximum effort throughout the sales process. Conversely, retainer fees are paid in advance for an agent's assistance regardless of whether or not the business is eventually sold. This approach ensures that the intermediary receives payment for their time and effort, although it may not provide the same degree of motivation to complete the sale successfully. Comprehending these payment arrangements is crucial for sellers to make informed financial choices and to ensure their goals align with the agents' intentions.

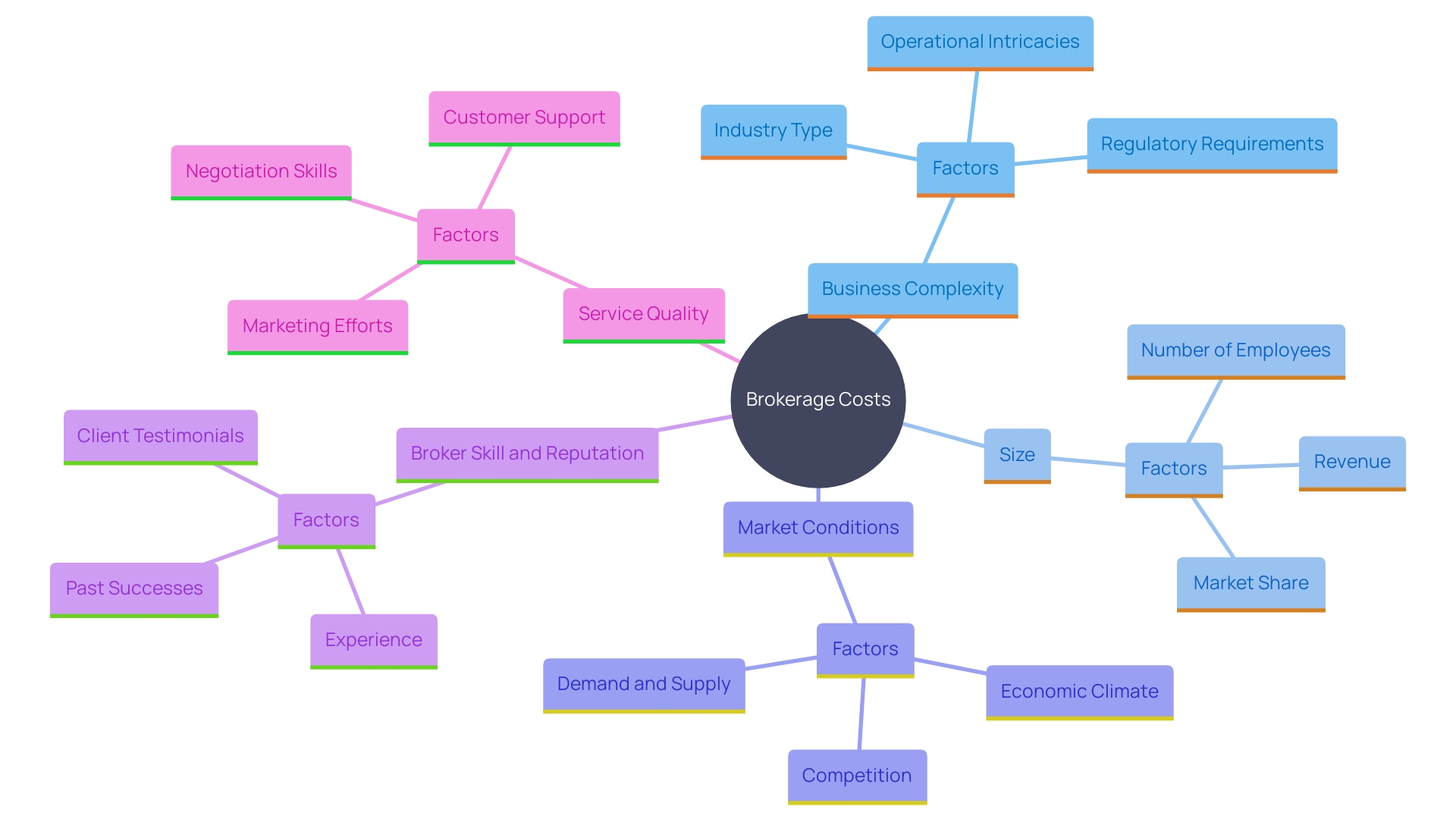

Factors Affecting Business Broker Fees

Different elements influence the brokerage costs associated with selling a business, including the complexity of the business itself and its size, as well as the current market conditions, which are essential factors to take into account in assessing them.. Additionally, the skill and reputation of the broker also have an impact in this process. The quality of service provided affects how these charges are organized; experienced brokers typically offer various services that validate their elevated costs. As global real estate technology strategist Mike DelPrete notes, 'Valuation in the brokerage sector has unique characteristics that differentiate it from other industries and businesses.' 'This distinctiveness frequently results in fee arrangements tailored to individual provider requirements. Providers are advised to thoroughly assess these components to guarantee they obtain value that aligns with the fees levied.'.

Choosing the Right Fee Structure

Selecting the pricing model for an intermediary plays a vital role in optimizing profits for sellers and buyers alike. Sourcing parties should take into account individual factors like time sensitivity and budgetary limits. By weighing the pros and cons of various pricing models, parties can tailor their decisions according to their objectives, resulting in a smoother deal process. An example from Applied Cartography's acquisition of five SaaS companies underscores the significance of meticulous assessment and thoughtful planning. While going through the process of finding sources and negotiating deals to finalize them effectively in the end play a crucial role in their results.. This practical example highlights how the selection of a suitable fee structure can greatly influence the overall outcome.

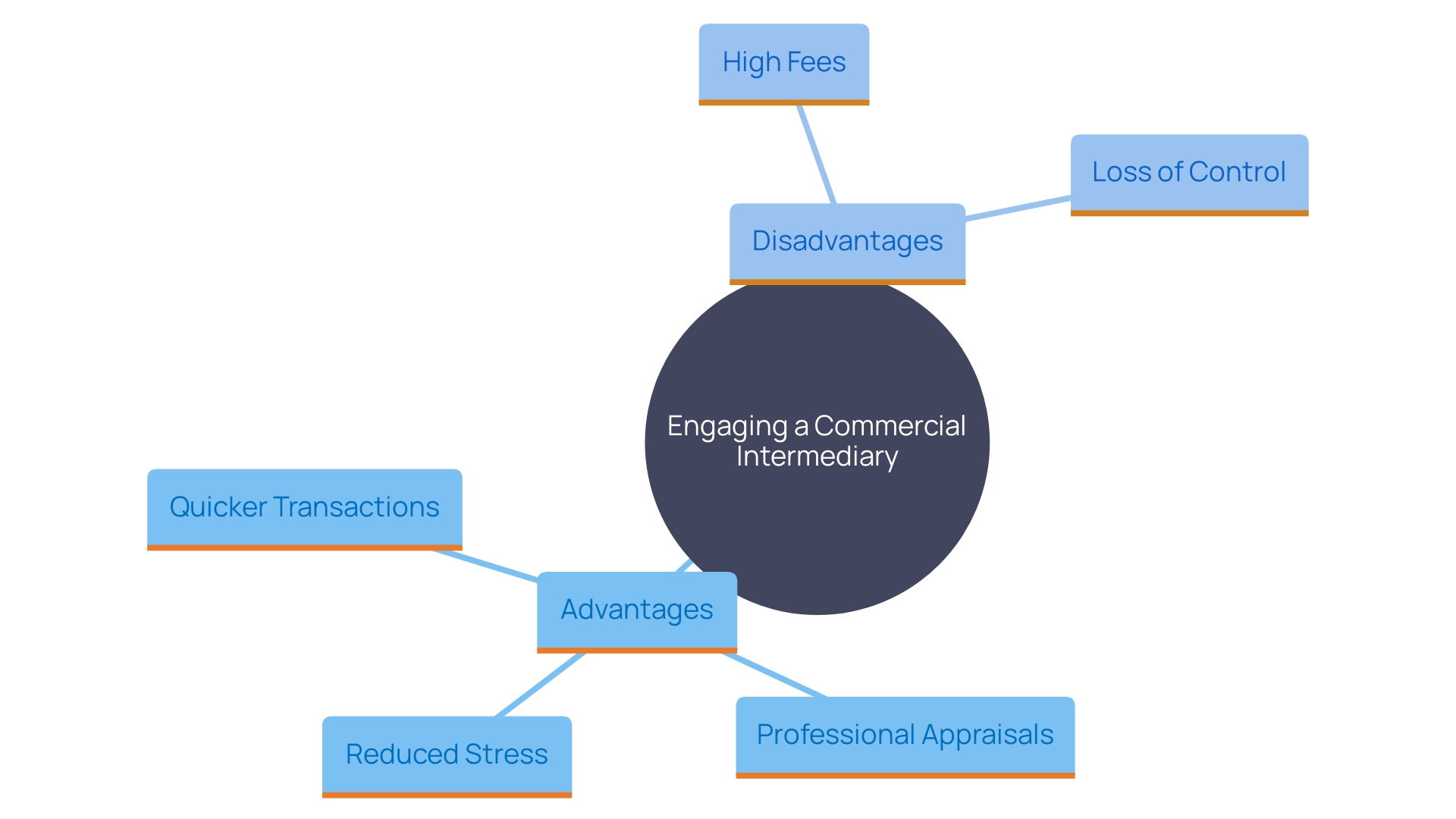

Benefits and Drawbacks of Using a Business Broker

Engaging a commercial intermediary offers advantages of note. These professionals possess a reach of potential purchasers facilitating a quicker transaction process and enhancing the likelihood of locating a fitting buyer. Their proficiency, in appraisals and bargaining guarantees the pricing of your enterprise and the attainment of a favorable agreement. As highlighted by Abhijeet Kaldate from Astra WordPress Theme correctly evaluating your company's value plays an essential role in deciding whether selling is the appropriate course of action. Brokers make selling easier, by saving time and reducing stress – a sentiment echoed by Stephanie Wells from Formidable Forms as she emphasizes the importance of knowing your businesss value.

However using a broker does have its downsides. Broker fees can be quite high. There might be a need to give up some control over how the sales process unfolds. It's important to consider these aspects. Many entrepreneurs tend to rely on valuation techniques like quick estimates made on the fly which can result in either undervaluing or overestimating the worth of their enterprise. It is advisable to conduct a valuation by comparing your business with similar ones that were recently sold in order to avoid these potential pitfalls.

Selecting the intermediary is like finding a reliable partner for your investment endeavor. In locations such as the UK where there are plenty of options available to you in terms of financial intermediaries. It's essential to choose an intermediary that aligns with your objectives to ensure a smooth transaction. Being aware of both the benefits and drawbacks of engaging a broker will assist you in making a informed choice and ultimately reaching a positive result, for the sale of your business.

Conclusion

Knowing the ways business brokers charge fees is important for sellers who are navigating the complexities of selling a business successfully. Each fee option like fees or hourly rates has its pros and cons. When a brokers goals align, with the sellers goals during a sale process it creates an atmosphere that can increase the chances of a successful transaction happening.

When deciding between success fees and retainers in real estate transactions it's crucial as it affects the brokers drive and commitment to finalizing the deal. Sellers need to consider these choices thoughtfully based on their goals and financial needs. Moreover factors like business intricacy, market circumstances and the brokers standing play a role in determining the fee format highlighting the need, for a comprehensive assessment.

Choosing the payment structure not only boosts potential earnings but also smoothens the selling procedure efficiently. Enlisting the expertise of a business intermediary can expedite deals and improve bargaining results; however it is crucial to be mindful of the expenses involved and the chance of surrendering control in the selling process. By comprehending the advantages and disadvantages of collaborating with a broker sellers can make informed choices that result in positive outcomes.

Ultimately a thoughtful strategy towards broker fees and payment arrangements enables sellers to confidently navigate the landscape of selling a business paving the way, for a deal that reflects their objectives and ambitions.