Introduction

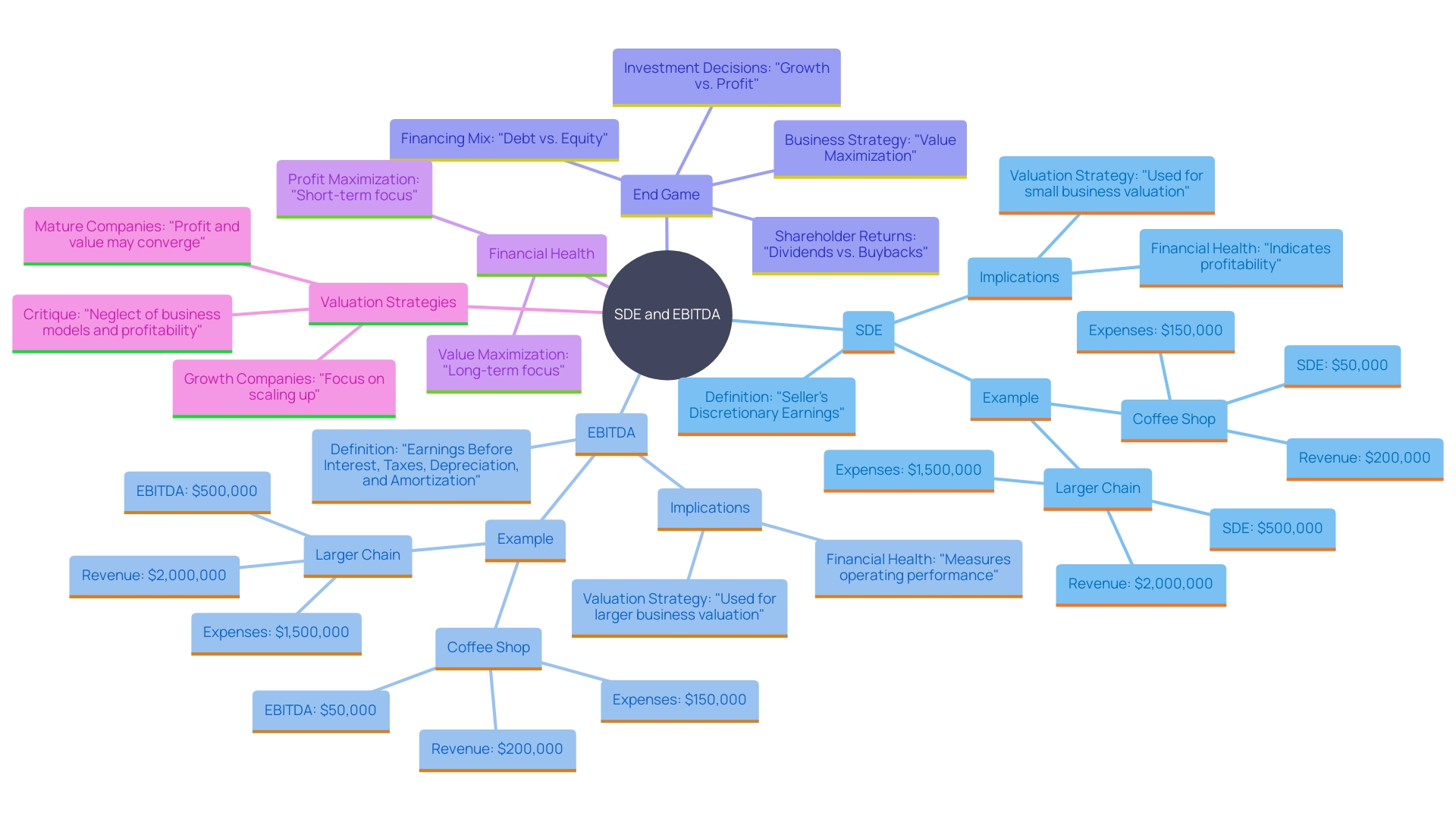

Understanding the worth of a company is crucial for sellers and buyers alike – whether they're small business proprietors or big corporations. This article explores two financial measures – Sellers Discretionary Earnings (also known as SDE) and Earnings Before Interest Taxes, Depreciation and Amortization (commonly referred as EBITDA) shedding light on their unique roles and applications. While SDE accounts for owner perks and flexible expenses—proving beneficial for small enterprises—EBITDA provides a clearer view of operational profitability which proves invaluable, for large corporations.

Understanding the variations in cost considerations and assessment ratios can help business proprietors enhance the appeal of their companies for buyers and attract suitable purchasers effectively. The piece also delves into how selecting between SDE and EBITDA could influence company valuation strategies; offering guidance for making informed choices dependent on company scale and setup. By examining real life scenarios as examples in the article reveals that a customized valuation method can unveil advantages and future opportunities, for growth. Leading to precise and beneficial assessments of businesses.

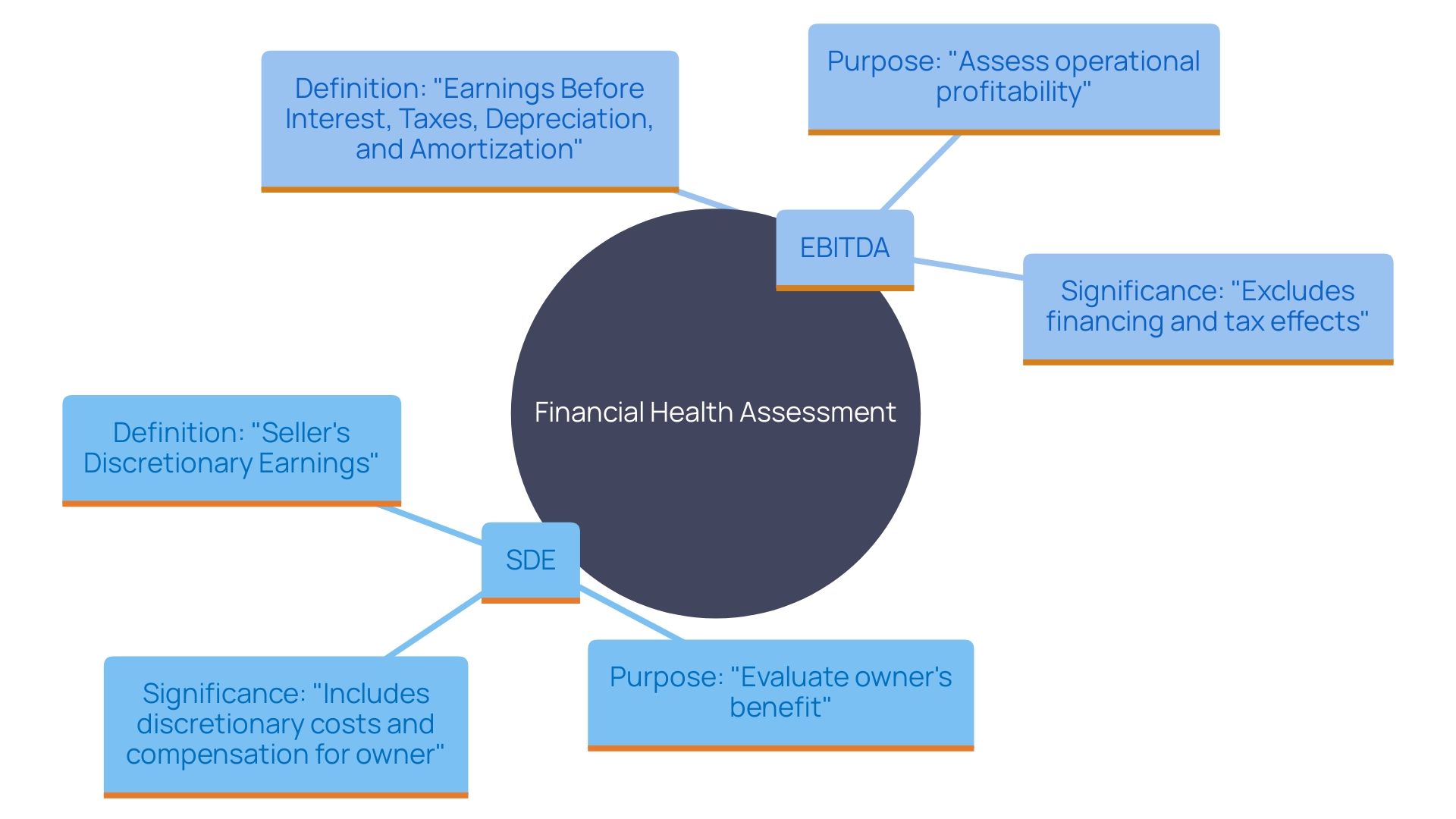

Key Differences Between SDE and EBITDA

Sellers Discretionary Earnings (or SDE for short) and Earnings Before Interest, Taxes, Depreciation and Amortization provide insights into assessing the value of an enterprise but serve different purposes. 'While SHE considers all advantages for the proprietor, including discretionary costs and compensation for the proprietor and is particularly significant for small enterprise operators managing the operations themselves, it emphasizes operational profitability by excluding elements, such as financing and tax approaches that could skew earnings.'. This approach aids in offering insight into how an enterprise is performing over time and is essential for potential purchasers and investors to comprehend this information precisely for small company operators to assess their venture's worth accurately and make prudent financial decisions based on it Anna Delvillar emphasizes that comprehending elements like EBITDA and revenue is fundamental, in portraying a representation of the financial state."

SDE Calculation: Adding Back Owner's Salary and Discretionary Expenses

Calculating the Sellers Discretionary Earnings (SDE) involves factoring in the owner's salary and any extra costs that are not essential to the operations or growth plan in the computation process. These might cover perks or benefits as well as one-time expenditures and other adjustments aimed at reflecting the actual profit potential of the enterprise. This approach guarantees a precise depiction of the financial well being of the company and holds significant importance for potential purchasers. According to industry experts, advice and practices in this field adjustments made for occurrences or non-operational costs play a pivotal role in providing an accurate financial snapshot of the organization. In industries such, as the manufactured housing sector know it's important for buyers to know the earning possibilities. Understanding SDE accurately assists sellers in attracting a group of potential buyers and possibly achieving a higher selling price.

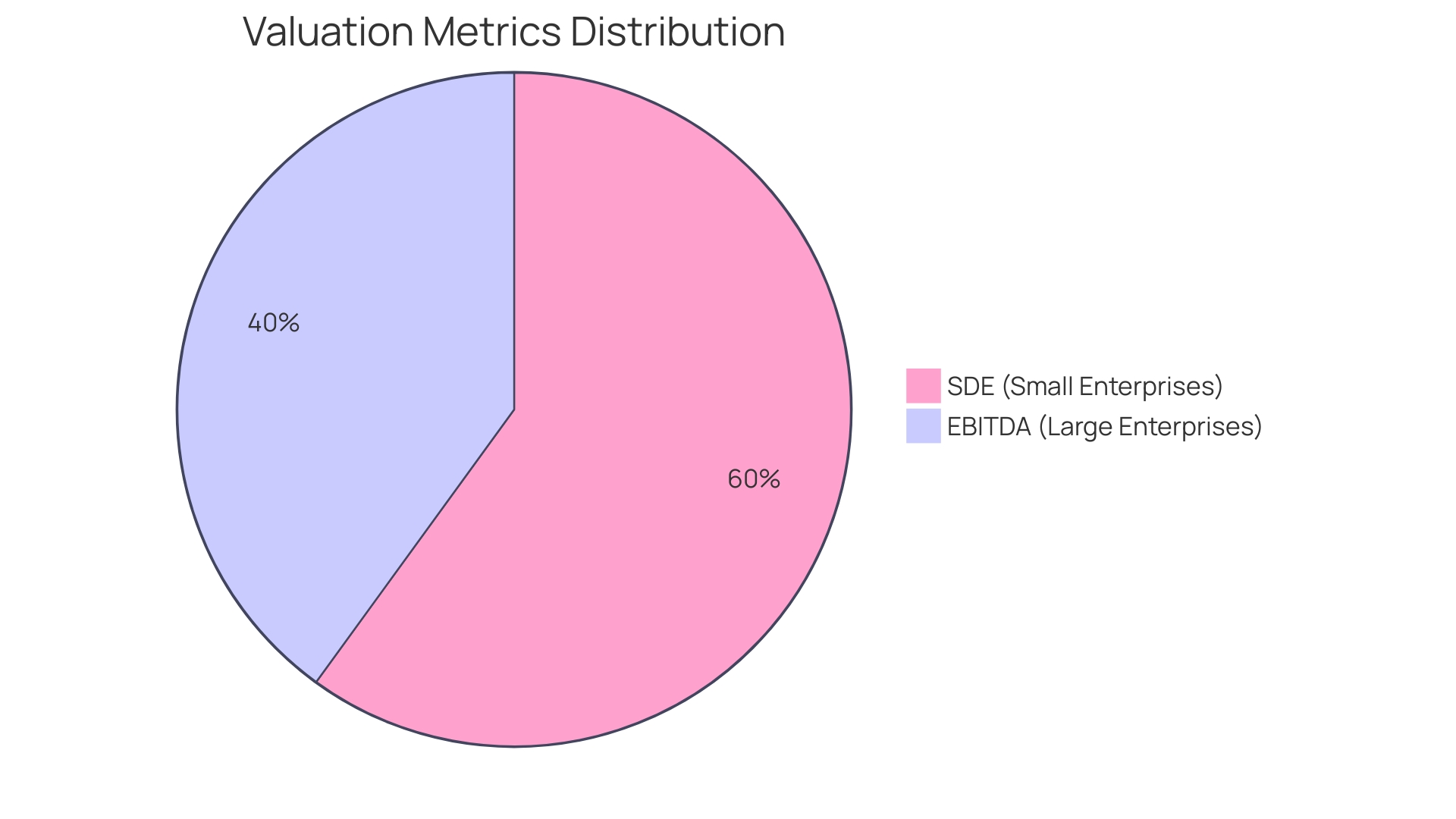

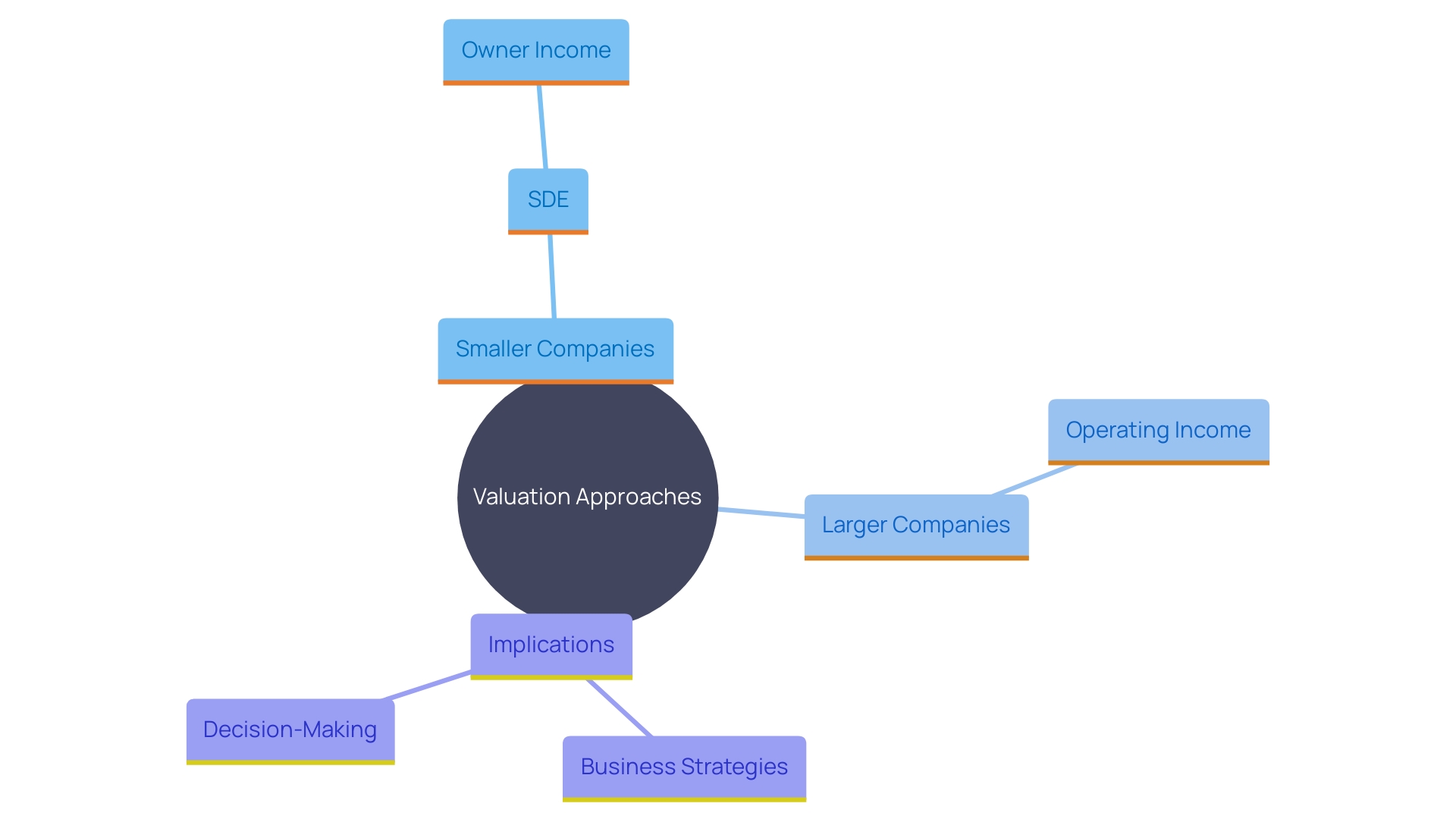

Applicability: SDE for Small Businesses and EBITDA for Larger Corporations

Small enterprises often depend on Sellers Discretionary Earnings (SDE), a metric that illustrates the individual's direct profits from the venture and provides a comprehensive view of its financial health—a crucial understanding for potential purchasers aiming to comprehend the complete financial benefits linked to the operations. In contrast, to this method utilized by enterprises is the practice adhered to by larger organizations that concentrate on Earnings Before Interest, Taxes, Depreciation, and Amortization, which aids in assessing operational efficiency while disregarding any impact of the proprietor. It's important to remember that selecting the method to assess worth relies on the size of the enterprise and how it is organized. This helps make sure financial evaluations are, on point and meaningful.

Expense Inclusions: SDE vs. EBITDA

When comparing Sellers Discretionary Earnings (SDE) with Earnings Before Interest and Taxes, it's crucial to understand the variations in the expenses factored into their calculations. SDE considers costs that an proprietor could decide to cover like personal expenses and non-critical operational expenditures. On the contrary, Earnings Before Interest and Taxes concentrates on essential operational expenses offering a more precise view of the company's fundamental profitability. This difference can result in variations in assessing the value of the enterprise. For example, medium sized enterprises (SMEs) could demonstrate better profits because they can factor in costs that are specific only for the owner and can be altered based on the owner's choice. On the side, earnings before interest, taxes, depreciation, and amortization provides a standardized method of evaluating performance that allows for easier comparisons among different companies. To ensure accuracy in comparing and valuing enterprises, it is important to define and categorize expenses according to each method. This clarity is crucial, for buyers and investors who heavily rely on these metrics when making informed decisions.

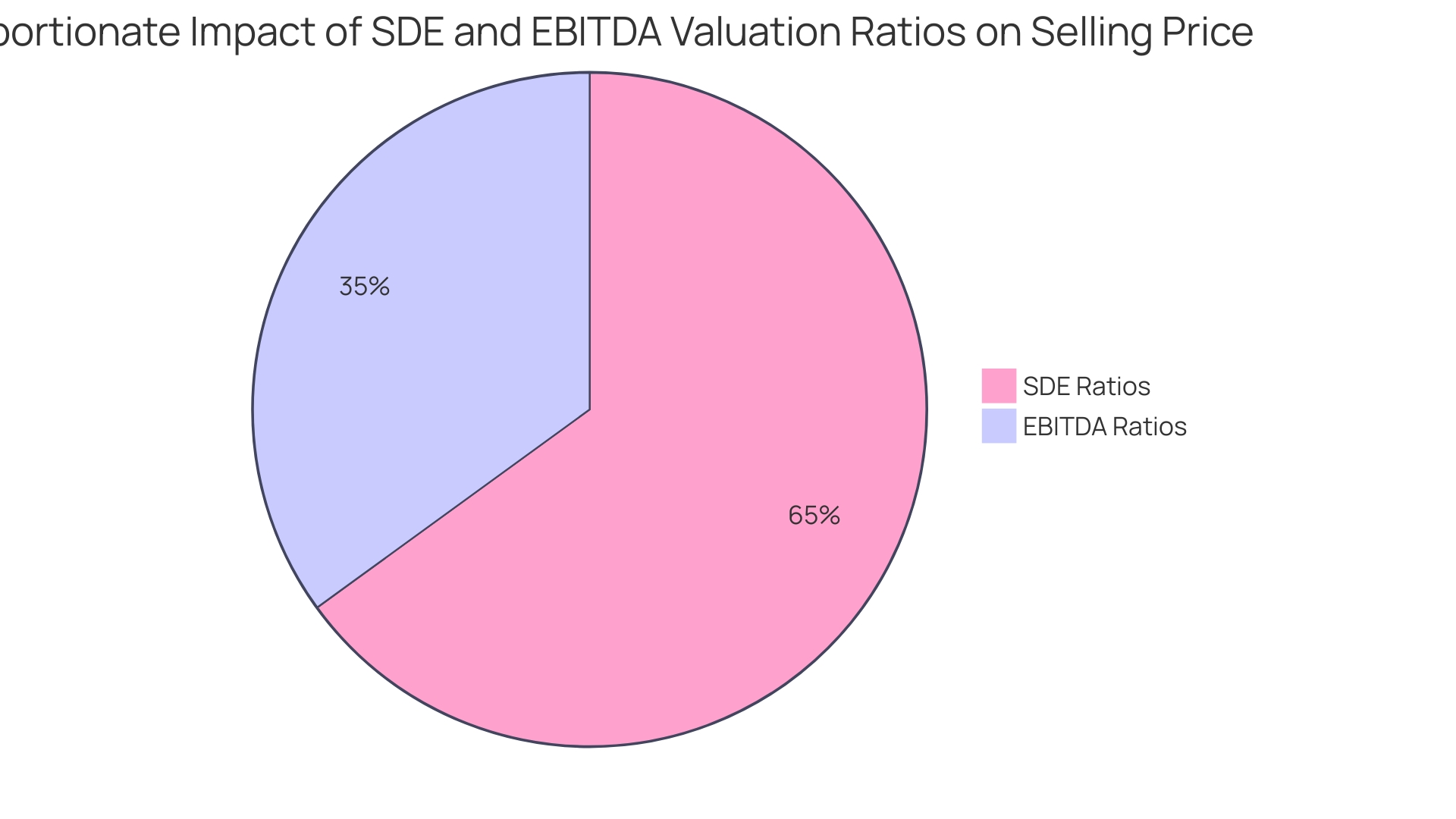

Valuation Multiples: SDE and EBITDA

Valuation ratios determined using SDE and earnings before interest, taxes, depreciation, and amortization can affect the selling price of an enterprise. SDE ratios are typically more beneficial for companies as they take into account personal benefits for the proprietor, which can elevate the valuation. In contrast Earnings Before Interest, Taxes and Amortization(EBITDA)ratios tend to be lower since they do not factor in expenses related to the owner giving a balanced financial perspective. 'Recognizing these distinctions helps owners adjust their expectations in line with market dynamics.'. Jeron Paul, an investor and the founder of several companies, emphasizes the significance of concentrating on key challenges and understanding the financial complexities for an enterprise to flourish. 'This knowledge becomes crucial during the sale preparation process as it guarantees an precise assessment that truly represents the value of the enterprise.'.

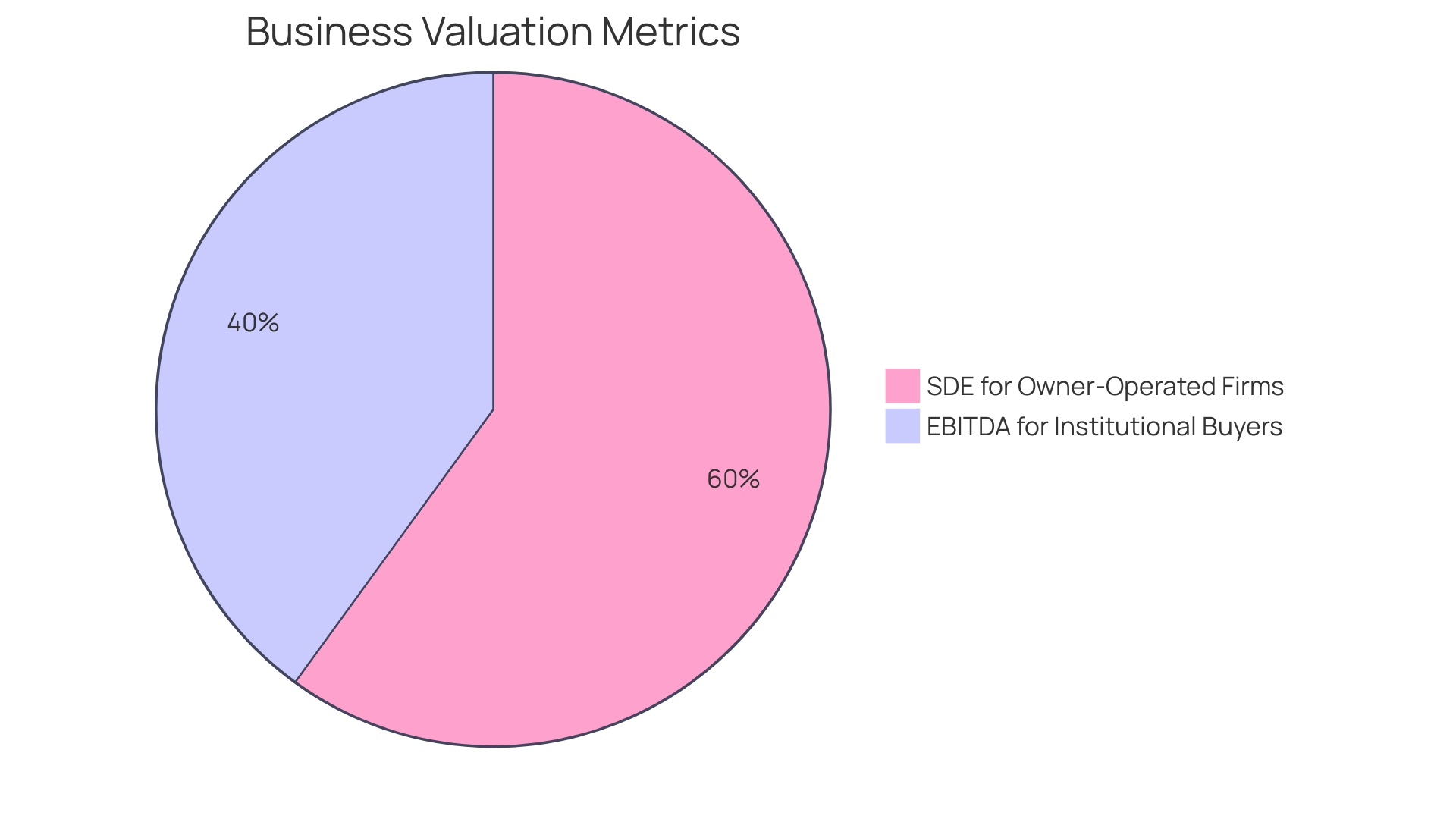

Choosing Between SDE and EBITDA for Business Valuation

Identifying the measure for assessing a company's value is essential and largely relies on the organization's nature and the potential purchasers involved. For enterprises that are managed directly by their operators, Sellers Discretionary Earnings (SDE) tends to provide a more precise reflection of the business's value. This is because SDE takes into consideration the perks enjoyed by the owner, which can play a role, in gauging the actual earning potential for a single buyer. On the other hand, for businesses or those focusing on institutional purchasers, earnings before interest, taxes, depreciation, and amortization is frequently regarded as more suitable. Earnings before interest, taxes, depreciation, and amortization highlights the profitability and could serve as a valuable metric for investors interested in scalability and future expansion opportunities.

Selecting between SDE and earnings before interest, taxes, depreciation, and amortization can significantly affect how the market perceives and assesses a business entity's appeal. For instance; To evaluate the advantage and market standing of a software firm involves considering aspects such as its market share dynamics, growth trends and ability for innovation. A company with a market position because of its unique product offerings or advanced technology may view earnings before interest, taxes, depreciation, and amortization as more indicative of its future potential since it highlights sustainable growth and operational effectiveness.

Furthermore. 'Intellectual property (IP) is crucial in assessing the value of technology companies. Investing in IP can enhance investor confidence and elevate the firm's market position. A comprehensive IP evaluation that looks at both licensed and unlicensed rights can reveal significant worth associated with future revenue sources and strategic goals. This all-encompassing viewpoint can also influence the decision between SDE or another appropriate measure, ensuring that the assessment aligns with the company's future ambitions and market circumstances.'.

Impact of Business Size on SDE and EBITDA Usage

The scale of a company plays a role in how important Seller’s Discretionary Earnings (SDE) and Earnings Before Interest Taxes Depreciation and Amortization are during valuation procedures. Smaller enterprises, such as those reliant on the owner's direct involvement and future growth possibilities, tend to thrive on SDEs attention towards the owner's income. This approach not only reflects the actual financial benefits that owners can gain but also underscores the significance of personal engagement in managing the enterprise. Bigger firms often utilize operating income to gain insight into their operational performance without the impact of financial and accounting decisions affecting the outcomes.

This difference emphasizes the importance of customizing valuation techniques according to a company's size and organization style. For instance; Smaller companies may prioritize profits for growth sustainability while larger companies might concentrate on maximizing long term value despite short term profit sacrifices. Recent research has shown that the valuation approach can greatly influence business strategies and results. From now on, understanding when it's suitable to use SDE is crucial for accurately representing a company's health and making informed choices.

Case Studies: Comparing SDE and EBITDA Valuations

Examining instances from the real world demonstrates how SDE and earnings before interest, taxes, depreciation, and amortization assessments can provide different perspectives on a company's financial health. For instance, a cozy coffee shop operated by a proprietor could demonstrate a robust SDE due to the manager's hands-on management approach. In contrast, a larger chain enterprise might present reliable EBITDA figures highlighting a steady profit margin unaffected by individual owner involvement. These differences emphasize the significance of grasping both assessment measures. By following this approach، entrepreneurs can achieve an understanding of their business operations and make informed decisions that support their future objectives، just like we see in the tech sector، where firms with a solid market presence and competitive edge typically command higher valuations thanks to their innovative and adaptable nature، This concept holds true across industries، underlining the importance of a valuation strategy, in uncovering key strengths and growth prospects within a business.

Conclusion

To accurately evaluate their companys worth business owners must understand the differences between Sellers Discretionary Earnings (SDE) which includes owner perks and optional expenses for small businesses financial assessment and Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) more suited for assessing operational profitability, in larger corporations.

Understanding these distinctions enables business owners to customize their assessment methods to match their individual business size and setup.

Choosing between SDE and EBITDA can greatly impact how a business is viewed by the markets stakeholders.Small businesses leverage the touch portrayed in SDE while larger corporations often use EBITDA as a metric for showcasing their operational effectiveness.The consideration of expenses also plays a pivotal role, in shaping the overall assessment of a companys worth.

Understanding how to classify and evaluate these indicators can help business owners improve their attractiveness, to potential buyers and ultimately create better selling opportunities.

In real life situations it becomes clear how crucial it is for businesses to choose the way of valuing their worthiness and success metrics when assessing their performance and potential growth opportunities.

By using a tailored assessment method for valuation purposes companies can discover their points and pinpoint areas, for growth ensuring they are well prepared to thrive in a challenging market environment.